Re: The Fed: Dishonest or Incompetent?

In an odd way, this thread has added some hope for me even though the subjects and outlooks are quite dark (and realistic too in my opinion).

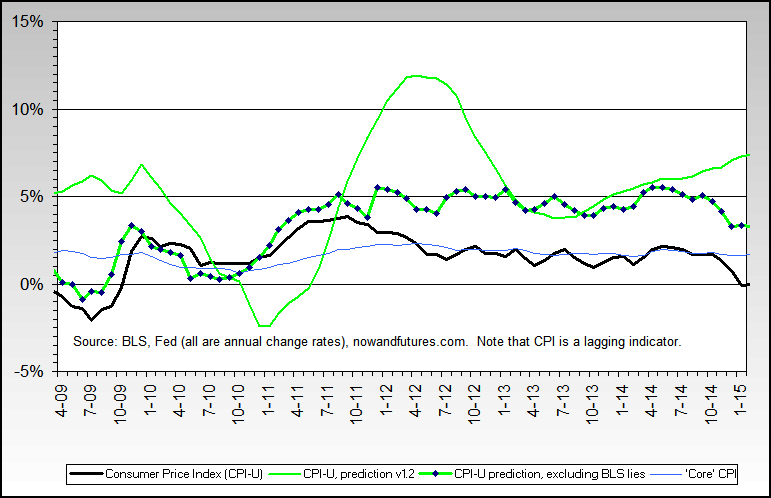

In another odd way, it will be interesting to see the machinations and spin to come - who and what will be targeted for the blame? The GSEs like Fannie are a large probability, and the Fed "overshoot" is also likely even though by my calculations real interest rates are still negative due to all the CPI fiddling & lies.

I do agree that the Fitts approach is not exactly a high probability short term scenario... but it sure has more sanity than most. Great link, and thanks!

The more I study the history of the economic track along with the various anti-social elements and their effects, the more I see the ebb & flow between the "good guys" and the "bad guys", and that the cycles do eventually turn... and that helps during my inevitable darker moments. Frameworks like the ka-poom theory also help to keep things in perspective as we ride the idiocy of Fed and other central bank created waves.

And to actually answer the thread question - the Fed is primarily dishonest, and incompetent too - as well as unethical.

On a lighter and perhaps excessively cynical note, I wish I knew a Photoshop maven - it would be a hoot to see a Mercedes 450 with a flag showing and a gun rack in the rear window.

Originally posted by Fred

In an odd way, this thread has added some hope for me even though the subjects and outlooks are quite dark (and realistic too in my opinion).

In another odd way, it will be interesting to see the machinations and spin to come - who and what will be targeted for the blame? The GSEs like Fannie are a large probability, and the Fed "overshoot" is also likely even though by my calculations real interest rates are still negative due to all the CPI fiddling & lies.

I do agree that the Fitts approach is not exactly a high probability short term scenario... but it sure has more sanity than most. Great link, and thanks!

The more I study the history of the economic track along with the various anti-social elements and their effects, the more I see the ebb & flow between the "good guys" and the "bad guys", and that the cycles do eventually turn... and that helps during my inevitable darker moments. Frameworks like the ka-poom theory also help to keep things in perspective as we ride the idiocy of Fed and other central bank created waves.

And to actually answer the thread question - the Fed is primarily dishonest, and incompetent too - as well as unethical.

On a lighter and perhaps excessively cynical note, I wish I knew a Photoshop maven - it would be a hoot to see a Mercedes 450 with a flag showing and a gun rack in the rear window.

and :mad:

and :mad:

Comment