|

Hey, am I reading you correctly? Gold is not going to be the next big bubble and make me so wealthy that most of the people I know won't talk to me anymore? Your new look at gold was a bit of a surprise to me and maybe a few others.

Can you elaborate on what you think the precious metals are going to be doing as the bubbles deflate?

Thanks!

Rick

Dear Rick,

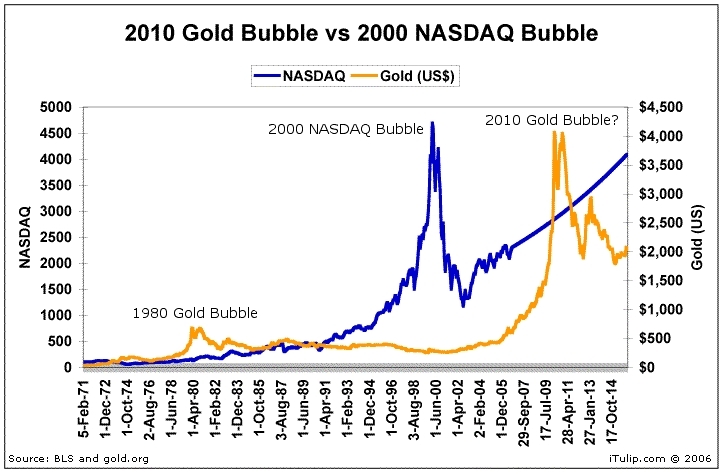

We are aware that some of our readers are surprised, if not to say saddened, by our position that no "bubble" in gold is going to happen. Our point is that asset bubbles, such as in tech stocks and mortgage backed securities (MBS), cannot occur without the help of governments in the form of monetary policy and tax policy. Gold will go through the roof, but government will always be on the other side of the trade.

So why not a gold bubble? Can you imagine the day when you can go to the bank and borrow a few hundred thousand dollars to buy gold and write the interest on that loan off against your income every year as you can with your home? How about a $500,000 tax free capital gains give-away on gold you and your wife own for more than two years as is available to home owners? Imagine what would happen to the price of gold if it was re-classified from a "collectible" with a short term capital gains tax rate of 35% to, say, an asset class that benefits from the 15% rate that hedge fund managers pay on their annual 2% carry on invested funds? The gold price would jump from $750 to over $1,000 practically overnight.

But those policy changes are never going to happen. Why? It's important to not confuse the bubbles in MBS and stocks with the underlying physical objects backing the paper, dot coms and houses respectively. Their valuations certainly impact the value of the securities, as hapless workers at dot com companies, venture capitalists who failed to bale out of their dot com investments in time, the 33 year old pension fund managers who bought the MBS, and millions of home owners can attest. Perhaps the market for mining stocks can be bubbled up, except that not only is the mining industry's lobby not as savvy as the real estate industry's, but gold specifically is a bet against government management of currency and credit markets. Why would the government bet against itself?

No bubble in gold is possible, at least in the same sense of bubbles in MBS and tech stocks.

This does not mean the gold price can't go through the roof as the latest government gambit to fight markets and manage currencies and credit unravels. We have not changed our $2,500 - $3,000 gold price target.

What is in question is the purchasing power of those 2,500 - 3,000 bonars. One isn't rich if one's gold is worth 2,500 bonars if a cup of coffee is going for $25. Most of our effort here at iTulip is focused on understanding the level of currency depreciation and all-goods inflation we are likely to experience as a result of the ongoing Ka-Poom debt deflation.

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

For a book that explains iTulip concepts in simple terms see americasbubbleeconomy

For the safest, lowest cost way to buy and trade gold, see The Bullionvault

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2007 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Comment