Re: Real DOW Update: Still looking for a bottom?

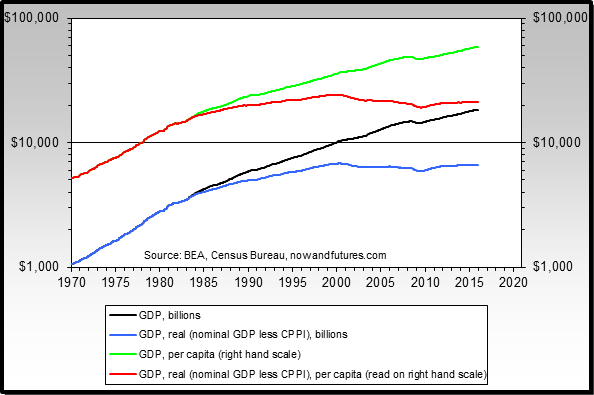

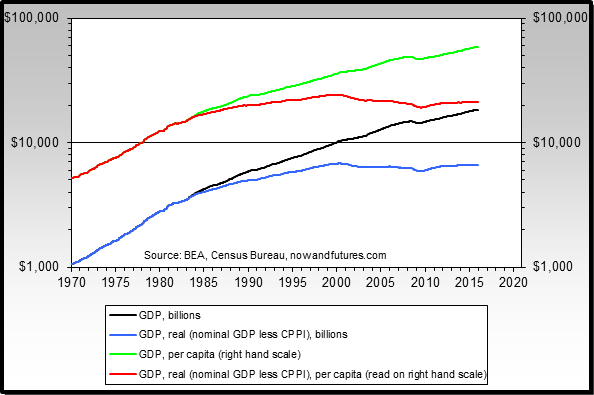

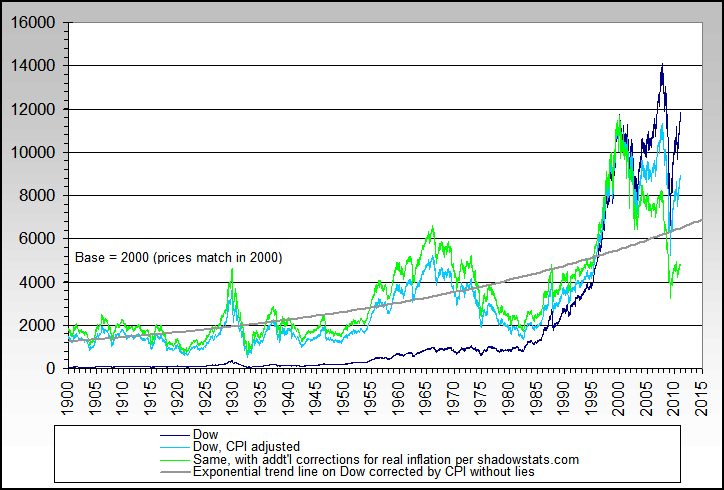

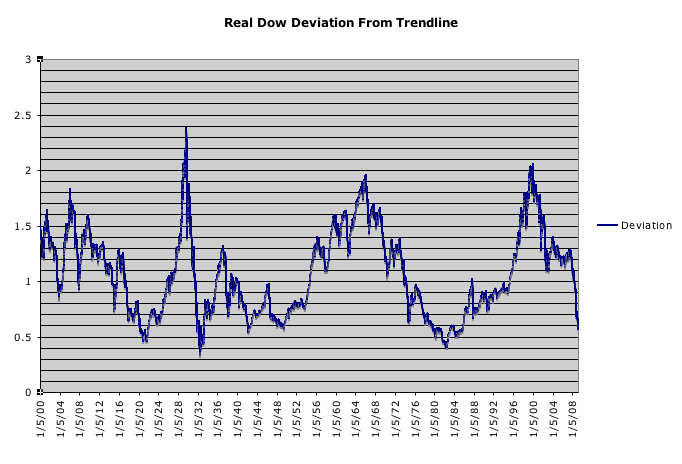

Thankfully, I have the data before 1980 and it was trivial to put together a new chart. I elected to use a log based chart since it seems to show the relationships better.

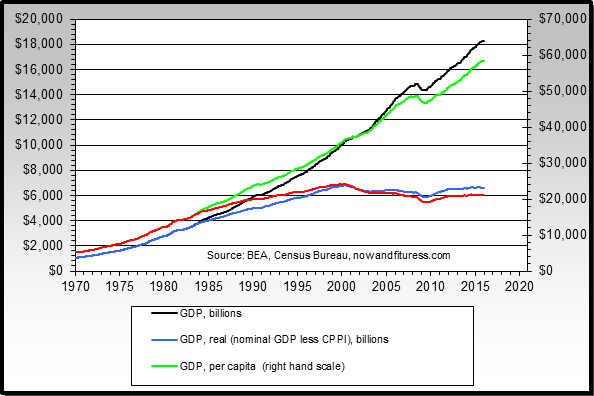

I hope it helps, but I suspect you'll have to ask EJ about GDP or RP GDP vs. the Dow, and also his assumptions. It's far from my strong suit and I don't want to second guess him.

I've kept quiet about that 1.64% figure he uses, even though it has some problems, since it truly is close enough and is quite workable too. Almost any way one can statistically approach something like Dow real returns has problems and shortcomings, and that very much includes my own work.

Originally posted by orion

View Post

Thankfully, I have the data before 1980 and it was trivial to put together a new chart. I elected to use a log based chart since it seems to show the relationships better.

I hope it helps, but I suspect you'll have to ask EJ about GDP or RP GDP vs. the Dow, and also his assumptions. It's far from my strong suit and I don't want to second guess him.

I've kept quiet about that 1.64% figure he uses, even though it has some problems, since it truly is close enough and is quite workable too. Almost any way one can statistically approach something like Dow real returns has problems and shortcomings, and that very much includes my own work.

Comment