|

Before the Stroke of Midnight

July 25, 2007 (iTulip)

Investors await their fate, again

In our view, Thurow's warning is more relevant today than 20 years ago, and Hormats brings it up to date and into focus.

What does it mean? Given the extremes of imbalance that have developed since 1987, we'll state the risks simply: the market event we are due, when it occurs, will make the October 1987 crash seem benign by comparison.

In our Newsletter, Monday July 30, 2007 we referred readers to that warning first, noting additionally: "The last time we made a similar call was back in March 2000."July 25, 2007 (iTulip)

Investors await their fate, again

In our view, Thurow's warning is more relevant today than 20 years ago, and Hormats brings it up to date and into focus.

What does it mean? Given the extremes of imbalance that have developed since 1987, we'll state the risks simply: the market event we are due, when it occurs, will make the October 1987 crash seem benign by comparison.

For long time readers of iTulip, that was back here...

Janszen Crying Wolf? Not So Fast.

March 21, 2000 (BankRate.com)

I have no quarrel with anyone who is in this market or who encourages playing the market. But I do take issue with those who fail to mention the risks. This leads many to put retirement money into the market, or take out a second mortgage on the house to buy stocks, or borrow money against stocks to buy property. My message is for them.

We hope two crash calls in seven years is not too many. March 21, 2000 (BankRate.com)

I have no quarrel with anyone who is in this market or who encourages playing the market. But I do take issue with those who fail to mention the risks. This leads many to put retirement money into the market, or take out a second mortgage on the house to buy stocks, or borrow money against stocks to buy property. My message is for them.

We received several emails today along the following lines:

If only everybody read your website...

I re-positioned my investments a couple of weeks ago in light of the market turmoil (rise in volatility, liquidity drying up) and your top call helps reaffirm my thoughts on this. Your website has been an unbelievably invaluable resource helping to guide me through this very challenging marketplace!

Keep up the good work!!

Wayne

Our man Jim Cramer completely freaks out at Ben Bernanke on national TV.I re-positioned my investments a couple of weeks ago in light of the market turmoil (rise in volatility, liquidity drying up) and your top call helps reaffirm my thoughts on this. Your website has been an unbelievably invaluable resource helping to guide me through this very challenging marketplace!

Keep up the good work!!

Wayne

Our opinion isn't that the Fed is an inherently bad institution any more than is the European Central Bank, the Bank of Japan, the People's Bank of China, or any other central bank.

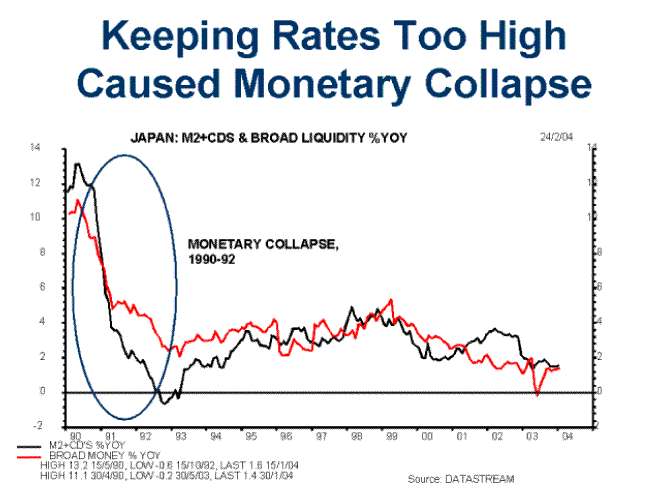

The principle here is that the concept of free and efficient markets needs apply as evenly to businesses that fail because of, for example, offshoring as to business that make losing financial bets. Even the Japanese, famous for using public funds to support corrupt banks that made uneconomic loans to favored bank clients, allowed their second largest financial firm to go under in the early 1990s after their credit bubble popped. The head of the Japanese Ministry of Finance put it well when asked why the firm was allowed to fail: "Easy come, easy go."

Of course, the Fed will need to step in at some point. We don't want this...

... followed by this...

See also:

Goldman's "Ready." Are you?

The Con Before the Storm

Turkeys fall back to earth: It started with real estate

Sell Everything

Bulls Rush Back In Where Angels Fear to Tread

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

Special iTulip discounted subscription and pay services:

For a book that explains iTulip concepts in simple americasbubbleeconomy

For macro-economic and geopolitical currency ETF advisory services see Crooks on Currencies

For macro-economic and geopolitical currency options advisory services see Crooks Currency Options

For the safest, lowest cost way to buy and trade gold, see The Bullionvault

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2007 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Comment