Asian Central Banks May Spook Investors in 2007

Dec. 15, 2006 (Andy Mukherjee – Bloomberg)

While China's economy is plagued by overinvestment, India's is overheating. Economic activity in Korea, too, has been surprisingly strong, says Goldman Sachs Group Inc. analyst Kim Sun Bae in Hong Kong.

At least in these three Asian nations, investors may not find themselves worrying as much about a U.S.-induced growth slowdown next year as they may about the central banks suddenly turning off the money taps.

AntiSpin: U.S. investors are closely watching the Fed as it collects data on the impact of the collapse of the latest asset bubble–in housing–and weighs the negative economic impacts of that against inflation induced by dollar depreciation, rising wage rates, and the need to print more money to pay for energy.

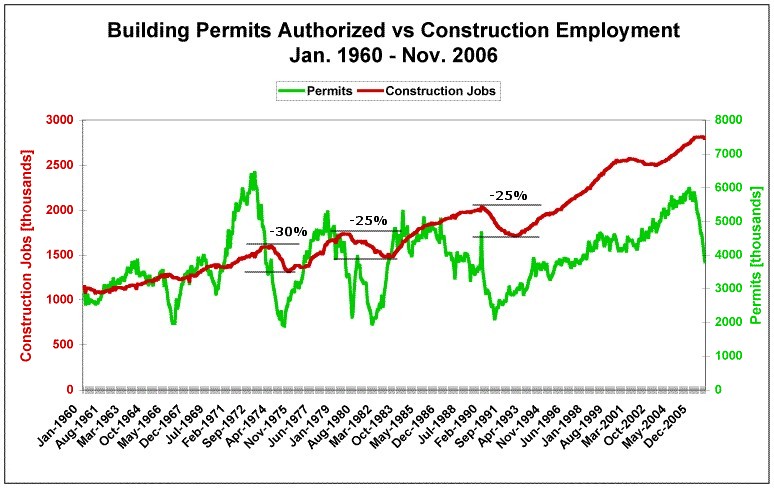

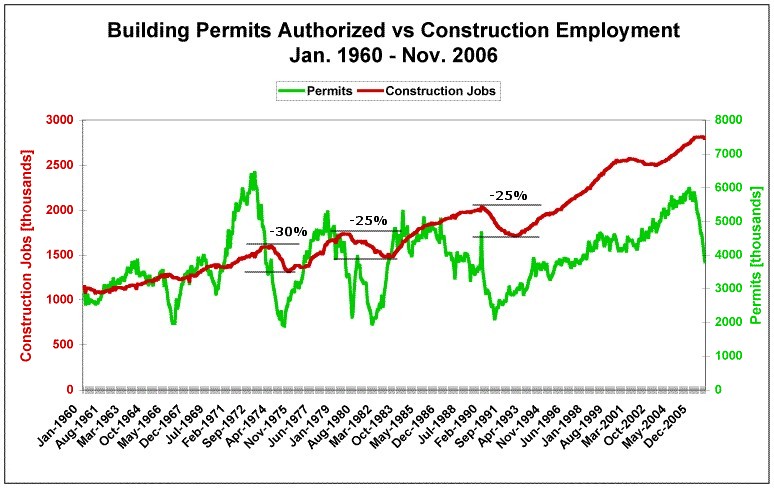

In assessing the direct impact of the collapsing housing bubble, it's not hard to see where construction employment is going. Expect a minimum 25% fall-off in construction jobs.

What is more difficult to assess is how much that will hurt the employment picture overall. In mid-2005, just as the housing bubble started to collapse, Asha Bangalore, an economist for Northern Trust Co. in Chicago, estimated that housing created 43% of all new private sector jobs between late 2001 and the time of her report. Her calculation included direct employment in construction and mortgage services, and also jobs created indirectly in retail and service industries because consumers were tapping their rising home equity to buy more items for their homes while high transaction volumes and home ownership turn-over sent new homeowners to Home Depot and Pier One Imports for new stuff to put in their new homes. Bangalore predicted then that "the housing slowdown that we are seeing is very modest, not alarming, but I think the ripple effects are going to be enormous because of the employment factor."

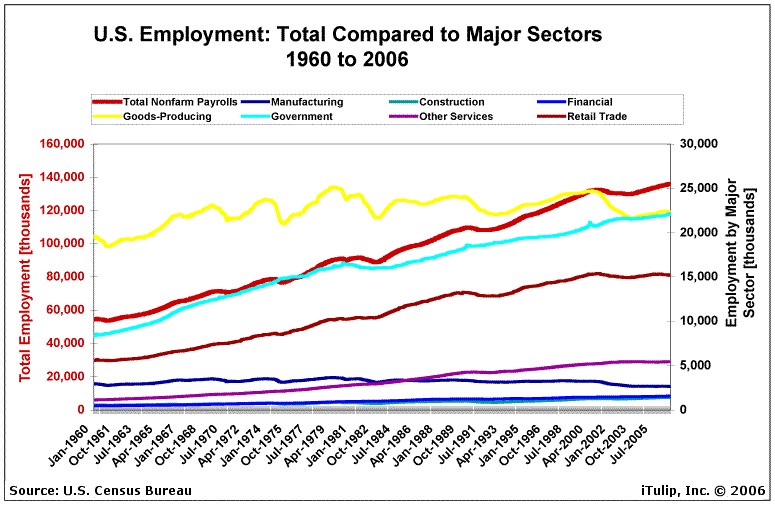

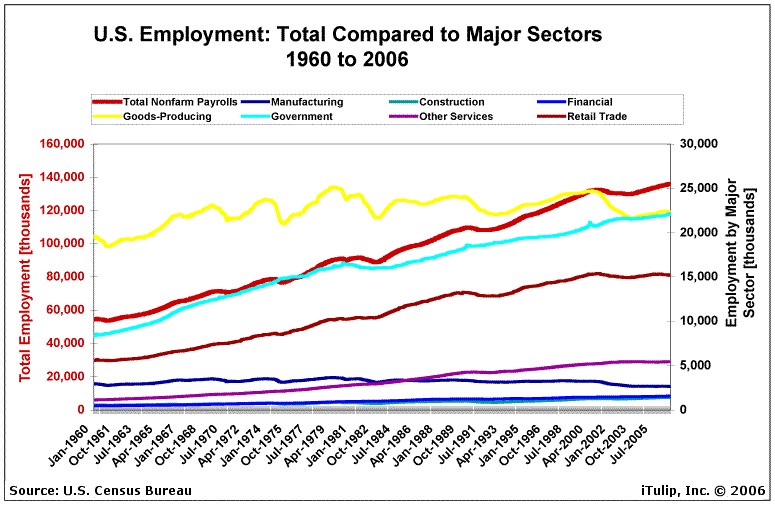

The big dogs of U.S. employment are, as you can see from the chart below, goods production, government, and retail trade, in descending order of importance. Construction jobs are a drop in the bucket. While goods production jobs have declined significantly since 2001, government–either directly or through companies that contract to the government–picked up the slack.

Government contractors responding to demand from Washington for "War on Terra" and other defense related spending has helped hold up the economy for the past several years. Will the spending and employment continue as housing declines? Tom Shoop of GovExec.com reports:

___

For macro-economic and geopolitical currency ETF advisory services see "Crooks on Currencies"

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2006 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Dec. 15, 2006 (Andy Mukherjee – Bloomberg)

While China's economy is plagued by overinvestment, India's is overheating. Economic activity in Korea, too, has been surprisingly strong, says Goldman Sachs Group Inc. analyst Kim Sun Bae in Hong Kong.

At least in these three Asian nations, investors may not find themselves worrying as much about a U.S.-induced growth slowdown next year as they may about the central banks suddenly turning off the money taps.

AntiSpin: U.S. investors are closely watching the Fed as it collects data on the impact of the collapse of the latest asset bubble–in housing–and weighs the negative economic impacts of that against inflation induced by dollar depreciation, rising wage rates, and the need to print more money to pay for energy.

In assessing the direct impact of the collapsing housing bubble, it's not hard to see where construction employment is going. Expect a minimum 25% fall-off in construction jobs.

What is more difficult to assess is how much that will hurt the employment picture overall. In mid-2005, just as the housing bubble started to collapse, Asha Bangalore, an economist for Northern Trust Co. in Chicago, estimated that housing created 43% of all new private sector jobs between late 2001 and the time of her report. Her calculation included direct employment in construction and mortgage services, and also jobs created indirectly in retail and service industries because consumers were tapping their rising home equity to buy more items for their homes while high transaction volumes and home ownership turn-over sent new homeowners to Home Depot and Pier One Imports for new stuff to put in their new homes. Bangalore predicted then that "the housing slowdown that we are seeing is very modest, not alarming, but I think the ripple effects are going to be enormous because of the employment factor."

The big dogs of U.S. employment are, as you can see from the chart below, goods production, government, and retail trade, in descending order of importance. Construction jobs are a drop in the bucket. While goods production jobs have declined significantly since 2001, government–either directly or through companies that contract to the government–picked up the slack.

Government contractors responding to demand from Washington for "War on Terra" and other defense related spending has helped hold up the economy for the past several years. Will the spending and employment continue as housing declines? Tom Shoop of GovExec.com reports:

Agencies are spending at historic levels - none more than Defense - but a downturn looms.

What happens when a nation fights a war overseas, battles the threat of terrorism around the globe and addresses the unprecedented effects of major natural disasters at home?

It writes checks to contractors for hundreds of billions of dollars, for one thing.

Federal agencies issued $388 billion in contracts in fiscal 2005, up more than 18 percent from the year before. Defense contracts topped $278 billion, a healthy increase from $229 billion in 2004.

The Army alone spent more than $103 billion on procurement in 2005. That's almost as much as the contracts issued by all civilian federal agencies combined ($109 billion). Much of the Army's spending came straight out of emergency appropriations for Iraq operations. Not only has Halliburton Co. remained among the nation's top 10 contractors due to its logistics work on behalf of U.S. forces in the Middle East, but companies such as Bahrain National Oil Co. and Kuwait National Petroleum Co. have made their way onto the Top 200 list in recent years. Each had more than $300 million in contracts in fiscal 2005.

Other names are brand-new to the list this year. Take Fairmont Homes Inc. Its place among the top contractors was sealed when Hurricane Katrina roared ashore on Aug. 29, 2005. In short order, the company had $521 million in FEMA contracts for its GulfStream travel trailers. Likewise, Morgan Buildings and Spas Inc. was awarded nearly $400 million for trailers and mobile homes. And Circle B Enterprises vaulted onto the list on the strength of a $287.5 million FEMA contract for temporary housing for hurricane victims. Carnival Corp. garnered $236 million in contracts, funneled through the Navy, for providing short-term housing on cruise ships.

Short term, it's likely that agencies will continue to spend money on contracts at historic levels. But what goes up almost certainly will come down. Emergency spending can't go on forever. And the long-term federal budget outlook is increasingly bleak, as deficits continue to climb and the entitlements bill for aging baby boomers comes due. Soon, the stakes in the federal procurement game could be very different.

Maybe up a bit longer. David Perera of GovExec.com thinks that at least IT spending will hold up:What happens when a nation fights a war overseas, battles the threat of terrorism around the globe and addresses the unprecedented effects of major natural disasters at home?

It writes checks to contractors for hundreds of billions of dollars, for one thing.

Federal agencies issued $388 billion in contracts in fiscal 2005, up more than 18 percent from the year before. Defense contracts topped $278 billion, a healthy increase from $229 billion in 2004.

The Army alone spent more than $103 billion on procurement in 2005. That's almost as much as the contracts issued by all civilian federal agencies combined ($109 billion). Much of the Army's spending came straight out of emergency appropriations for Iraq operations. Not only has Halliburton Co. remained among the nation's top 10 contractors due to its logistics work on behalf of U.S. forces in the Middle East, but companies such as Bahrain National Oil Co. and Kuwait National Petroleum Co. have made their way onto the Top 200 list in recent years. Each had more than $300 million in contracts in fiscal 2005.

Other names are brand-new to the list this year. Take Fairmont Homes Inc. Its place among the top contractors was sealed when Hurricane Katrina roared ashore on Aug. 29, 2005. In short order, the company had $521 million in FEMA contracts for its GulfStream travel trailers. Likewise, Morgan Buildings and Spas Inc. was awarded nearly $400 million for trailers and mobile homes. And Circle B Enterprises vaulted onto the list on the strength of a $287.5 million FEMA contract for temporary housing for hurricane victims. Carnival Corp. garnered $236 million in contracts, funneled through the Navy, for providing short-term housing on cruise ships.

Short term, it's likely that agencies will continue to spend money on contracts at historic levels. But what goes up almost certainly will come down. Emergency spending can't go on forever. And the long-term federal budget outlook is increasingly bleak, as deficits continue to climb and the entitlements bill for aging baby boomers comes due. Soon, the stakes in the federal procurement game could be very different.

Deficits, budget cuts. No matter what, technology spending keeps on growing.

Federal deficits and Office of Management and Budget tightfistedness threaten to diminish the information technology market boom that lately has made Northern Virginia such a happy place. But there's little reason to worry.

Congress, for all its huffing and puffing, generally allows IT spending to grow faster than inflation. Many of the market drivers that helped sustain the boom past the spike days of Y2K remain in place - military and homeland security demand principal among them. New ones have arisen, too, cybersecurity in particular. In fact, market analysis firm INPUT in Reston, Va., predicts a compound annual growth rate of 4.4 percent through fiscal 2011, topping out at $93.4 billion. Admittedly, that's less than the firm's projection last year of 5.5 percent through fiscal 2010. But nobody expects actual reductions in IT spending, just a little less exuberant growth.

Of course, what's really fun about the federal IT budget is that nobody really knows how big it is. Supplemental spending manages to boost it, most people can only guess what the intelligence community spends on it (INPUT estimates $10.4 billion this fiscal year), and the Defense Department doesn't break out IT embedded in weapons systems. Earlier this year, a Defense spokesman said it would be virtually impossible to extract that information, given the degree to which IT has become a basic component of weapon design.

Barring another attack on the U.S. that keeps the defense spending budget-watchers at bay, aside from tech spending, it's hard to see the major drivers for post-housing bust employment in 2007. Which brings us back to our story. While U.S. investors are watching the Fed watching the U.S. economy while the housing bubble deflates, central banks in Asia are slapping down asset bubbles of their own. Will they be more successful than Greenspan in 1994 when he tried to "prick the bubble in the equity markets" but wound up tanking the bond market instead? As we originally reported in January 2005, the Federal Open Market Committee (FOMC) meeting minutes from March 22, 1994 have Greenspan saying:Federal deficits and Office of Management and Budget tightfistedness threaten to diminish the information technology market boom that lately has made Northern Virginia such a happy place. But there's little reason to worry.

Congress, for all its huffing and puffing, generally allows IT spending to grow faster than inflation. Many of the market drivers that helped sustain the boom past the spike days of Y2K remain in place - military and homeland security demand principal among them. New ones have arisen, too, cybersecurity in particular. In fact, market analysis firm INPUT in Reston, Va., predicts a compound annual growth rate of 4.4 percent through fiscal 2011, topping out at $93.4 billion. Admittedly, that's less than the firm's projection last year of 5.5 percent through fiscal 2010. But nobody expects actual reductions in IT spending, just a little less exuberant growth.

Of course, what's really fun about the federal IT budget is that nobody really knows how big it is. Supplemental spending manages to boost it, most people can only guess what the intelligence community spends on it (INPUT estimates $10.4 billion this fiscal year), and the Defense Department doesn't break out IT embedded in weapons systems. Earlier this year, a Defense spokesman said it would be virtually impossible to extract that information, given the degree to which IT has become a basic component of weapon design.

"When we moved on February 4th, I think our expectation was that we would prick the bubble in the equity markets. What in fact occurred is that, as evidence of the dramatic shift in the economic outlook began to emerge after we moved and long-term rates began to move up, we were also clearly getting a major upward increase in expectations of corporate earnings. While the stock market went down after our actions on February 4th, it has gone down really quite marginally on net over this period. So what has occurred is that while this capital gains bubble in all financial assets had to come down, instead of the decline being concentrated in the stock area, it shifted over into the bond area. But the effects are the same. These are major capital losses, which have required very dramatic changes in the actions and activities on the part of individuals and institutions.

"So the question is, having very consciously and purposely tried to break the bubble and upset the markets in order to sort of break the cocoon of capital gains speculation, we are now in a position—having done that and in a sense succeeded perhaps more than we had intended—to try to restore some degree of confidence in the System."

We shall see if China's, India's, or Korea's central banks can do better. In any case, Mukherjee's story reminds us how difficult it is to predict the trigger for the next global financial crisis. It's foolhardy to try, but engaging in informed speculation on several likely outcomes and positioning for them is prudent. "So the question is, having very consciously and purposely tried to break the bubble and upset the markets in order to sort of break the cocoon of capital gains speculation, we are now in a position—having done that and in a sense succeeded perhaps more than we had intended—to try to restore some degree of confidence in the System."

___

For macro-economic and geopolitical currency ETF advisory services see "Crooks on Currencies"

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2006 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Comment