Institutional Investor recently released its 2007 All-America Research Team of the best sell-side analysts. Below we list the top five rated firms along with their rankings from last year.

This year Lehman (LEH) retained the top rated spot, and Bear Stearns (BSC) moved up from fourth to second place. Merrill (MER), which was rated third last year, dropped down two spots to number five.

While making the Institutional Investor list of top analysts is still considered a ticket to a bigger paycheck at the end of the year, some argue that the best analysts are now on the buy-side, and therefore the list is not as meaningful as it used to be. However, one look at this year's list shows that there are still plenty of great analysts on the sell-side.

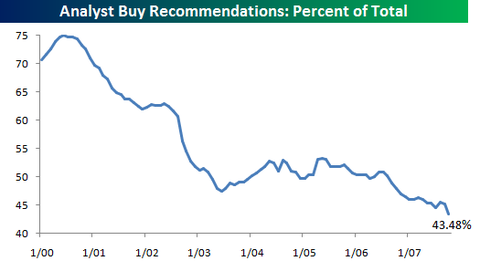

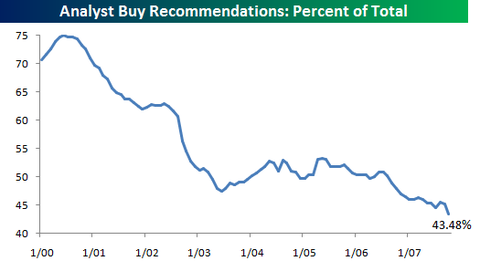

One thing that has changed about the sell-side though, is that just like the media, analysts as a whole are not a very optimistic group. Over the last seven years, they have been steadily becoming more bearish in their calls. In the chart below, using information compiled from Bloomberg, we show analyst buy calls as a percentage of total recommendations.

In 2000, at the height of the last bull market, 75% of all analyst recommendations were buys. At the start of the current bull market, in October 2002, that figure stood at 54.6%. Now, five years into the bull market, analyst sentiment is at its lowest levels of the decade, with buys making up only 43.48% of all their recommendations.

http://seekingalpha.com/article/5169...source=d_email

Looks like lot's of upside potential to me, 43.48% would be about as low as it goes.

This year Lehman (LEH) retained the top rated spot, and Bear Stearns (BSC) moved up from fourth to second place. Merrill (MER), which was rated third last year, dropped down two spots to number five.

While making the Institutional Investor list of top analysts is still considered a ticket to a bigger paycheck at the end of the year, some argue that the best analysts are now on the buy-side, and therefore the list is not as meaningful as it used to be. However, one look at this year's list shows that there are still plenty of great analysts on the sell-side.

One thing that has changed about the sell-side though, is that just like the media, analysts as a whole are not a very optimistic group. Over the last seven years, they have been steadily becoming more bearish in their calls. In the chart below, using information compiled from Bloomberg, we show analyst buy calls as a percentage of total recommendations.

In 2000, at the height of the last bull market, 75% of all analyst recommendations were buys. At the start of the current bull market, in October 2002, that figure stood at 54.6%. Now, five years into the bull market, analyst sentiment is at its lowest levels of the decade, with buys making up only 43.48% of all their recommendations.

http://seekingalpha.com/article/5169...source=d_email

Looks like lot's of upside potential to me, 43.48% would be about as low as it goes.

Comment