Re: How much house should you finance? Follow the 20/28/36 rule.

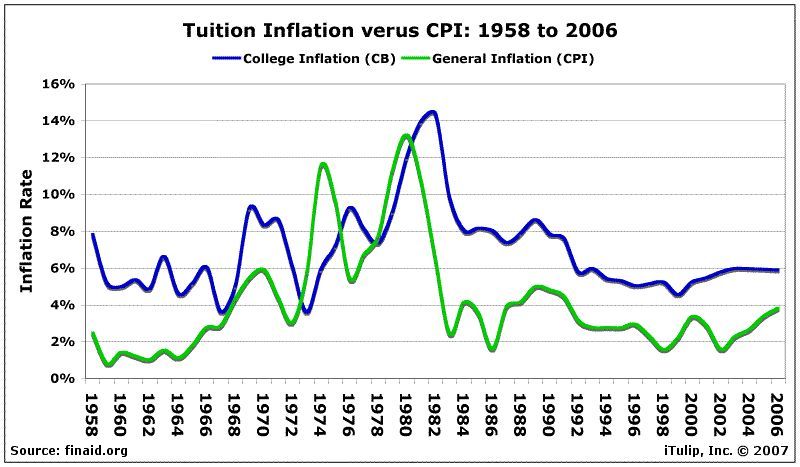

But the problem is that college tuition is rising at twice the general inflation rate. So it is extremely unlikely that stagflation will enable what you propose -- unless banks charge a low rate -- but that then giving free money away would be regarded in some rarified circles as "SOCIALISM"

is this a set-up or what? inflation, dude! that's how he's gonna pay it off. add a zero into the end of that nominal income. that's the ticket!

Comment