|

The perennial question of the final outcome of the credit bubble is heating up after the zero bound of interest rates got 125 basis points closer and the Fed Funds rate only 3% away from rock bottom. The end game for the debt financed US economy is typically argued among contrarians as a choice between either a deflationary spiral as the US experienced during the early years of the 1930s or a hyper-inflation as Argentina suffered in the late 1980s. Behind Door Number Two, iTulip offers a less dire outcome than the extremes behind Door Number One and Door Number Three.

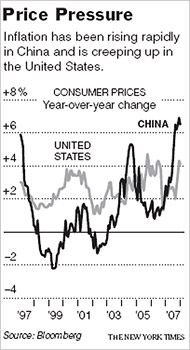

Today one of our best and brightest iTulip members posted an excerpt and a link to yesterday's comments by Stephanie Pomboy: Economic Fear Taking Hold. In it she says a US deflationary spiral is a mere 3% away. Our long standing position is that the ongoing asset price deflation, debt deflation, now with rising unemployment, falling demand and recession will lead to further erosion in the purchasing power of the dollar and thus to more inflation.

Pomboy's suggestion sounds like a variation on ideas that Mish and many of the good folks over at Minyanville believe. We call the group Deflationistas. Deflationistas have repeatedly called for a deflation spiral and all-goods prices declines for the past several years, since at least 2005. Each oft repeated forecast of imminent price deflation has been contradicted by evidence of ever-increasing all-goods price inflation. You'd think repeated failures would send them back to the drawing board to try to figure out what went wrong but instead they keep doubling down. The deflation spiral has been temporarily defeated by the Fed supplying even more credit. As a result the inevitable deflation spiral will be even more severe, or so the thinking goes.

The underlying analysis and research is sufficiently sparse that I'm left to conclude that these beliefs are largely ideological or moralistic, that the US economy "should" fall into a deflation spiral because excessive credit creation is "bad" and that we should all be punished for it, especially those slacker debtors. Mish's most famous and careful analysis was made in May 2005 in Deflation is in the Cards. It lays out his position.

Door Number One

In it Mish offers the following summary.

The Mish top ten reasons why deflation is inevitable:

1) Enormous consumer debt

2) Falling wages

3) Global wage arbitrage

4) Credit expansion that can not be maintained

5) Mal-investments

6) Over capacity

7) A world-wide housing bubble

8) A re-inflated stock market bubble

9) The normal business cycle

10) Past history

These are all good reasons to expect the US economy to run into trouble but for the purposes of forecasting a deflationary spiral he misses the most important one: US dependence on foreign borrowing to fund its merchandise trade and fiscal deficits and the implications for the dollar.1) Enormous consumer debt

2) Falling wages

3) Global wage arbitrage

4) Credit expansion that can not be maintained

5) Mal-investments

6) Over capacity

7) A world-wide housing bubble

8) A re-inflated stock market bubble

9) The normal business cycle

10) Past history

Then he lays out his descent into a deflation spiral scenario. It's fairly accurate, at least until he reaches his conclusion; he doesn't understand why the scenario is dollar negative and therefore inflationary, and therefore leads inexorably to the opposite of his conclusion. Here's the scenario with my comments in parentheses.

This is the scenario I envision:

Wages continue to fall due to outsourcing, mergers, and global wage arbitrage (no, they are starting to rise due to inflation)

Home prices level off then fall sharply (correct)

Home equity loans stagnate as result of stagnating home prices (correct)

Home building stalls because affordability finally starts to matter (correct)

Trade jobs fall with falling home starts (correct)

Expansion of Walmarts, Home Depots, etc. stops with the slowdown of new home subdivisions (correct)

Retail expansion peaks and stalls (correct)

Consumer sales slow with the slowing economy (correct)

Bankruptcies increase (correct)

Consumer lending based on rising home prices falls flat (correct)

Credit growth declines (correct)

The US goes into a recession (correct)

Layoffs in the financial sector increase (correct)

Layoffs in the real estate sector increase (correct)

Credit is destroyed in more bankruptcies (correct)

Deflation is finally recognized in hindsight (No. The dollar weakens further as these events occur, leading to further inflation.)

Hyper-inflationists throw in the towel (No, this is a straw man argument. The choice is not between a US 1930s style deflation spiral and a hyperinflationary spiral that ends with a complete repudation of the currency. The rate of decline of the dollar is buffered by foreign central bank holdings.)

Door Number ThreeWages continue to fall due to outsourcing, mergers, and global wage arbitrage (no, they are starting to rise due to inflation)

Home prices level off then fall sharply (correct)

Home equity loans stagnate as result of stagnating home prices (correct)

Home building stalls because affordability finally starts to matter (correct)

Trade jobs fall with falling home starts (correct)

Expansion of Walmarts, Home Depots, etc. stops with the slowdown of new home subdivisions (correct)

Retail expansion peaks and stalls (correct)

Consumer sales slow with the slowing economy (correct)

Bankruptcies increase (correct)

Consumer lending based on rising home prices falls flat (correct)

Credit growth declines (correct)

The US goes into a recession (correct)

Layoffs in the financial sector increase (correct)

Layoffs in the real estate sector increase (correct)

Credit is destroyed in more bankruptcies (correct)

Deflation is finally recognized in hindsight (No. The dollar weakens further as these events occur, leading to further inflation.)

Hyper-inflationists throw in the towel (No, this is a straw man argument. The choice is not between a US 1930s style deflation spiral and a hyperinflationary spiral that ends with a complete repudation of the currency. The rate of decline of the dollar is buffered by foreign central bank holdings.)

The Hyperinflationistas behind Door Number Three are typically Von Mises followers, who expect an event Mises called a "crack-up boom." They believe that the outcome of the collapsing credit bubble is a government with no choice but to print money to pay its expenses leading to hyperinflation and ruination of the dollar.

We disagree. For a nation to experience a hyperinflation, all four of the following conditions need to be met:

- Large and growing external debt as a percentage of GDP with falling GDP (Yes, like the US.)

- Politically and economically isolated and irrelevant (Not like the US. Think: Zimbabwe.)

- No external demand for the currency (Not like the US dollar. Think: Iraqi Dinar.)

- Political chaos (i.e., tanks rolling down the street, not like the US.)

Oddly, both the Hyperinflationistas and the Deflationistas agree that gold is a good hedge. While gold holds value relative to a crashing currency, if you are expecting a deflationary spiral you ought to sell all of your gold right away and load up on hard cash and short term treasury bonds. In a deflationary spiral, cash gains in purchasing power and asset prices, including gold, crash. This basic contradiction in Deflationista theory is explained by Mish as:

That said, I believe gold will rise as the FED attempts to fight deflation just as they attempted to fight it by slashing rates to 1%. This FED has learned NOTHING from history. The root cause of the great depression was an over-expansion of credit. One can NOT defeat the business cycle by throwing more money at it. All hyperbolic credit expansions end the same way. It will NOT be different this time.

This is more than a little ambiguous. Does this mean we'll see a deflationary spiral unless the Fed attempts to prevents one, which of course it will, in which case we'll see inflation? Isn't that the inflationist's argument?The second biggest problem with the deflation spiral theory, besides a complete lack of evidence to support it, is that it is not even self-consistent. Bottom line: if you believe that the Fed cannot maintain negative real interest rates, sell your gold.

Door Number Two

The value of a common share of USA, Inc.–the US dollar–will continue to come under pressure. We have always promoted the idea that we will see a major inflation albeit not technically a "hyper" inflation. And that's what we're getting.

Back to Pomboy.

I expect the euro will soon begin to trade inversely with rates (eg., the tighter the ECB the weaker the euro, because it virtually ensures they completely disintegrate). Meanwhile, in the US, the Fed, running out of room to cut short rates, will shift to the long end and US treasuries will move well below 3%. This isn't a statement about the value of Treasuries. Heck, there wasn't any value in Treasuries at 6%!! But that's not the point.

Jack Crooks reported today: "A dismal U.S. Jobs report this morning sent the euro soaring, and the dollar tanking, at first. The euro soon settled down and reversed its entire move, triggering our stop-loss order. The British pound wasn’t able to benefit from the initial dollar beating, either. GBPUSD is plunging. This combination tells us that traders are leaning more towards risk-averse trades – Japanese yen and Swiss franc – in light of the newest piece of evidence signaling a U.S. recession is looming."By Pomboy's thinking, shouldn't the dollar be rising on negative US economic news if deflation beckons? Or is her theory that the FX markets won't start to price deflation into currencies until it becomes "real" and we're "living in it" versus only experiencing it as a "theoretical" possibility today?

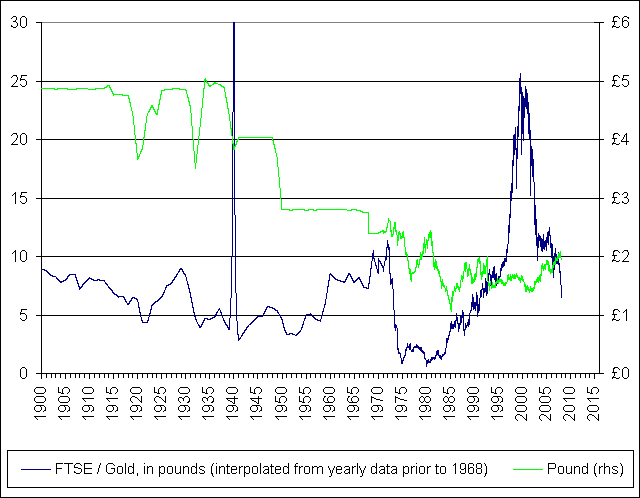

Clearly we are seeing price deflation in asset prices–stocks, housing and soon commercial real estate–and marked-down consumer goods as the Monthly Payment Consumer buckles under the combined pressures of rising inflation and unemployment. Platinum and other industrial metals are starting to fall in price as markets anticipate falling demand. Gold is rising in anticipation of what the government must continue to do to keep real interest rates negative: inflate, inflate, inflate.

After ten years of reading dozens of books, hundreds of articles, conducting dozens of interviews, participating in many debates, and writing many articles on this topic, I've at last developed a theory to explain how anyone can expect a currency with no gold backing–and with as many liabilities against it as the dollar has–to appreciate in an economic crisis and thus for a deflation spiral to occur: they don't travel. This is not surprising. When we interviewed Louis Gave a few months ago he explained that fewer than 9% of Americans have passports and only half of those who do use them to travel outside the US in a given year. This creates a huge mass of US-centric thinkers to stew in their own US-centric ideas.

If you have traveled much over the past few years then you cannot fail to see what's happening. Go to Europe. Go to Asia. Go to Mexico. Go anywhere. Gold is not rising, gold is priced in dollars and the dollar is falling. It is acting as a Fourth Currency. It is behaving this way because it is the only metal that central banks hold as a reserve asset. If CBs held platinum it would be going up, too. Gold is becoming The Fourth Currency.

A corollary to my travel theory is that the more you travel and the more you see the more afraid you become that the process ends with a 100 dollar bill buying a cup of coffee. Jim Rogers travels so much that he went to Singapore and never came back. His old pal George Soros has also seen too much. I was interviewed by the right wing Italian magazine Panorama the day last week when Soros made his now famous comments in "The worst market crisis in 60 years." The reporter asked me, "Isn't that what you've been saying for years?" My reply is here.

My recommendation to Deflationistas who see the US economy 300 basis points away from a deflation spiral is to step away from the keyboard, climb out of the basement office, buy a plane ticket–hit the road, so to speak. The tour should include Canada, Germany, UK, Japan, China, Hong Kong, Singapore and Mexico. Bring lots of dollars because they don't go far in those places. When you return, think about what you've learned. Ponder how the dollar can have fallen so much and be worth so little even as US treasury bond yields have fallen and gold prices gone up.

The critical flaw in the US deflation spiral analysis is that the Deflationistas forgot to ask: In what currency is a US treasury bond denominated? Of course the dollar is deflating with respect to itself! But imports determine a nation's inflation rate. As the dollar deflates that can only mean one thing: rising imports prices and all-goods price inflation.

How can the dollar depreciation and inflation be brought under control? The same way as in Mexico or any other nation that's been in a similar position. Two options: fiscal and monetary austerity or tap a new source of credit and fund a new asset bubble. Given the past behavior of politicians and of the US Congress in particular, do you really want to bet on austerity in an election year? We expect a Next Bubble, but don't plan on seeing it kick in to help the economy until 2009 at the earliest.

Behind Door Number One are guys who have been wrong for years on end and will stay that way unless the US enacts the kind of austerity measures the IMF once imposed on debtors: raise taxes, cut spending, send 20 million people into the unemployment lines. In an election year. The probability of that occurring is zero. Behind Door Number Three are guys who may eventually be right but three new conditions have to be met first: The US must become as politically and economically isolated and unimportant on a global scale as Argentina was in the 1980s, external demand for the dollar has to fall to the level of the Iraqi Dinar, and there have to be tanks rolling down the street. The probability of all three of those occurring? Zero. Behind Door Number Two are guys who have turned a few million dollars into more than a hundred million after reaching the same conclusion in 2002 that I did in 2001, that the dollar will decline but will not crash, and the decline will exert an inflationary bias on the economy.

Which door do you choose? Better hurry! Only 300 basis points to go.

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

To learn about the Next Bubble, sign up for one year of iTulip Select by January 31 and receive the February 2007 issue of Harper's Magazine with Eric Janszen's cover article The Next Bubble free.

For the safest, lowest cost way to buy and trade gold, see The Bullionvault

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2007 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Comment