|

February 26, 2007 (Associated Press)

Alan Greenspan, the former chairman of the U.S. Federal Reserve, warned Monday that the American economy might slip into recession by the end of the year.

Speaking to a business conference in Hong Kong, Greenspan said that the U.S. economy had been expanding since 2001 and that there were signs that the current economic cycle was coming to an end.

"When you get this far away from a recession, invariably forces build up for the next recession, and indeed we are beginning to see that sign," Greenspan said via a satellite link. He cited the stabilization of profit margins as "an early sign we are in the later stages of a cycle."

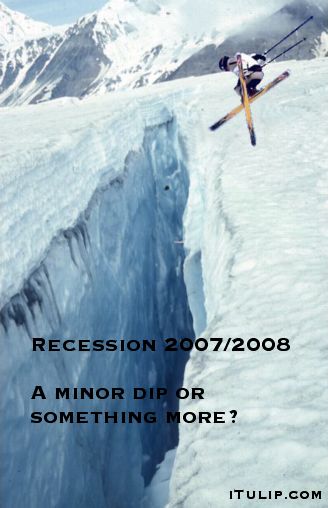

AntiSpin: Since late last year, according to nine out of ten economists, the U.S. economy has due to zip along nicely in 2007. Along comes Greenspan today with the opinion that it may be too far over its skis. After a couple of nervous months, we are finally feeling less lonely in our prediction of a recession toward the end of 2007.

When our Jane Burns interviewed a half dozen economists early this year, the consensus was one to two feet of fresh dry powder for 2007. Now Greenspan is the first economist of repute–or, at least, notoriety–to forecast a possible recession in 2007.

Remember, Greenspan's record on recession forecasting is less than de-lux. Only a month before the start of a relatively severe recession in the early 1990s he insisted in testimony before a congressional committee that none was in the offing. That may mean he's hallucinating this one, or–more likely–preparing us for something worse.

The Greenspan story was reinforced by a few like this one that show nine out of ten economists are starting to notice a change in each others' body language. The new consensus is that the U.S. economy is on the ice.

Slower Economic Growth Is Predicted

Forecasters say the economy will grow at the slowest pace in 5 years in 2007

Restrained by a worse-than-expected slump in housing, the economy will grow at the slowest pace in five years in 2007, leading economic forecasters say. They predict consumers will get a break on inflation from falling energy prices.

The survey of 47 top forecasters, released Monday by the National Association for Business Economics, found a greater expected impact from the ailing housing market this year than did the previous forecast in November. Stronger consumer spending will help offset the housing drag, according to the survey.

Construction spending dropped by 4.2 percent for all of 2006. That decline was a chief factor in the economy's sluggish growth in the second half of last year. Thousands of construction workers lost their jobs and home builders struggled with slumping sales as the five-year housing boom ended abruptly.

More concrete evidence of a slowdown started to show up today in company guidance. Forecasters say the economy will grow at the slowest pace in 5 years in 2007

Restrained by a worse-than-expected slump in housing, the economy will grow at the slowest pace in five years in 2007, leading economic forecasters say. They predict consumers will get a break on inflation from falling energy prices.

The survey of 47 top forecasters, released Monday by the National Association for Business Economics, found a greater expected impact from the ailing housing market this year than did the previous forecast in November. Stronger consumer spending will help offset the housing drag, according to the survey.

Construction spending dropped by 4.2 percent for all of 2006. That decline was a chief factor in the economy's sluggish growth in the second half of last year. Thousands of construction workers lost their jobs and home builders struggled with slumping sales as the five-year housing boom ended abruptly.

U.S. Concrete Predicts 1Q Slowdown, Loss

HOUSTON (AP) - U.S. Concrete Inc., which makes ready-mixed concrete, said Monday it expects a fourth-quarter loss, due primarily to a seasonal slowdown in the construction industry.

Read over news for RMIX in the past few years and there is no mention of "seasonal" factors in numbers. Perhaps they mean "recession season, " in which case we can all expect similar announcements from construction related businesses.

The markets took these prognostications in stride, with the DOW dropping a mere 15 points. We might be surprised at how poorly the stock market has been pricing in the housing slowdown and related impacts except that the see-no-evil trend is unmistakable. Toll Brothers' stock decline, for example, started in April 2005, only two months before the start of the end of the housing bubble, discounting it by a only two months. If the pattern continues, the stock market may tank a couple of months before the recession gets underway. We may even get a traditional October crash.HOUSTON (AP) - U.S. Concrete Inc., which makes ready-mixed concrete, said Monday it expects a fourth-quarter loss, due primarily to a seasonal slowdown in the construction industry.

Read over news for RMIX in the past few years and there is no mention of "seasonal" factors in numbers. Perhaps they mean "recession season, " in which case we can all expect similar announcements from construction related businesses.

With new warnings about recession, we are getting alerts on the stock market, too. These include Blomberg pointing out NYSE Margin Debt Reaches $285.6 Billion, Topping 2000 Record and today's Wall Street Journal, Wrong Way? Street Signs Point to Speed:

"According to Sanford C. Bernstein chief investment officer Vadim Zlotnikov, the average holding period for stocks on the New York Stock Exchange and American Stock Exchange last year was less than seven months. In 1999 -- stereotyped as a time of rapid-fire day trading -- the average holding period was more than a year.In fact, the last time stocks were being held for as short a period as they are now was 1929, when students of history may recall something happened to the market."

We can see where this is all headed. Not a year ago there was no housing bubble. Then a "boom" was acknowledged but no impending housing slowdown. Then, yes, a boom and a slowdown, but "no recession." Now, a recession in 2007 "is possible."  |

Speaking of rats, you may be wondering why they wandered all the way up from Wall Street to Greenwich Village. Should we keep your eyes pealed for the news of a leveraged buy-out of Yum! Brands, Inc. (owns KFC-Taco Bell)?

No hint of it in this recent interview by USA Today's Insana of Yum!'s CEO Novac.

Insana: Since China's currency is not fully convertible, how do you repatriate profits?

Novak: We are very successful taking cash out.

Insana: In paper bags?

Novak: Well, no. We work it through Treasury. It's a very complicated process, but we basically have no problem at all repatriating our profits. In the last quarter we brought back about $50 million from China. The great thing about China is that we're self-funding all of our growth, plus we have free cash flow that we bring back into the U.S. It's a great business.

"Very complicated." I'm sure.Novak: We are very successful taking cash out.

Insana: In paper bags?

Novak: Well, no. We work it through Treasury. It's a very complicated process, but we basically have no problem at all repatriating our profits. In the last quarter we brought back about $50 million from China. The great thing about China is that we're self-funding all of our growth, plus we have free cash flow that we bring back into the U.S. It's a great business.

Comment