A doomed currency

December 13, 2006 (Telegraph.uk)

The achievement of economic and monetary union by 11 European countries in 1999 was based on a deal: Germany, the strongest member, gave up the Deutschemark on the understanding that the others would not debauch the new common currency, the euro. Nearly eight years on, that inherently doomed project is coming apart at the seams.

The fundamental problem is that the economies of the "Germanic" members have diverged so far from those of the "Latin" bloc that the single interest rate set by the European Central Bank (ECB) is becoming a huge political liability.

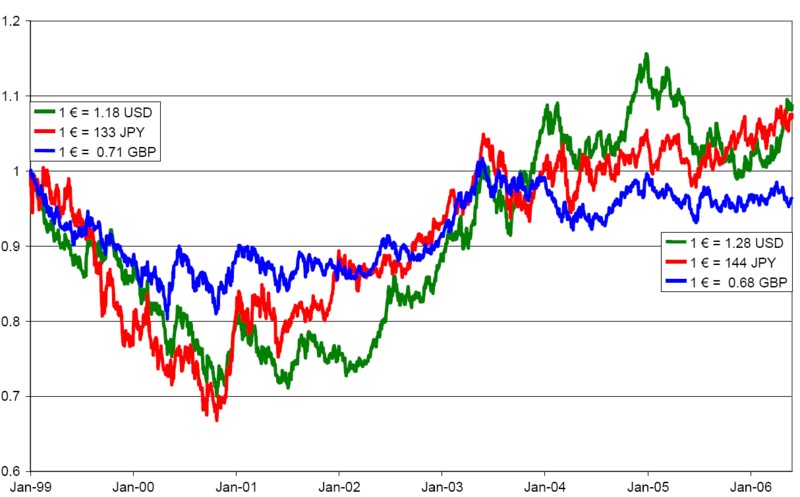

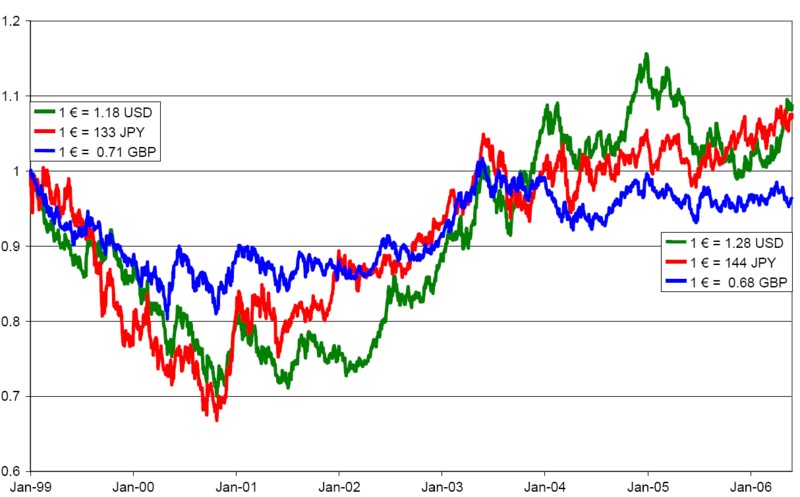

The threat to the cohesion of the eurozone is best illustrated by comparing France and Germany. The second, having established a competitive advantage over the southern bloc of about 30 per cent over the past decade, is facing incipient inflation and favours a tight monetary policy. The first, devastated by the strength of the euro against the yen, dollar and renminbi, would like a halt to interest-rate rises. While the French political establishment has already turned against present policy, its abandonment would undermine support for the EU in Germany. The two "motors" of Europe are pulling in opposite directions.

AntiSpin: We recall in 1998 when iTulip first went on the air, before the euro was adopted by the EU, one commentator said, "Europe is about to lock themselves in a cage and throw away the key. They'll be at each other's throats within ten years. Don't they ever learn?"

While we have been euro bulls short term, longer term we are very bearish on the euro. Buying euro denominated bonds at US0.75 in 2001 and selling today at US$1.32 is not a bad trade. The question is, what might cause the euro to continue to appreciate relative to the dollar in spite of the structural political issues?

Consider the latest from Crooks on Currencies' John Ross Crooks III:

For more on the economic slowing, see John Serrapere's December Portfilio A update.

For more on inflation, see Aaron Krowne's report today on the announcement by the U.S. mint that melting pennies and nickels is now a crime punishable by $10,000 fine and/or five years in prison. The key phrase in the press release:

December 13, 2006 (Telegraph.uk)

The achievement of economic and monetary union by 11 European countries in 1999 was based on a deal: Germany, the strongest member, gave up the Deutschemark on the understanding that the others would not debauch the new common currency, the euro. Nearly eight years on, that inherently doomed project is coming apart at the seams.

The fundamental problem is that the economies of the "Germanic" members have diverged so far from those of the "Latin" bloc that the single interest rate set by the European Central Bank (ECB) is becoming a huge political liability.

The threat to the cohesion of the eurozone is best illustrated by comparing France and Germany. The second, having established a competitive advantage over the southern bloc of about 30 per cent over the past decade, is facing incipient inflation and favours a tight monetary policy. The first, devastated by the strength of the euro against the yen, dollar and renminbi, would like a halt to interest-rate rises. While the French political establishment has already turned against present policy, its abandonment would undermine support for the EU in Germany. The two "motors" of Europe are pulling in opposite directions.

AntiSpin: We recall in 1998 when iTulip first went on the air, before the euro was adopted by the EU, one commentator said, "Europe is about to lock themselves in a cage and throw away the key. They'll be at each other's throats within ten years. Don't they ever learn?"

While we have been euro bulls short term, longer term we are very bearish on the euro. Buying euro denominated bonds at US0.75 in 2001 and selling today at US$1.32 is not a bad trade. The question is, what might cause the euro to continue to appreciate relative to the dollar in spite of the structural political issues?

Consider the latest from Crooks on Currencies' John Ross Crooks III:

Thursday 14 December 2006 5:00 AM EST

Key News

• The Swiss central bank raised interest rates for the fifth time in a year. (Bloomberg)

• The Nihon Keizai newspaper reported the Bank of Japan will probably leave interest rates unchanged at its next meeting. (Bloomberg)

• The yen hit record lows against the euro.

• European Central Bank council member Axel Weber signaled support for increasing interest rates again,

saying forecasts on inflation by the bank’s staff don’t signal an all clear for policy makers.

• Key Reports (WSJ):

8:30a.m. Initial Jobless Claims. For Dec 9 Wk. Expected: -4K. Previous: -34K.

8:30a.m. Nov Import Prices. Expected: -0.1%. Previous: -2.0%.

10:00a.m. DJ-BTMU Business Barometer. For Dec 2 Wk. Previous: -0.1%.

FX Trading – A surprise!

Stronger-than-expected retail sales data was a big surprise yesterday—it gave the greenback a major shot-in-the-arm, changes the dynamics near-term, and sets the table for a decent $ correction.

Holiday infused retail sales rose 1.0 percent in November -- the first gain since July -- and left traders questioning whether U.S. economic growth is slowing.

These numbers followed Tuesday’s inflation-themed FOMC meeting. Those betting on inevitable rate cuts (and we’re in that camp) were disappointed when growth concerns played second fiddle to inflation concerns yet again.

The way we look at it the Fed is throwing investors a serious head-fake here. That’s because it’s in the U.S. Central Bank’s best interest to maintain the upper hand on the outlook for the U.S. economy. So many new bears are jawboning away at the U.S. dollar that it makes sense to keep them back on their heels with some heavy inflation rhetoric. more...

My take is that the Fed is praying for data that shows that economic slowing is starting to moderate the global inflation that has resulted from the coordinated global central bank reflation since 2001. The ongoing stimulus continues to create the perverse situation of a high correlation among all asset classes–all asset prices up. Apparently, the Fed has to acknowledge a growing stagflation problem as the U.S. economy slows (housing with lag effects) and all goods prices continue to rise (reflation with lag effects). Key News

• The Swiss central bank raised interest rates for the fifth time in a year. (Bloomberg)

• The Nihon Keizai newspaper reported the Bank of Japan will probably leave interest rates unchanged at its next meeting. (Bloomberg)

• The yen hit record lows against the euro.

• European Central Bank council member Axel Weber signaled support for increasing interest rates again,

saying forecasts on inflation by the bank’s staff don’t signal an all clear for policy makers.

• Key Reports (WSJ):

8:30a.m. Initial Jobless Claims. For Dec 9 Wk. Expected: -4K. Previous: -34K.

8:30a.m. Nov Import Prices. Expected: -0.1%. Previous: -2.0%.

10:00a.m. DJ-BTMU Business Barometer. For Dec 2 Wk. Previous: -0.1%.

FX Trading – A surprise!

Stronger-than-expected retail sales data was a big surprise yesterday—it gave the greenback a major shot-in-the-arm, changes the dynamics near-term, and sets the table for a decent $ correction.

Holiday infused retail sales rose 1.0 percent in November -- the first gain since July -- and left traders questioning whether U.S. economic growth is slowing.

These numbers followed Tuesday’s inflation-themed FOMC meeting. Those betting on inevitable rate cuts (and we’re in that camp) were disappointed when growth concerns played second fiddle to inflation concerns yet again.

The way we look at it the Fed is throwing investors a serious head-fake here. That’s because it’s in the U.S. Central Bank’s best interest to maintain the upper hand on the outlook for the U.S. economy. So many new bears are jawboning away at the U.S. dollar that it makes sense to keep them back on their heels with some heavy inflation rhetoric. more...

For more on the economic slowing, see John Serrapere's December Portfilio A update.

For more on inflation, see Aaron Krowne's report today on the announcement by the U.S. mint that melting pennies and nickels is now a crime punishable by $10,000 fine and/or five years in prison. The key phrase in the press release:

"In all essential respects, these regulations are patterned after the Department of the Treasury's regulations prohibiting the exportation, melting, or treatment of silver coins between 1967 and 1969, and the regulations prohibiting the exportation, melting, or treatment of one-cent coins between 1974 and 1978."

Begs the question, what happened between 1967 and 1969 to require silver dimes, quarters and half dollars to be taken out of circulation and replaced with clad coins? What happened between 1974 and 1978 to require copper pennies to be taken out of circulation and replaced with clad coins? These were episodes in a stagflationary period of rising inflation and slowing economic growth, like the one we appear to be headed into now.

)

)

Comment