Re: Economic Crisis Avoidance Deus ex Machina - Part I: Active Asset Price Inflation - Eric Janszen

I think many of the countries problems boil down to just 2-3 very prosaic issues:

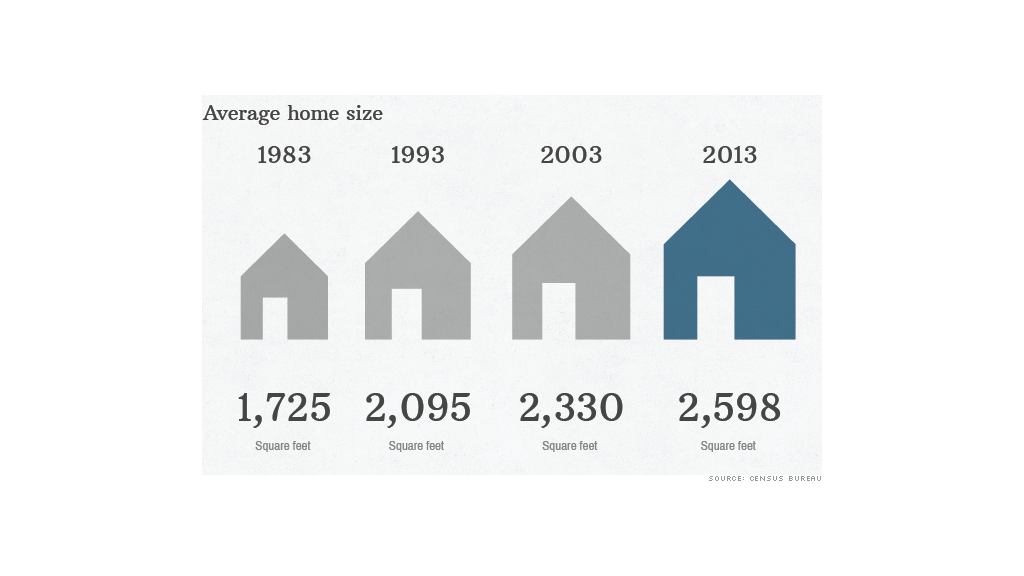

1) Housing costs rising continually

why: because population is increasing but zoning is static.

2) Health care costs rising without limit.

why: the legal & insurance structure promotes profiteering, opacity and price collusion, prevents choice and competition.

A "free market" would act like cars: a viable car gets cheaper over time because there is so much choice and competition.

(witness my 1999 mitsubishi galant, still running great, at an incredibly low cost of ownership)

A real "free market" can have moral and equality problems, but seldom a cost/efficiency issue.

3) College costs rising without limit and insistence on a bachelor's degree for nearly every good paying job.

None of these issues aligns with party positions .

Do the parties even have policies anymore ?

None of them is prominent in public dialog.

None of them will inspire mass protests or propel election victories.

There is something called "Beumal's disease" which is the idea that the sectors which are the least efficient

always dominate the cost. The efficient sectors keep reducing cost, so by definition they will never dominate

the over all cost.

A political version would be " A democracy is destroyed by problems too abstract to be resolved by elections controlled by

typical human beings. " The problems which are amenable to solution via election & democratic process do get solved.

We might see more "occupy" style mass movements, with vague moralistic rhetoric, but unable to articulate practical solutions or even

understand the problem.

How do you vote against the high cost of housing, health care, and tuition?

If you protest against these things, what change are you asking for?

How do you vote against corporations expanding in areas already overcrowded and over priced?

I think many of the countries problems boil down to just 2-3 very prosaic issues:

1) Housing costs rising continually

why: because population is increasing but zoning is static.

2) Health care costs rising without limit.

why: the legal & insurance structure promotes profiteering, opacity and price collusion, prevents choice and competition.

A "free market" would act like cars: a viable car gets cheaper over time because there is so much choice and competition.

(witness my 1999 mitsubishi galant, still running great, at an incredibly low cost of ownership)

A real "free market" can have moral and equality problems, but seldom a cost/efficiency issue.

3) College costs rising without limit and insistence on a bachelor's degree for nearly every good paying job.

None of these issues aligns with party positions .

Do the parties even have policies anymore ?

None of them is prominent in public dialog.

None of them will inspire mass protests or propel election victories.

There is something called "Beumal's disease" which is the idea that the sectors which are the least efficient

always dominate the cost. The efficient sectors keep reducing cost, so by definition they will never dominate

the over all cost.

A political version would be " A democracy is destroyed by problems too abstract to be resolved by elections controlled by

typical human beings. " The problems which are amenable to solution via election & democratic process do get solved.

We might see more "occupy" style mass movements, with vague moralistic rhetoric, but unable to articulate practical solutions or even

understand the problem.

How do you vote against the high cost of housing, health care, and tuition?

If you protest against these things, what change are you asking for?

How do you vote against corporations expanding in areas already overcrowded and over priced?

Comment