|

More than 25 years of successful credit bubble re-inflations have trained us to think of consumer retrenchment as temporary. This time it is not. Invest accordingly.

The monthly payment consumer (MPC) first appeared in the late 1920s with the advent of installment credit that temporarily extended the purchasing power of the American middle class enough to make exciting consumer products affordable, products that entrepreneurs unleashed in a wave as they beat government financed WWI military technology swords into consumer products plowshares--radios, refrigerators, and automobiles. By 1929, personal consumption expenditures (PCE) grew to 75% of US GDP and briefly spiked to 83% in 1932 as GDP collapsed faster than PCE during The Great Depression. PCE fell rapidly to 49% percent of GDP in 1944 and never again reached the 1929 pre-crash level, but peaked at 71% in 2008, the same year household debt service payments as a percent of disposable personal income peaked at 14.3%.

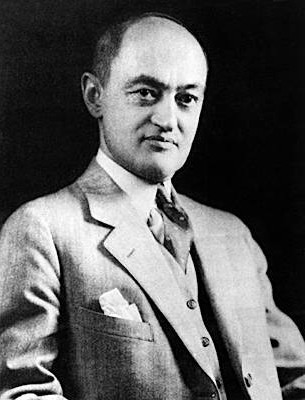

Joseph A. Schumpeter said of the consumer crisis in his 1939 book Business Cycles: “Consumers' borrowing is one of the most conspicuous danger points in the secondary phenomena of prosperity, and consumers' debts are among the most conspicuous weak spots in recession and depression... the load of debt thus light heartedly incurred by people who foresaw nothing but booms should become a serious matter whenever incomes fell. Nothing is so likely to produce cumulative depressive processes as such commitments of a vast number of households to an overhead financed to a great extent by commercial banks.”

The credit bubble that started in the early days of the FIRE Economy in the early 1980s collapsed with the housing bubble starting in 2006. Debt deflation and global depression will put an end to the MPC over the coming years in a rhyme of events that Schumpeter explained 70 years ago.

Personal consumption expenditures decline for the first time in over 70 years

Household debt levels fall for the first time since The Great Depression

The collapse of the FIRE Economy is revealed in the March 2009 Fed Flow of Funds report Z.1 table d.2 for anyone to see.

Since it started in the early 1980s, every time the FIRE Economy ran into trouble (1987 post stock market crash, 1989 post LBO bubble collapse, and 2000 post tech stock collapse) it was bailed out by central banks either directly or indirectly. In 1991, debt levels declined in every category except financial, which virtually doubled, accounting for the growth shown. After the tech stock bubble collapse, foreign central bank borrowing restarted the FIRE Economy. But in 2008, all avenues failed. Non-financial, finaicial sector, and even local and state government debt growth declined, all except for Federal government debt. (See: Flow of Funds Q4 2008: Debt Deflation confirmation - Eric Janszen)

Wrong lesson

The Federal Reserve mistakenly believes that the lesson of 1930s was to re-inflate a credit bubble quickly before its collapse becomes self-reinforcing, when in fact the lesson lost was to not allow a credit bubble to form in the first place; collapse is inevitable and cannot be stopped but the debt excess canceled either by monetary deflation or inflation, and the Fed is committed to the latter path.

End of the second credit and consumption-based US economy in 70 years, forecast in red

The economic crisis will again turn a generation of Americans into savers and critical consumers that look at total prices of goods, not monthly payments, and avoid debt. The era of mass marketing of consumer credit and riding the wave of debt-financed consumerism of the past 25 years is over. Only those companies that prepare for this sea change in consumer attitudes will survive.

See also:

Can Anything Bring Down the Monthly Payment Consumer? - Jane Burns Aug. 2007 (free)

Can Anything Bring Down the Monthly Payment Consumer? Revisited - Eric Janszen - Mar. 2009 (free)

Venture Capital in a Transformational Depression - Janszen - Mar. 2009 ($ubscription)

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2009 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Comment