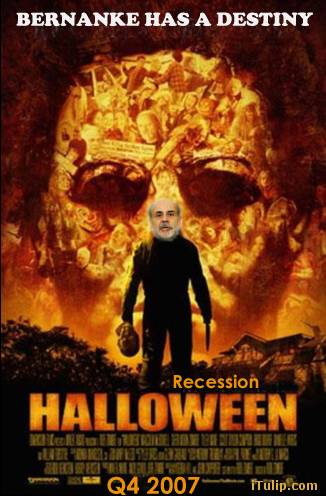

|

AntiSpin: Recession? Really? With millions of homeowners facing foreclosure, ARM resets, and other problems, who could have guessed?

"There is a growing concern for an economic recession in the United States,'' said Toru Umemoto, chief currency strategist at Barclays Bank Plc, citing the spillover effect of the U.S. subprime mortgage crisis into consumption in the United States.

Umemoto also warned that the housing slump will also have a downside effect on employment, as seen in large-scale layoffs by major U.S. financial institutions including Bank of America Corp.'s announcement Wednesday to cut 3000 employees.

Umemoto also warned that the housing slump will also have a downside effect on employment, as seen in large-scale layoffs by major U.S. financial institutions including Bank of America Corp.'s announcement Wednesday to cut 3000 employees.

...certain to raise concerns about whether the severe slump in housing and a serious credit crunch were beginning to adversely affect the overall economy.

There were sizable downward revisions to sales totals for August, July and June. Those revisions show that housing was much weaker than believed in the middle of the year. In addition, sales of new homes were down 23.3 percent from September, 2006.

Other new reports showed economic weakness. The Commerce Department said durable goods orders fell 1.7 percent in September. The result was weaker than the 1.5 percent gain expected by economists, but marked an improvement over a 5.3 percent plunge in August.

The two straight months of orders slowdowns mirrors national manufacturing softness and suggests that problems in housing won't be offset by business spending, according to Ian Shepherdson, Chief U.S. Economist at High Frequency Economics.

Claims for state unemployment benefits last week fell by 8,000 to 331,000, but the more reliable four-week average reached its highest level in seven weeks, the Labor Department said. Economists expected a larger drop in the latest week.

The two straight months of orders slowdowns mirrors national manufacturing softness and suggests that problems in housing won't be offset by business spending, according to Ian Shepherdson, Chief U.S. Economist at High Frequency Economics.

Claims for state unemployment benefits last week fell by 8,000 to 331,000, but the more reliable four-week average reached its highest level in seven weeks, the Labor Department said. Economists expected a larger drop in the latest week.

Meanwhile, the Weak Dollar Policy is chipping away at export-based economies whose currencies, unlike China's, are not tied to the dollar. Korea, for example.

AntiSpin: And Germany...

AntiSpin: In fact, all of Europe is starting so slow down as the strong euro policy loses out to the weak dollar policy.

AntiSpin: How much longer will US trade partners tolerate the US keeping its post-housing bubble economy alive on the backs of its trade partners? Some euro members have housing bubbles of their own to deal with. Seems the only one that's doing well is the one that isn't following the rules: China.

Comment