Re: Fed cuts dollar, Fire sales vs FIRE sales, Duh-flation, and Bezzel shrinks again - Eric Janszen

Bart, for a clinical exposition of evil, consider the book "Political Ponerology"

Announcement

Collapse

No announcement yet.

Fed cuts dollar, Fire sales vs FIRE sales, Duh-flation, and Bezzle shrinks again - Eric Janszen

Collapse

X

-

Re: Fed cuts dollar, Fire sales vs FIRE sales, Duh-flation, and Bezzel shrinks again - Eric Janszen

Somewhat true, like in the sense where I call the ECB's buy & sell actions in the gold market either manipulation or control, but the difference in my usage of "evil" above is in a very dark sense and well beyond things like national self interest or similar.Originally posted by jtabeb View PostDon't confuse evil (although it could very well be called that) with a strenuous defense of national self-interest on the part of policy makers. (Their view of national interest, that is)

The problem is that the word evil has such a broad connotation, like the smoke filled back room picture. Although there is some of that, I'm more referring to things like a major worship of power, control and Mammon to the exclusion of other important things in life - including ethical or even moral behavior. And now that I've used almost all the truly hot words (except sex) in life and very intentionally avoided specifics, I'll be heading for my cage...

Leave a comment:

-

Re: Fed cuts dollar, Fire sales vs FIRE sales, Duh-flation, and Bezzel shrinks again - Eric Janszen

Thanks santefe2 and GRG55. I get it now. So much money chased into treasuries (or already there before from SWFs) is bound to get chased out. Then all that money chases other stuff. I was thrown by the broadness of the terms "creditors" and "assets" whch can mean so many different things.

Leave a comment:

-

Re: Fed cuts dollar, Fire sales vs FIRE sales, Duh-flation, and Bezzle shrinks again - Eric Janszen

Bravo.

Well written and informative.

I'll read this one more than once, for sure.

Leave a comment:

-

Re: Fed cuts dollar, Fire sales vs FIRE sales, Duh-flation, and Bezzel shrinks again - Eric Janszen

Don't confuse evil (although it could very well be called that) with a strenuous defense of national self-interest on the part of policy makers. (Their view of national interest, that is)Originally posted by bart View Post

The iTulip theory of jocks and geeks does not include any allowance for "evil" though, and I submit that at the very least it is quite incomplete for that reason, albeit workable.

Leave a comment:

-

Re: Fed cuts dollar, Fire sales vs FIRE sales, Duh-flation, and Bezzle shrinks again - Eric Janszen

"Creditors" = primarily foreign private and official sector. Foreign private sector buyers of US Treasuries have declined in recent years, but official sector buyers [foreign Central Banks] have stepped in to replace them.Originally posted by pianodoctor View PostCan someone kindly help an econo-dummy understand the following quote from EJ's article of subject?: "inflation, accomplished, as usual, via currency depreciation, but this time executed by unwitting US creditors selling dollar denominated assets versus deflating the dollar against gold."

I'm not quite grasping what kind of "US creditor" (our foreign creditors? Creditors within the US like mortgage, credit card companies?) What kind of assets will they be selling? And if they are selling things and getting dollars in return, why is that inflationary?

What does "unwitting" imply? Is someone manipulating the unwitting party intentionally to cause inflation? How?

I understand most of what EJ writes most of the time (and I consider that a testimony to his writing quality, considering how unschooled I am in economics), but I'm not quite 'getting' this one.

"Unwitting", I think, because most have suffered US$ exchange rate losses for the past number of years [although the capital gains in US Treasuries this year has been something to behold]. As well, some are still willing to lend to the US Government at zero to near-zero returns, today.

As for......my interpretation is that deflating the dollar against gold, as was done in the 1930's, isn't directly possible [by the Fed] since there is no longer any official convertability link, as there was then. That leaves creating inflation by creating a sufficient surplus of US$ compared to goods and services available. santafe2's post covers how they might do it."inflation, accomplished, as usual, via currency depreciation, but this time executed by unwitting US creditors selling dollar denominated assets versus deflating the dollar against gold."

Leave a comment:

-

Re: Fed cuts dollar, Fire sales vs FIRE sales, Duh-flation, and Bezzle shrinks again - Eric Janszen

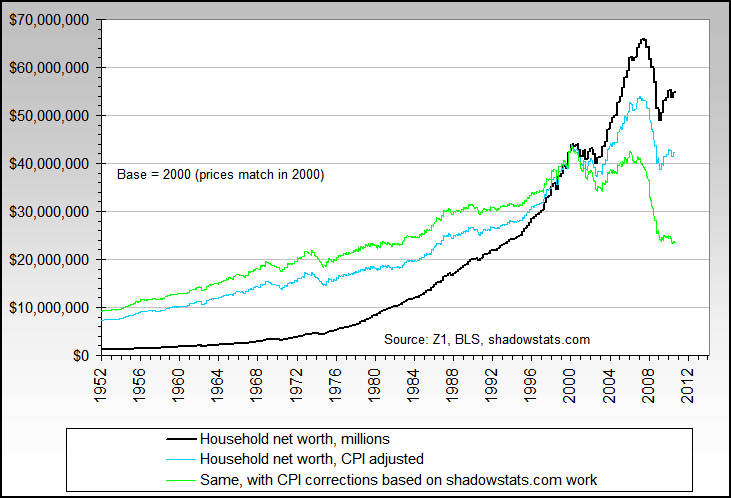

The chart is two weeks old but functionally accurate. Retracement has a way to go to wipe out the FIRE economy but its blown straight by the 2001 downturn without so much as a pause. This can't be a positive sign.Originally posted by EJ View PostThe latest data from ECRI indicate that the US economy on track to contract to near its pre-FIRE Economy level.

19YearECRI_Level.jpg

Leave a comment:

-

Re: Fed cuts dollar, Fire sales vs FIRE sales, Duh-flation, and Bezzle shrinks again - Eric Janszen

US$ depreciation should happen when too many US dollars become unattached to US treasuries in too short a period of time. The stuff these dollars chase goes up in value and the dollars go down in value. The stuff can be as simple as other currencies. Lots of fear is driving US$ holders into US treasuries today but as these creditors run to other assets and dump their dollars, the US$ will be less prized and will begin to fall in value. They won't intend to drive the dollar down, won't want to any more than investors in any other investment that has become toxic. But nonetheless, that will likely be the outcome.Originally posted by pianodoctor View PostCan someone kindly help an econo-dummy understand the following quote from EJ's article of subject?: "inflation, accomplished, as usual, via currency depreciation, but this time executed by unwitting US creditors selling dollar denominated assets versus deflating the dollar against gold."

I'm not quite grasping what kind of "US creditor" (our foreign creditors? Creditors within the US like mortgage, credit card companies?) What kind of assets will they be selling? And if they are selling things and getting dollars in return, why is that inflationary?

What does "unwitting" imply? Is someone manipulating the unwitting party intentionally to cause inflation? How?

I understand most of what EJ writes most of the time (and I consider that a testimony to his writing quality, considering how unschooled I am in economics), but I'm not quite 'getting' this one.

Others here are more qualified to give a more complete explanation.

Leave a comment:

-

Re: Fed cuts dollar, Fire sales vs FIRE sales, Duh-flation, and Bezzel shrinks again - Eric Janszen

1. Maybe not, But I do recall a quote in which you agreed with the government's and OPEC position that the Oil price was justified on the basis of "resource depletion", I believe was the term. So what you did say was that money games/leverage/OTC trading were not manifestly impacting the Oil Price. (If MISH is not allowed to rewrite history, you should not be able to either).Originally posted by FRED View PostFactually incorrect.

1. We never insinuated that oil was not due to decline in price from $147, nor gold from $1013 for that matter, only that these were not "bubbles" by our definition. This is critical to understand. If we included these in our definitions of bubbles, along with tech stocks in 1999 and houses 2002 to 2006, then subsequent price actions in oil and gold raise the obvious question: if oil is a bubble at $40 in 2006, and gold at $1013 in 2008, what is oil at $45 in 2008 after the oil "bubble" has popped and gold at $850 after the gold "bubble" has "popped"?

2. We believe that both oil and gold prices are, long term, more a function of dollar supply and demand than commodity supply and demand. Thus the price will likely behave in ways that are completely uncharacteristic of bubbles. Bubbles are characterized by a rapid rise, a collapse to a mean, and overshoot followed by an extended period of suppressed price. Oil remains at prices that were called a "bubble" in 2006 yet the talk now is of deflation as demand collapses. Gold at $850 during a "deflation" makes no sense at all of gold was a "bubble" at $1013. We maintain a consistent set of definitions and concepts here and do not change them as the wind blows.

3. The Fed has not engineered an economic collapse.

2. Ok, then please explain Itulip's shift in position on the term Disinflation. First is was NO deflation then NO SUSTAINED DEFLATION, then it was NO SELF-REINFORCING SUSTAINED DEFLATION. That seems like more than just a symantic shift to me.

3. You present a suppostion as fact, with no evidence presented at all. This of lack of intellectual curiosity will not provide far-reaching insights into policy deconstruction and is a grave disservice to your readership. Bottom line, you dismiss a supposition that I have presented outright, while at the same time presenting a supposition of you own as factually based (with out presenting any evidence). That seems to be a woeful double standard. And I said earlier, you reject theories that match the observable behavior because they are not proveable (although, at least twice these theories have been vindicated by coroborating evidence that emerges later) BUT at the same time present your OPINION as fact with out even meeting your own burdon of proof.

4. No response or mention of the Iraq PM I sent you? Why? Was that not a case of an plausible but unprovable theory that was later coroborated by a factual disclousure from a very reputable source? So it's not like what I (and Bart) are talking about here is without a historical prescident. I think you would be more open to different ideas having been scooped once before. No?

I would add that from everything I know and everything I heard (Fred are you listening here), there is a VERY large geopolitical/military chess game that is being played out on the world stage right now that is flying below the radar of most of the retail news sources. This game is so significant that is impacting all of the economies of the world. If you doubt the veracity of the Pol/Mil complex to operate in this arena, I would strongly advise you all to do your research on US Doctrine and specifically the instruments of national power and their use. If you IGNORE the significance of what is being decided and why, you will have absolutely no basis for conjecturing on future economic outcomes, NONE WHAT SO EVER.

Yes FRED, you are going to say "prove it", I can't. That does not mean that it is not occuring and I will offer you this. If this theory better explains future outcomes, you'd damn well better listen if you don't want to get burned. How will we know?

I shoot my mouth off enough round here that most of you know exactly the calls that I have made.

Just to re-state, for those not familiar, here they are.

a. Gold and silver are cheaper than dirt, buy them!

b. houses in non-bubble areas or forclosures in bubble areas (where you can find 50% sales) are dirt cheap. By a house if you need a house. Yes, this means stop renting! (If it's good enough for my mom, well, you can decide if you think I'm correct and act accordingly).

c. I think stocks are cheap (cheaper than 1982 prices anyway) in inflation adjusted gold terms, so yes I went 50% long with my remaining cash (25% of my portfolio)

See here:

http://www.ritholtz.com/blog/2008/12...ow-gold-price/

d. The dollar is as overvalued as all get out. Remember when the dollar was devalued in 1933 by from $20oz to $35oz of gold? A big dollar de-valuation come'th, and it come'th soon. Things seem to be moving much MUCH faster than during the thirties, I would expect that the dollar devaluation comes much MUCH sooner too. (Sooner than everyone is expecting).

Think what that will do to assets like stocks and houses and gold VS. say BONDS? You can draw your own conclusions.

e. You ain't gonna have an Alt-E boom w/out being competitive with conventional fuels. There is only two ways that occurs. Conventional prices go back up(1), carbon cap-and-trade pushes conventional prices back up(2) or some combination of the two.

Those are my calls for the public record. (You can hound me on them as much as you like if they are incorrect, but if they are correct, please take note of the possiblity).

P.S. The beauty of this site is that no one is correct all the time. I am very thankful for the insights provided by all the members and ESP. our founders. You can gain alot from a good many very intellegent people. But in the end, you have to construct your own operating understanding of what is going on in the world. I do that by taking the most logically consistent ideas and unifing them as best as I can into a multi-dimensional working theory about what's happeing. My synergy may be very different than yours. But by presenting it here, maybe you will find something to refine your own construct. Good luck.

P.P.S. I'd rather be wrong in public than right in private because what the hell good would that do for everyone (besides me).Last edited by jtabeb; December 16, 2008, 11:00 PM.

Leave a comment:

-

Re: Fed cuts dollar, Fire sales vs FIRE sales, Duh-flation, and Bezzel shrinks again - Eric Janszen

Fred more than anything else specific...but mostly just for fun.Originally posted by ASH View PostThat's funny, but... is that directed at my conversation with vinoveri, or bart's conversation with FRED?

Leave a comment:

-

Re: Fed cuts dollar, Fire sales vs FIRE sales, Duh-flation, and Bezzel shrinks again - Eric Janszen

Of course it's a point in the disinflation/deflation columns, along with many other items... but the bottom line is whether you think that the combination of governments and central banks can't and won't reverse the trend.Originally posted by DemonD View PostI can't get it out of my head, the article that EJ posted that said that in a market at any given time, there are inflationary and deflationary forces. And I also can't get it out of my head that a drop in household debt is deflationary in nature. I know we're just looking at one data point in a vacuum, but it's another point in that column.

This is why I was asking, what if the fiscal stimulus being pumped into the FIRE sector never makes it to the P/C economy? Wouldn't the above chart be a data point in favor of that type of action?

Here's another one in the disinflation/deflation columns - the drop so far in US household net worth both in absolute dollars and in percentage is the largest since the beginning of the data set in 1952.

Leave a comment:

-

Re: Fed cuts dollar, Fire sales vs FIRE sales, Duh-flation, and Bezzle shrinks again - Eric Janszen

I am glad you high-lighted that video on inflation as I finally watched it. I just wonder .... :rolleyes:

What happens if nobody is interested in more pipe?

What happens if nobody has money they are sitting on for that new car?

What happens if we are not a manufacturing society anymore?

It sounds so good, whatever happened to Weimar Germany? (too much fun?)

Finally I wonder if Uncle Ben is too quick on the draw right now and nobody reacts to inflation. Consequently he has to really print and whoops, off we go to high inflation (hopefully not hyper inflation, let's see that video! :eek

Leave a comment:

-

Re: Fed cuts dollar, Fire sales vs FIRE sales, Duh-flation, and Bezzel shrinks again - Eric Janszen

Down from a peak of $450 a kilo to about $80 today. By all accounts, it's headed lower since most of the manufacturers are running at very low production levels. There are mountains of purified silicon building up while solar panel manufacturers, distributors and installers work off the current inventory. As EJ pointed out, there's going to be a very good time to be a consumer in the future.Originally posted by GRG55 View PostThose that insist that the price action of oil is "proof" of some sort of sophisticated, organized, ETN-conspiracy financial manipulation seem to completely overlook identical price behaviour in...solar cell manufacturers...

Leave a comment:

-

Re: Fed cuts dollar, Fire sales vs FIRE sales, Duh-flation, and Bezzel shrinks again - Eric Janszen

Cheap peak creditOriginally posted by jtabeb View PostYou are, with out a doubt, MAKING MY POINT for me. Does it not strike you as "odd" that ther first people to receive "reflation" funds were the banks, AND that how they have spent those funds is completely unaccounted for?

It does me.

(and yes, this does seem like a generous quid-pro-quo, in light of the events that have transpired)

Leave a comment:

-

Re: Fed cuts dollar, Fire sales vs FIRE sales, Duh-flation, and Bezzel shrinks again - Eric Janszen

You are, with out a doubt, MAKING MY POINT for me. Does it not strike you as "odd" that ther first people to receive "reflation" funds were the banks, AND that how they have spent those funds is completely unaccounted for?Originally posted by GRG55 View PostThose that insist that the price action of oil is "proof" of some sort of sophisticated, organized, ETN-conspiracy financial manipulation seem to completely overlook identical price behaviour in uranium equities, corn, zinc, nickel, wheat, solar cell manufacturers, natural gas and a host of other things, each of which became the object of desire for the cheap money, leveraged set for a brief, shining moment. I simply do not see why oil is somehow so special for these folks. The cheap money era is over [unless you are the US Government and "unwitting creditors" are still giving you their savings for zero return], and every asset class is being reset. And they will all be reset at least once more, relative to one another, as the reflation takes hold.

It does me.

(and yes, this does seem like a generous quid-pro-quo, in light of the events that have transpired)

Leave a comment:

Leave a comment: