|

Surprise rebound in housing, outlook still shaky

May 16, 2008 (AP)

Housing posts surprising rebound in April on apartment construction, outlook still shaky

The Commerce Department reported Friday that housing construction rose by 8.2 percent in April to a seasonally adjusted annual rate of 1.03 million units. Building of single-family homes continued to weaken, however. The growth came from a big jump in apartment construction.

Analysts predicted the surprising rebound in April would be temporary given the headwinds builders are still confronting, from slumping sales to soaring home foreclosures.

The strength in housing construction in April came entirely from a huge increase in apartment construction, which can be extremely volatile from month to month. Building of apartments, defined as two or more units, jumped by 36 percent to a seasonally adjusted annual rate of 340,000 units.

AntiSpin: An increase in the number of permits to build apartments for renters is hardly surprising. Where are all the foreclosed-on former "home owners" going to live? Let's dig into the data and see what's going on.

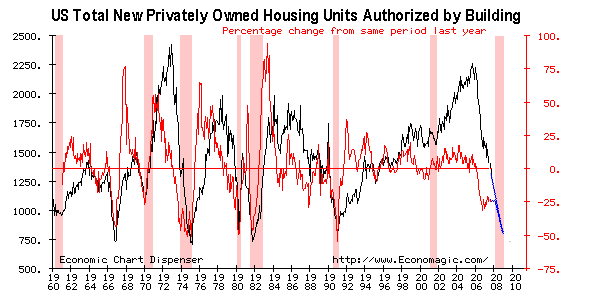

Building permits for all four major classes of residential structures: the rate of decline

has leveled off only for structures with five or more units.

The graph above shows the four classes of buildings that the government tracks: privately owned units, and structures with one unit, two to four units, and five or more units. Note that all are sucking wind and typically do so together, but that starting in the early 1990s buildings with two or more units started to diverge from single units.

The reason is that after 1990 they are financed differently and demand characteristics are apples and oranges.

Last June before the shit hit the fan in the credit markets and mortgages

backed by CDOs were still readily available, fewer than 15% of loan

officers surveyed reported tighter credit standards; as of April 2008 60% do.

The sub-prime is worse with nearly 80% reporting tighter

lending versus 55% last August.

Lending standards for commercial buildings tightened up too,

but leveled off in February.

As the article noted states, "The strength in housing construction in April came entirely from a huge increase in apartment construction, which can be extremely volatile from month to month. Building of apartments, defined as two or more units, jumped by 36 percent to a seasonally adjusted annual rate of 340,000 units. The larger single-family sector dropped by 1.7 percent to an annual rate of 692,000 units. It was the 12th consecutive monthly decline and pushed single-family building activity to its lowest point in 17 years, since a severe housing slump in the early 1990s."

The relevant action continues in the market for single family homes. Let's update our housing permits chart to see how our forecast of permits, a leading indicator of future home construction correlated to recession, is holding up.

October 2007 our building permits chart, with our forecast in blue, appeared as follows:

iTulip Chart from Oct. 2007, forecast is the blue line

Today, the chart looks like this.

Actual permits data May 2008

Permit issuance has been declining year over year since mid 2005; we are now clearly in recession territory.

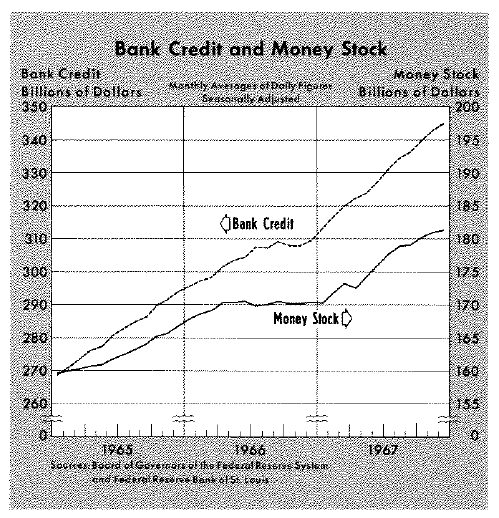

The exception to the correlation between housing permit issuance and recession? The 1966 to 1968 period. What happened to delay that recession until 1970? The Fed's response to the 1966 credit crunch – that it caused.

Source: Federal Reserve

The 1969 Fed report Historical Analysis ol the Credit Crunch of 1966 by ALBERT E. BURGER report states:

In early 1966 the U.S. economy was entering the sixth year of continuous economic expansion. The unemployment rate was at 4 per cent, a level believed almost unattainable two or three years earlier, capacity utilization was close to 90 per cent, and firms were faced with an exceptionally large backlog of orders. The economy had not only reached a state of full employment, but there was every indication that the “boom” would continue. To many, it appeared that the “New Economics” had finally removed the danger of recession or economic slowdown.

The year 1966 was not, however, to be remembered as a year of smooth economic expansion. The two main topics in discussions of economic stabilization policy in 1966 were as follows: (1) the sharply rising level of Government spending for the Vietnam war, and (2) the emergence of inflation.

Reflecting demand pressures on the productive capacity of the economy, prices rose rapidly. In the summer of 1966 a policy of monetary restraint led to conditions popularly called the Credit Crunch of 1966. The most publicized features of this period were (1) the development in August of an alleged near liquidity crisis in the bond markets and (2) a record decrease in savings inflows into non-bank financial intermediaries and the resulting reduced rate of residential construction.

In other words, the Fed created the credit crunch that resulted in the declines in residential real estate construction, and since the Fed created the credit crunch the Fed was able to fix it, too. All it had to do was not deal with inflation. The year 1966 was not, however, to be remembered as a year of smooth economic expansion. The two main topics in discussions of economic stabilization policy in 1966 were as follows: (1) the sharply rising level of Government spending for the Vietnam war, and (2) the emergence of inflation.

Reflecting demand pressures on the productive capacity of the economy, prices rose rapidly. In the summer of 1966 a policy of monetary restraint led to conditions popularly called the Credit Crunch of 1966. The most publicized features of this period were (1) the development in August of an alleged near liquidity crisis in the bond markets and (2) a record decrease in savings inflows into non-bank financial intermediaries and the resulting reduced rate of residential construction.

The possibility of causing another “Credit Crunch,” with all of its feared ramifications on the financial markets and the savings and loan and housing industries, acted as an important constraint on a decision to move toward a tighter monetary policy in the last half of 1967.

Even though inflation was uncomfortably high, the Fed did nor raise rates, choosing instead to focus on the credit crunch and deal with inflation later. And we all remember what happened next. The Fed is, in this cycle, behaving as though it intends to again focus first on the credit crunch and deal with inflation later. This time, however, the exogenous credit markets not the Fed created the credit crunch that is both a cause and an effect of the housing market collapse. The Fed may find that by the time the credit crunch is over, the inflation problem will again be hard to control. With gold back over $900, silver nearing $17, and platinum back over $2100, the market for precious metals is broadcasting this loud and clear.

For our iTulip Select subscribers we have a report from our correspondent in Spain, a property developer and manager who rode the housing boom up and is now riding it down. It's like the US version, except with Russian oil money and cash from questionable sources. Read on... ($ubscription)

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2007 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Comment