Re: Anatomy of a credit crunch induced bankruptcy - Eric Janszen

EJ writes in:

This is a fair point. We previously noted in Interview with Dr. Steven Keen: the Future of Debt Deflation the mechanism of inflation caused by the weak dollar during the 2004 and 2008 period.

If a weak dollar, sustained over four years, started to produce inflation in oil prices, which then began to feed into other goods prices, how long after the dollar strengthens will it take for that process to reverse?

More than half the dollar's decline against a broad index of currencies over four years until Q4 2008 has retraced in a few months, and the PPI nearly simultaneously.

The assertion "no deflationary forces" may border on hyperbole but is not entirely off base. Clearly a deflationary force of falling import prices exists, not to mention collapsing demand generally. That said, the impact of a stronger dollar on import prices, especially oil, takes years to work its way into the price structure in the economy beyond producer prices, and the dollar has only recently strengthened due to de-leveraging. We estimated that process to end within six months of the start of Q4 2008, which means soon, if it hasn't already; clearly the dollar spike is faltering, and may soon reverse, all before a strong dollar can exert a sustained deflationary force on prices in the US economy. As evidence, witness oil prices still over $40, a price referred to as a "bubble" level by oil price analysts back in 2004.

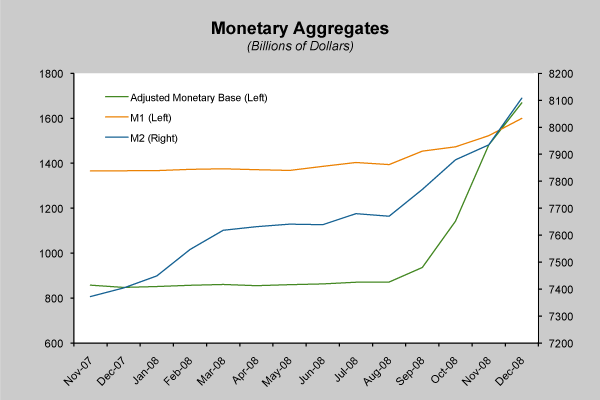

On the inflationary side of the equation, as the article states and consistent with our Ka-Poom Theory going back to 1999, is a heroic increase in money by the Fed to reflate the economy, and consistent with our 2009 forecast from last year, rampant supply destruction across the supply chain.

Before the end of the 2009, money over-production meets supply destruction meets dollar devaluation for an inflationary 1-2-3 punch not seen since 1975. Gold scratching $900 during a supposed "deflation" is in my opinion telling us everything we need to know about where inflation is going.

Originally posted by Boerg

View Post

This is a fair point. We previously noted in Interview with Dr. Steven Keen: the Future of Debt Deflation the mechanism of inflation caused by the weak dollar during the 2004 and 2008 period.

This produced one of two forces of demand destruction that tipped the US into recession in Q4 2007, as we forecast in Oct. 2006.

If a weak dollar, sustained over four years, started to produce inflation in oil prices, which then began to feed into other goods prices, how long after the dollar strengthens will it take for that process to reverse?

More than half the dollar's decline against a broad index of currencies over four years until Q4 2008 has retraced in a few months, and the PPI nearly simultaneously.

The assertion "no deflationary forces" may border on hyperbole but is not entirely off base. Clearly a deflationary force of falling import prices exists, not to mention collapsing demand generally. That said, the impact of a stronger dollar on import prices, especially oil, takes years to work its way into the price structure in the economy beyond producer prices, and the dollar has only recently strengthened due to de-leveraging. We estimated that process to end within six months of the start of Q4 2008, which means soon, if it hasn't already; clearly the dollar spike is faltering, and may soon reverse, all before a strong dollar can exert a sustained deflationary force on prices in the US economy. As evidence, witness oil prices still over $40, a price referred to as a "bubble" level by oil price analysts back in 2004.

On the inflationary side of the equation, as the article states and consistent with our Ka-Poom Theory going back to 1999, is a heroic increase in money by the Fed to reflate the economy, and consistent with our 2009 forecast from last year, rampant supply destruction across the supply chain.

Before the end of the 2009, money over-production meets supply destruction meets dollar devaluation for an inflationary 1-2-3 punch not seen since 1975. Gold scratching $900 during a supposed "deflation" is in my opinion telling us everything we need to know about where inflation is going.

Comment