Re: What do I think of the World Bank President's call for discussion of a new gold standard?

Could not disagree more. There are several aspects of an oil backed currency that make the whole idea totally unworkable.

1. The oil represents the potential for use; but if ever used, the value completely disappears.

On the other hand, Gold, never disappears. We constantly see reports of Gold that has been stashed away more than a thousand years ago, but the moment it is dug out of the ground, its value is immediately recognised.

2. What happens to the value of the oil when, (note the use of the word "when"), another energy source is discovered?

There is every possibility that someone will open the door to a new form of energy technology that costs much less to create and use. Once that moment arrives, your oil value drops to that of the new form of energy.

3. Accidental loss? What are you going to say to your creditors when the oil store catches fire and you suffer a total loss? You will never receive the full value via insurance.

Golds' real strength is the simple fact of its immutability; you cannot degrade the value by use, replacement, (has not occurred for thousands of years), nor accident. The one thing you can utterly rely upon is that Gold retains all it physical properties and cannot be replaced. That is the great strength of holding Gold.

Originally posted by xPat

View Post

1. The oil represents the potential for use; but if ever used, the value completely disappears.

On the other hand, Gold, never disappears. We constantly see reports of Gold that has been stashed away more than a thousand years ago, but the moment it is dug out of the ground, its value is immediately recognised.

2. What happens to the value of the oil when, (note the use of the word "when"), another energy source is discovered?

There is every possibility that someone will open the door to a new form of energy technology that costs much less to create and use. Once that moment arrives, your oil value drops to that of the new form of energy.

3. Accidental loss? What are you going to say to your creditors when the oil store catches fire and you suffer a total loss? You will never receive the full value via insurance.

Golds' real strength is the simple fact of its immutability; you cannot degrade the value by use, replacement, (has not occurred for thousands of years), nor accident. The one thing you can utterly rely upon is that Gold retains all it physical properties and cannot be replaced. That is the great strength of holding Gold.

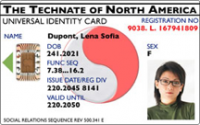

The principal scientist behind Technocracy was M. King Hubbert, a young geoscientist who would later (in 1948-1956) invent the now-famous Peak Oil Theory, also known as the Hubbert Peak Theory. Hubbert stated that the discovery of new energy reserves and their production would be outstripped by usage, thereby eventually causing economic and social havoc. Many modern followers of Peak Oil Theory believe that the 2007-2009 global recession was exacerbated in part by record oil prices that reflected validity of the theory.

The principal scientist behind Technocracy was M. King Hubbert, a young geoscientist who would later (in 1948-1956) invent the now-famous Peak Oil Theory, also known as the Hubbert Peak Theory. Hubbert stated that the discovery of new energy reserves and their production would be outstripped by usage, thereby eventually causing economic and social havoc. Many modern followers of Peak Oil Theory believe that the 2007-2009 global recession was exacerbated in part by record oil prices that reflected validity of the theory.  Scott further wrote,

Scott further wrote,

Comment