Re: Real DOW Update: Still looking for a bottom?

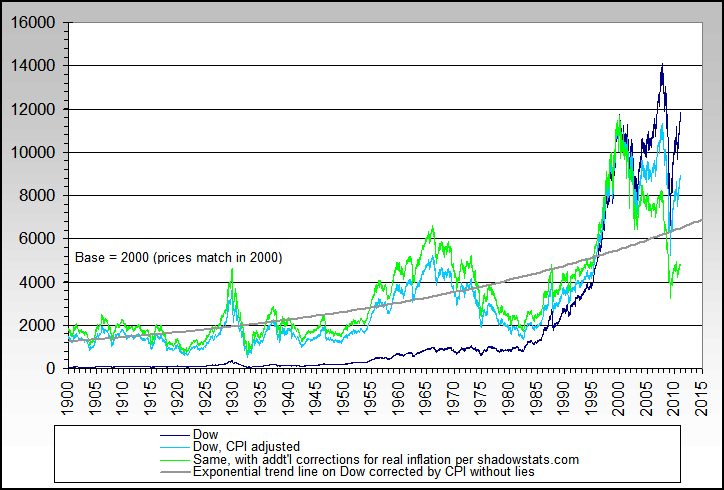

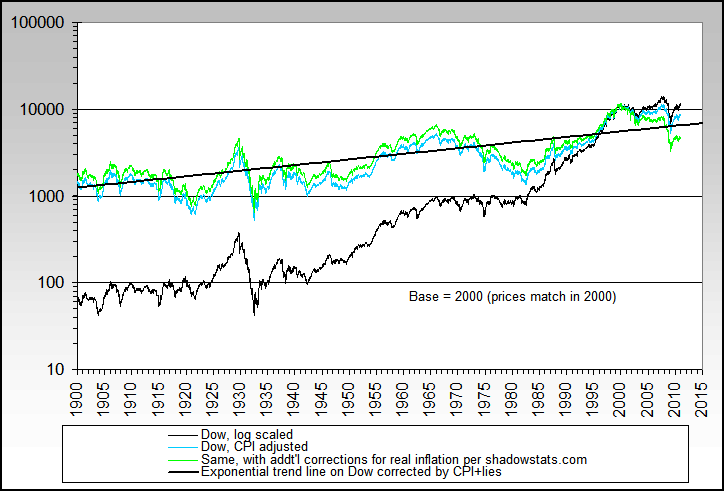

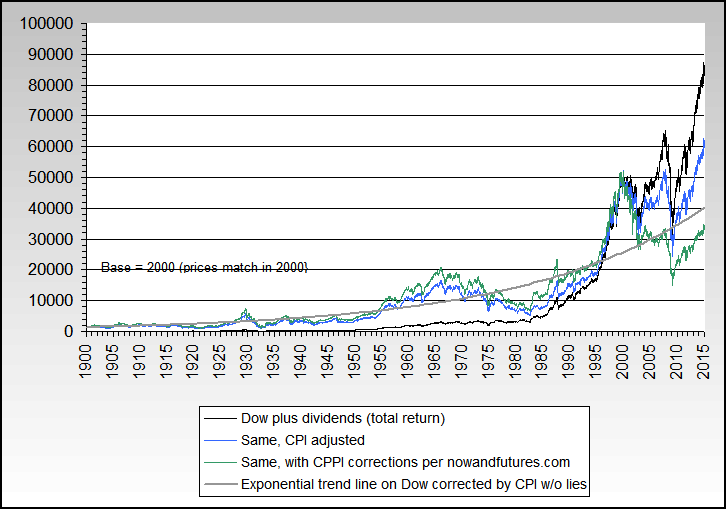

You can't have very high inflation, let alone hyperinflation and a collapsing stock market. One of these two variables is either lying (evidently it's not the stock market lying, as it's doing a swan dive) or that variable will have to turn right around and scoot right back towards the other one in a hurry - it's either that, or we are in an environment which has nothing whatsoever to do with inflation. My suggestion, DOW has to turn and scoot up in a hurry just as soon as iTulip's core thesis (very high inflation) manifests. Last time I checked, iTulip's thesis was that inflation would have to appear ... soon. IMO proponents of the DOW as a bottomless pit are not adding this up. Or iTulip's high inflation forecast is way early. Take your pick. You can't have both.

You can't have very high inflation, let alone hyperinflation and a collapsing stock market. One of these two variables is either lying (evidently it's not the stock market lying, as it's doing a swan dive) or that variable will have to turn right around and scoot right back towards the other one in a hurry - it's either that, or we are in an environment which has nothing whatsoever to do with inflation. My suggestion, DOW has to turn and scoot up in a hurry just as soon as iTulip's core thesis (very high inflation) manifests. Last time I checked, iTulip's thesis was that inflation would have to appear ... soon. IMO proponents of the DOW as a bottomless pit are not adding this up. Or iTulip's high inflation forecast is way early. Take your pick. You can't have both.

Comment