|

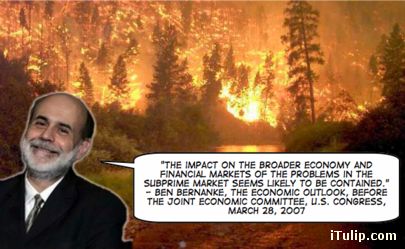

Only a year ago the "sub-prime crisis" was contained. Then the credit crisis expanded but we were told was a limited "Wall Street" problem. Well, don't tell that to 40,000 Massachusetts students who suddenly find themselves without funding.

No funds to lend to 40,000 students

July 29, 2008 (Beth Healy - Boston Globe)

The Massachusetts Educational Financing Authority yesterday said it will not be able to provide student loans this fall for the first time in its 26-year history, leaving more than 40,000 families without an important source of tuition funds just weeks before college classes begin.

The nonprofit lending authority, which last school year provided $510 million in loans, said it has been unable to secure funding to provide private student loans due to the ongoing turmoil in the nation's credit markets. The agency had already disclosed in April that it would no longer offer federally backed student loans.

It is now contacting the tens of thousands of students to whom it has made loans in the past, urging them to seek other options.

"As a result of our problems and the continued dislocation of the capital markets, we have been unable to raise funds for the coming academic year," said Thomas M. Graf, the authority's executive director. more...

AntiSpin: The lending industry has insinuated itself into every aspect of our lives over the past 30 years until few decisions can be made in life without first considering how much will need to be borrowed. To buy a car. To eat out. To go to school. The use of credit for these expenses used to be considered foolish, but the culture changed. As credit came to be applied to these purchases, credit did what it always does: it created inflation.

Car, food, and education costs went up, along with the prices of everything else that came to be purchased with credit instead of cash.

Now that these costs are inflated by credit so that the average family can only afford them on credit as a monthly payment, what happens when the credit disappears through no fault of the family trying to buy a car, pay for a meal, or college?

Demand will fall, followed by bankruptcies of businesses that cannot maintain prices at a level that covers their costs.

Here's an example of how it's playing out for one restaurant chain that did not read our warning in Inflation in America - Part I: Five signs of inflation, from rising prices, to shrinking candy bars, to increased fees:

Inflation’s impact on business: Your local restaurant

Have you noticed prices on the menu going up at your local restaurant even though it's not as crowded? To a business like a restaurant that cannot increase exports like IBM or Cisco can to take advantage of a falling dollar to boost revenues, inflation means higher input costs resulting in less positive cash flow and declining real profits. Here’s what is happening to your local eatery as a result of today's inflation.

Let’s say in April 2008 the restaurant's monthly gross revenues are $100,000 and expenses $70,000, so gross profits are $30K for the month. The owners take $10,000 as personal income and add the remaining $20,000 to the cash account to pay taxes and other expenses later. If that cash account held $40,000 at the end of March at the start of May it holds $60,000. Payments for raw ingredients, labor, and other ongoing expenses in May will come out of this cash account and also out of cash flow from sales.

Now lets dial in the 12% annual inflation. The purchasing power of the $60,000 balance in that account is declining 1% per month, eating away at it like termites, bit by bit turning last month's profits into less purchasing power to buy materials and labor for the following month to run the business. The owners will find that over a year the cash account has dwindled even though revenue appears to be as robust as before. What is happening is that input costs the business are rising faster than the output prices and revenues, the prices of plates of food and glasses of wine. Through this insidious process, the business is gradually going cash-flow negative. The restaurant must either lower costs or raise prices, or both, or fail as a business.

At first, to avoid price hikes that will deter customers management may respond to inflation by trying to lower unit costs (cost per plate of food) by substituting cheaper for higher cost ingredients. It’s a gamble that customers are less likely to be deterred by marginally lower quality than marginally higher prices. Portions may also shrink. You will start to notice fewer shrimp in the shrimp egg foo young at your favorite local Chinese take-out joint.

In spite of these cost reductions, eventually your local restaurant is forced to raise prices to cover rising input costs. Unit volumes decrease because customers’ incomes are not rising to cover the added cost of items on the menu. Customers will also notice the cheaper ingredients and the restaurant’s food quality reputation will suffer. Management tries to lower fixed expenses (versus per plate of food unit costs) by reducing staff. Customers experience this as slowness and crankiness among the remaining overburdened wait staff.

If your wait person is cranky and unresponsive, count how many tables they are covering before passing judgment. These days it's probably too many.

This is how a business goes out of business in an inflationary recession. In an inflationary recession the most profitable operations, if they have maintained a large cash cushion and especially if they hedged inflation in their cash account with sound investments, can survive by letting inflation grind down competing businesses with weaker balance sheets by forcing them to raise prices and reduce product and service quality. By not raising prices and taking the profit hit, the stronger competing company steals the weaker company’s customers. If they have enough cash to keep it up, it's a matter of time before the stronger business has enough of the weaker business's customers that the weaker business fails.

Then guess what the surviving company gets to do? That’s right: raise prices. This is part of the dynamic of an inflation cycle.

Here was the announcement today.Have you noticed prices on the menu going up at your local restaurant even though it's not as crowded? To a business like a restaurant that cannot increase exports like IBM or Cisco can to take advantage of a falling dollar to boost revenues, inflation means higher input costs resulting in less positive cash flow and declining real profits. Here’s what is happening to your local eatery as a result of today's inflation.

Let’s say in April 2008 the restaurant's monthly gross revenues are $100,000 and expenses $70,000, so gross profits are $30K for the month. The owners take $10,000 as personal income and add the remaining $20,000 to the cash account to pay taxes and other expenses later. If that cash account held $40,000 at the end of March at the start of May it holds $60,000. Payments for raw ingredients, labor, and other ongoing expenses in May will come out of this cash account and also out of cash flow from sales.

Now lets dial in the 12% annual inflation. The purchasing power of the $60,000 balance in that account is declining 1% per month, eating away at it like termites, bit by bit turning last month's profits into less purchasing power to buy materials and labor for the following month to run the business. The owners will find that over a year the cash account has dwindled even though revenue appears to be as robust as before. What is happening is that input costs the business are rising faster than the output prices and revenues, the prices of plates of food and glasses of wine. Through this insidious process, the business is gradually going cash-flow negative. The restaurant must either lower costs or raise prices, or both, or fail as a business.

At first, to avoid price hikes that will deter customers management may respond to inflation by trying to lower unit costs (cost per plate of food) by substituting cheaper for higher cost ingredients. It’s a gamble that customers are less likely to be deterred by marginally lower quality than marginally higher prices. Portions may also shrink. You will start to notice fewer shrimp in the shrimp egg foo young at your favorite local Chinese take-out joint.

In spite of these cost reductions, eventually your local restaurant is forced to raise prices to cover rising input costs. Unit volumes decrease because customers’ incomes are not rising to cover the added cost of items on the menu. Customers will also notice the cheaper ingredients and the restaurant’s food quality reputation will suffer. Management tries to lower fixed expenses (versus per plate of food unit costs) by reducing staff. Customers experience this as slowness and crankiness among the remaining overburdened wait staff.

If your wait person is cranky and unresponsive, count how many tables they are covering before passing judgment. These days it's probably too many.

This is how a business goes out of business in an inflationary recession. In an inflationary recession the most profitable operations, if they have maintained a large cash cushion and especially if they hedged inflation in their cash account with sound investments, can survive by letting inflation grind down competing businesses with weaker balance sheets by forcing them to raise prices and reduce product and service quality. By not raising prices and taking the profit hit, the stronger competing company steals the weaker company’s customers. If they have enough cash to keep it up, it's a matter of time before the stronger business has enough of the weaker business's customers that the weaker business fails.

Then guess what the surviving company gets to do? That’s right: raise prices. This is part of the dynamic of an inflation cycle.

Bennigan's, Steak & Ale file for bankruptcy

LOS ANGELES, July 29 (Reuters) - The company that runs Bennigan's and Steak & Ale chains filed for one of the largest restaurant bankruptcies ever on Tuesday and closed several hundred restaurants, costing thousands of workers their jobs.

The bankruptcy petition underscores how economic weakness and rising costs in the United States are squeezing mid-tier restaurants. The restaurant chains have grappled with higher food and labor costs while U.S. consumers are trying to cope with higher grocery and gas bills. more...

Look around you. Do you see other examples?LOS ANGELES, July 29 (Reuters) - The company that runs Bennigan's and Steak & Ale chains filed for one of the largest restaurant bankruptcies ever on Tuesday and closed several hundred restaurants, costing thousands of workers their jobs.

The bankruptcy petition underscores how economic weakness and rising costs in the United States are squeezing mid-tier restaurants. The restaurant chains have grappled with higher food and labor costs while U.S. consumers are trying to cope with higher grocery and gas bills. more...

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2007 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Comment