|

Even smart contrarians are confused about our predicament

Paul B. Farrell, one of my favorite economics writers at MarketWatch, published 17 reasons America needs a recession today to make the case, "Yes, America needs a recession. Bernanke and Paulson won't admit it. And investors hate them. We're all trapped in outdated 1990s wishful thinking about a 'new economy' and 'perpetual growth.'"

While I appreciate the sentiment and have expressed similar views such as in Upside Down to Right Side Up, fact is the U.S. cannot have the kind of recession Farrell describes this time around because the antecedents preclude it. The problem is rooted in both the source of our current economic challenges and the political mandate to mitigate them that far predates the 1990s. The moral hazard of reflation became embedded in U.S. economic policy after The Great Depression; the mandate became "No more Great Depressions."

The Fed, Treasury, and Congress have been fighting the recession we forecast last fall as due to start in Q4 2007, led by the housing market correction. Throwing the dollar under the bus to briefly boost exports and bring plane loads of tourists into the U.S. has helped avert a far more blatant recession from occurring than the subtle one we're already in. With inflation rising as quickly as the U.S. economy is slowing, picking the exact month or quarter when the real (inflation-adjusted) GDP growth recession starts–or started–will not be possible until after the inevitably revised GDP and inflation figures come in. We expect to see confirmation June 2008 at the earliest.

As for an economic contraction that "cleanses the system" with debt defaults, bankruptcies, and high unemployment–well, that's coming, too. Sort of. But it won't lead to the hoped for economic and political structural reforms outlined in Farrell's romanticized vision of recession.

1. Purge the excesses of the housing boom

No, it's not heartless. Not like wartime calculations of "acceptable collateral damage." Yes, The Economist admits "the economic and social costs of recession are painful: unemployment, lower wages and profits, and bankruptcy." But we can't reverse Greenspan's excessive rate cuts that created the housing/credit crisis. It'll be painful for everyone, especially millions of unlucky, mislead homeowners who must bear the brunt of Wall Street's greed and Washington's policy failures.

You don't need a recession to see housing bubble excesses purged. It's happening before the recession. In fact, the correction in the housing market is the primary cause of the recession we forecast a year ago to start this quarter. No, it's not heartless. Not like wartime calculations of "acceptable collateral damage." Yes, The Economist admits "the economic and social costs of recession are painful: unemployment, lower wages and profits, and bankruptcy." But we can't reverse Greenspan's excessive rate cuts that created the housing/credit crisis. It'll be painful for everyone, especially millions of unlucky, mislead homeowners who must bear the brunt of Wall Street's greed and Washington's policy failures.

The housing market is highly correlated to employment. Regional home prices rarely if ever fall during periods of high or rising employment, and home prices have not fallen nationally even during national recessions since the Great Depression. Since 2006, national home prices have been declining even as the economy expanded and the labor market was relatively strong. What's going to happen to the real estate market when the U.S. goes into recession? The U.S. economic policy makers are not eager to find out, especially in an election year, so first they are going to try to prevent one happening, first using dollar depreciation and doling out of short term loans at the Fed's Discount Window, then later with rate cuts, then deeper Federal deficit spending, then state deficit spending (yes, the laws will be changed), and on and on. Think post bubble Japan except inflationary versus deflationary.

2. U.S. dollar wake-up call

Reverse the dollar's free fall and revive our global credibility. Warnings from China, France, Iran, Venezuela and supermodel Gisele haven't fazed Washington. Recession will.

In our floating exchange rate currency system, relative economic performance is the main determinant of currency values. A U.S. recession will only lead to dollar strengthening if the economies of U.S. trade partners contract even faster than the U.S. economy does. We have since 2005 forecast the next U.S. recession to be U.S. centric, meaning more severe in the U.S. than among some U.S. trade partners with lesser internal and external liabilities. You don't have to swallow the whole global decoupling theory hook, line, and sinker to see that. All you have to do is note the USA's external liabilities relative to its trade partners and ask how U.S. creditors are likely to respond when U.S. national income drops. Think the dollar is tanking today? Wait until the U.S. goes into the next recession. It'll be a dollar wake-up call alright.Reverse the dollar's free fall and revive our global credibility. Warnings from China, France, Iran, Venezuela and supermodel Gisele haven't fazed Washington. Recession will.

3. Write-offs

Expose Wall Street's shadow-banking system. They're playing with $300 trillion in derivatives and still hiding over $100 billion of toxic off-balance sheet asset-backed securities, plus another $300 billion hidden worldwide. A lack of transparency is killing our international credibility. Write it all off, now!

Agree whole heartedly with the sentiment. A market is only as good as the market institutions that support it, including regulators and credit rating agencies. U.S. regulatory and rating institutions have recently revealed themselves to be less effective than those in many third world countries. However, according to our best sources Martin Mayer and Dr. Peter Warburton–who are arguably the most credible experts on the topic of credit derivatives–the market for these instruments will be gone for years, and when it comes back it will be nothing like it is today. Asking for these to be written off all at once is like asking a vet to shoot a sick dog. The dog is going to be out for a long while as it is.Expose Wall Street's shadow-banking system. They're playing with $300 trillion in derivatives and still hiding over $100 billion of toxic off-balance sheet asset-backed securities, plus another $300 billion hidden worldwide. A lack of transparency is killing our international credibility. Write it all off, now!

4. Budgeting

Force fiscal restraint back into government. America has been living way beyond its means for years: A recession will cut back revenues at all levels of government and cutbacks will encourage balanced budgeting.

The exact opposite is true. Washington is filled with brave talking free market economists during boom times but they quickly morph into Keynesian softies during busts. It has always been thus:Force fiscal restraint back into government. America has been living way beyond its means for years: A recession will cut back revenues at all levels of government and cutbacks will encourage balanced budgeting.

1%-Off

TIME Magazine

Nov. 25, 1929

On the day last week's stockmarket plunked to the bottom President Hoover let his Secretary of the Treasury, Andrew William Mellon, make an announcement which the President had been saving up as the Big-News-Item for his own first message to Congress next month, an announcement of immediate tax reduction.

... into the Treasury trooped Senators Smoot, Reed, Simmons, Harrison—potent majority and minority members of the Senate Finance Committee. At their heels followed Speaker Longworth, Chairman Hawley of the Ways & Means Committee.

Already tardy, [Treasury] Secretary Mellon hurried off to keep a dinner engagement at his home with New York bankers. Into the hands of eager pressmen went the Mellon announcement:

"The Secretary of the Treasury considers the [Budget] estimates have reached the point where tax reduction should be recommended to the Congress at the coming session. . . ."

Democrats in Congress dropped their plan for a $300,000,000 tax reduction to join with Republicans in promises to pass the Mellon proposal, if possible, before Christmas. Even Chairman Smoot of the Finance Committee, long an outspoken opponent of immediate tax reduction, swung into line, pledged prompt action.

Declared Congressman Garner, chief Democratic member of the House Ways & Means Committee and minority leader of the House: "I look at the proposal from the point of view of the good of the country and I shall support it. . . . Even though a business crash might aid in placing the Democratic party in power, the price would be too great to pay for party success."

In other words, the Democrats figured the stimulus of the Republican tax cut was going to help prevent a recession from occurring after the stock market crashed. If they opposed it and no tax cut passed, the economy was sure to go into recession and they'd win the upcoming elections. Good for the Democrats but bad for the nation. TIME Magazine

Nov. 25, 1929

On the day last week's stockmarket plunked to the bottom President Hoover let his Secretary of the Treasury, Andrew William Mellon, make an announcement which the President had been saving up as the Big-News-Item for his own first message to Congress next month, an announcement of immediate tax reduction.

... into the Treasury trooped Senators Smoot, Reed, Simmons, Harrison—potent majority and minority members of the Senate Finance Committee. At their heels followed Speaker Longworth, Chairman Hawley of the Ways & Means Committee.

Already tardy, [Treasury] Secretary Mellon hurried off to keep a dinner engagement at his home with New York bankers. Into the hands of eager pressmen went the Mellon announcement:

"The Secretary of the Treasury considers the [Budget] estimates have reached the point where tax reduction should be recommended to the Congress at the coming session. . . ."

Democrats in Congress dropped their plan for a $300,000,000 tax reduction to join with Republicans in promises to pass the Mellon proposal, if possible, before Christmas. Even Chairman Smoot of the Finance Committee, long an outspoken opponent of immediate tax reduction, swung into line, pledged prompt action.

Declared Congressman Garner, chief Democratic member of the House Ways & Means Committee and minority leader of the House: "I look at the proposal from the point of view of the good of the country and I shall support it. . . . Even though a business crash might aid in placing the Democratic party in power, the price would be too great to pay for party success."

As it turns out, even though Congress was on the tax cut economic stimulus case right after the stock market crash, tax cuts didn't help much because tax rates were already so low that stimulus from cutting them didn't make much difference.

Point is, recessions bring on less fiscal restraint, not more. U.S. economic policy makers should have been raising taxes along with interest rates during the 2003 to 2006 recovery to balance the budget. They didn't for impractical, politically motivated ideological reasons so now we head into this next recession with huge deficits, a hangover from the last reflation. Soon we will have plummeting tax revenues. This will not encourage balanced budgeting. Substitute Paulson for Mellon and you see how little things change.

5. Overconfidence

A recession will wake up short-term investors playing the market. In bull markets traders ride the rising tide, gaining false confidence that they're financial geniuses. Downturns bruise egos but encourage rational long-term strategies.

It's not a recession but the financial market crash that leads to the recession that takes the speculators out of the stock market, just as the collapsing housing bubble has taken the house flippers out and is causing this recession. However, since Keynesian recession-fighting reflation policies are a sure bet, speculators will move the party to a new arena, to whatever asset class reflation bubbles up. A recession will wake up short-term investors playing the market. In bull markets traders ride the rising tide, gaining false confidence that they're financial geniuses. Downturns bruise egos but encourage rational long-term strategies.

In 2001 we figured one beneficiary of 2001 recession reflation would be commodities, including gold. We missed predicting the housing bubble. Call us stupid, but real estate bubbles after they eventually collapse are notoriously dangerous to a nation's macro economy, banking system, and financial markets, so we assumed the Fed was going to stick to the program they followed in the 1970s and 1980s when they came down hard with rate hikes and regulatory action to stop housing froth. Silly us. (The lesson we learned is that you cannot underestimate the arrogance and stupidity of the supposed stewards of our economy. In fact, it's sufficiently predictable as to be tradable.)

Most of the increase in commodity prices we expected was due at first to dollar depreciation. That was followed by coordinated global central bank currency depreciation. Besides currency depreciation, other reflation efforts included credit expansion. Most of the credit creation that was needed to peel the economy off the floor after the year 2000 stock market crash was developed using sales of credit derivatives to foreign pension funds and central banks. By keeping credit creation off the balance sheets of commercial banks, the money supply that fueled the housing bubble did not show up in traditional measures of the money supply, and thus was not commodity inflationary, although it was properly asset price inflationary.

That game is over. Am I sure? When's the last time you heard of a big private equity deal closing? Not since the summer when the CLO machine broke that had been feeding the LBO bubble. Without the fancy credit machine to create the credit to inflate these assets, what's left to expand credit and money but the good old fashioned printing press? Is it any wonder that gold prices are rising? The investment banks may have something else up their sleeve. I'll let you know if I find out what because if they do, it may be time to lighten up on the reflation hedges.

6. Ratings

Rating agencies have massive conflicts of interest; they aren't doing their job. They're supposed to represent the investors, but favor Corporate America, which pays for the reports. Shake them up.

Our contacts tell us they're getting shaken up quite well even without a recession, thank you very much. A recession might make matters worse but only marginally.Rating agencies have massive conflicts of interest; they aren't doing their job. They're supposed to represent the investors, but favor Corporate America, which pays for the reports. Shake them up.

7. China

Trigger an internal recession in China. Make it realize America's not going into debt forever to finance China's domestic growth and military war machine. A recession will also slow recycling their reserves through sovereign funds to our equities.

This is already happening.Trigger an internal recession in China. Make it realize America's not going into debt forever to finance China's domestic growth and military war machine. A recession will also slow recycling their reserves through sovereign funds to our equities.

The alarm bells begin to ring in China

Nov. 21, 2007 (Times Online)

The Pollyanna economists think it is all different now, a view espoused by the World Bank in its most recent report on East Asian economic growth. China is creating its own demand, “decoupling” from the US economy, it says.

Only a day after the World Bank released its fug of warm air, Beijing’s Commerce Ministry raised the alarm, giving warning that things had reached a “turning point” and Chinese exporters could be “devastated” if US demand continues to fall.

Exports account for a third of China’s growth and America is the destination for a fifth of the stuff. “The risks of economic slowdown in the US . . . plague our export prospects,” the Commerce Ministry said.

But why assume a recession will be worse for China than for the U.S.? A reduction in China's exports demands an equal reduction in China's import of U.S. financial assets. China has repeatedly stated a desire to diversity out of, that is, sell U.S. financial assets and government debt anyway. The only reason they have not is because U.S. consumers are buying Chinese exports and China balances the trade by purchasing treasury bonds, agency debt, and other dollar denominated assets. That's the deal.Nov. 21, 2007 (Times Online)

The Pollyanna economists think it is all different now, a view espoused by the World Bank in its most recent report on East Asian economic growth. China is creating its own demand, “decoupling” from the US economy, it says.

Only a day after the World Bank released its fug of warm air, Beijing’s Commerce Ministry raised the alarm, giving warning that things had reached a “turning point” and Chinese exporters could be “devastated” if US demand continues to fall.

Exports account for a third of China’s growth and America is the destination for a fifth of the stuff. “The risks of economic slowdown in the US . . . plague our export prospects,” the Commerce Ministry said.

China's trade with the world, per 2005 and 2006 World Trade Organization data. N. America includes Canada.

China's exports to the U.S. alone is estimated at 1/5th of all Chinese exports.

About 20% of China's export trade comes from the U.S. Can China take a major hit in U.S. export trade income? Yes, but not without the economy slowing and the CCP experiencing political challenges. Can the U.S. take a big a cut in China's lending? Yes, but not without economic and political consequences. The U.S. will have to find an alternate, someone else to grab the hot potato.

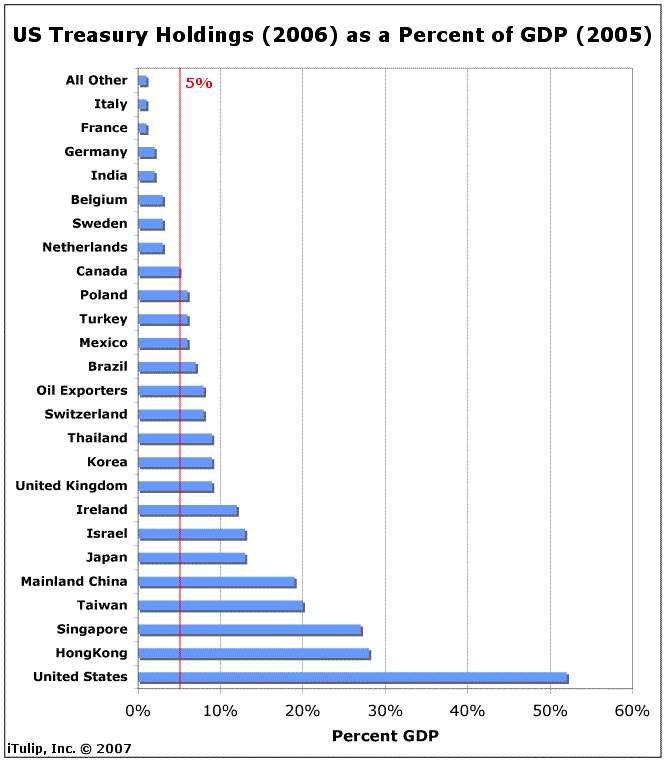

In proportion to size of economy, European nations do not purchase U.S. treasury debt at the level of

Asian goods exporters. Germany specifically, a larger goods exporter than the U.S. and with a positive

trade balance, purchases little U.S. sovereign and agency debt relative to GDP.

As you can see from the above, not all U.S. trade partners are "pulling their weight" buying U.S. debt. With treasury purchases scaled to the size of each county's economy, you can see that countries that either need U.S. military support or U.S. consumer demand for their exports buy the most significant dollar volumes of U.S. debt. China surely doesn't need U.S. military "protection." If the U.S. doesn't continue to import Chinese lead covered toys and pesticide infused ginger at an ever increasing rate, what motive does China have to buy more U.S. financial assets?

I'm confused by Farrell's assertion that the U.S. funds China's military by borrowing from China. That's backwards. China is diverting national savings into reserves that might otherwise be used to build its military. From China's perspective:

US-China relations are influenced by a wide array of issues from Taiwan to trade relations and human rights. More recently, the nexus of the relationship has centered on the so-called "Bretton Woods II" arrangement, a continuation by other means of the dollar-centered international order that prevailed in the postwar decades. This monetary status quo, based on structural current account deficits in the U.S. and structural current account surpluses in Asia, in which Asian current account surpluses are recycled to provide cheap financing for the US current account deficits, largely explains why the US dollar has not collapsed despite the country's increasingly parlous debt build-up. It has been characterized by PIMCO's Paul McCulley as a "stable disequilibrium".

But Bretton Woods II is increasingly beset with internal contradictions: the Chinese have in effect initiated a dollar reserve accumulation policy that acts as a quasi oil reserve, given that oil is priced in dollars. But in so doing, they have helped to fund an increasingly confrontational and militaristic US, which in turn threatens China's energy security. How long before this circular relationship, which underpins the stability of today's global markets, breaks down?

China's Dollars Versus America's Guns

Japan Policy Research Institute - Marshall Auerback - February 2007

We coined the term Economic Mutually Assured Destruction to describe the relationship. Whatever you want to call it, a recession helps China's position more than the U.S. position. In a global recession, the net goods exporters tend to weather the storm better than the net financial assets exporters. The global quest for yield is replaced by the desire to avoid losses and preserve purchasing power, as Marc Faber recently cleverly put it, "a shift from return on investment to a return of investment." This decreases demand for financial assets by exporters generally and demand for goods decreases by goods importers as well but not as much, and demand tends to shift from luxuries to necessities.But Bretton Woods II is increasingly beset with internal contradictions: the Chinese have in effect initiated a dollar reserve accumulation policy that acts as a quasi oil reserve, given that oil is priced in dollars. But in so doing, they have helped to fund an increasingly confrontational and militaristic US, which in turn threatens China's energy security. How long before this circular relationship, which underpins the stability of today's global markets, breaks down?

China's Dollars Versus America's Guns

Japan Policy Research Institute - Marshall Auerback - February 2007

8. Oil

Force the energy and auto industries to get serious about emission standards and reducing oil dependency.

Recession will have the opposite result unless Farrell is expecting, as we are, that the dollar will fall even faster than oil demand. That means the U.S. may find itself with 2/3 of pre-recession oil import demand but each unit of demand will be inflated by another 50% reduction in the value of the monetary unit, the dollar. As energy prices rise and the energy purchasing power of income falls, cars will get a whole lot smaller. The same result is achieved in Europe via taxation; dollar depreciation acts as a politically expedient regressive domestic tax on energy consumption.Force the energy and auto industries to get serious about emission standards and reducing oil dependency.

9. Inflation

Expose the "core inflation" farce Washington uses to sugarcoat reality.

How will recession expose the "core inflation" farce? Reflation, which is inevitable, will make inflation worse, and don't expect the analysis and reporting to improve if the facts are against the house.Expose the "core inflation" farce Washington uses to sugarcoat reality.

10. Moral hazard

Slow the Fed from cutting interest rates to bail out speculators.

When the U.S. goes into recession, the Fed will cut rates. The only way to keep the Fed from bailing out speculators is for the Fed to not allow speculators to get into the position of needing to get bailed out. Too late for that.Slow the Fed from cutting interest rates to bail out speculators.

11. War costs

Force Washington to get honest about how it's going to pay for our wars, other than supplemental bills that are worse than Enron-style debt financing.

What Enron did wrong was report debt as operating income. Here in the USA, we depend on foreign borrowing for GDP growth.Force Washington to get honest about how it's going to pay for our wars, other than supplemental bills that are worse than Enron-style debt financing.

Besides, here we are, no official recession yet, and Congress can't even cut spending on current wars without the DoD making political threats of election year layoffs and instigating economic havok: 200,000 layoffs between now and Christmas is a formidable stick to use to beat Republican members of Congress into voting "the right way."

Pentagon Warns of Civilian Layoffs If Congress Delays War Funding

Nov. 21, 2007 (Jonathan Weisman and Ann Scott Tyson - Washington Post)

Democrats Are Firm on Link to Troop Withdrawals From Iraq

The Defense Department warned yesterday that as many as 200,000 contractors and civilian employees will begin receiving layoff warnings by Christmas unless Congress acts on President Bush's $196 billion war request, but senior Democrats said no war funds will be approved until Bush accepts a shift in his Iraq policy.

Nov. 21, 2007 (Jonathan Weisman and Ann Scott Tyson - Washington Post)

Democrats Are Firm on Link to Troop Withdrawals From Iraq

The Defense Department warned yesterday that as many as 200,000 contractors and civilian employees will begin receiving layoff warnings by Christmas unless Congress acts on President Bush's $196 billion war request, but senior Democrats said no war funds will be approved until Bush accepts a shift in his Iraq policy.

And there are plenty more such sticks where that came from, such as this threat–I mean–warning from Goldman Sachs that without further assistance from the Fed and others, the U.S. faces a $2 trillion "lending shock" during an election year.

This is precisely the dynamic of inflationary, politically motivated government spending in the face of recession that our Ka-Poom Theory anticipates. As the inflationary recession progresses, each political standoff between Congress and various political groups ends in additional spending. The end result is predictable: even more inflation. Expect the unions get into the act in 2008, and when they do don't forget where it all came from, no matter what you hear from the conservative media which will spin rising wage inflation as being caused by the unions: the initial decision to allow inflation to rise to forestall recession in 2001 planted the political seeds of further inflation as various groups fight to make up for the lost purchasing power of income suffered by their respective constituencies.

Rather than reveal the true source of war financing, a recession may just as well drive it farther underground by creating additional impetus for war. Recessions particularly preceded by credit booms have historically led to unpleasant unintended consequences; if a country can't spend its way out of recession peacefully, it may do so militarily.

12. CEO pay

Further expose CEO compensation that's now about five hundred times the salaries of workers, compared with about 40 times a generation ago.

It's already overexposed. What's missing is the will to do anything about it. That's up to shareholders. When the DOW is trading either nominally or in real terms near half where it is today, shareholders may get more militant. As long as inflation via share buy-backs, balance sheet engineering and other tricks supports share prices, shareholders will remain tolerant of this nonsense.Further expose CEO compensation that's now about five hundred times the salaries of workers, compared with about 40 times a generation ago.

13. Privatization

Stop the privatization of our federal government to no-bid contractors and high-priced mercenary armies fighting our wars.

Recession means more deficit spending means more pork means more privatization not less.Stop the privatization of our federal government to no-bid contractors and high-priced mercenary armies fighting our wars.

14. Entitlements

Force Congress to get serious about the coming Social Security/Medicare disaster. With boomers now retiring, this problem can only get worse: A recession now could avoid a depression later.

Recessions put further burdens on government not less.Force Congress to get serious about the coming Social Security/Medicare disaster. With boomers now retiring, this problem can only get worse: A recession now could avoid a depression later.

15. Consumers

Yes, we're all living way beyond our means, piling up excessive credit-card debt, encouraged by government leaders who tell us "deficits don't matter." Recessions will pressure individuals to reduce spending and increase savings.

I'll say. Yes, we're all living way beyond our means, piling up excessive credit-card debt, encouraged by government leaders who tell us "deficits don't matter." Recessions will pressure individuals to reduce spending and increase savings.

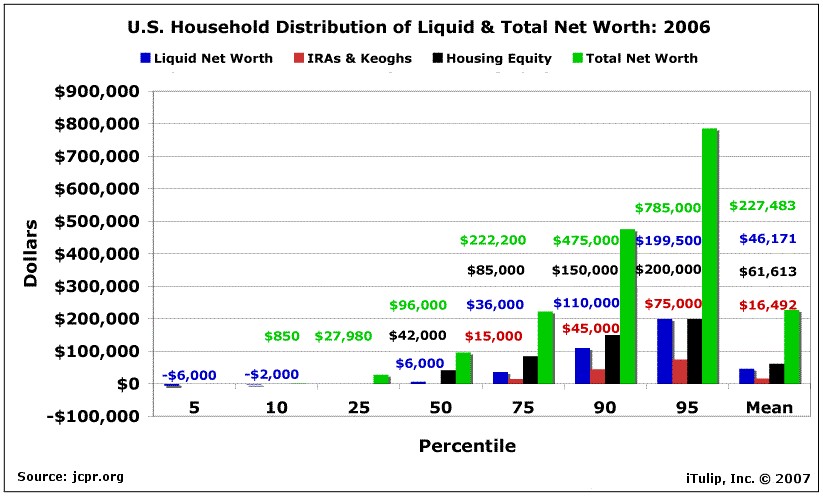

In a recession as unemployment rises, the majority of Americans (read: voters) will not have enough liquid net worth to fund expenses without increasing debt and/or selling assets. Median duration of unemployment has increased from seven to nine months this year. At the same time, secured credit (mortgage and HELOC) conditions are tightening. What does that leave to fund household expenses? Evidence is that demand for credit card debt is rising and assets are being sold.

We have surveyed a group of coin and jewelry dealers across the U.S. since 1999. For the past six months in particular it's been a tale of two markets. Working families are selling to raise money, liquidating coin collections and jewelry to raise cash. At the same time high net worth families have been buying gold and rare coins to hedge inflation fueled by dollar depreciation. As a result, the spread between bullion and rare gold coins prices has increased from around $20 where it had been for years to over $80 in the past few months. Prices of very rare coins are going through the roof.

If you can afford to hedge inflation, you do. For everyone else, there's Mastercard.

Credit card debt is also rising and, like everything else, it is not so evenly distributed. Average household debt was 91% of net worth for the middle 20% wealth group in 2004, 10% of wealth for the top 10% group.

Families in the top net worth groups don't have much debt so when recessions come around, the ratio of debt to net worth hardly changes. As you can see above, that is not the case for the bottom 40%. Note that during recessions accompanied by tight credit, such as during the early 1980s and in 2001, debts are paid off and savings increase. In the early 1980s, debt to wealth ratio for the bottom 40% dropped in line with the top 10%. Meanwhile, the top 40% was relatively unaffected.

Our warnings about wealth and debt inequality over the years are rooted in our concerns about the political backlash that historically follows from economic distress in the context of such imbalances–a return to greater government interference in small business and the capital markets that support them. We fear a rolling back of gains since the 1980s that have made the U.S. a mecca for entrepreneurs and inventors. Here at iTulip our motto is: "We like capitalism–don't break it." A major recession that follows on the heels of widespread financial system abuses, preferential taxation, and lack of enforcement of regulations inevitably causes the political system to gear up to throw the baby out with the bathwater.

The U.S. economy has built up not only historic wealth inequality since 2001 but massive disparities of liquid net worth and debt. In a recession, these will create a political nightmare as unemployment rises and credit tightens. A recession will be bad for the rich and middle class, but will hammer the poor and push segments of the middle class into the ranks of the poor. We've long expected a political reflex to these circumstances in our Ka-Poom Theory. If the U.S. ever gets a populist, socialistic president it will follow from of the kind of recession Farrell is hoping for.

16. Regulation

Lobbyists have replaced regulation. Extreme theories of unrestrained free trade plus zero regulation just don't work; proven by our credit crisis, hedge funds' nondisclosures, private-equity taxation, rating agencies failures, junk home mortgages, and more. Get real, folks.

For economic reasons, trade needs to be unrestrained during periods of recession, more managed during expansions. Of course, politics usually forces the opposite to happen. Lobbyists have replaced regulation. Extreme theories of unrestrained free trade plus zero regulation just don't work; proven by our credit crisis, hedge funds' nondisclosures, private-equity taxation, rating agencies failures, junk home mortgages, and more. Get real, folks.

|

17. Sacrifice

"We have not seen a nationwide decline in housing like this since the Great Depression," says Wells Fargo CEO John Stumpf. As individuals and as a nation Americans have always performed best in crises, like the Depression or WWII, times when we're all asked to make sacrifices. Pampering us with interest-rate cuts and tax cuts during the Iraq and Afghan wars may have stimulated the economy temporarily, but they delayed the real damage of the '90s stock bubble while setting the stage for this new subprime/credit crisis.

I'll respond to this one with a comment made to our interview with James Scurlock."We have not seen a nationwide decline in housing like this since the Great Depression," says Wells Fargo CEO John Stumpf. As individuals and as a nation Americans have always performed best in crises, like the Depression or WWII, times when we're all asked to make sacrifices. Pampering us with interest-rate cuts and tax cuts during the Iraq and Afghan wars may have stimulated the economy temporarily, but they delayed the real damage of the '90s stock bubble while setting the stage for this new subprime/credit crisis.

"Did you guys know, the bankrupcy laws changed? You cannot declare bankruptcy anymore. In the near future, we may have debtors prisons. When we have a war with Iran, Syria, Russia, and China, you know who will be recruited. They will give you a choice, pay off your debts or we will throw you in prison. If you don't want to go to jail, you join the military for 8 years."

What if 20 million voters share the same vision? How are they likely to vote? The political bed we've made is not conducive to constructive change in an economic crisis. We'll get a recession alright, but it won't improve anything. There will be nothing romantic or cleansing about it.

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

For a book that explains iTulip concepts in simple terms see americasbubbleeconomy

For the safest, lowest cost way to buy and trade gold, see The Bullionvault

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2007 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

.

.

Comment