Dear iTulip,

As always, thanks for sharing your knowledge and insider access with our online community.

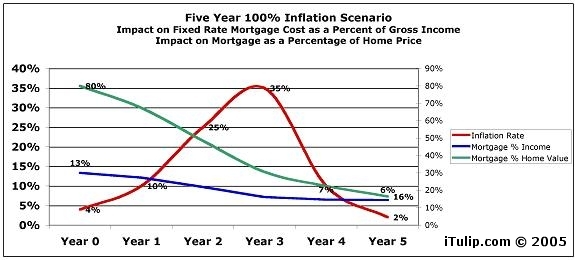

I have been a bit puzzled by EJ's diagnosis of the housing market being composed of 50% fictitious value. It is stated that housing has historically risen at the rate of inflation. Since the CPI is no longer an accurate measure of inflation, shouldn't the Shadowstats CPI be the benchmark? Seems to me the 3.3% historical average is no longer realistic based on today's government abuse of our fiat currency.

Looking at even the most conservative Shadowstats numbers (pre-1990 method), it appears that inflation from 1990-2005 averaged about 5.5% (I don't have access to the exact numbers so I'm eyeballing it). That means a compounded 15-year increase in prices of about 123%. Even if it was only 5% annual inflation, that's 108% total.

Median home prices from the US Census indicate a rise from $96,400 in 1990 to $219,600 in 2005, or a 128% increase. By my calculations, that puts the fictitious value between 2% and 18%. And that's not even taking into account the 19% rise in average square footage (1905sf to 2273sf).

Whether or not Americans can actually afford the houses is the main issue in my mind. Median incomes over the period only rose 55% while M3 per capita skyrocketed 137%. So the money's out there, it's just not in the average Joe's pocket.

Could it be that the housing bubble is really more a problem of oversupply caused by cheap money fueling the construction of larger homes than incomes can sustain? Might this play out through slowing construction and wage pressure-driven inflation? And back to my original question... since the CPI is no longer an accurate measure of inflation, shouldn't the Shadowstats CPI be the benchmark for housing prices?

Thanks!

Jimmy

See response here.

As always, thanks for sharing your knowledge and insider access with our online community.

I have been a bit puzzled by EJ's diagnosis of the housing market being composed of 50% fictitious value. It is stated that housing has historically risen at the rate of inflation. Since the CPI is no longer an accurate measure of inflation, shouldn't the Shadowstats CPI be the benchmark? Seems to me the 3.3% historical average is no longer realistic based on today's government abuse of our fiat currency.

Looking at even the most conservative Shadowstats numbers (pre-1990 method), it appears that inflation from 1990-2005 averaged about 5.5% (I don't have access to the exact numbers so I'm eyeballing it). That means a compounded 15-year increase in prices of about 123%. Even if it was only 5% annual inflation, that's 108% total.

Median home prices from the US Census indicate a rise from $96,400 in 1990 to $219,600 in 2005, or a 128% increase. By my calculations, that puts the fictitious value between 2% and 18%. And that's not even taking into account the 19% rise in average square footage (1905sf to 2273sf).

Whether or not Americans can actually afford the houses is the main issue in my mind. Median incomes over the period only rose 55% while M3 per capita skyrocketed 137%. So the money's out there, it's just not in the average Joe's pocket.

Could it be that the housing bubble is really more a problem of oversupply caused by cheap money fueling the construction of larger homes than incomes can sustain? Might this play out through slowing construction and wage pressure-driven inflation? And back to my original question... since the CPI is no longer an accurate measure of inflation, shouldn't the Shadowstats CPI be the benchmark for housing prices?

Thanks!

Jimmy

See response here.

), note that the numbers are normalized to the year 2000, so you are only seeing the expanding difference in the last few years. If they were matched to, say, 1960, it might look more extreme.

), note that the numbers are normalized to the year 2000, so you are only seeing the expanding difference in the last few years. If they were matched to, say, 1960, it might look more extreme.

Comment