|

I was just CC'd on an email from my friend Rick Ackerman to his co-conspirator in deflation prognostication Mike (Mish) Shedlock. I don't know if Mike has given up yet on his now four year old "inflation is just around the corner" forecast, but it appears Rick hasn't. Here's what Rick had to say:

What is both unfamiliar and frightening about the inflation “story” is that it is unrelieved by even the dimmest prospect of higher wages. This is where the stagflationists' forecast of persistent but nonetheless tolerable sluggishness in the economy fails, since merely annoying, 1970s-style stagflation would be preferable to the deflationary noose that has been asphyxiating the economy. Indeed, while prices for nearly everything are continuing to rise, and quite steeply, incomes remain hopelessly stagnant. Were this to continue, do you think the endgame will be inflationary, or deflationary? If you have any doubts, here's a story from the Chicago Tribune that is likely to dispel them:

In weak economy, forgoing $4 lattes for home brews

June 19, 2008 (Chicago Tribune)

The "latte effect" of the go-go years had consumers spending $4 a day on coffee. Now the downturn is forcing them to rethink the wisdom of such habits.

As inflation squeezes budgets, middle-class Americans are taking fresh stock of their spending in search of ways to save a nickel or a dime. The result: People are giving up a variety of small financial vices.

For Michelle Hovis, that means refilling her husband's used soda container from a 2-liter bottle she buys on sale for 98 cents. She tweaked his daily habit of buying a 20-ounce bottle when the price crept up to $1.39.

"The price of gas, milk, eggs -- everything you can't control -- is going up. So you need to watch the things you can control," said Hovis, a 31-year-old stay-at-home mom from Iron Station, N.C.

June 19, 2008 (Chicago Tribune)

The "latte effect" of the go-go years had consumers spending $4 a day on coffee. Now the downturn is forcing them to rethink the wisdom of such habits.

As inflation squeezes budgets, middle-class Americans are taking fresh stock of their spending in search of ways to save a nickel or a dime. The result: People are giving up a variety of small financial vices.

For Michelle Hovis, that means refilling her husband's used soda container from a 2-liter bottle she buys on sale for 98 cents. She tweaked his daily habit of buying a 20-ounce bottle when the price crept up to $1.39.

"The price of gas, milk, eggs -- everything you can't control -- is going up. So you need to watch the things you can control," said Hovis, a 31-year-old stay-at-home mom from Iron Station, N.C.

Oh, geez. We’re not still beating this dead horse, are we? Where is it written that you cannot have an inflation spiral without wage inflation? Here’s the process as explained by a couple of bright guys over at the IMF writing about India's experience, depicted with this simple diagram. The inflation is launched by a disturbance in the exchange rate value of the currency. The depreciating currency then feeds into a self reinforcing process of money supply growth, inflation, price increases, and further pressure on the exchange rate value of the currency.

There were two exchange rate “Disturbances” in our case: the collapsing housing bubble and energy price shock. Both are ongoing.

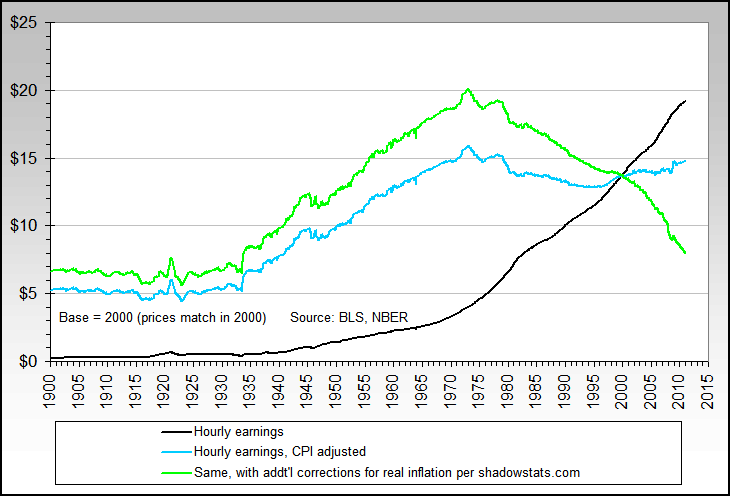

We have experienced for years on end commodity price inflation driven by energy imports that exert out-sized influence on prices of everything that has energy as in input cost – that is to say, just about everything. Meanwhile, real wages have declined. If you don’t believe me, eat or drive or go to Paris for a weekend.

At the same time, we have experienced asset price deflation, especially in RRE and soon in CRE. Many banks are technically insolvent, although they don't know it yet, soon to be zombies ala Japan 1995 supported by government but without explicit nationalization.

Both inflationary and deflationary forces are always at work in any economy. Clearly, they are netting out to inflation today. Yet by the standard deflationista's theory, the commodity price inflation will reverse with falling demand and without wage inflation commodity price deflation will commence, any day now. I have never been able to see the logic of this argument. The US has experienced inflation for years without wage inflation. Why will wage inflation be a prerequisite for future inflation if it has not been for years on end in the past?

Tell it to the Argentines

The primary source of our inflation for the past few years, dollar depreciation, doesn’t go away just because demand is falling and GDP is negative as the economy shrinks and folks shift from lattes to home brewed coffee. Usually it does, but not this time.

Data point: when average duration of unemployment reaches a post recession peak of 40 weeks, typical since 1960 (now it’s zero), inflation peaks about six months previously. By this measure we have a long way to go. The Fed could raise interest rates and throw the US into a deep recession, but it's not clear that such a move will not simply cause the dollar to fall even more, as exchange rates are now as much determined by relative economic performance among nations as by relative interest rates and inflation. One way or another, average duration of unemployment will eventually rise to 40 weeks.

What's "different this time" for the USA is the same old, same old for all indebted nations with huge external liabilities throughout history. Take Argentina 1988 to 1991, for example.

As we explained to our readers last year, we are on a version of the curve shown in the graphs below that show the Argentine inflation and recession of the late 1980s. Not as extreme because we don’t have the levels of short term debt that the Argentines had and, of course, the dollar is a reserve currency unlike their peso. Our peso is better than their peso, but it’s still a peso – here at iTulip we call it the bonar. Still, we are on a similar curve. This is what happens when you are in debt and your government chooses to externalize its problems via currency depreciation.

Note that the first rise in inflation in 1985 settles back down again before the moon shot in 1989. We are not talking about a predictable, linear process here. In fact that inflation was an higher amplitude version of the 1976 inflation.

Let’s zero in on the main event, from 1988 to 1991. Note that GDP in dollars declined 35% during the period in 1989 when inflation exploded to over 3000%. Yet GDP in pesos remained relatively flat. Sound familiar? Here in the US by a measure of GDP in dollars we’re still not in a “recession.” US GDP as measured in euros or gold, we’ve been in recession since Q4 2007, as we forecast at the end of 2006.

Back to Argentina. What were wages doing in pesos during the period? Can't have an inflation spiral without wage inflation, right? Wages were falling in dollars, of course, much as US wages have been falling in gold, silver, oil, and euros here for the past few years; that’s our currency standard today compared to an Argentine peso holder’s US dollar in 1989.

The Argentine inflation didn’t end until the peso was tied to the US dollar in 1991. The bonar inflation will end when the bonar is tied to a new currency, now in the early stages of negotiation with the Chinese et al, according to our sources. Looks like the IMF may have a new role after all.

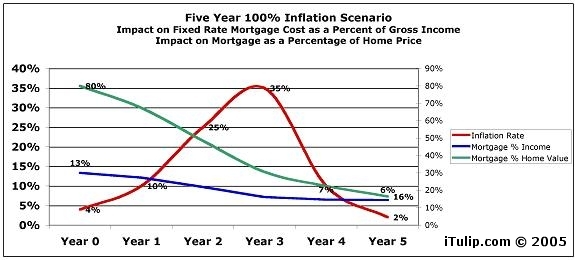

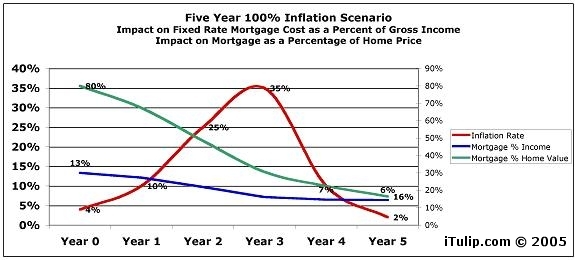

The US version may go something like this. From our 2005 hypothesis of a 100% US inflation over six years Inflation is Dead! Long Live Inflation!

Our 2005 analysis says home prices likely do not rise as shown,

as asset price deflation follows asset price inflation.

So not 3000% inflation as in Argentina but a more modest 30% or so peak year. Sound far fetched? It sure did in 2005. Question is, is the theory sounding more or less reasonable as the years go by, or should we three years later still be holding our breath waiting for the commodity price deflation to arrive?

See also:

Inflation unlikely to ease, economists say

Indians fear repeat of 1990s as inflation soars

What's so wrong with big wage rises anyhow?

Gold may rise to $5,000 on inflation, Schroder says

The debate continued the next day:

There were two exchange rate “Disturbances” in our case: the collapsing housing bubble and energy price shock. Both are ongoing.

We have experienced for years on end commodity price inflation driven by energy imports that exert out-sized influence on prices of everything that has energy as in input cost – that is to say, just about everything. Meanwhile, real wages have declined. If you don’t believe me, eat or drive or go to Paris for a weekend.

At the same time, we have experienced asset price deflation, especially in RRE and soon in CRE. Many banks are technically insolvent, although they don't know it yet, soon to be zombies ala Japan 1995 supported by government but without explicit nationalization.

Both inflationary and deflationary forces are always at work in any economy. Clearly, they are netting out to inflation today. Yet by the standard deflationista's theory, the commodity price inflation will reverse with falling demand and without wage inflation commodity price deflation will commence, any day now. I have never been able to see the logic of this argument. The US has experienced inflation for years without wage inflation. Why will wage inflation be a prerequisite for future inflation if it has not been for years on end in the past?

Tell it to the Argentines

The primary source of our inflation for the past few years, dollar depreciation, doesn’t go away just because demand is falling and GDP is negative as the economy shrinks and folks shift from lattes to home brewed coffee. Usually it does, but not this time.

Data point: when average duration of unemployment reaches a post recession peak of 40 weeks, typical since 1960 (now it’s zero), inflation peaks about six months previously. By this measure we have a long way to go. The Fed could raise interest rates and throw the US into a deep recession, but it's not clear that such a move will not simply cause the dollar to fall even more, as exchange rates are now as much determined by relative economic performance among nations as by relative interest rates and inflation. One way or another, average duration of unemployment will eventually rise to 40 weeks.

What's "different this time" for the USA is the same old, same old for all indebted nations with huge external liabilities throughout history. Take Argentina 1988 to 1991, for example.

As we explained to our readers last year, we are on a version of the curve shown in the graphs below that show the Argentine inflation and recession of the late 1980s. Not as extreme because we don’t have the levels of short term debt that the Argentines had and, of course, the dollar is a reserve currency unlike their peso. Our peso is better than their peso, but it’s still a peso – here at iTulip we call it the bonar. Still, we are on a similar curve. This is what happens when you are in debt and your government chooses to externalize its problems via currency depreciation.

Note that the first rise in inflation in 1985 settles back down again before the moon shot in 1989. We are not talking about a predictable, linear process here. In fact that inflation was an higher amplitude version of the 1976 inflation.

Let’s zero in on the main event, from 1988 to 1991. Note that GDP in dollars declined 35% during the period in 1989 when inflation exploded to over 3000%. Yet GDP in pesos remained relatively flat. Sound familiar? Here in the US by a measure of GDP in dollars we’re still not in a “recession.” US GDP as measured in euros or gold, we’ve been in recession since Q4 2007, as we forecast at the end of 2006.

Back to Argentina. What were wages doing in pesos during the period? Can't have an inflation spiral without wage inflation, right? Wages were falling in dollars, of course, much as US wages have been falling in gold, silver, oil, and euros here for the past few years; that’s our currency standard today compared to an Argentine peso holder’s US dollar in 1989.

The Argentine inflation didn’t end until the peso was tied to the US dollar in 1991. The bonar inflation will end when the bonar is tied to a new currency, now in the early stages of negotiation with the Chinese et al, according to our sources. Looks like the IMF may have a new role after all.

The US version may go something like this. From our 2005 hypothesis of a 100% US inflation over six years Inflation is Dead! Long Live Inflation!

Our 2005 analysis says home prices likely do not rise as shown,

as asset price deflation follows asset price inflation.

So not 3000% inflation as in Argentina but a more modest 30% or so peak year. Sound far fetched? It sure did in 2005. Question is, is the theory sounding more or less reasonable as the years go by, or should we three years later still be holding our breath waiting for the commodity price deflation to arrive?

See also:

Inflation unlikely to ease, economists say

Indians fear repeat of 1990s as inflation soars

What's so wrong with big wage rises anyhow?

Gold may rise to $5,000 on inflation, Schroder says

Rick and EJ continue the discussion, below.

Rick: Better you should ask how the yen performed relative to all other classes of yen assets. Answer: Just fine. Gold in fact has always done relatively well as an investable (sic) during deflationary times. Still, as a hard-core deflationist, I have my doubts that the POG will get to Sinclair’s promised land above $5000 oz.

Please take another look at the Argentina example. The relationship between the dollar and gold now for the US is similar to the relationship between the peso and the dollar for Argentina in the late 1980s. Deflation in domestic peso terms, yes, inflation in dollar terms, yes also. Asset prices are falling in dollar terms but crashing in euro terms.

Not only US stocks but US real estate is cheap if you are a European.

Wage rates increased in Argentina during their 1988 - 1991 inflation but an American company could buy labor in Argentina for pennies on the dollar. Today US wage rates are 50% lower in euro terms than a few years ago -- great if you are a European company paying employees in the US. US wages are deflating against commodities priced in dollars, and domestic commodity prices, to the extent that these are determined by imports, are continuing to inflate.

Oil not gold is the ultimate money as it is the critical input to everything else. As Peak Cheap Oil arrives, everything is deflating against oil, which we experience as commodity price inflation. This event is widely misunderstood as a demand shock. Oil demand in OECD nations has declined to 2% annual growth rates since 2004 as oil prices doubled then doubled again. As China and oil producers are starting to reduce subsidies, demand may fall some more, but we'll see how long the oil kelptocracies and Chinese state continues with that program -- government give-aways are all they have to maintain political legitimacy. Meanwhile, oil producers have demonstrated that they intend to keep more of the oil they have left in the ground, so in spite of politically motivated assertions to the contrary they are not increasing supply but cutting it faster than demand is falling.

Rick: But I have no qualms about assuring my subscribers that gold is all but certain to hold its purchasing power – not only relative to all other classes of assets, but relative to anything that you would care to call money.

My theory since 2001 is that this process will eventually take gold to $2500. Needless to say, that was contrarian back when gold was trading at $270. At $900 we have new entrants with very deep pockets to take us to the next stage of the market:

"Gold prices may rise to $5,000 an ounce as investors seek to protect themselves against accelerating inflation, said Schroder Investment Management Ltd., which oversees $277 billion of assets globally."

If funds keep throwing billions at the gold market, and CBs become net buyers as Schroder expects, who knows – maybe we'll get to $5000. The paradox is that the guys who created this mess are the same guys who are now struggling to maintain the purchasing power of all the money they made on it. The rest of us are collateral damage.

Rick: Even more certain is that, on a day in the not-too-distant future, Americans will realize that the hundred dollar bills they carry in their wallets are fundamentally and intrinsically worth no more or less than the $1 bills. I can’t tell from your writing whether you understand this, but if you do, it should disabuse you of the notion that the economy is somehow going to continue to muddle along. Muddling is one thing we deflationists all strongly agree cannot continue for much longer.

USA, Inc. Common Shares: Long or Short?

A Financial Market Crash is a Process, Not an Event

The Myth of the Slow Crash

A Financial Market Crash is a Process, Not an Event

The Myth of the Slow Crash

Rick: Concerning deflation and its symptoms, there is little I would care to add to the story I linked from the Chicago Tribune (which you have yet to acknowledge and presumably did not bother to read). When middle-class America cuts out lattes and starts refilling soda-pop containers, that is not inflation, or stagflation, or hyperinflation; it is a small step toward Depression, when almost nothing pleasurable, or that we currently take for granted, will be affordable.

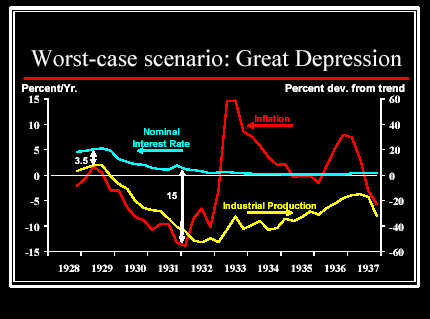

This inflation occurred after thousands of banks failed and the banking system had basically cratered. Those who hold fast to the theory that we are going to see commodity and wage price deflation as an outcome of this credit bubble don't seem to understand this part of the history of the last US credit bubble.

By the way, the gasoline sign using to illustrate the Five Signs of Inflation piece was created using a web tool atom.smasher.org. Actual gas prices at the time in April were around $3.50 for regular and few believed that regular gas was going to rise of over $4. Now the sign looks like what you see everywhere. Soon those prices will look quaint.

Rick: Like Mish, I’m not looking for an argument -- I simply don’t have the time.

The only major adjustment that I've had to make is my forecast is on long term interest rates. I expected they'd have turned up by now, given the high levels of inflation. A friend who is a hedge fund manager running $1B told me in March he was finally taking huge short positions in long treasuries. He moved into the 10 yr at 3.34% and now it's at 4:16%. Good move. Will yields continue up and prices down?

Here's a surprising voice added to the inflation chorus:

When asked about the potential for stagflation, a combination of weak growth and high inflation, Greenspan said, "Oh certainly."

Greenspan also said, contrary to the opinion of many, that there isn't a commodities bubble building. "Once you get inflation pressure starting to emerge, you don't get bubbles." he said. (Forbes, May 2008)

I'm sure Bernanke wasn't too happy about that pronouncement. Greenspan also said, contrary to the opinion of many, that there isn't a commodities bubble building. "Once you get inflation pressure starting to emerge, you don't get bubbles." he said. (Forbes, May 2008)

But I would be grateful if you would provide me with a bullet-point synopsis of the major economic events that you expect to occur over the next 7-10 years. That will be the easiest way for me to determine whether I may have misunderestood you. Do we perhaps envision the same endgame -- an economy in smouldering ruins, credit markets wrecked for at least a generation, widespread poverty and unemployment to match or exceed the Great Depression, and the U.S. having to rebuild its manufacturing capacity almost from scratch in order to make an honest living in the global marketplace? If that’s “stagflation,” or hyperinflation, then you needn’t bother to respond.

iTulip's consistent record forecasting inflation 2005 - 2008:

Inflation is Dead! Long Live Inflation!

No Deflation! Disinflation then Lots of Inflation

Door Number Two: No hyperinflation but high inflation

The deflation case: caught, gutted, poached and eaten

You're not going to believe this: Inflation/deflation debate still alive?

I'm writing a book for Penguin that explains a tough transition period. We took a wrong turn in the 1970s. Now we have to go back and fix it.Inflation is Dead! Long Live Inflation!

No Deflation! Disinflation then Lots of Inflation

Door Number Two: No hyperinflation but high inflation

The deflation case: caught, gutted, poached and eaten

You're not going to believe this: Inflation/deflation debate still alive?

The thesis of the book may help you understand where I'm coming from:

Working title: The New New Deal, Re-industrialization of Post Depression America

The recession that the US is entering in the early part of 2008 is not a typical business cycle recession or even a post bubble recession as occurred in 2001. The collapse of the housing bubble and the energy price shock are the triggers that started a process of major structural change in the US and World economy. When the transition is over in a decade, the US economy will hardly resemble its current form:

- Dependence on foreign borrowing to finance consumption and operate the government will end and reverse

- Dominance of the Finance, Insurance and Real Estate (FIRE) sectors of the economy for economic growth will give way to new productive industries in transportation, energy, and communications

- Trade deficits that started in the early 1980s will reverse and the US will begin to run a trade surplus

- Burden of economic rent extraction in the form of interest on public and Private sector debt will be lifted via a combination of inflation, restructuring, and debt cancellation

- Low national and household savings rates will rise to 1960s levels

- Consumption will decline by half, from 70% of GDP today to 50% of GDP

- Energy intensity, the amount of energy needed to produce a dollar of GDP growth will decline by half, led by conservation initiatives

The US will experience the transition as a series of recessions which,

cumulatively, may be as severe as in The Great Depression, but inflationary versus deflationary. We are seeing the first of these now.

The New New Deal asks and answers:

How did we get into this mess?

- Why have US financial markets been in turmoil for over a year?

- Why has the dollar weakened over 40% since 2002?

- Why is inflation rising?

- Why is unemployment rising?

- Why are asset prices falling?

How are we going to get resolve our crises?

My publisher doesn't want me sharing the solutions part of the book, but basically the idea is that unlike the old New Deal, this time we unleash markets on the problem, with equity versus debt based financing.

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2007 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Comment