Dollar Drops to 19-Month Low Against Euro; Breaches $1.30 Level

November 24, 2006 (Bloomberg)

The dollar fell to its lowest in 19 months against the euro on speculation the Federal Reserve is done raising interest rates, while central banks in Europe will keep increasing them.

The U.S. currency extended its losses after breaching $1.30 against the euro for the first time since April 2005, a level where traders had placed automatic orders to sell the dollar. The European Central Bank has raised rates to an almost four-year high and President Jean-Claude Trichet on Nov. 20 said inflation remains a threat. The Fed has left rates unchanged since August.

"The break of 1.30 is a strong signal that the dollar has to weaken," said Carsten Fritsch, a currency strategist at Commerzbank AG in Frankfurt. "The sentiment for the dollar is negative. In the euro-zone, growth will remain strong."

AntiSpin: Over the centuries, monetary systems have come and gone–such as the international fractional gold reserve system that ended in 1971. There is a pattern of events leading up to these transitions. The typical scenario for a transition from one monetary system to another is as follows.

The old system is organized around the ability of the main players in the system to produce internationally valued real-goods output for export and capital goods used as reserves at little or not cost. Imbalances build up in the system because the ability of economies in it to produce goods for export to earn foreign exchange revenues, relative to capital goods for export, changes over time. The main players in the system are not motivated to re-organize the system to accommodate these imbalances because the transition costs from the old system to a new system are higher than the apparent benefit, and the political costs tend to be highest for the largest player in the system. The largest player and the others are motivated to work for many years to find ways to sustain the old system in a state of imbalance.

In the current instance, the most likely system to arise from the current unilateral US dollar based system is a multi-lateral dollar-euro-yen reserve system. Getting there from a unilateral dollar based system to a multi-lateral dollar-euro-yen system minimally requires that the EU develop a euro bond market nearly as liquid and transparent as the dollar bond market, and that the EU change trade policies 180 degrees to begin running trade deficits. These two requirements alone are significant transition cost barriers to a planned transition. As a result, the US, Asia and the EU continue to make concessions to maintain the system as it grows further out of balance over time. The investments and changes in mindset and practice required to create a new system have only happened in the past as a response to a systemic monetary crisis.

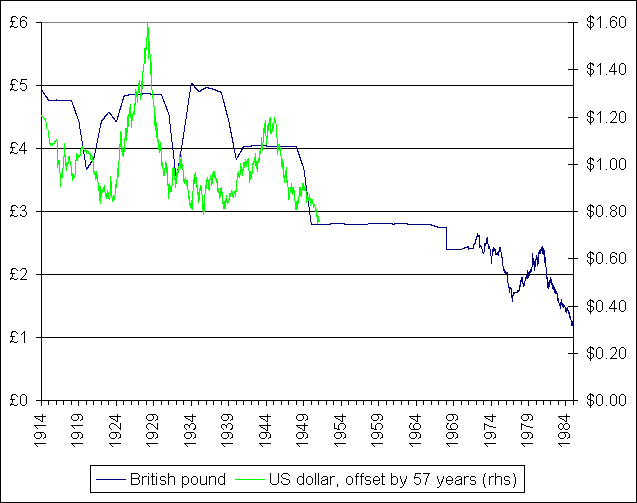

The typical life span of an international monetary system is 30 to 50 years. An unbalanced system can continue for many years, until one day an event that is mundane under circumstances of greater global balance causes one of the major players in the system to calculate that the cost of breaking from the others and absorbing the transition costs of moving to a new system is lower than either staying with the old one or waiting until the inevitable crisis occurs. This is how the fractional gold reserve system ended, when Charles de Gaulle in the late 1960s demanded re-payment of gold owed to France by the US, after he decided that the US–then running what was considered a large trade deficit–intended to depreciate the dollar and pay its trading partners back with cheap dollars. Nixon responded by taking the US off the fractional gold standard and defaulting on US debts in 1971, just as de Gaulle had feared. Nixon also devalued the dollar not just once, but twice, later that same decade. A more principled US President might have heeded the advice of economic adviser Milton Friedman and not have done any of these things. Which brings me to the main point here: the outcome of global imbalances is primarily determined by national leadership–who the leaders are in the system and how they are likely to behave in a crisis.

Charles de Gaulle had accurately sized-up Nixon, but sometimes miscalculation precipitates crisis, such as when the US attempted to bale out Great Britain in the late 1920s to try to preserve the international gold standard based monetary system. The question today is, how do China's President Hu Jintao and Japan's Pre Prime Minister Shinzo Abe think about Bush? If the dollar and the US economy came under duress because of trade balances, can Bush be expected to act unilaterally or internationally? If the other main players calculate that a unilateral response is likely, then they may be motivated to jump the gun, as de Gaulle did. Alternatively, a player at the periphery of the system with international aspirations and strained political ties with the US, such as Russia, may form a block to threaten to break with the system, and either receives political and economic concessions within the context of the system or forces a fundamental change in the system.

We keep a close eye on Russian-U.S. relations as well as China-U.S., then, as that is at least for now the hot spot for a international monetary crisis.

_____

For guidance on how to play the coming currency corrections, see "Crooks on Currencies"

To buy and trade gold easily and inexpensively, see BullionVault

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2006 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

November 24, 2006 (Bloomberg)

The dollar fell to its lowest in 19 months against the euro on speculation the Federal Reserve is done raising interest rates, while central banks in Europe will keep increasing them.

The U.S. currency extended its losses after breaching $1.30 against the euro for the first time since April 2005, a level where traders had placed automatic orders to sell the dollar. The European Central Bank has raised rates to an almost four-year high and President Jean-Claude Trichet on Nov. 20 said inflation remains a threat. The Fed has left rates unchanged since August.

"The break of 1.30 is a strong signal that the dollar has to weaken," said Carsten Fritsch, a currency strategist at Commerzbank AG in Frankfurt. "The sentiment for the dollar is negative. In the euro-zone, growth will remain strong."

AntiSpin: Over the centuries, monetary systems have come and gone–such as the international fractional gold reserve system that ended in 1971. There is a pattern of events leading up to these transitions. The typical scenario for a transition from one monetary system to another is as follows.

The old system is organized around the ability of the main players in the system to produce internationally valued real-goods output for export and capital goods used as reserves at little or not cost. Imbalances build up in the system because the ability of economies in it to produce goods for export to earn foreign exchange revenues, relative to capital goods for export, changes over time. The main players in the system are not motivated to re-organize the system to accommodate these imbalances because the transition costs from the old system to a new system are higher than the apparent benefit, and the political costs tend to be highest for the largest player in the system. The largest player and the others are motivated to work for many years to find ways to sustain the old system in a state of imbalance.

In the current instance, the most likely system to arise from the current unilateral US dollar based system is a multi-lateral dollar-euro-yen reserve system. Getting there from a unilateral dollar based system to a multi-lateral dollar-euro-yen system minimally requires that the EU develop a euro bond market nearly as liquid and transparent as the dollar bond market, and that the EU change trade policies 180 degrees to begin running trade deficits. These two requirements alone are significant transition cost barriers to a planned transition. As a result, the US, Asia and the EU continue to make concessions to maintain the system as it grows further out of balance over time. The investments and changes in mindset and practice required to create a new system have only happened in the past as a response to a systemic monetary crisis.

The typical life span of an international monetary system is 30 to 50 years. An unbalanced system can continue for many years, until one day an event that is mundane under circumstances of greater global balance causes one of the major players in the system to calculate that the cost of breaking from the others and absorbing the transition costs of moving to a new system is lower than either staying with the old one or waiting until the inevitable crisis occurs. This is how the fractional gold reserve system ended, when Charles de Gaulle in the late 1960s demanded re-payment of gold owed to France by the US, after he decided that the US–then running what was considered a large trade deficit–intended to depreciate the dollar and pay its trading partners back with cheap dollars. Nixon responded by taking the US off the fractional gold standard and defaulting on US debts in 1971, just as de Gaulle had feared. Nixon also devalued the dollar not just once, but twice, later that same decade. A more principled US President might have heeded the advice of economic adviser Milton Friedman and not have done any of these things. Which brings me to the main point here: the outcome of global imbalances is primarily determined by national leadership–who the leaders are in the system and how they are likely to behave in a crisis.

Charles de Gaulle had accurately sized-up Nixon, but sometimes miscalculation precipitates crisis, such as when the US attempted to bale out Great Britain in the late 1920s to try to preserve the international gold standard based monetary system. The question today is, how do China's President Hu Jintao and Japan's Pre Prime Minister Shinzo Abe think about Bush? If the dollar and the US economy came under duress because of trade balances, can Bush be expected to act unilaterally or internationally? If the other main players calculate that a unilateral response is likely, then they may be motivated to jump the gun, as de Gaulle did. Alternatively, a player at the periphery of the system with international aspirations and strained political ties with the US, such as Russia, may form a block to threaten to break with the system, and either receives political and economic concessions within the context of the system or forces a fundamental change in the system.

We keep a close eye on Russian-U.S. relations as well as China-U.S., then, as that is at least for now the hot spot for a international monetary crisis.

_____

For guidance on how to play the coming currency corrections, see "Crooks on Currencies"

To buy and trade gold easily and inexpensively, see BullionVault

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2006 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Comment