Dear iTulip,

We really appreciate your website and excellent content (we'd send weekly emails of praise and thanks... but you'd get tired of hearing from us). You continue to raise major issues and we hope they'll get attention they deserve from the powers that be.

We do have some questions on your recent article entitled "Economic Cognitive Dissonance." You have a chart labeled "U.S Household Distribution of Liquid & Total Net Worth: 2006" with the following explanation underneath:

"This chart shows the distribution of liquid net worth, IRAs and Keoghs, housing equity, and total net worth in the HRS. All values are in 1992 dollars. Liquid net worth is the sum of checking and saving accounts, bonds, stocks, and other assets, minus short-term debt. Total net worth is the sum of liquid net worth, IRAs and Keoghs, housing equity, other real estate, business equity, and vehicles. The number of observations is 5,292. Figures are weighted using survey weights."

Our questions are:

1. Why would the chart be stated in 1992 dollars unless it is 1992 data? For example, the 95th percentile shows a total net worth of $785,000. But in 2006 dollars that would equate to $1,127,983 according to the FRB of Minneapolis website and we know how cooked that is, given BLS propensity to substitute dog food for tenderloin in their calculations?

2. If it is 1992 data, then how meaningful could it be, given the well-documented wealth distribution shifts that have occurred in the past 14 years, especially under Bush 2?

This household has little room for complaint, having moved from the bottom 40% to the top 5% over the past 20 years. But given the abounding uncertainties brought on by the lunatics now running the asylum as we approach retirement, we find our comfort level is not all that great. Given high levels of debt and deficit, unfunded liabilities, bogus accounting and statistics, unregulated derivative markets, etc., we feel like powerless observers to a pending train wreck. The real beginning of the decline of the American empire can be laid at the feet of Ronald Reagan's deregulation and massive deficits. Why he continues to be portrayed as a hero is beyond us.

Please keep focus on this wealth distribution issue. This would be a far greater country if the gap between those with too much and those with too little was substantially reduced. I experienced some of that during an extended visit to New Zealand some years ago and it was incredibly pleasant.

Below are some links on the subject which we've found of interest. Maybe you will too.

Thanks again for your website and articles.

Best Regards,

Gary Erickson

___

Dear Gary,

The decision by a statistician to use a particular date as the basis for inflation adjustment can be arbitrary. We can only speculate as to why 1992 was used by the researchers who developed the data we used, from The Joint Center for Poverty Research at Northwestern University Institute for Policy Research and University of Chicago. We can say that most of the research in this area is consistent and draws similar conclusions.

Take for example this recent research by The Economic Policy Institute, "The State of Working America 2006/2007" billed as, "an exhaustive reference work that will be welcomed by anyone eager for a comprehensive portrait of the economic well-being of the nation." A summary is available here (pdf).

Using Dr. Hudson's model of the U.S. economy as composed of a large Finance Economy which has grown to envelope the "Keynesian" or Industrial Economy, we can trace the demise of the Industrial Economy and the growth of the Finance Economy back to the early 1970s. He points to several developments, specifically changes in tax law and the adoption of the U.S. Treasury dollar reserve standard in place of the gold-backed dollar standard. These were intended to change the structure of the economy to promote the interests of a minority group of creditors ahead of the interests of a majority group of debtors. Ronald Reagan's and Milton Friedman's contribution to the growth of the Finance Economy and the dismantling of the Industrial Economy was to dress the system up as free market reform. In fact, these policies were a codification of government subsidies of banking, finance, and real estate.

src="http://pagead2.googlesyndication.com/pagead/show_ads.js">

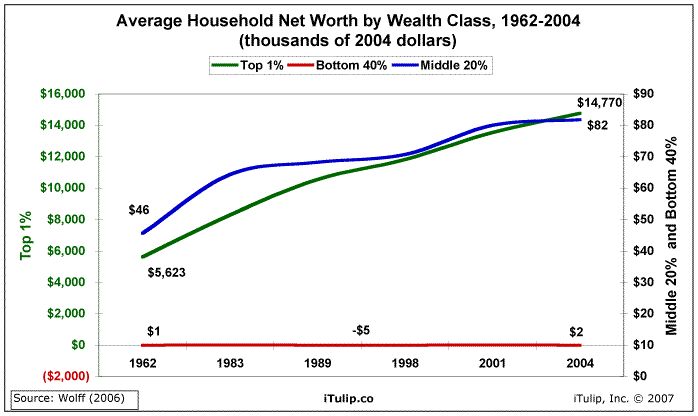

If Dr. Hudson's theory of the two economies is true, research such as "The State of Working America 2006/2007" should show household net worth consistently low for the politically insignificant bottom 40 percent which reliably serve as an uncomplaining rentier group, improving for the politically significant middle 20 percent–such as yourself–who are cultivated as beneficiaries of the system, and growing like crazy for the top 1%. Here's what the data show:

The net worth of the average household in the bottom 40% was $2,000 in 2004, up from $1,000 in 1962. The net worth of the average household in the middle 20% is $82,000, up from $46,000 in 1962. The net worth of the average household in the top 1% is $14.7 million, up from $5.6 million in 1962.

If Dr. Hudson is correct, the research should also show debt as a percentage of net worth flat for the 1% savings/creditor group, rising steadily for the middle 20%, and consistently high for the folks at the bottom. In fact:

The debt carried by the average household in the bottom 40% was about 15 times net worth in 2004, a modest improvement from nearly 20 times net worth in 1962. The average household in the middle 20% was 92% of net worth, up from 65% of net worth. Among the top 1%, debt remained constant at 4% of net worth.

The data also confirm what we see happening around us–a middle class becoming more more indebted and living one paycheck away from joining the bottom 40%, and the top 1% getting really rich.

The reason iTulip focuses on the wealth disparity issue is not only because this state of the economy and the system that produced it is unfair. We have friends who, like you, moved up from the middle 20% to the top 5% and feel good about it. They feel no animosity toward anyone who made it into the top 1% or toward anyone in the top 1% whose net worth increased from $5.6 million to $14.7 million. Yours truly feels good about how well he's done, thank you.

Such broad disparities in net worth among groups within American society create a manageable level of social friction during flush economic times. However, in an economic crisis they are the foundation for political crisis. Markets which are un-free and thus unfair in the way of creating a large group of debt serfs by the imposition of economic rents on their labor can quickly become un-free and unfair in the other direction. In the 1930s, the reorganization of democratic, capitalist societies following the economic collapse of The Great Depression took two forms. In the case of pure socialism (e.g., the Soviet Union), a new class of bureaucrats was formed to more evenly distribute the poverty that pure socialism creates. In the case of dictatorship, the consolidation of power among an elite in the form of either left wing (e.g., China) or right wing (e.g., Nazi Germany) government controlled the distribution of wealth by systems of government planning. In the more egalitarian U.S. of the era, at least with respect to debt as compared to today, democracy and capitalism survived albeit with some socialistic features. By the late 1930s, the most successful system economically proved, unfortunately for the world, to be the totalitarian capitalism adopted by Nazi Germany, employing as it did Keynesian policies, albeit not in name.

In more homogeneous and egalitarian societies during a contemporary crisis, such as Korea's in the late 1990s, the entire population rallies if the nation's economy collapses. Not even ten years later the Korean episode has been virtually forgotten, but the lesson is important. Modern economies can crash dramatically and quickly, and in some cases recover spectacularly, as in the case of Korea 1998 to present. But a society which is as divided along the lines of race and wealth as the U.S. today, a very different process–longer and less constructive–with a less attractive outcome is likely.

The data suggest what we might expect in the next economic crisis in the U.S. Political splits will tend to form along existing debtor/creditor divides. The main ones: rich versus poor, young versus old, and black versus white. Given the geographic distribution of debt, a north versus south political conflict may be in the cards. The debtor group represents the vast majority of the U.S. military; if the U.S. is still engaged in major conflicts from its 720 military bases around the globe, another source of manpower may be needed to maintain the current troop level at 2.5 million, such as the institution of a draft. One scenario is that the creditor group, which also has the largest stake in the mass media, will attempt to set segments within the debtor group against each other (e.g., white versus black) to avoid a confrontation with debtors as a cohesive political force. The opposite scenario is also possible, with a populist president leading a new political party comprised of debtors, imposing "progressive" taxes on the top wealth holders, and letting debtors off the hook either by debt forgiveness or inflation–or both.

One thing you can be sure of is that the political process, with grossly uneven wealth and debt distribution as the backdrop, will be unpredictable. We will continue to track the wealth distribution issue and watch future developments together.

We really appreciate your website and excellent content (we'd send weekly emails of praise and thanks... but you'd get tired of hearing from us). You continue to raise major issues and we hope they'll get attention they deserve from the powers that be.

We do have some questions on your recent article entitled "Economic Cognitive Dissonance." You have a chart labeled "U.S Household Distribution of Liquid & Total Net Worth: 2006" with the following explanation underneath:

"This chart shows the distribution of liquid net worth, IRAs and Keoghs, housing equity, and total net worth in the HRS. All values are in 1992 dollars. Liquid net worth is the sum of checking and saving accounts, bonds, stocks, and other assets, minus short-term debt. Total net worth is the sum of liquid net worth, IRAs and Keoghs, housing equity, other real estate, business equity, and vehicles. The number of observations is 5,292. Figures are weighted using survey weights."

Our questions are:

1. Why would the chart be stated in 1992 dollars unless it is 1992 data? For example, the 95th percentile shows a total net worth of $785,000. But in 2006 dollars that would equate to $1,127,983 according to the FRB of Minneapolis website and we know how cooked that is, given BLS propensity to substitute dog food for tenderloin in their calculations?

2. If it is 1992 data, then how meaningful could it be, given the well-documented wealth distribution shifts that have occurred in the past 14 years, especially under Bush 2?

This household has little room for complaint, having moved from the bottom 40% to the top 5% over the past 20 years. But given the abounding uncertainties brought on by the lunatics now running the asylum as we approach retirement, we find our comfort level is not all that great. Given high levels of debt and deficit, unfunded liabilities, bogus accounting and statistics, unregulated derivative markets, etc., we feel like powerless observers to a pending train wreck. The real beginning of the decline of the American empire can be laid at the feet of Ronald Reagan's deregulation and massive deficits. Why he continues to be portrayed as a hero is beyond us.

Please keep focus on this wealth distribution issue. This would be a far greater country if the gap between those with too much and those with too little was substantially reduced. I experienced some of that during an extended visit to New Zealand some years ago and it was incredibly pleasant.

Below are some links on the subject which we've found of interest. Maybe you will too.

Thanks again for your website and articles.

Best Regards,

Gary Erickson

___

Dear Gary,

The decision by a statistician to use a particular date as the basis for inflation adjustment can be arbitrary. We can only speculate as to why 1992 was used by the researchers who developed the data we used, from The Joint Center for Poverty Research at Northwestern University Institute for Policy Research and University of Chicago. We can say that most of the research in this area is consistent and draws similar conclusions.

Take for example this recent research by The Economic Policy Institute, "The State of Working America 2006/2007" billed as, "an exhaustive reference work that will be welcomed by anyone eager for a comprehensive portrait of the economic well-being of the nation." A summary is available here (pdf).

Using Dr. Hudson's model of the U.S. economy as composed of a large Finance Economy which has grown to envelope the "Keynesian" or Industrial Economy, we can trace the demise of the Industrial Economy and the growth of the Finance Economy back to the early 1970s. He points to several developments, specifically changes in tax law and the adoption of the U.S. Treasury dollar reserve standard in place of the gold-backed dollar standard. These were intended to change the structure of the economy to promote the interests of a minority group of creditors ahead of the interests of a majority group of debtors. Ronald Reagan's and Milton Friedman's contribution to the growth of the Finance Economy and the dismantling of the Industrial Economy was to dress the system up as free market reform. In fact, these policies were a codification of government subsidies of banking, finance, and real estate.

src="http://pagead2.googlesyndication.com/pagead/show_ads.js">

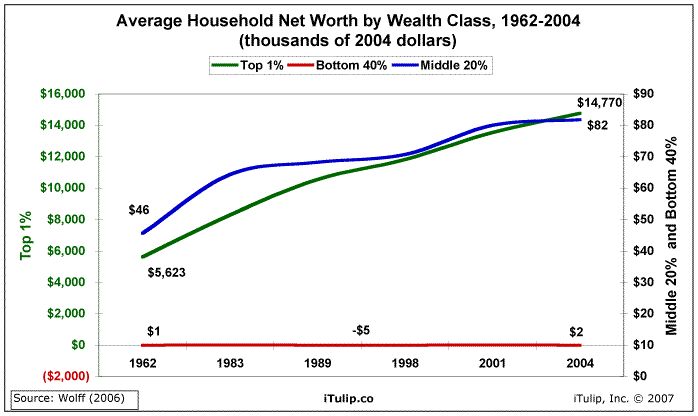

If Dr. Hudson's theory of the two economies is true, research such as "The State of Working America 2006/2007" should show household net worth consistently low for the politically insignificant bottom 40 percent which reliably serve as an uncomplaining rentier group, improving for the politically significant middle 20 percent–such as yourself–who are cultivated as beneficiaries of the system, and growing like crazy for the top 1%. Here's what the data show:

The net worth of the average household in the bottom 40% was $2,000 in 2004, up from $1,000 in 1962. The net worth of the average household in the middle 20% is $82,000, up from $46,000 in 1962. The net worth of the average household in the top 1% is $14.7 million, up from $5.6 million in 1962.

If Dr. Hudson is correct, the research should also show debt as a percentage of net worth flat for the 1% savings/creditor group, rising steadily for the middle 20%, and consistently high for the folks at the bottom. In fact:

The debt carried by the average household in the bottom 40% was about 15 times net worth in 2004, a modest improvement from nearly 20 times net worth in 1962. The average household in the middle 20% was 92% of net worth, up from 65% of net worth. Among the top 1%, debt remained constant at 4% of net worth.

The data also confirm what we see happening around us–a middle class becoming more more indebted and living one paycheck away from joining the bottom 40%, and the top 1% getting really rich.

The reason iTulip focuses on the wealth disparity issue is not only because this state of the economy and the system that produced it is unfair. We have friends who, like you, moved up from the middle 20% to the top 5% and feel good about it. They feel no animosity toward anyone who made it into the top 1% or toward anyone in the top 1% whose net worth increased from $5.6 million to $14.7 million. Yours truly feels good about how well he's done, thank you.

Such broad disparities in net worth among groups within American society create a manageable level of social friction during flush economic times. However, in an economic crisis they are the foundation for political crisis. Markets which are un-free and thus unfair in the way of creating a large group of debt serfs by the imposition of economic rents on their labor can quickly become un-free and unfair in the other direction. In the 1930s, the reorganization of democratic, capitalist societies following the economic collapse of The Great Depression took two forms. In the case of pure socialism (e.g., the Soviet Union), a new class of bureaucrats was formed to more evenly distribute the poverty that pure socialism creates. In the case of dictatorship, the consolidation of power among an elite in the form of either left wing (e.g., China) or right wing (e.g., Nazi Germany) government controlled the distribution of wealth by systems of government planning. In the more egalitarian U.S. of the era, at least with respect to debt as compared to today, democracy and capitalism survived albeit with some socialistic features. By the late 1930s, the most successful system economically proved, unfortunately for the world, to be the totalitarian capitalism adopted by Nazi Germany, employing as it did Keynesian policies, albeit not in name.

In more homogeneous and egalitarian societies during a contemporary crisis, such as Korea's in the late 1990s, the entire population rallies if the nation's economy collapses. Not even ten years later the Korean episode has been virtually forgotten, but the lesson is important. Modern economies can crash dramatically and quickly, and in some cases recover spectacularly, as in the case of Korea 1998 to present. But a society which is as divided along the lines of race and wealth as the U.S. today, a very different process–longer and less constructive–with a less attractive outcome is likely.

The data suggest what we might expect in the next economic crisis in the U.S. Political splits will tend to form along existing debtor/creditor divides. The main ones: rich versus poor, young versus old, and black versus white. Given the geographic distribution of debt, a north versus south political conflict may be in the cards. The debtor group represents the vast majority of the U.S. military; if the U.S. is still engaged in major conflicts from its 720 military bases around the globe, another source of manpower may be needed to maintain the current troop level at 2.5 million, such as the institution of a draft. One scenario is that the creditor group, which also has the largest stake in the mass media, will attempt to set segments within the debtor group against each other (e.g., white versus black) to avoid a confrontation with debtors as a cohesive political force. The opposite scenario is also possible, with a populist president leading a new political party comprised of debtors, imposing "progressive" taxes on the top wealth holders, and letting debtors off the hook either by debt forgiveness or inflation–or both.

One thing you can be sure of is that the political process, with grossly uneven wealth and debt distribution as the backdrop, will be unpredictable. We will continue to track the wealth distribution issue and watch future developments together.

Comment