Five Things You Need to Know: Stagflation

June 21, 2006 (Minyanville)

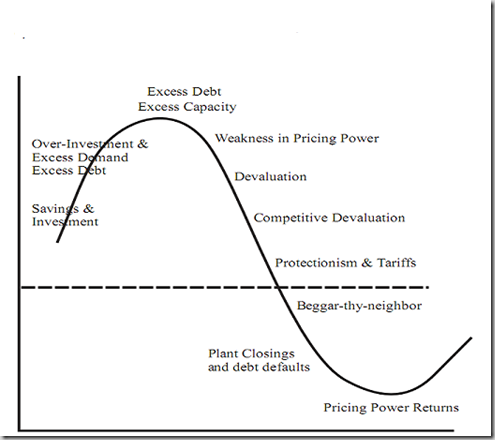

What we see as stagflation looming on the horizon in our side-view mirror today, may be full-blown deflation up close as dollars are hoarded to pay down excessive debt and reduce, reduce, reduce. Warning: object in mirror may be closer than it appears.

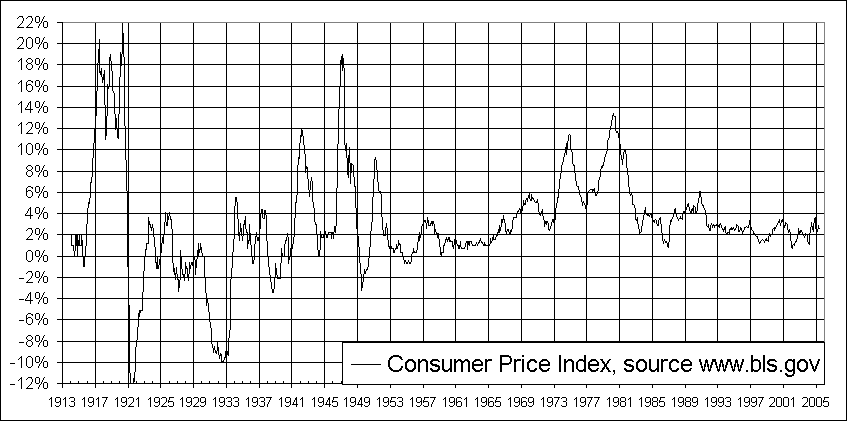

AntiSpin: How can you have deflation when your currency has declined 50%? Given that U.S. inflation today is only as low as it is because foreign lenders are supporting the dollar via purchased of dollar denominated financial assets, if they slow, inflation will rise. Still, Minyville makes an articulate case for deflation over our case for deflation versus our long standing case for inflation as an outcome of debt repudiation.

June 21, 2006 (Minyanville)

What we see as stagflation looming on the horizon in our side-view mirror today, may be full-blown deflation up close as dollars are hoarded to pay down excessive debt and reduce, reduce, reduce. Warning: object in mirror may be closer than it appears.

AntiSpin: How can you have deflation when your currency has declined 50%? Given that U.S. inflation today is only as low as it is because foreign lenders are supporting the dollar via purchased of dollar denominated financial assets, if they slow, inflation will rise. Still, Minyville makes an articulate case for deflation over our case for deflation versus our long standing case for inflation as an outcome of debt repudiation.

Comment