IMF Identifies Risk of `Disorderly' U.S. Dollar Drop

September 13, 2006 (Bloomberg)

A "disorderly'' drop in the dollar is the biggest risk to world financial markets, the International Monetary Fund said, urging policy makers to prepare and act quickly when asset prices slump.

Investors are buying U.S. bonds under the assumption that the dollar won't slide, and a drop in the currency might turn into a rout as foreign investors and central banks move to cut losses, the global financial watchdog said.

"A low-probability but potentially high-cost risk to the global financial system is that a dollar decline could become self-reinforcing and hence disorderly,'' the IMF said in its Global Financial Stability Report today.

Last week, IMF Managing Director Rodrigo De Rato singled out lopsided global trade and investment flows, protectionist sentiment and high energy prices as sources of concern to an otherwise benign outlook for the global economy. The IMF says the U.S. current account deficit, running at a record rate, needs to narrow.

AntiSpin: The "Poom" in Ka-Poom Theory, first proposed in 1999, is fueled by a disorderly, self-reinforcing decline in the dollar. The fact that the IMF is issuing a public warning on this "remote" possibility means that the boys at the IMF believe that USA, Inc. has a couple of bad quarters coming – a recession – in its near term future. Given data provided today by our resident real estate expert, Sean O'Toole, future recession is a safe bet.

The love expressed by foreign central banks for shares of USA, Inc., the US Bonar*, in the form of US financial assets, is proportionate to the ability of the US consumer to covert said loans into purchases of lenders' exports. The extent of this love is expressed clearly by iTulip contributor Aaron Krowne, below.

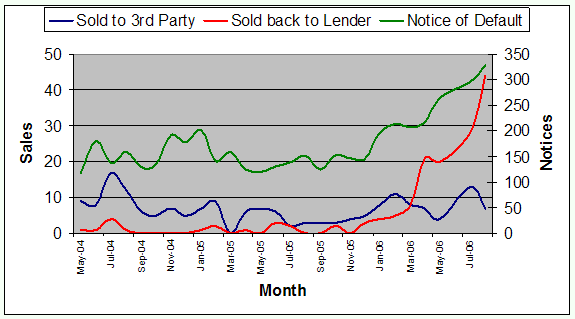

The US consumer is losing the ability to satisfy the Bonar buyer because he's running short of cash-out refi money. As the chart by O'Toole above shows, twice as many consumers are in danger of getting thrown out of the house they purchased with a suicide loan compared to a year ago. The picture below shows that holders of said suicide loans are concentrated in areas where the most real estate speculation has occurred.

Affection for Bonars will shift to more attractive shares, such as those issued by Euro, Inc. Not that Euro, Inc. is a better run business than USA, Inc., and housing bubbles are collapsing there as well. But euro shares are issued according to bureaucratic rules, whereas shares in USA, Inc. are issued in quantities determined more by the relationship between the geeks with their hands on the "print" lever and the jocks with their hands on the "spend" lever. Sometimes the relationship is not too healthy.

The IMF knows that no holder of piles of Bonars, such as China or Japan, wants to see the value of their Bonar reverves decline, so they will never sell. The optimists refer to this as a "balance" whereas we refer to it as Economic Mutually Assured Destruction. The realists understand that should foreign lenders fall out of love with shares of USA, Inc., the Bonar, because the US consumer can't continue buying the flat panel TVs the lenders are selling using the cash he pulls out of his home equity or the revolving credit supplied by US PayDay Loan banking system, the Oh yes, it can happen here event happens.

Among the lenders the optimists assume will never sell, a race to the bottom begins in the manner of the currency crisis in Asia in 1997 – last guy out's a rotten egg. But actually selling is not necessary to create problems. If foreign purchasers of US assets merely slows and the rate of purchases decline from their current lofty rate of 80% of issuance to, say, 60% as in the year 2000, the self-reinforcing dynamic that the IMF warns about might begin: US interest rates climb and the US Bonar declines, US consumption of exports further declines as imports become more expensive and consumers have less access to cheap credit, making Bonar denominated assets less attractive for foreign lenders, and so on. The traditional method of ending such a cycle when it has happened in other countries: the central banks cranks up interest rates, which tends to slow the economy even more and make matters worse.

* Bonar: From now on, the US dollar will be referred to on iTulip.com as the Bonar, a name given to the dollar by forum poster brian4 on indexcalls.com. The dollars you spend today have little in common with the dollars of old, except in name. The power of the US dollar brand remains, but the quality behind the brand was long ago squandered.

September 13, 2006 (Bloomberg)

A "disorderly'' drop in the dollar is the biggest risk to world financial markets, the International Monetary Fund said, urging policy makers to prepare and act quickly when asset prices slump.

Investors are buying U.S. bonds under the assumption that the dollar won't slide, and a drop in the currency might turn into a rout as foreign investors and central banks move to cut losses, the global financial watchdog said.

"A low-probability but potentially high-cost risk to the global financial system is that a dollar decline could become self-reinforcing and hence disorderly,'' the IMF said in its Global Financial Stability Report today.

Last week, IMF Managing Director Rodrigo De Rato singled out lopsided global trade and investment flows, protectionist sentiment and high energy prices as sources of concern to an otherwise benign outlook for the global economy. The IMF says the U.S. current account deficit, running at a record rate, needs to narrow.

AntiSpin: The "Poom" in Ka-Poom Theory, first proposed in 1999, is fueled by a disorderly, self-reinforcing decline in the dollar. The fact that the IMF is issuing a public warning on this "remote" possibility means that the boys at the IMF believe that USA, Inc. has a couple of bad quarters coming – a recession – in its near term future. Given data provided today by our resident real estate expert, Sean O'Toole, future recession is a safe bet.

The love expressed by foreign central banks for shares of USA, Inc., the US Bonar*, in the form of US financial assets, is proportionate to the ability of the US consumer to covert said loans into purchases of lenders' exports. The extent of this love is expressed clearly by iTulip contributor Aaron Krowne, below.

The US consumer is losing the ability to satisfy the Bonar buyer because he's running short of cash-out refi money. As the chart by O'Toole above shows, twice as many consumers are in danger of getting thrown out of the house they purchased with a suicide loan compared to a year ago. The picture below shows that holders of said suicide loans are concentrated in areas where the most real estate speculation has occurred.

Affection for Bonars will shift to more attractive shares, such as those issued by Euro, Inc. Not that Euro, Inc. is a better run business than USA, Inc., and housing bubbles are collapsing there as well. But euro shares are issued according to bureaucratic rules, whereas shares in USA, Inc. are issued in quantities determined more by the relationship between the geeks with their hands on the "print" lever and the jocks with their hands on the "spend" lever. Sometimes the relationship is not too healthy.

The IMF knows that no holder of piles of Bonars, such as China or Japan, wants to see the value of their Bonar reverves decline, so they will never sell. The optimists refer to this as a "balance" whereas we refer to it as Economic Mutually Assured Destruction. The realists understand that should foreign lenders fall out of love with shares of USA, Inc., the Bonar, because the US consumer can't continue buying the flat panel TVs the lenders are selling using the cash he pulls out of his home equity or the revolving credit supplied by US PayDay Loan banking system, the Oh yes, it can happen here event happens.

Among the lenders the optimists assume will never sell, a race to the bottom begins in the manner of the currency crisis in Asia in 1997 – last guy out's a rotten egg. But actually selling is not necessary to create problems. If foreign purchasers of US assets merely slows and the rate of purchases decline from their current lofty rate of 80% of issuance to, say, 60% as in the year 2000, the self-reinforcing dynamic that the IMF warns about might begin: US interest rates climb and the US Bonar declines, US consumption of exports further declines as imports become more expensive and consumers have less access to cheap credit, making Bonar denominated assets less attractive for foreign lenders, and so on. The traditional method of ending such a cycle when it has happened in other countries: the central banks cranks up interest rates, which tends to slow the economy even more and make matters worse.

* Bonar: From now on, the US dollar will be referred to on iTulip.com as the Bonar, a name given to the dollar by forum poster brian4 on indexcalls.com. The dollars you spend today have little in common with the dollars of old, except in name. The power of the US dollar brand remains, but the quality behind the brand was long ago squandered.

Comment