US consumer's insolvency, a catalyst of the impact phase of the global systemic crisis

November 17, 2006 (LEAP/E2020)

Extract of the GlobalEurope Anticipation Bulletin N°9

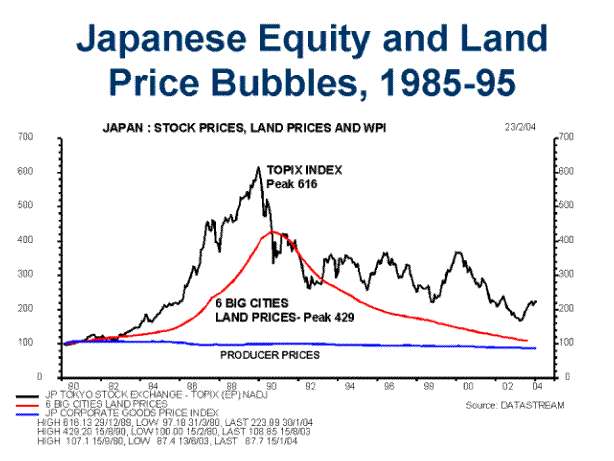

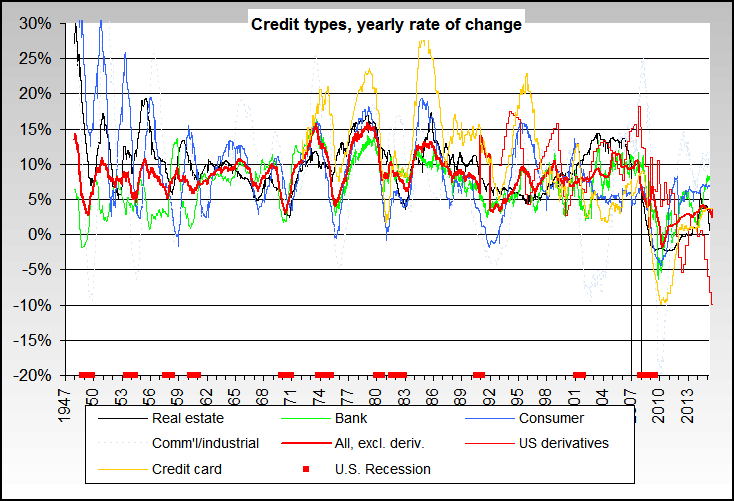

The American mid-term elections have now passed and, only a week later, as announced by LEAP/E2020 in GEAB N°8 of last October 15, the “euphorisation” of US voters/consumers and world financial players seems to have already passed with them. The development process of the global systemic crisis has resumed its course, artificially stopped last July due to the upcoming mid-term elections, as shown by the recent changes in the Dollar’s value and by the latest US economy indicators. In parallel, a series of topics which had curiously disappeared from the pages of financial media these last months is reappearing, such as the end of the “carry-trade” based on the Yen, increasing fears of the risk of implosion of the market for derivatives and “hedge funds” and of course the uninterrupted fall of US real estate with its procession of negative consequences on American growth (all these developments generating from now on increasing reflection as to the health of the US banking sector, one depending more and more on unsound debt). For the team of LEAP/E2020, all these trends, which mark the beginning of the impact phase of the global systemic crisis, have a common catalyst, and that is the insolvency of the US consumer in the framework of a generalized degradation of the quality of credit to all US financial and economic operators.

For the LEAP/E2020 team, it is from now on time to remove the ‘conditional’ from this scenario. It is currently happening throughout all the United States and constitutes a catalyst of the impact phase of the global systemic crisis. The US consumer, i.e. the US middle class, basically becomes insolvent, victim of overwhelming debt, a negative rate of saving, the bursting of the real estate bubble, the rise of interest rates and the collapse of US growth. All these elements are dependent, and mutually reinforcing, to plunge the United States, starting from the end 2006, into an economic, social and political crisis without precedent.

Very concretely, this November issue of GEAB sounds two “LEAP/E2020 Alerts”:

When I talk about matters iTulip at these kinds of events, as with such events during the tech stock bubble 1998 to 2000, most react with a either disbelief or uninterest. But there's usually at least one member of the audience for whom the message rings true. After the panel and event were over, I was approached by a man who is close friends with someone who shall remain nameless who holds a relatively high level position at the IMF. The man who spoke with me is well known in the community. His IMF pal has been telling him the same thing as iTulip: that the dollar is an accident waiting to happen, but no one knows when, and that any central bank that supports it is on a fool's errand, delaying and worsening the outcome of an inevitable correction, and that the world's central banks should long ago have followed the markets' lead and allowed the dollar to fall, rather than face the risk of a disorderly dollar collapse as we do today.

As I mention in today's Quick Comment, Asian and European central banks are collectively making a mistake similar to the one that, paradoxically, the Fed made in the 1920s when it intervened to keep the pound sterling from falling and Great Britain's interest rates from rising, as the flow of captive capital from its colonies declined and it could no longer pay for its imports. In those days, they tinkered with domestic reserves to lower rates to match Great Brittain's. Today the trick is to buying US sovereign debt. It seems that what holds true for ex-colonies with important trade relationships with their once imperial rulers holds true for ex-communist countries that rely on export revenue from the US: they are reluctant to move on to develop more sustainable trade relationships, and put the entire global financial system at risk in the process.

While no one welcomed the news of my prediction of a recession in 2007, the point was made was that both Europe and Asia are in far better shape to withstand a US recession than ever before. From my upcoming conclusion of the Recession 2007 series...

November 17, 2006 (LEAP/E2020)

Extract of the GlobalEurope Anticipation Bulletin N°9

The American mid-term elections have now passed and, only a week later, as announced by LEAP/E2020 in GEAB N°8 of last October 15, the “euphorisation” of US voters/consumers and world financial players seems to have already passed with them. The development process of the global systemic crisis has resumed its course, artificially stopped last July due to the upcoming mid-term elections, as shown by the recent changes in the Dollar’s value and by the latest US economy indicators. In parallel, a series of topics which had curiously disappeared from the pages of financial media these last months is reappearing, such as the end of the “carry-trade” based on the Yen, increasing fears of the risk of implosion of the market for derivatives and “hedge funds” and of course the uninterrupted fall of US real estate with its procession of negative consequences on American growth (all these developments generating from now on increasing reflection as to the health of the US banking sector, one depending more and more on unsound debt). For the team of LEAP/E2020, all these trends, which mark the beginning of the impact phase of the global systemic crisis, have a common catalyst, and that is the insolvency of the US consumer in the framework of a generalized degradation of the quality of credit to all US financial and economic operators.

For the LEAP/E2020 team, it is from now on time to remove the ‘conditional’ from this scenario. It is currently happening throughout all the United States and constitutes a catalyst of the impact phase of the global systemic crisis. The US consumer, i.e. the US middle class, basically becomes insolvent, victim of overwhelming debt, a negative rate of saving, the bursting of the real estate bubble, the rise of interest rates and the collapse of US growth. All these elements are dependent, and mutually reinforcing, to plunge the United States, starting from the end 2006, into an economic, social and political crisis without precedent.

Very concretely, this November issue of GEAB sounds two “LEAP/E2020 Alerts”:

- The first relating to banking and finance sectors which, by the way of “hedge funds” and “bad quality credit”, will be at the centre of the impact phase of the global systemic crisis;

- And the other, which again amplifies the Alert published in GEAB N°4, relating to European real estate, with as an illustration, an analysis of the market trends of the British and French real estate.

When I talk about matters iTulip at these kinds of events, as with such events during the tech stock bubble 1998 to 2000, most react with a either disbelief or uninterest. But there's usually at least one member of the audience for whom the message rings true. After the panel and event were over, I was approached by a man who is close friends with someone who shall remain nameless who holds a relatively high level position at the IMF. The man who spoke with me is well known in the community. His IMF pal has been telling him the same thing as iTulip: that the dollar is an accident waiting to happen, but no one knows when, and that any central bank that supports it is on a fool's errand, delaying and worsening the outcome of an inevitable correction, and that the world's central banks should long ago have followed the markets' lead and allowed the dollar to fall, rather than face the risk of a disorderly dollar collapse as we do today.

As I mention in today's Quick Comment, Asian and European central banks are collectively making a mistake similar to the one that, paradoxically, the Fed made in the 1920s when it intervened to keep the pound sterling from falling and Great Britain's interest rates from rising, as the flow of captive capital from its colonies declined and it could no longer pay for its imports. In those days, they tinkered with domestic reserves to lower rates to match Great Brittain's. Today the trick is to buying US sovereign debt. It seems that what holds true for ex-colonies with important trade relationships with their once imperial rulers holds true for ex-communist countries that rely on export revenue from the US: they are reluctant to move on to develop more sustainable trade relationships, and put the entire global financial system at risk in the process.

While no one welcomed the news of my prediction of a recession in 2007, the point was made was that both Europe and Asia are in far better shape to withstand a US recession than ever before. From my upcoming conclusion of the Recession 2007 series...

Comment