Re: Deflationistas, inflationistas, and hyperinflationistas - Eric Janszen

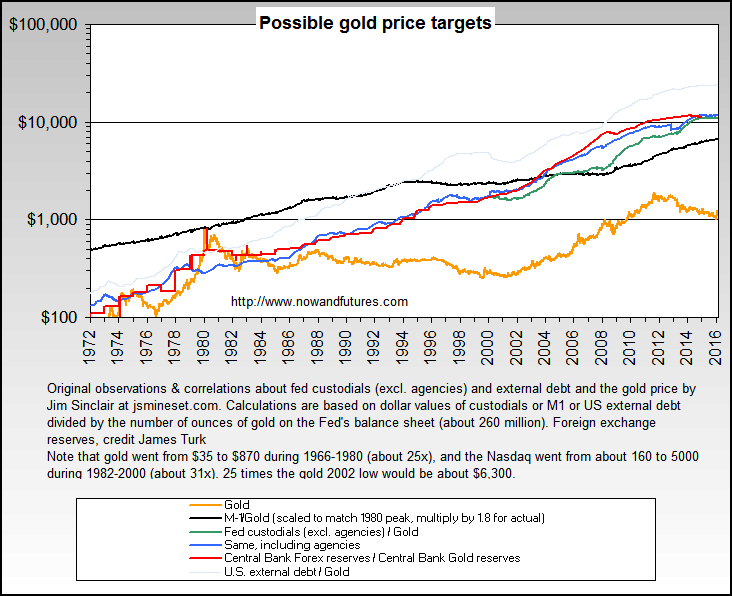

So, that move was 10 to the 12th power. EJ is looking for only a one order of magnitude move... from $250 to $2500. What about yourself?

In terms of purchasing power my yardstick has been 100 oz of gold for a median existing house and 1 oz of gold for the DJIA. But, in Weimar there are stories of houses selling for just a couple oz of gold in the worst part of the crisis.

Originally posted by bart

View Post

In terms of purchasing power my yardstick has been 100 oz of gold for a median existing house and 1 oz of gold for the DJIA. But, in Weimar there are stories of houses selling for just a couple oz of gold in the worst part of the crisis.

Comment