Re: The Hard Way or the Harder Way

jk,

I always appreciate your perspectives and your time to make more than brief comments.

Part of what we are all thinking about is what will happen and how to play it.

Today in Barron's which requires subscription, in Abelson's column, he comments on Stephanie Pompoy's (MacroMaven's chief maven) prophesies.

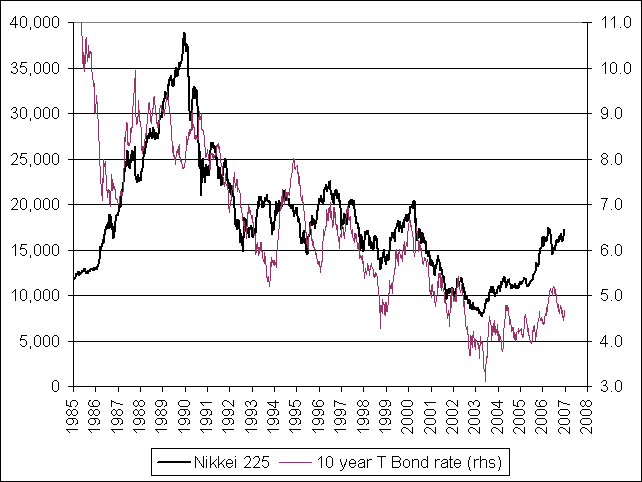

To paraphrase: Deflation in housing market will be worse than the dot-com bust, hitting the US consumer and the financial system with its record exposure to real estate. Current fear of inflation will succumb to fear of deflation with FOMC action to lower rates possibly by Christmas. She thinks these efforts--using Japan and dot-com bubbles as recent examples--will fail because consumers will resist taking on new debt even cheaper debt. A worsening US credit environment will "send liquidity in sharp retreat, taking all assets with it."

She thinks it is high-end consumers who drive discretionary spending, so she'd short Starbucks, go long Spam (Hormel), and long pawn brokers.

Financials involved with home building in any way will be hit. Banks still own 3 trillion Bonars (43% of total assets) and 1 trillion in mortgage backed securities, thus a 55% exposure to real estate. She supposed banks will have to rebuild their loan-loss reserves, now at 20 year lows. [I, JN, do not personally understand the implications of the last sentence.]

Suggestions (hers): short or underweight regional banks, credit card companies and subprime lenders.

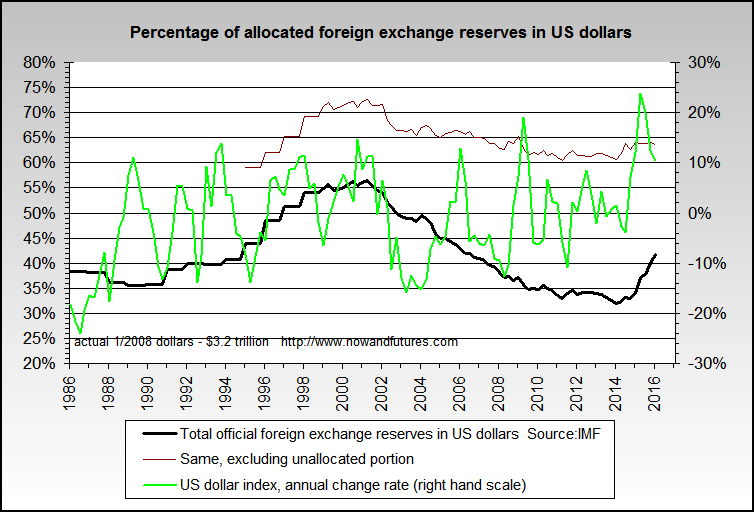

She thinks the Feds will be forced to monetize Treasuries (print more money to buy them which is inflationary) while the rest of the world does not devalue their currencies competitively. If that happens the Bonar will start steadily to decline. Assuming that, US investors should seek hard-assets, and certain things--Treasuries, multinationals, and consumer staples may rally, but those rallies will disguise their devaluation in dollar terms.

Simplest answer to play the coming Bonar decline--according to Ms. Pompy: long commodities and short stocks; specifically long gold-index and short bank-stock index. Abelson said she said a lot more, but this is all he shared.

jk,

I always appreciate your perspectives and your time to make more than brief comments.

Part of what we are all thinking about is what will happen and how to play it.

Today in Barron's which requires subscription, in Abelson's column, he comments on Stephanie Pompoy's (MacroMaven's chief maven) prophesies.

To paraphrase: Deflation in housing market will be worse than the dot-com bust, hitting the US consumer and the financial system with its record exposure to real estate. Current fear of inflation will succumb to fear of deflation with FOMC action to lower rates possibly by Christmas. She thinks these efforts--using Japan and dot-com bubbles as recent examples--will fail because consumers will resist taking on new debt even cheaper debt. A worsening US credit environment will "send liquidity in sharp retreat, taking all assets with it."

She thinks it is high-end consumers who drive discretionary spending, so she'd short Starbucks, go long Spam (Hormel), and long pawn brokers.

Financials involved with home building in any way will be hit. Banks still own 3 trillion Bonars (43% of total assets) and 1 trillion in mortgage backed securities, thus a 55% exposure to real estate. She supposed banks will have to rebuild their loan-loss reserves, now at 20 year lows. [I, JN, do not personally understand the implications of the last sentence.]

Suggestions (hers): short or underweight regional banks, credit card companies and subprime lenders.

She thinks the Feds will be forced to monetize Treasuries (print more money to buy them which is inflationary) while the rest of the world does not devalue their currencies competitively. If that happens the Bonar will start steadily to decline. Assuming that, US investors should seek hard-assets, and certain things--Treasuries, multinationals, and consumer staples may rally, but those rallies will disguise their devaluation in dollar terms.

Simplest answer to play the coming Bonar decline--according to Ms. Pompy: long commodities and short stocks; specifically long gold-index and short bank-stock index. Abelson said she said a lot more, but this is all he shared.

.

.

and I don't know too much about the others.

and I don't know too much about the others.

Comment