|

February 19, 2007 (Krishna Guha - Financial Times)

It would be a "terrible mistake" for the Federal Reserve to adopt any form of inflation target to guide its interest rate decisions, Barney Frank, the Democratic chairman of the House financial services committee, has told the Financial Times.

Mr Frank, whose committee is one of two in Congress charged with oversight of the US central bank, said such a target "would come at the expense of equal consideration of the other main goal, that is employment".

Mr Frank noted that Alan Greenspan, the former Fed chairman, always resisted an inflation target on the grounds that it would reduce his operational flexibility.

AntiSpin: I sense they are going to take all the operational flexibility they can get. Everyone here knows my take on deflation, disinflation, inflation, and hyper-inflation, in the context of a post debt and asset bubble deflation, so I won't repeat it. I will say that as we are editing the debate I had with Rick Ackerman last week for posting here soon (after Finkel this week, and Dr. Hudson after that), it is becoming clear that a confusion of terms that is clouding the discussion.

From the iTulip.com Glossary we have:

inflation : n. (Janszen 2006) 1. to an economist, an increase in the general or "all goods" price level resulting from an oversupply of money; 2. to a government statistician, a political football thrown onto the field as producer and consumer price indexes, continuously reformulated and subject to interpretations invented to suit various constituencies over time, such as the under-reporting of home price inflation via an equivalent rent formula when home prices are rising and rents are falling, in order to hide the fact of a housing bubble that is needed to keep the economy from falling into recession (see housing bubble); 3. to the person on the street, rapidly rising prices of non-traded goods and services, especially insurance, education, and health care, resulting from an excess of cheap credit and the inappropriate use of credit to purchase depreciating assets.

deflation : n. the opposite of inflation, a negative rate of inflation, e.g., "CPI inflation averaged -1.3% in 2007."

disinflation : n. declining rate of inflation, e.g., "CPI inflation declined to 2.1% in Q4 2007 from 2.5% in Q3 2007."

A "little" deflation may in fact be "deflation" technically, but it is hardly an economic catastrophe at the levels Japan has maintained for the past 15 years or so. I have traveled to Japan several times from the tail end of the bubble in the late 1980s when a room at the Hyatt in Tokyo cost me over US$500 to 2001 when the same room went for US$180 to 2005 when it went back over US$500. Economic expansion has been very slow during the period, but did not contract as economies that suffered from severe deflationary depression have, such as in the U.S. during The Great Depression. Traveling in Japan off and on over those 15 years, one did not get the impression of a "poor" country. Far from it. In fact, during the Japanese "lost decade" when the Japanese outsourced manufacturing jobs to the U.S. and, by designing better cars, have been able to take over the automobile industry in the U.S. while the finance economy boomed, and its industrial economy declined. deflation : n. the opposite of inflation, a negative rate of inflation, e.g., "CPI inflation averaged -1.3% in 2007."

disinflation : n. declining rate of inflation, e.g., "CPI inflation declined to 2.1% in Q4 2007 from 2.5% in Q3 2007."

Keynesian economics says that there are two ways that money is borrowed into existence in an economy: by private sector borrowing (e.g., credit cards, auto loans, mortgage loans), and by public sector borrowing (e.g., purchase of treasury securities by the Fed.) Absent gold reserve constraints, the degree of expansion of the money supply by the Fed via borrowing is theoretically limitless. If private sector borrowing becomes dysfunctional, public sector borrowing can be increased to compensate. Currently the Fed is allowed to monetize U.S. treasury securities. However, the Fed has announced on several occasions that if an extreme case were to arise, several asset classes which are currently restricted, such as mortgages and stocks, may become unrestricted and purchased by the Fed in order to support their price.

Recall that during the most severe deflationary period for Japan, that the Bank of Japan purchased stocks directly on the Nikkei. These were later sold off slowly as the market recovered. The Fed has been clear that it is willing to perform a similar role, if necessary, to support U.S. asset markets, be they real estate, stocks, or some other asset class, depending on the risk their collapse poses to the finance economy and, secondarily, to the industrial economy. The list of potential purchases under extreme conditions ranges from mortgage-backed securities to mortgages to stocks to General Motors' bonds.

The Japanese experience is instructive because it shows how politics and economics combine to produce difficultly predicted results.

Is the Bank of Japan Barreling toward a Bailout?

Now the central bank is under intense pressure from the ruling Liberal Democratic Party and its allies in the Finance Ministry to buy more stocks, plus corporate bonds, and even real estate. Insiders worry about the huge growth in the bank's potential liabilities. Policy Board member Shin Nakahara insists: "There should be a limit to the bank's discretionary purchase of such risky assets."

The bank has already crossed a dangerous line. It has to maintain capital adequacy ratios just like other financial institutions. For the fiscal half-year period ended last September, it didn't: Because Japanese pulled so much yen out of the banking system, the ratio fell below its minimum target of 8%, to 7.6%, for the first time in 12 years.

Hayami, 77, successfully resisted pressure to hit the accelerator on the bank's bond purchases at a two-day central bank meeting beginning on Jan. 21. But his term expires in March, and things could get really radical then. Prime Minister Junichiro Koizumi could tap a maverick--someone who'll make an aggressive effort to counter Japan's spiral of deflation by buying up everything in sight. Morgan Stanley analyst Takehiro Sato says that under such an "anything goes" monetary policy, the central bank could seek to relieve the debt burden of banks and corporations by adding more stocks, corporate bonds, and real estate to its portfolio. The idea would be not only to halt deflation but generate inflationary expectations that would give companies pricing power and prompt consumers to start spending again.

Ka-Poom Theory posits two distinct periods in an asset and debt deflation/inflation cycle. "Ka" is a period of disinflation attended by a decline in the money supply, falling asset prices, contraction of private sector credit, and negative GDP. In the last 2000 - 2001 "Ka" cycle, gold prices declined from around $300 to $250, marking the "ass" of a 20 year long bear market in gold. (Since then, his ass is all we've seen of him.) "Poom" is a period of inflation created by an expansion in public sector borrowing, reductions in taxes, lower short term interest rates, and currency depreciation attended by an increase in the money supply, recovering assets prices, expansion in private sector credit, and positive GDP growth. Executed as intended, the result is as we had in the U.S. economy until mid 2006: increase in the money supply, housing bubble, and positive GDP growth. Now the central bank is under intense pressure from the ruling Liberal Democratic Party and its allies in the Finance Ministry to buy more stocks, plus corporate bonds, and even real estate. Insiders worry about the huge growth in the bank's potential liabilities. Policy Board member Shin Nakahara insists: "There should be a limit to the bank's discretionary purchase of such risky assets."

The bank has already crossed a dangerous line. It has to maintain capital adequacy ratios just like other financial institutions. For the fiscal half-year period ended last September, it didn't: Because Japanese pulled so much yen out of the banking system, the ratio fell below its minimum target of 8%, to 7.6%, for the first time in 12 years.

Hayami, 77, successfully resisted pressure to hit the accelerator on the bank's bond purchases at a two-day central bank meeting beginning on Jan. 21. But his term expires in March, and things could get really radical then. Prime Minister Junichiro Koizumi could tap a maverick--someone who'll make an aggressive effort to counter Japan's spiral of deflation by buying up everything in sight. Morgan Stanley analyst Takehiro Sato says that under such an "anything goes" monetary policy, the central bank could seek to relieve the debt burden of banks and corporations by adding more stocks, corporate bonds, and real estate to its portfolio. The idea would be not only to halt deflation but generate inflationary expectations that would give companies pricing power and prompt consumers to start spending again.

To help keep this discussion clear, I propose additional refinements to the terms we use.

debt deflation : n. a decline in the aggregate level of debt carried by all sectors of an economy, private and public. Caused by either 1) debt defaults (abrogation of contracts and failure to pay principle amounts) or 2) accelerated repayment of principle and interest enabled by increased nominal incomes due to inflation in wages and other sources. In the case of debt defaults, the price of assets declines by the price of traded-goods may or may not decrease, and the price of non-traded goods may or may not increase. The price of traded-goods will increase if dollar depreciation is significant. The price of non-traded goods will increase only if wage inflation rises or private sector credit expands to previous levels.

hyperinflation : n. inflation in excess of 100% annually. Created by the conditions of high foreign indebtedness and loss of interest by creditor nations in supporting the indebted nations' currency.

runaway inflation : n. inflation greatly exceeding central bank inflation targets, but not reaching the level of a hyperinflation, less than 100% annually. Examples are Russia 1992-1993 and Mexico 1984 to 1989. Starts when the government must print money to pay fixed expenses that cannot be significantly reduced for political reasons (e.g., salaries to government employees) and when taxes are not sufficient and access to sources of borrowing are not available.

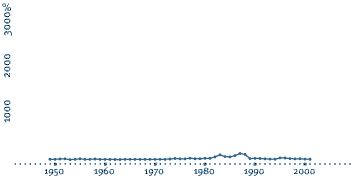

Example: Mexico 1980shyperinflation : n. inflation in excess of 100% annually. Created by the conditions of high foreign indebtedness and loss of interest by creditor nations in supporting the indebted nations' currency.

runaway inflation : n. inflation greatly exceeding central bank inflation targets, but not reaching the level of a hyperinflation, less than 100% annually. Examples are Russia 1992-1993 and Mexico 1984 to 1989. Starts when the government must print money to pay fixed expenses that cannot be significantly reduced for political reasons (e.g., salaries to government employees) and when taxes are not sufficient and access to sources of borrowing are not available.

Inflation neared 100% in two years during the inflation, but life went on.

In the grand scheme of things, no big deal.

Can the Fed reflate asset prices to keep the finance economy from descending into a self-reinforcing deflationary cycle without causing a rise in the general price level? In the last instance (2000 - 2007), the answer was, Yes. Can the Fed reflate asset prices to keep the finance economy going without causing a bubble to form in one of more assets? The answer appears to be, No.

Ka-Poom says that politicians will generally take the path of least resistance in a pinch, will choose to limit the political risks of high unemployment over the perils of inflation. Barney Frank is keeping up the stereotype, but his view is nothing special.

Policy option for discussion: Can the Fed engineer a soft landing for the finance economy and manage the decline in the industrial economy to limit unemployment growth by allowing import prices to rise via dollar depreciation, enabling the carrying cost of existing long term external debt to be reduced via repayment with depreciated dollars, and for the prices of non-traded goods and services to fall with a reduction in demand? Can they keep aggregate all-goods CPI inflation, the sum of traded and non-traded goods, on net, more or less constant?

Comment