Anatomy of a credit crunch induced bankruptcy in debt deflation

You know things are bad when wholesale liquidators -- companies that sell goods for companies that are going out of business -- are themselves going out of business

When we first started to outline the dimensions of this economic depression back in 2006, we did not foresee the extraordinary rate of economic decline we are experiencing today. Processes we expected to take months to transpire are happening in a matter of weeks. Nor did we imagine the range of businesses that are now getting caught up in this disaster. Usually a retail sales collapse starts at the luxury end of the market and slowly works its way down. Not this time. A document sent to us (hat tip to Sapiens) is indicative, a recent bankruptcy court filing by a wholesale liquidator. That's right, a company that sells goods for companies that are going out of business is filing for bankruptcy protection.

Below are excepts of the filing by the company, identified here only as Debtor, with comments.

The Debtor has many subsidiaries.

The Debtor is not a neophyte that has not gone through a downturn before. Debtor was founded 25 years ago at the start of the post 1980s recessions, and survived the early 1990s and 2001 recessions.

Debtor does business with established vendors. Going over the whole document, it appears that Debtor is and has always been a well run company. If there is a weakness in Debtor's business strategy in the current environment, beside the taking on of excessive debt, it is that the Debtor did not focus on the well healed but rather those who can only afford goods at below standard retail prices, even when times are good. That said, you'd think a few hundred thousand laid off FIRE Economy workers might improve the company's prospects as they join the ranks of Debtor's "lower and lower/middle income" target customer base. Apparently there are not as many newly minted poor joining from the upper rungs of the income ladder as there are customers falling the bottom rungs into abject poverty.

Debtor has some very big stores. If they do not emerge from bankruptcy, the goods supply will no doubt be missed.

Debtor employs a lot of people, nearly 2,000 total. If they do not emerge from bankruptcy those jobs are gone.

Alas, the Debtor could not resist the siren song of the private equity boom, and early in the game; they took PE money in 1998.

Debtor enjoyed sustained profitability until the post credit bubble economy pulled the rug out from under Debtor's customers. Whipsawed by energy inflation then falling incomes due to rising unemployment, the discount clearance wholesaler's goods became unaffordable to its customers.

Unfortunately for the Debtor, the 60% the PE boys own is a majority stake, so even though the company has been profitable for its entire 25 year life, when the economy turned down the boys still wanted to get their piece of the cash flow first.

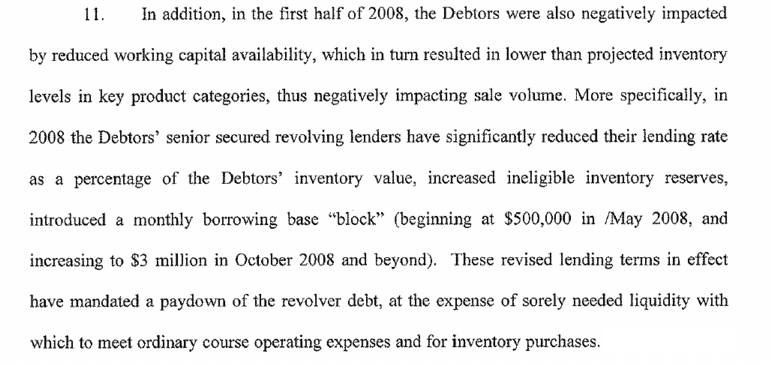

The Debtor has many creditors, and just as the economy took away its customers its creditors tightened up on it lending terms, forcing a reduction of inventory in demand, reducing the supply of goods wanted by the remaining customers, further lowering sales below capacity, and feeding a vicious circle.

Debt Deflation versus Goods Price Deflation

This is where the business rubber meets the debt deflation road, and why it's important to distinguish between debt deflation and all-goods price deflation, because what happens next is that as supply falls, goods prices will rise (see F.I.R.E. sales and Fire sales).

But don't take our word for it, again. Consider this report today by Richard M. Ebeling at the American Institute for Economic Research (AIER).

Today the gold market once again frustrated the impatient deflationistas who have been calling for gold to fall to under $450 since at least mid 2008. Settling just below $900, market participants confirmed what the AEIR and others who understand how the economy and monetary system operate already know, that on the other side of all of this money pumping by the Fed is a tide of inflation that will be expressed as rising goods prices, no matter that prices of assets inflated by CDOs and another financial magic -- such as houses and retail commercial real estate -- are down for the count.

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2009 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

You know things are bad when wholesale liquidators -- companies that sell goods for companies that are going out of business -- are themselves going out of business

When we first started to outline the dimensions of this economic depression back in 2006, we did not foresee the extraordinary rate of economic decline we are experiencing today. Processes we expected to take months to transpire are happening in a matter of weeks. Nor did we imagine the range of businesses that are now getting caught up in this disaster. Usually a retail sales collapse starts at the luxury end of the market and slowly works its way down. Not this time. A document sent to us (hat tip to Sapiens) is indicative, a recent bankruptcy court filing by a wholesale liquidator. That's right, a company that sells goods for companies that are going out of business is filing for bankruptcy protection.

Below are excepts of the filing by the company, identified here only as Debtor, with comments.

The Debtor has many subsidiaries.

The Debtor is not a neophyte that has not gone through a downturn before. Debtor was founded 25 years ago at the start of the post 1980s recessions, and survived the early 1990s and 2001 recessions.

Debtor does business with established vendors. Going over the whole document, it appears that Debtor is and has always been a well run company. If there is a weakness in Debtor's business strategy in the current environment, beside the taking on of excessive debt, it is that the Debtor did not focus on the well healed but rather those who can only afford goods at below standard retail prices, even when times are good. That said, you'd think a few hundred thousand laid off FIRE Economy workers might improve the company's prospects as they join the ranks of Debtor's "lower and lower/middle income" target customer base. Apparently there are not as many newly minted poor joining from the upper rungs of the income ladder as there are customers falling the bottom rungs into abject poverty.

Debtor has some very big stores. If they do not emerge from bankruptcy, the goods supply will no doubt be missed.

Debtor employs a lot of people, nearly 2,000 total. If they do not emerge from bankruptcy those jobs are gone.

Alas, the Debtor could not resist the siren song of the private equity boom, and early in the game; they took PE money in 1998.

Debtor enjoyed sustained profitability until the post credit bubble economy pulled the rug out from under Debtor's customers. Whipsawed by energy inflation then falling incomes due to rising unemployment, the discount clearance wholesaler's goods became unaffordable to its customers.

Unfortunately for the Debtor, the 60% the PE boys own is a majority stake, so even though the company has been profitable for its entire 25 year life, when the economy turned down the boys still wanted to get their piece of the cash flow first.

The Debtor has many creditors, and just as the economy took away its customers its creditors tightened up on it lending terms, forcing a reduction of inventory in demand, reducing the supply of goods wanted by the remaining customers, further lowering sales below capacity, and feeding a vicious circle.

Debt Deflation versus Goods Price Deflation

This is where the business rubber meets the debt deflation road, and why it's important to distinguish between debt deflation and all-goods price deflation, because what happens next is that as supply falls, goods prices will rise (see F.I.R.E. sales and Fire sales).

But don't take our word for it, again. Consider this report today by Richard M. Ebeling at the American Institute for Economic Research (AIER).

False Fears of Deflation in Dangerous Inflationary Waters

The Consumer Price Index (CPI) data for December has made many commentators raise the fear of a coming deflation. There is only one problem with these concerns: There are no deflationary forces at work. If anything, a huge inflationary process has been undertaken by the Federal Reserve over the last several months.

The Department of Labor reported January 16 that the CPI for all urban consumers (seasonally adjusted) decreased by 0.7 percent for December and was a mere 0.1 percent higher than a year earlier. Prices have not declined significantly, and the trend certainly has not been deflationary.

Since the time of Adam Smith, economists generally have defined inflation or deflation as a rise or fall in the money supply (broadly defined). Whether or not such a monetary change brings about a rise or fall in the general level of prices will depend on people’s demand to hold money relative to the increase in the supply of money.

At a time of economic crisis and uncertainty such as the present, individuals may choose to hold money balances larger than usual as they try to hedge against a more unpredictable future and restore their financial balance.

But normally the crisis atmosphere passes after a period of adjustment during which the write-downs are made and markets rebalance, with the likely future being less cloudy. At that point demands to hold a larger than usual amount of money tends to diminish.

The Federal Reserve is fearful that the collapse in housing and assets prices coupled with individuals and financial institutions shoring up their cash positions will put significant downward pressure on prices in general. So over the last several months, the Fed has undertaken a massive increase in the supply of money and credit.

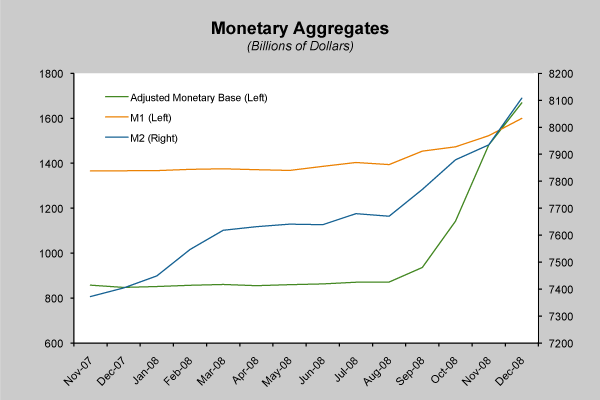

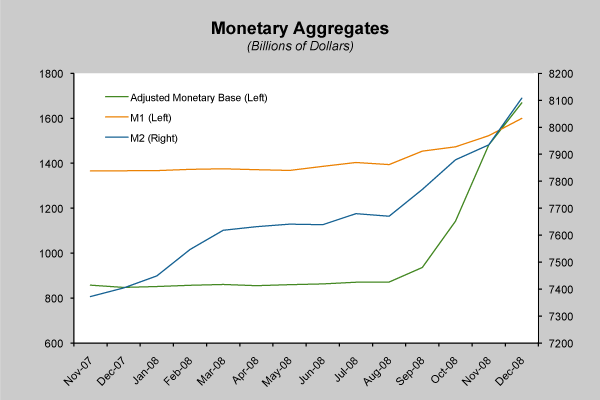

As shown in the chart below, the Monetary Base (dollar cash held by the public and bank reserves held at the Fed) increased from $871 billion in September 2008 to nearly $1.7 trillion in December 2008. This amounts to a 95 percent increase in only four months. M-1 (Cash and demand deposits) increased by 40.2 percent and M-2 (M-1 plus and variety of forms of demand and savings deposits) grew by 17.4 percent at annualized rates of increase over this period.

The Consumer Price Index (CPI) data for December has made many commentators raise the fear of a coming deflation. There is only one problem with these concerns: There are no deflationary forces at work. If anything, a huge inflationary process has been undertaken by the Federal Reserve over the last several months.

The Department of Labor reported January 16 that the CPI for all urban consumers (seasonally adjusted) decreased by 0.7 percent for December and was a mere 0.1 percent higher than a year earlier. Prices have not declined significantly, and the trend certainly has not been deflationary.

Since the time of Adam Smith, economists generally have defined inflation or deflation as a rise or fall in the money supply (broadly defined). Whether or not such a monetary change brings about a rise or fall in the general level of prices will depend on people’s demand to hold money relative to the increase in the supply of money.

At a time of economic crisis and uncertainty such as the present, individuals may choose to hold money balances larger than usual as they try to hedge against a more unpredictable future and restore their financial balance.

But normally the crisis atmosphere passes after a period of adjustment during which the write-downs are made and markets rebalance, with the likely future being less cloudy. At that point demands to hold a larger than usual amount of money tends to diminish.

The Federal Reserve is fearful that the collapse in housing and assets prices coupled with individuals and financial institutions shoring up their cash positions will put significant downward pressure on prices in general. So over the last several months, the Fed has undertaken a massive increase in the supply of money and credit.

As shown in the chart below, the Monetary Base (dollar cash held by the public and bank reserves held at the Fed) increased from $871 billion in September 2008 to nearly $1.7 trillion in December 2008. This amounts to a 95 percent increase in only four months. M-1 (Cash and demand deposits) increased by 40.2 percent and M-2 (M-1 plus and variety of forms of demand and savings deposits) grew by 17.4 percent at annualized rates of increase over this period.

By any definition, there has been no monetary deflation that would have decreased the amount of money and credit in the economy. The current monetary expansion comes before any reestablishment of a non-crisis demand for money by consumers, producers, and financial institutions. And its magnitude warns of a serious danger of significantly rising prices in the future if the Federal Reserve fails to reverse the expansion.

The threat facing the economy as a whole in 2009 will be the consequences from this vast inflationary increase in the monetary aggregates.

In case you are not familiar with the AEIR, they have been at this economic analysis and forecasting game a lot longer than we have. We recommend this AEIR article from Nov. 1934 (PDF). You will find it eerily familiar (hat tip to Paul and Wes for passing it on).Today the gold market once again frustrated the impatient deflationistas who have been calling for gold to fall to under $450 since at least mid 2008. Settling just below $900, market participants confirmed what the AEIR and others who understand how the economy and monetary system operate already know, that on the other side of all of this money pumping by the Fed is a tide of inflation that will be expressed as rising goods prices, no matter that prices of assets inflated by CDOs and another financial magic -- such as houses and retail commercial real estate -- are down for the count.

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2009 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

]

]

Comment