Re: Fed cuts dollar, Fire sales vs FIRE sales, Duh-flation, and Bezzel shrinks again - Eric Janszen

Funny EJ should come out with a more thought out article on inflation.

After readng his last article about which goods and services would experience deflation or inflation, I was thinking about which goods would do the same in Ireland. I went through a few industries and realised that all the goods I could think of would go up once the extra inventory had been depleted. The surviving suppliers would deliberately understock as a reaction to the drop in demand from 2008/2009. BTW we are seeing 20 or 25% sales here BEFORE Christmas in ALL stores which nobody I have spoken to has ever seen before in their lifetimes.

The exception was housing which would continue to plummet as supply would (is) increase phenomenally in Ireland (demand is virtually non-existant as it is) due to the East Europeans going home. 91% of Irish own their own property. Foreigners rent. Economy very bad - foreigners go home - empty apartments. Couple this with vastly increasing unemployment (and fear of such) and lack of credit availability and we have a hell of a cocktail for house prices.

On unemployment, my exponential 16.2% (end of 2009) forecast has been optimistic so far. The rate is getting WORSE! Holy collapse Batman.

January will be a bloodbath here. If this continues (pray to the Lord that it bottoms somewhere in 2009) then we will have at least a 20% unemployment rate by the end of 2009 (more like 25+%).

Our government is also clueless which is frightening.

Can anybody think of an industry apart from housing which will avoid the inflationary push in 2010+?

Some services perhaps? :confused:

Announcement

Collapse

No announcement yet.

Fed cuts dollar, Fire sales vs FIRE sales, Duh-flation, and Bezzle shrinks again - Eric Janszen

Collapse

X

-

Re: Fed cuts dollar, Fire sales vs FIRE sales, Duh-flation, and Bezzel shrinks again - Eric Janszen

Yea, Russia is doing so great they're aping soviet antics yet again...:rolleyes:Originally posted by jtabeb View PostAs I said, COORDIANTED policy objective. Helps us, helps them, let's us get away with running the game a little longer... Qui Bono I think is the term.

Russian LEADERSHIP is not having anytrouble right now, even though the counrty is.

Leave a comment:

-

Re: Fed cuts dollar, Fire sales vs FIRE sales, Duh-flation, and Bezzel shrinks again - Eric Janszen

I don't think it is a coincidence that this started when boomers hit retirement age.

Leave a comment:

-

Re: Fed cuts dollar, Fire sales vs FIRE sales, Duh-flation, and Bezzel shrinks again - Eric Janszen

I submit that you can not prove that there was not an intent to have a failure of a significant degree.Originally posted by FRED View Post...

But this time they failed. This is a debt deflation as has not happened since the 1930s.

The hog is in the tunnel.

Leave a comment:

-

Re: Fed cuts dollar, Fire sales vs FIRE sales, Duh-flation, and Bezzel shrinks again - Eric Janszen

I guess I didn't understand what you were driving at. Regardless of EJ, why do you propose to compare SPY and gold after ten years? I presume that the performance of those two asset classes will diverge, but surely not monotonically and for all time. Why ten years? Would not "market down and gold up" be a useful prediction if it was so for five years? Gold is not something you buy and hold. In addition to being currency crash insurance, gold can function as a "macro timing" tool -- a temporary position to take when currency is being devalued. In that context, I don't think it makes much sense to look at the merits of a macro timing prediction on the basis of an arbitrary time frame.Originally posted by goadam1 View PostI don't really care about EJ being right or not. I don't care about when he made the call. Here I stand. My ratio is pretty even and I think it is a good game from here. However, my hard earned money isn't a stake in a game. So, let's start from here. Now is fair. And the prediction has been for a market down and gold up. I think he may still be right. But I do know that you don't bet it all on black (see Madoff). I don't think EJ gives that kind of advice. I do think the theory will be adjusted because the terrain is new.

Oh to be mildly contrarain on a board of contrarian.

I do notice that the true followers have higher gold holdings than EJ suggests.

You are absolutely right about "betting it all on black" and that EJ has never advised his readers to do so. You are also right that some of the "true believers" are much more heavily invested in gold than EJ himself.

== EDIT ==

P.S. I am writing as someone who fervently hopes somewhere better to put my money, other than gold, turns up long before 10 years elapse.Last edited by ASH; December 16, 2008, 07:28 PM.

Leave a comment:

-

Re: Fed cuts dollar, Fire sales vs FIRE sales, Duh-flation, and Bezzel shrinks again - Eric Janszen

http://www.econstats.com/r/rjap__m21.htm

It's a bit dated, but the M2+CD's numbers in 1/1990 was 4681037.00, and in 10/2006 it was 7138859.00 (both numbers in 100 million yen).

The official inflation statistics from japan show that, indexed to a value of 100 in 2005, was:

1/1990: 92.5

10/2006: 100.6

(and note that in the interim, there were a LOT of negative numbers in there in terms of the % change yoy)

source (warning: .xls file) : http://www.stat.go.jp/english/data/c...you/a001hh.xls

Now maybe my rudimentary analysis is overly simplistic. Which is why I'm asking here. But here's the math:

7138859.00 - 4681037.00 = 2457822

2457822/4681037 = .525, or a 52.5% increase in the monetary base

100.6-92.5 = 8.1

8.1/92.5 = .0876, or 8.76% increase in consumer prices.

Now maybe japan has fudged their figures, and they didn't have dozens of months of yoy deflation in the past 18 years. I don't live or know anyone in Japan, but my understanding is that cost of living isn't that much greater if at all than it was in 1990.

The question here is this: Isn't it possible to have a large increase in the money supply, without high inflation, and even possibly with somewhat sustained deflationary forces for years?

I know you've made good arguments against the Japan cycle being repeated here in the US Eric, but it's not just Mish that has brought out a lot of pertinent data in terms of sustained deflation. To a certain extent, I can even see a case being made that the FIRE, Gov't, and P/C economies might even make a deflationary scenario even worse - what if all the monetary base just stays in the FIRE economy and never makes it to the P/C economy at all?

http://online.wsj.com/article/SB122938932478509075.html

There are other striking similarities between the US and Japan. Developed nations with greying/aging workforces, etc.

BTW, I'm not writing this post to be a rabble-rouser, or to flame the debate because I agree that

My recognition here is that I see significant monetary inflation with a very similar set of scenarios, and I see a very recent example in a 1st world country of sustained deflation or very low/virtually zero inflation, with massive stimulation thrown at it to try to prevent deflation. The question is, isn't it possible that the US will rhyme more closely with Japan from 1990-now, as opposed to the US from 1974-1980?It's about time to give up debating inflation and deflation with anyone who does not distinguish between asset prices in the FIRE Economy and commodities, goods, services, and wages prices in the Production/Consumption Economy.

Leave a comment:

-

Re: Fed cuts dollar, Fire sales vs FIRE sales, Duh-flation, and Bezzel shrinks again - Eric Janszen

Leave a comment:

-

Re: Fed cuts dollar, Fire sales vs FIRE sales, Duh-flation, and Bezzel shrinks again - Eric Janszen

I get the debt deflation component at work this time. I have made myself a pariah in conversations on the topic for years. I don't have debts. Zero. I know this will be a bad run. But I get in trouble on this board for saying that you can't dig a hole and hide with your gold. My business was down 20% last year but my profit margin was up the same. You don't give up until the piggy squeals.

Leave a comment:

-

Re: Fed cuts dollar, Fire sales vs FIRE sales, Duh-flation, and Bezzel shrinks again - Eric Janszen

Think of modern central banking policy as behavioral engineering. Central banks count on the fact that consumer behavior lags reality by a considerable period. Consumers don't like to change their habits downward to adjust for reduced income. (See Dynamic Consumption Behavior: Evidence from Japanese Household Panel Data PPT.) This is how recessions have been made short and shallow via monetary policy since the early 1980s: central banks expand credit before consumer behavior changes and becomes self-reinforcing.Originally posted by goadam1 View PostI don't remember anyone going out of business in the last recession. So far in New York the places are as busy as ever, from the fancy Waverly Inn ($100 dollar truffle mac and chesse) to Olive Garden. I do know about a lot of looming layoffs. But I also know some people who left jobs for better jobs.

I'm sure it won't be as fancy in fancyville soon.

But this time they failed. This is a debt deflation as has not happened since the 1930s.

The hog is in the tunnel.

Leave a comment:

-

Re: Fed cuts dollar, Fire sales vs FIRE sales, Duh-flation, and Bezzel shrinks again - Eric Janszen

I don't remember anyone going out of business in the last recession. So far in New York the places are as busy as ever, from the fancy Waverly Inn ($100 dollar truffle mac and chesse) to Olive Garden. I do know about a lot of looming layoffs. But I also know some people who left jobs for better jobs.

I'm sure it won't be as fancy in fancyville soon.

Leave a comment:

-

Addendum

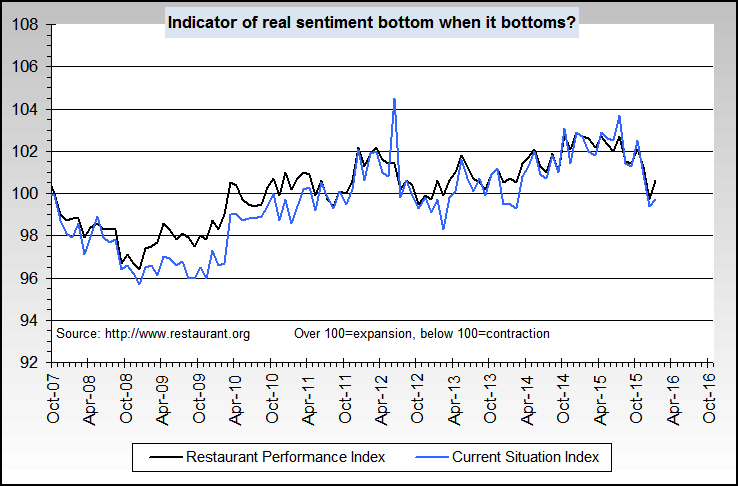

While you're at it, get out there and enjoy your favorite restaurants while they're still in business.

Remember the bad old days after the dot com crash in 2001 when the crowds cleared out of restaurants and some went under? Today conditions are considerably worse.

Leave a comment:

-

Re: Fed cuts dollar, Fire sales vs FIRE sales, Duh-flation, and Bezzel shrinks again - Eric Janszen

I don't really care about EJ being right or not. I don't care about when he made the call. Here I stand. My ratio is pretty even and I think it is a good game from here. However, my hard earned money isn't a stake in a game. So, let's start from here. Now is fair. And the prediction has been for a market down and gold up. I think he may still be right. But I do know that you don't bet it all on black (see Madoff). I don't think EJ gives that kind of advice. I do think the theory will be adjusted because the terrain is new.

Oh to be mildly contrarain on a board of contrarian.

I do notice that the true followers have higher gold holdings than EJ suggests.

Leave a comment:

-

Re: Fed cuts dollar, Fire sales vs FIRE sales, Duh-flation, and Bezzel shrinks again - Eric Janszen

A test that is more fair to EJ would be to make the comparison at the point when EJ recommends to sell gold and trade out of cash. That isn't necessarily in ten years.Originally posted by goadam1 View PostI guess in ten years we will see if 10 shares of spy is more or less than 10 gold eagles. We will count after tax worth (yes the system is rigged).

Leave a comment:

-

Re: Fed cuts dollar, Fire sales vs FIRE sales, Duh-flation, and Bezzel shrinks again - Eric Janszen

As I said, COORDIANTED policy objective. Helps us, helps them, let's us get away with running the game a little longer... Qui Bono I think is the term.Originally posted by Spartacus View PostAren't the oligarchs a pain for Putin, and a pro-western front within Russia?

and crushing them and making Putin's life easier does NOT help any US interest, even the FED's?

Russian LEADERSHIP is not having anytrouble right now, even though the counrty is.

Leave a comment:

-

Re: Fed cuts dollar, Fire sales vs FIRE sales, Duh-flation, and Bezzel shrinks again - Eric Janszen

Russia, Venezuela, Iran seem to be hurt FAR worse than we are at present.Originally posted by ASH View PostIn my opinion, this theory doesn't wash because this recession is creating much bigger problems for America and the world than it is solving by starving Russia of cash. Is there any country which is not being hurt by the recession? This would really be a case of cutting off your nose to spite your face.

And as for cutting off your nose to spite your face, god knows we have done that many MANY times.

Leave a comment:

Leave a comment: