Economy Often Defies Soft Landing

August 11, 2006 (New Your Times) Free Registration Required

In the cool and quiet marble corridors of the Federal Reserve, the strategy for taming inflation sounds painless, even soothing: a “soft landing” for the economy after several years of flying high.

As the central bank contended on Tuesday, when it decided to pause in its two-year effort to raise interest rates, inflation is “elevated” right now but will begin to decline because economic growth is poised for a modest slowdown.

Many economists, though, warn that the soft landing may seem anything but soft, and suggest that the Fed is either too rosy about the looming slowdown or naïve about the difficulty of reaching its goal for inflation.

In practice, the Fed has achieved only one true soft landing — in 1994-95, when, under the leadership of Alan Greenspan, it was able to slow the economy enough to cool spending and ease inflation pressure but not so much as to cause a big jump in unemployment. But even Mr. Greenspan, whose ability to fine-tune policy made him famous, presided over two formal recessions, in 1991 and in 2001.

AntiSpin: We all know that cheap imports from China have for years balanced out rapid inflation in the prices of non-traded goods and services -- energy, healthcare, insurance, and education -- to give us the magic low numbers we get out of the Bureau of Labored Statistics, that group of government number collectors and crunchers that iTulipers hold in low esteem. If the BLS used the same method of accounting to generate the CPI as was used before it was tortured into its current shape during the Clinton administration, CPI inflation is currently running at around 7.5% annually versus the 4.3% reported in by the BLS.

CPI validity arguments aside, if the major counter-balance of non-traded goods and services inflation is cheap goods imports from China, then they'd better stay cheap or even the BLS isn't going to be able to hide the resulting rise in CPI.

Assuming relatively stable currency exchange rates between the Chinese RMB and the US dollar, labor and land prices are the major factors keeping Chinese products cheap. This recent article from Supply Chain Digest delivers some unwelcome news:

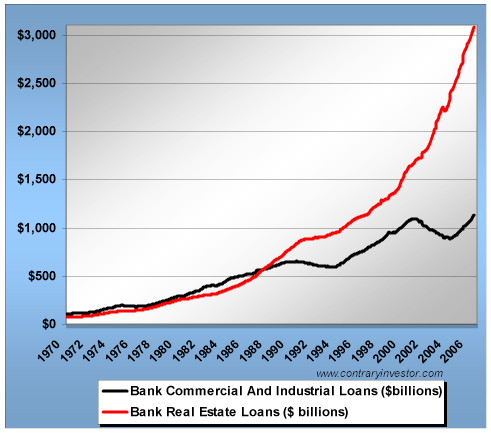

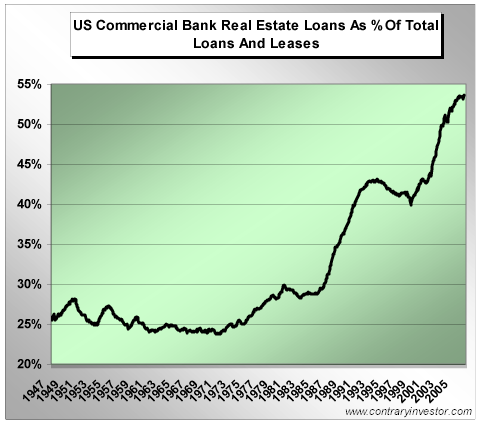

If the Fed counters this inflation with monetary policy with gradual rate increases, the US economy will likely experience a series of relatively minor recessions that adjust the economy to reach a lower level of demand. If the Fed does not, the current stagflationary environment will drag on, riding the edge of recession while inflation continues to build, requiring more agressive rate hikes that will cause a more severe recession. In either case, the NYTimes story is correct, recession is in the offing, and all of these longer term trends will be overshadowed by the impact of the collapsing housing bubble.

August 11, 2006 (New Your Times) Free Registration Required

In the cool and quiet marble corridors of the Federal Reserve, the strategy for taming inflation sounds painless, even soothing: a “soft landing” for the economy after several years of flying high.

As the central bank contended on Tuesday, when it decided to pause in its two-year effort to raise interest rates, inflation is “elevated” right now but will begin to decline because economic growth is poised for a modest slowdown.

Many economists, though, warn that the soft landing may seem anything but soft, and suggest that the Fed is either too rosy about the looming slowdown or naïve about the difficulty of reaching its goal for inflation.

In practice, the Fed has achieved only one true soft landing — in 1994-95, when, under the leadership of Alan Greenspan, it was able to slow the economy enough to cool spending and ease inflation pressure but not so much as to cause a big jump in unemployment. But even Mr. Greenspan, whose ability to fine-tune policy made him famous, presided over two formal recessions, in 1991 and in 2001.

AntiSpin: We all know that cheap imports from China have for years balanced out rapid inflation in the prices of non-traded goods and services -- energy, healthcare, insurance, and education -- to give us the magic low numbers we get out of the Bureau of Labored Statistics, that group of government number collectors and crunchers that iTulipers hold in low esteem. If the BLS used the same method of accounting to generate the CPI as was used before it was tortured into its current shape during the Clinton administration, CPI inflation is currently running at around 7.5% annually versus the 4.3% reported in by the BLS.

CPI validity arguments aside, if the major counter-balance of non-traded goods and services inflation is cheap goods imports from China, then they'd better stay cheap or even the BLS isn't going to be able to hide the resulting rise in CPI.

Assuming relatively stable currency exchange rates between the Chinese RMB and the US dollar, labor and land prices are the major factors keeping Chinese products cheap. This recent article from Supply Chain Digest delivers some unwelcome news:

The News: After many years of rapid growth, foreign direct investment in China has slowed dramatically.

The Impact: Rising costs of land and labor are diminishing China’s manufacturing cost advantages. Interest and activity in Vietnam, Malaysia and other lower cost countries is showing a corresponding increase.

The Story: After a sharp decrease in June, direct foreign investment in China is down for the first half of 2006, a sign that many experts think is driven in part by rapid increases in the cost of labor and land in China, especially in the coastal regions.

To a certain extent, other Asian countries with lower labor costs than China's, such as Malaysia and Vietnam, will pick up the slack, and we'll see more products in the shelves from these countries. But in the long term the US can expect that as living standards increase among goods exporting countries, labor costs will rise and the anti-inflation free ride in the US has enjoyed will gradually come to an end, ushering in an era of higher inflation and interest rates and slower economic growth.The Impact: Rising costs of land and labor are diminishing China’s manufacturing cost advantages. Interest and activity in Vietnam, Malaysia and other lower cost countries is showing a corresponding increase.

The Story: After a sharp decrease in June, direct foreign investment in China is down for the first half of 2006, a sign that many experts think is driven in part by rapid increases in the cost of labor and land in China, especially in the coastal regions.

If the Fed counters this inflation with monetary policy with gradual rate increases, the US economy will likely experience a series of relatively minor recessions that adjust the economy to reach a lower level of demand. If the Fed does not, the current stagflationary environment will drag on, riding the edge of recession while inflation continues to build, requiring more agressive rate hikes that will cause a more severe recession. In either case, the NYTimes story is correct, recession is in the offing, and all of these longer term trends will be overshadowed by the impact of the collapsing housing bubble.

Comment