|

The bank note to the left is a 10 yuan note from the National Coinage of the Republic of China printed in 1914 by the Bank of Communications. I picked it up on a visit to Taiwan in the late 1990s. More on that note and how it fits into today's story later.

In keeping with my "less is more" and "keep it simple" New Year's resolutions, here's how our attentive readers made $301% since 2001:

Step 1: Buy gold (see Questioning Fashionable Financial Advice, Sept. 2001)

Step 2: Do nothing

As it turns out, the hardest part of following through on any investment thesis is Step 2. We've lost track of how many readers have written in over the years asking, "You guys have not said much about gold since 2001 except that "What gold bubble?" piece you wrote in Oct. 2006 when many were fretting about the rapid price rise. When are you going to sell?"

We have been asked this question every couple of weeks for the past six years. It's reasonable to assume that for every person who writes in to ask, 100 wonder about it but do not write in, and of the 100 who have been aware of iTulip's arguments since 2001, a million are not aware and instead have been fretting all this time about "deflation," by which they mean all-goods and services price deflation resulting from a decline in the money supply and the velocity of money, but not to be confused with a debt deflation, which is, in fact, happening. Incredibly, there are millions who continue to fret about "deflation." Their numbers are declining as the reality around them begins to sink in. Today I'll try to put a nail in the coffin of this absurd idea.

Can a run-away monetary "deflation" happen in a world of floating exchange rates and no gold standard? No. Just the opposite.

|

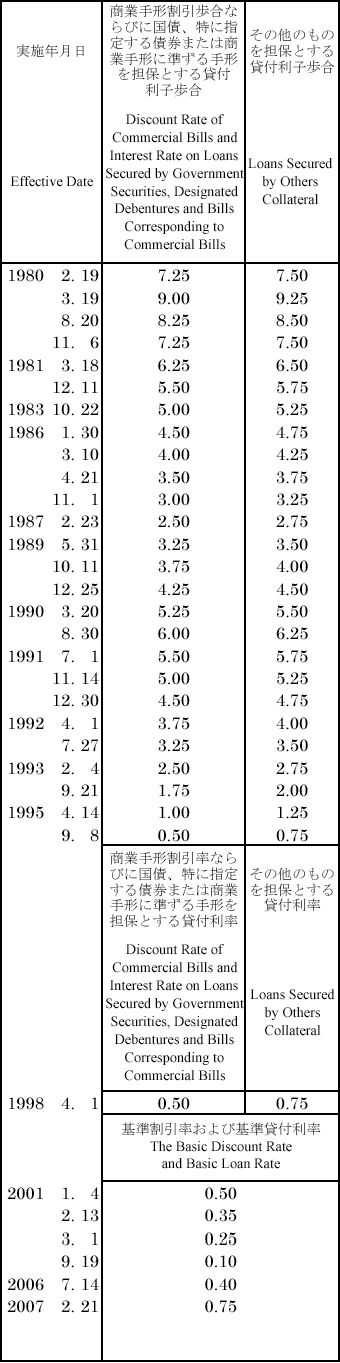

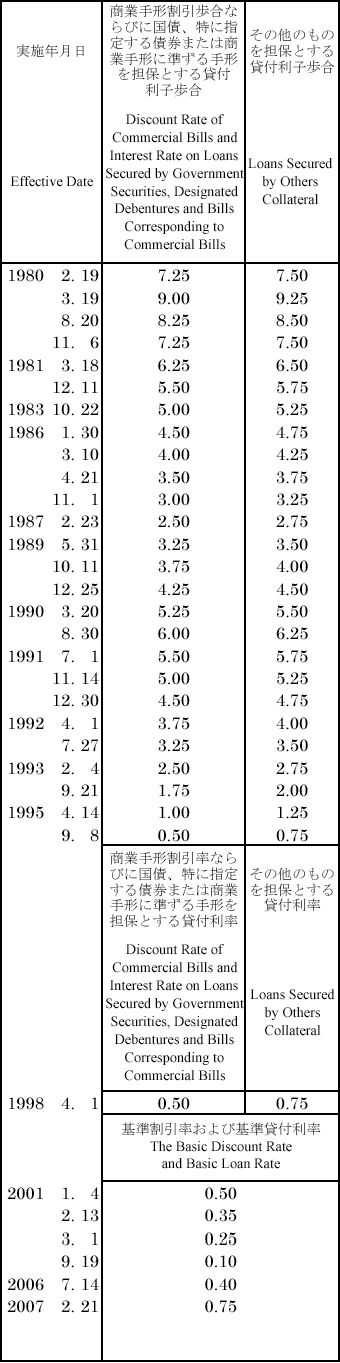

The only other case of an all-goods price deflation since central banks stopped using gold for either international trade or internal money backing was in Japan as a consequence of the Bank of Japan's bungling of their asset price and debt deflation. Note that the BoJ raised rates from 4.25% to 6% between Dec. 25, 1989 and Aug. 30, 1990, while the NIKKEI fell from 38,916 to 24,166. That's like the Fed raising rates starting March 2008 from 4.25% to 6% in August 2008 while the DOW falls from 13,100 to 8,700. Every reader who believes the Fed will do this, please raise your hand. Anyone? Nobody?

Discount Rate: Japan 1980 - 2007

Bank of Japan raises rates before and during the debt deflation

BoJ raises rates from 4.25% to 6% even as the NiKKEI falls 33%

Bank of Japan raises rates before and during the debt deflation

BoJ raises rates from 4.25% to 6% even as the NiKKEI falls 33%

Even then, the "deflation" in Japan was never more than 2% in any year, and all the poor "deflating" Japanese economy was able to do during its "lost decade" was take over the US auto industry as the US economy "boomed" with Toyota last year replacing General Motors as the largest auto maker in the world. Lesson learned: don't raise interest rates during a debt deflation, stupid. (In case you are wondering why the BoJ kept rates so high for so long when the US experience in the 1930s provided clear instruction against it, the answer is: to help get Ronald Reagan elected, but that's a tale for another day.)

If not deflation, then hyperinflation?

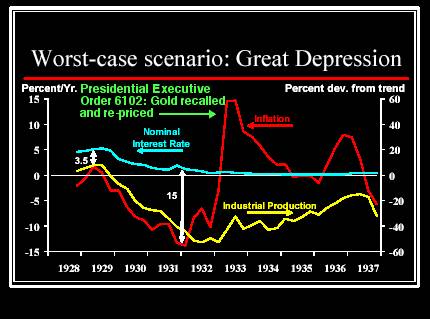

The US is not on the gold standard so a 1930s style deflation is impossible. The Fed even before Bernanke was hired repeatedly stated (as in the presentation we got the image from) that the Fed will not sit by and allow inflation to fall below zero, so a repeat of the Japanese 1990s "deflation" experience is about zero, unless the Fed decides to crash the US economy on purpose on behalf of some external political entity–and that ain't how we operate.

Besides the 1930s depression in the US and the self-inflicted ongoing debt deflation in Japan, every other instance when a government, its politicians, and their voters have gotten themselves in as much credit driven hot water as the US is in today has done one thing, and over and over. In fact, while the world experienced two (2) deflationary episodes in the past century, how many debt deflations resulted in currency depreciation and all-goods price inflation? The answer: 17.

- Germany 1920 - 1923: 3.25 million percent

- Russia 1921 - 1924: 213 percent

- Austria 1921 - 1922: 134 percent

- Poland 1922 - 1924: 275 percent

- Hungary 1922 - 1924: 98 percent

- Greece 1943 - 1944: 8.55 billion percent

- Hungary 1945 - 1946: 4.19 quintillion percent

- Shanghai 1949 - 1950: 100 percent

- Argentina 1984 - 1991: 5000 percent

- Brazil 1984 - 1997: 5 trillion percent

- Chile 1973: 600 percent

- Bolivia 1984: 14,700 percent

- Peru 1981 - 1989: 900 percent

- Poland 1989 - 1990: 344 percent

- Russia 1992 - 1995: 2,323 percent

- Ukraine 1991 - 1994: 10,000 percent

- Yugoslavia 1993 - 94: 1 trillion percent

I'm leaving off many minor examples, and that is just in the past 90 years. Go back centuries and several dozens of examples can be cited. Yet the one instance of a runaway price "deflation" in the 1930s becomes for some the model for a modern, post credit bubble US debt deflation. Bizarre.

Will the US experience a hyperinflation? No, that is also very unlikely to occur. Unlike the nations listed above, none had a currency that was a reserve currency. All were politically and economically isolated at the time they suffered the economic shock that set off the hyperinflation. We explored the idea of a technical hyperinflation (more than 100% over five years) in the early 2005 with the article Inflation is Dead! Long Live Inflation!. But for that to happen, US trade partners will have to repudiate economic and political ties to the US and abandon the dollar. That strikes us highly unlikely, unless President Bush canceled the Constititution and declared himself President for Life. Then maybe we'd have a dollar hyperinflation. So, as we explored in 2006 in Can the U.S.A. have a "Peso Problem"?, we do not expect a dollar hyperinflation but rather a period of higher than normal inflation but not as high as Mexico's nor as high as we floated out in our 2005 trial balloon back when many were still wringing their hands about deflation. Our best estimate at this point, as we approach the nexus of the debt deflation crisis, is peak inflation rates of 6% to 9% annual CPI-U or 9% to 12% in pre-1983 inflation measures.

The best reads on this topic that I can recommend are the IMF's Realities of Modern Hyperinflation: Despite falling inflation rates worldwide, hyperinflation can happen again (pdf), the Federal Reserve Bank of Minneapolis Research Department Staff Report 331 Deflation and Depression: Is There an Empirical Link? (PDF), and Daniel Leigh's Japan's Monetary Policy and the Dangers of Deflation: Lessons from Japan (PDF) for those who'd like to read some of the best background reading that we have used over the years.

When to Sell?

When the conditions we spelled out in 2001 and since then as reasons to own gold are no longer true; when events occur that cause a common share in USA, Inc. to increase in value. Requires the resolution of the following problems with USA, Inc.'s business model:

- Excessive dependence on the finance, insurance, and real estate sector for economic growth

- Excessive dependence on government and household debt

- Excessive dependence on government spending and employment

- Excessive dependence on politically motivated foreign borrowing

- Excessive dependence on money growth

- Excessive dependence on foreign energy supplies

- Excessive dependence on dollar depreciation to forestall recession

- Poor distribution of household wealth, income, and liquidity

We've tried to explain this 100 different ways over the past decade to our friends in the business who are somehow stuck on the idea that it's still 1932 when the US was on the gold standard or 1970 when the world was still on an international gold standard. No run-away deflations since then. This is not a coincidence.

If you understood the foregoing and purchased gold in 2001 and did nothing since then versus purchasing an equal value of the DOW, here is where you'd be. High returns with low volatility are what investors dream about, but as I look over the plethora of Year in Review coverage of the markets, I don't see this point highlighted anywhere.

Big returns, low volatility: Gold returns 12 times the DOW

As an entrepreneur who relies on the viability of USA, Inc. to succeed in business, as a believer in the wisdom of markets over governments most of the time, not to mention my love of my country, I'd prefer the data above to not be so; I don't like gold to be doing well. Its rise is a symptom of dysfunction.

A closer look at the 10 yuan note from 1914 reveals an interesting fact about the relationships among westernized banks in a global economy. The notes were printed by the American Bank Note Company of New York. The Chinese invented printing, so I doubt the challenge was technical. Today, US currency could easily be printed more cheaply in China. Yet somehow I don't think that is likely to happen. Still, when globalization is working, as it was up until the early 1930s, central bank cooperation is high, and the result of that cooperation is well managed currencies, interest rates, and inflation. When those relationships break down–watch out.

The San José State University Department of Economics has this to say about the Chinese state banks of that era:

A state bank for China, called the Hu-pu (Board of Revenue) Bank, was established in 1905. By 1907 two other government banks, the Bank of China and the Bank of Communications, were established and authorized to issue bank notes. The imperial government and all subsequent governments looked upon these banks as vehicles for creating money for the government to use to cover its deficits or for any other reason. There were severe penalties imposed for anyone discounting provincial government banknotes.

Despite attempts on the part of governments to abuse their control of the banking system, the banks were able to resist these attempts until the 1930's and the war with Japan.

Put away your calculators, money supply counters. It's all about politics. Always has been, and always will be. Don't bother looking at the money supply and inflation statistics; they are not going to be valid when you need them to be because governments cannot play the inflation game in full view. Also remember that "inflation" comes from the Latin word means "blowing up," a succinct characterization of current events. Despite attempts on the part of governments to abuse their control of the banking system, the banks were able to resist these attempts until the 1930's and the war with Japan.

In closing, one of our readers posted excerpts from Peter Schiff's more recent articles which are beginning to convey similar points as we have been making here. I'd like to welcome Peter to the inflation camp. My only word of warning is that riding gold's post stock bubble reflation curve from $265 in 2001 to $850 today was a lot more predictable and less hair raising then the coming events. At some point central banks are going to have to put the hammer down. The challenge from here is reading the signs that policy is going to change. As things stand, evidence for change is scant, but the need is growing. In the mean time, we'll be keeping an eye out for the Next Bubble.

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________ For the safest, lowest cost way to buy and trade gold, see The Bullionvault

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2007 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Comment