Announcement

Collapse

No announcement yet.

Beartrap

Collapse

X

-

Re: Beartrap

Originally posted by GRG55 View PostAmen. And after reading the next post, below, I'm once again looking around for the kool-aid...

Don't forget to collect the entire set... ;)

Being armed with the real facts, even though they're frequently not the most pleasant experiences, beats h*ll out of the alternatives.

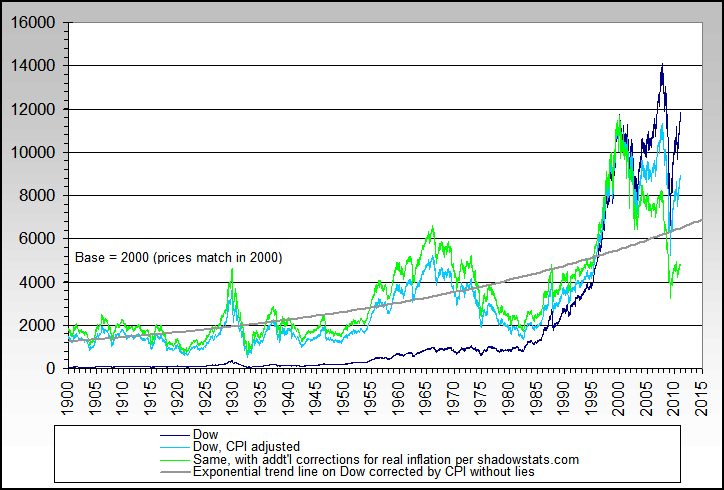

As an aside, many consider that John Williams CPI adjustments are too high... but the real point is that the CPI is so far off that the point is almost moot... and core CPI is well beyond ridiculous as a stat.

If food and energy are so volatile that they can't be included, why not do what so many do and just use a moving average to even out volatility?

Comment

-

Re: Beartrap

Something interesting going on here.Originally posted by Tet View PostLast summer's Israeli jack-up in the price of crude to $80 is being duplicated by this years Turkey's jack-up in the price of crude to $90. Last summer after the Israeli's turn tail and run away crappy tech stocks go on a 17% sprint to close out the year when the price of crude collapsed. I don't remember the last time crude was sitting so far removed from any support, looks like a good time for gravity to enter the equation, lots and lots of air sitting under this $90 number.

Time scale calls for a large correction here, the news gets spun to match the upcoming plunge in the price of crude. Turkey doesn't invade, BP announces large discovery of hydrocarbons in Antartica, it doesn't matter what they come up with the price is getting ready to drop.

Get ready for some major Petrol D0llar recyling into some QQQQ's, and other POS stocks. Judging from the Oil chart, Tech is getting ready for some major surprises to to upside this week or next, beware CISCO for all those who bet the short side. I'd bet double digit number in Tech to close out the year. TWT.

US economy slowing, UK slowing, Europe slowing, China continues to announce measures to squeeze its run-away growth. OPEC repeatedly insists there is plenty of oil supply. US refinery utilization consistently around 87%-88% - refineries have great trouble making any money at usage rates below 90% - implying demand softening? All this should be leading to crude inventory builds, and Tet's expected fall in crude prices (hard to argue the chart doesn't look like a blow-off).

But OECD crude inventories continue to fall, as are US seasonal product inventories (e.g. heating oil) and the WTI price looks increasingly likely to breach the "psychologically important" $100.

Early call? Or has something changed that we can't yet see? Is it really those unscrupulous speculators buying up oil at $98+ as OPEC (and many other pundits) would have us believe? Yet another conundrum...

Tet? Lukester? Anyone?Last edited by GRG55; November 26, 2007, 02:42 AM.

Comment

-

Re: Beartrap

What if the "unscrupulous speculators" were actually the OPEC oil producers themselves?

See below how OPEC statements from Sunday November 11 to Wednsesday November 14 manipulated the December oil options market to insure that the December 100 puts closed worthless on Tuesday November 13.

Last Update: 3:16 PM ET Monday Nov 12, 2007

SAN FRANCISCO (MarketWatch) -- Crude oil fell nearly $2 a barrel on Monday (November 12) and closed at the lowest level in a week on speculation members of the Organization of Petroleum Exporting Countries may consider increasing their output at an upcoming meeting..........

Saudi Arabia's Oil Minister Ali al-Naimi said Sunday (November 11)that OPEC, which controls more than 40% of the world's oil production, will discuss increasing production at its next meeting later this year...."

December crude call options, which are another bet on the rise of oil prices, will expire on Tuesday (November 13). "The Saudi statement could not have come at a worse time for December call option holders," said MF Global's Meir.

With oil prices lower than $95 a barrel, most call option holders betting on the $100 oil would likely not exercise the option and let it expire worthless, said Williams.

Published Wednesday November 14

No need for more oil now, OPEC tells US

Riyadh: OPEC sees no need to increase oil production at the moment, Secretary-General Abdullah Al Badri said on Wednesday November 14, rejecting a US appeal to boost output sooner than the producer group's meeting next month.

Comment

Comment