|

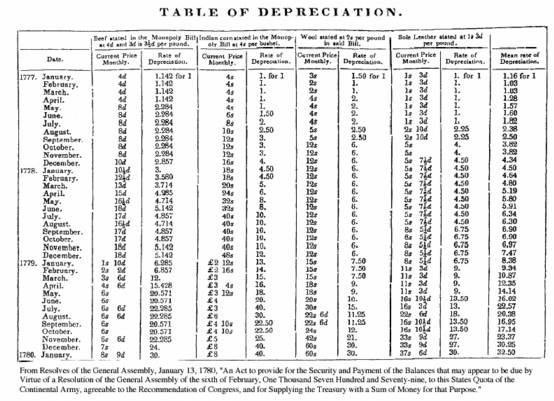

In 1779 when the dollar was toast, the Treasury paid soldiers with bonds indexed to a basket of commodities. Today they don't even want to pay up with bonds indexed to a dubious inflation index of the government's own making. Is this any way for a government to behave that's banking on deflation?

So convinced was I of imminent inflation in 1999 that in that year and the two years that followed I bought the maximum quantity of Series I savings bonds allowed for me and my wife, in those days $30,000 each per year. The yield on a Series I bond is the combined fixed rate plus a bi-annually applied inflation rate.

For the bonds I bought the fixed rate is 3.6%, 3.4%, and 3.0% for each of the years 1999, 2000, and 2001 respectively plus the inflation adjustment that started off at a measly 0.86% in 1999 and fell to 0.54% during the Fed’s Great Deflation Ruse of 2002.

You remember. They said, in effect, "Oh, woe is us! We can’t print money as fast as dot com stocks are crashing! Double entry bookkeeping will fail! We can't press the zero key on the keyboard fast enough!"

Seven years later, the highest inflation adjustment for all Series I bonds ever issued is the most recent. At 2.42% my Series I bonds earn a total risk-free yield of 5.42%, 5.82%, and 6.02% respectively.

Not bad. But the Treasury’s marketing push ended in 2003. The fixed rate dropped from a juice teaser rate of 3.6% to a lousy 2%. I wasn’t buying. Then in 2007 the Treasury lowered the maximum annual purchase from $30,000 to $5,000, cutting the opportunity to earn inflation tax back from the government by 83% – fun while it lasted. Then this May they set the fixed rate at a heart pounding 0%. With a $5,000 annual limit and a fixed rate dropped to 0% as inflation hits new highs, rest assured that Series I bonds will soon be directed at the financially uneducated where the government, and the FIRE Economy interests that fund it, aim all of the high powered marketing of bogus financial products, public or private.

What’s an inflation dodger to do besides buy foreign bonds or precious metals and hope the government doesn't figure out a way to cancel out the inflation compensation by taxes or some other means?

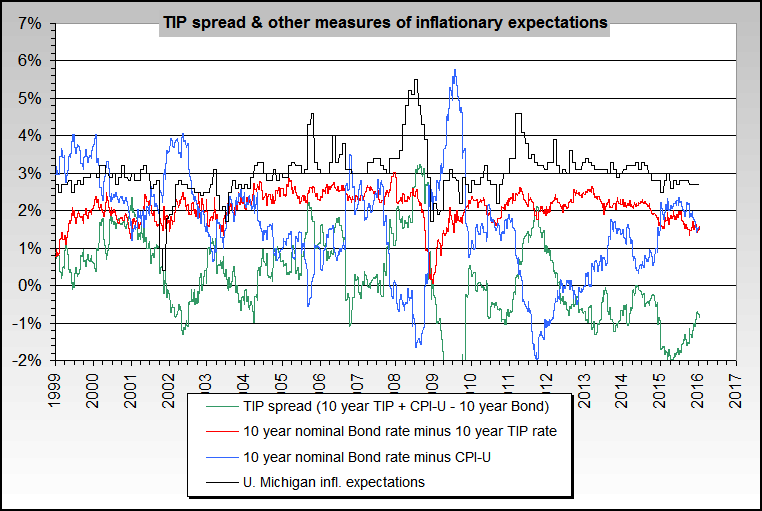

There’s always inflation indexed treasures – TIPS. Or maybe not. Today Bloomberg reports:

Paulson Asked to Spurn Rubin's Inflation Indexed Debt

Sept. 2 (Bloomberg) -- Almost 12 years after then-Treasury Secretary Robert Rubin championed inflation-linked bonds as a way to lower U.S. borrowing expenses, advisers to Henry Paulson say they have cost taxpayers an extra $30 billion.

The Treasury Borrowing Advisory Committee, consisting of officials from 14 investment firms including Goldman Sachs Group Inc. and Soros Fund Management, recommends eliminating five-year Treasury Inflation-Protected Securities. At a minimum, the supply of TIPS, now $517 billion outstanding, should be reduced relative to the amount of nominal Treasuries, the committee says.

Paulson and Rubin worked together at Goldman from 1974 to 1992. In 1988, Paulson was promoted to co-head of investment banking when Rubin was vice chairman and co-chief operating officer. Rubin left the firm in January 1993 to become assistant to President Bill Clinton for economic policy. He became Treasury Secretary in 1995.

The U.S. started selling TIPS in 1997, saying the market would help Americans' retirement savings keep pace with inflation.

Rubin, now a senior counselor to Citigroup Inc. in New York, told reporters in his office in January of 1997 before the first auction that TIPS had the ``potential'' to cut borrowing costs and predicted they would be ``a big, big program someday.'' The bonds account for 11 percent of the Treasury market, up from 6.2 percent at the end of 2004.

In countries that care about such things the Minister of Finance recuses himself for reasons of the appearance of conflicts of interest from decisions affecting the industry that he is likely to revolving-door back into. Countries like Norway. Not here, apparently.Sept. 2 (Bloomberg) -- Almost 12 years after then-Treasury Secretary Robert Rubin championed inflation-linked bonds as a way to lower U.S. borrowing expenses, advisers to Henry Paulson say they have cost taxpayers an extra $30 billion.

The Treasury Borrowing Advisory Committee, consisting of officials from 14 investment firms including Goldman Sachs Group Inc. and Soros Fund Management, recommends eliminating five-year Treasury Inflation-Protected Securities. At a minimum, the supply of TIPS, now $517 billion outstanding, should be reduced relative to the amount of nominal Treasuries, the committee says.

Paulson and Rubin worked together at Goldman from 1974 to 1992. In 1988, Paulson was promoted to co-head of investment banking when Rubin was vice chairman and co-chief operating officer. Rubin left the firm in January 1993 to become assistant to President Bill Clinton for economic policy. He became Treasury Secretary in 1995.

The U.S. started selling TIPS in 1997, saying the market would help Americans' retirement savings keep pace with inflation.

Rubin, now a senior counselor to Citigroup Inc. in New York, told reporters in his office in January of 1997 before the first auction that TIPS had the ``potential'' to cut borrowing costs and predicted they would be ``a big, big program someday.'' The bonds account for 11 percent of the Treasury market, up from 6.2 percent at the end of 2004.

A decision to eliminate TIPS, if taken, combined with the virtual elimination of inflation indexed savings bonds and of M3 money aggregate reporting in 2006, is a clear sign that our government is not anticipating a painful resurgence in deflation like the one that didn’t occur last time the Fed fretted about it in 2001 and 2002.

Here's the game: bring out the inflation indexed government financial products when inflation is low and the Treasury expects inflation to fall, then cancel them when inflation is due to rise.

Could have been worse for the government. If TIPS cost $30 billion at the contrived CPI-U rate that is now officially 5.5% per the Bureau of Labored Statistics but is per ShadowStats 13% using 1990 CPI measurement methods, imagine how much more the government could have lost.

As PIMCO's John Brynjolfsson said in the Bloomberg report, "TIPS serve as a real-time referendum on the ability of the central bank and government to contain inflation. Investors who have confidence in the resolve of policy makers to keep consumer prices in check are more willing to lend them money at lower rates." Well, we can't have that – markets setting bond prices – especially as the government explodes its balance sheet to bail out the collapsing FIRE Economy.

A Modest Proposal: Bring back the Commodity Indexed Bond

If the Treasury is dumping TIPS, I propose that the Treasury replace them with the world’s first inflation-indexed bond, issued by the US Treasury in 1779 during the Revolutionary War after the government massively inflated the dollar. Robert Shiller, who discovered the bonds in his research in 2003, said, "These bonds were invented to deal with severe wartime inflation and with angry discontent among soldiers in the U.S. Army with the decline in purchasing power of their pay." Rather than a politically manipulated, made-up inflation index, these bonds were indexed to a basket of commonly used commodities of the day: beef, corn, wool, and shoe leather.

To bring the concept up to date, the Treasury can create a Commodity Indexed Bond and index it to the price of beef, corn, iPods, and gasoline twice a year.

I'd expect my proposal to gain traction if the Treasury foresees the government shrinking its balance sheet, borrowing from foreign creditors at a lower rate of interest, and following monetary and economic policies to strengthen the dollar in the future. Obviously, they do not, so my Commodity Indexed Bond will have to wait until real versus ruse deflation appears on the horizon.

Still no deflation spiral

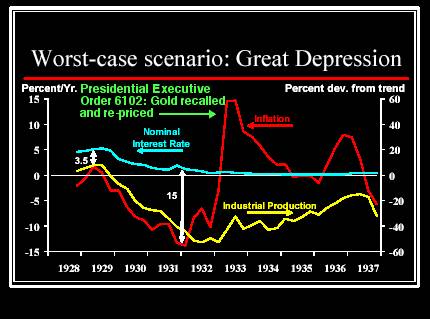

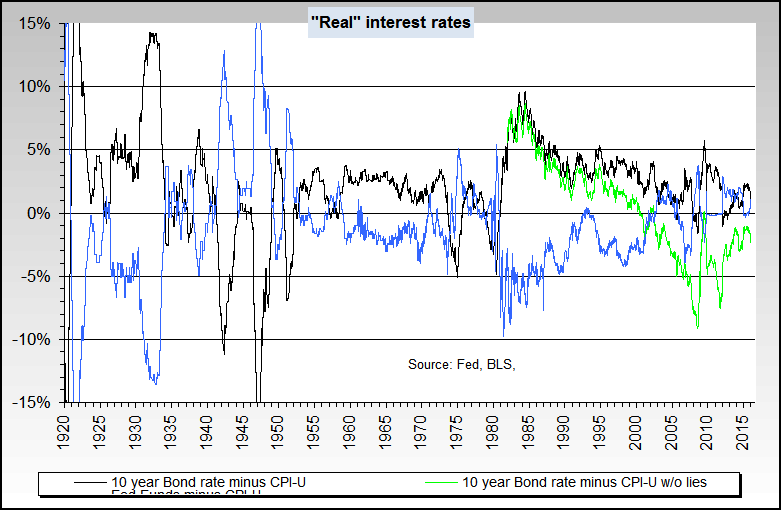

We summarize our anti-deflation spiral argument with two pictures. The first graph is from the Fed's 2003 "Deflation Handbook" (PDF).

- The US remained on the gold standard from the time of the 1929 crash until 1933

- A debt deflation and deflation spiral took inflation rates down to negative 14% in 1933

- A negative inflation rate indicates true "deflation," whereas a declining rate of inflation is called "disinflation"

- The US went off the gold standard in 1933, and gold was re-priced 40% from $20.67 to $35

- At the time, the banking system was for all intents and purposes broken

- Loans and investments of Federal Reserve member banks had declined 31% and loans overall by 50% (1)

- The money supply had contracted by over over 30% (2)

- Nonetheless, the result of the 40% dollar depreciation was 28% rise in inflation from -14% to +14% as shown by the Fed in the chart above

Anyone in long bonds betting on a continuation of deflation in 1933 got wiped out in the ensuing bond market crash.

(Source: Jesse's Crossroads Cafe)

Since the 1929 to 1933 deflation spiral episode in the US there has not been a single other example in history, despite all of the pre-conditions, such as over-indebtedness and asset price inflation, while dozens of inflationary events have occurred as a result of debt repudiation and currency depreciation.

Moral: Currency depreciation is the foolproof way out of a deflation spiral, irrespective of credit

and money creation by government or the endogenous credit markets.

Absent the constraints of a gold standard, governments can devalue currencies instantaneously, producing inflation – and do. Sometimes foreign investors, fearing losses, or hostile foreign governments do it for them by withdrawing funds.

The US will suffer a period of disinflation as debt deflation and recession continue. Commodity prices will decline with falling global demand, until producers cut output to reduce supply (inflationary). Then as surely as day follows night, the government will reflate via currency depreciation (inflationary). The question is, what will happen to US borrowing costs as a result?

The US will suffer a period of disinflation as debt deflation and recession continue. Commodity prices will decline with falling global demand, until producers cut output to reduce supply (inflationary). Then as surely as day follows night, the government will reflate via currency depreciation (inflationary). The question is, what will happen to US borrowing costs as a result?

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2007 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Comment