June 5, 2002. I'm in Seoul, South Korea. My business dinner is proceeding on schedule even though my host's country is about to get its first World Cup win in 47 years. On this warm evening the doors to our private dining room are open to a hallway that leads to the street. The roar of what must have been millions of Koreans screaming in unison in their apartments across the city poured through the streets and flooded in around us. Two years later in downtown Boston when the Red Sox beat the Yankees in 2004, a bigger deal than winning the Pennant, the public display was tepid compared to this communal outburst.

I was so sure there was a vast arena full of howling people somewhere below us, above us, or beside us that at one point I went outside to look for it. But the sound came from nowhere and everywhere. These were Koreans, a boisterous and communal group, being their boisterous and communal selves. My host said he didn't mind not watching the game, the business at hand was more important, but I knew he was lying. I asked our waiter to bring in a TV. On the flight to Japan the next day -- we did get a deal done -- the Koreans on the flight stopped me to ask, "Did you see the game?! Did you see that!"

So last night as I look at pictures of Italy, today's World Cup winner, and think of Korea. Reading about South Korea's nutty neighbor to the north, I'm also reminded that a mere four years before my visit, Korea stood on the brink of economic catastrophe and how they responded.

Here's an interview of Mary Jordan, Northeast Asia co-bureau chief for the Washington Post, by Phil Ponce of the Jim Lehrer Newhour, September 8, 1998:

PHIL PONCE: "You were here a year ago and you gave a picture of a very prosperous Korea, where people were buying things and were well dressed. What's Korea like now?"

MARY JORDAN: "Well, it's just been a stunning reversal of fortune for a country. This time last year it was still a powerhouse. You know, there was great pride in every American home. There was a Korean-made air conditioner or computer or some electronics goods. And this year so many people that were working in those factories are out of work that the city had almost no homeless people last year, but every city park now has become almost like a virtual tent city, with homeless people, families, people that were even owners of companies that are now sleeping under the stars, because they have lost everything, lost their jobs, lost all their savings."

Then, almost as quickly, Korea came roaring back. Michel Camdessus, Managing Director of the International Monetary Fund, speaking at the Conference on Economic Crisis and Restructuring, Seoul, Korea, December 2, 1999 put it this way:

"Two years ago, Korea stood on the brink of a potential disaster, a situation that came as a shock, as it became the latest, and perhaps the most unexpected, country to be caught-up in the tide of contagion that was sweeping through global financial markets and economies. One year later, the global economy, shaken by new crises in other corners of the world was in precarious condition."

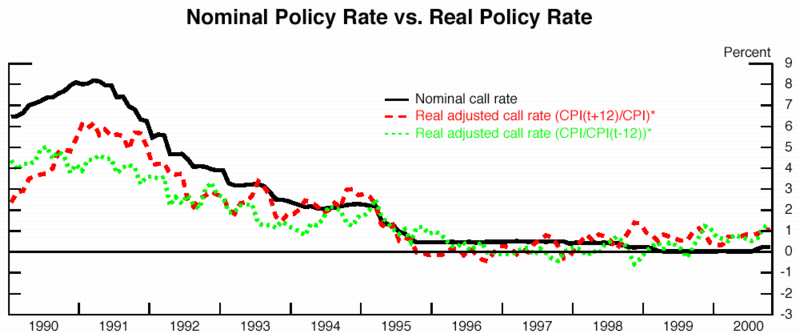

"With each passing month, we see ever more encouraging indicators of the speed and vitality of Korea's recovery, clear evidence -- Mr. President -- that the policies you adopted in response to the crisis were the right ones and that they are working. Well over a year ago, once the currency had stabilized, short-term interest rates fell below pre-crisis levels and now long-term rates have also done so. At the same time, the country's usable reserves were already climbing to record levels, and exports had begun a strong rebound. During 1999, unemployment has fallen sharply, and recent statistics show that Korea is well on its way to realizing 9 percent growth this year."

"President Kim, I should like today to salute the government, the institutions, and the people of Korea for the remarkable courage and determination with which you met the crisis. For if this was a Korean crisis, you have met it with a Korean response, and now the rewards are Korea's to build upon for the future. Of course, the IMF stepped forward as soon as Korea requested help and we are gratified to see that the program that was initiated immediately, and which is now entering its third and final year, has contributed to such a quick and strong recovery in Korea, which couldn't be explained without the spirit of sacrifice, the sense of community and solidarity, the capacity for renewal which are distinctive values and quality of your people."

Back to the Mary Jordan interview for background on the foundations of that spirit of sacrifice:

PHIL PONCE: "How about middle class families, those families that still have, where somebody is still employed and still earning some income, how have their lives been changed?"

MARY JORDAN: "Well, there's 44 million people in South Korea, and most of them are middle class people. And that's been the strength of this country. And I guess I think it's fair to say that there's no life that hasn't really been changed there. There's - Korea is famous for being kind of an education powerhouse. They tend to staff the Harvard - Stanford in greater numbers than any other country in the world, and many of those Korean students have had to return home because when the value of the currency crashed, Harvard, instead of costing 30 grand, cost 50 grand a year. So the middle class, the kids are hurt, they're coming back from school. Some are joining the army to help out. People have turned in gold necklaces that meant a lot, gold baseballs, souvenirs, trying to melt them down for money, trying to help the country. You know, even middle class people who were just kind of clawing their way up and have kind of finally made it, you know, good working conditions, a nice house, are now, you know, living on the floor of their relatives because they can't pay the rent."

Jordan alludes to what Camdessus meant by "...the spirit of sacrifice, the sense of community and solidarity..." It wasn't only the $58 billion loan from the IMF that pulled Korea out of the abyss. As this San Jose Mercury News article noted in December 1, 1999:

"The recovery may be partly a reflection of South Koreans' determination to overcome the crisis. At the height of the financial turmoil, millions of Koreans sold or donated 222 tons of rings, necklaces and other gold trinkets worth $2.2 billion to aid the bailout."

"I sold two gold rings and one necklace,'' said Lee Suk-ja, a housewife. "It was a small amount, but I take a great pride in taking part in helping the country in time of need.''

Imagine that. You're out of work or may be soon. Many of your friends are. What do you do? Do you sell your valuables to pay your bills? No, you sell them and give the proceeds to the government to help your country, your fellow Koreans. You can argue how much these $2.2B helped versus the $58B IMF loan and other steps, but this display of sacrifice by the individual to the group had to have a major positive psychological impact.

What's remarkable about the Korean crisis experience is both how quickly the nation fell from prosperity into despair and how quickly it got back out again. The US can fall just as quickly into despair. How quickly can it climb out again? That depends on the antecedents.

In the highly leveraged, crisis prone Globologna Economy, everyone gets their turn in the barrel. Maybe it will be the USA's turn next time. If so, will the people of the US display the "...the spirit of sacrifice, the sense of community and solidarity..." shown by a homogenous, egalitarian Korean society dominated by a large middle class?

Three reasons why a Korean Crisis Solution will not likely work for the US:

What can the US government do in case of a serious economic crisis like Korea's in the late 1990s? The tax cut and deficit spending bullets have been fired. The asset inflation game has played out in a housing bubble and bubbles in other assets. All the "wealth" that the US can print has been printed, and paid for with loans from energy and goods exporting nations. All the fiscal stimulous that can be generated by deficit spending has been applied, less debt that the US has to monetize and, in a world of $74 oil, create massive inflation.

Liquidity is the last bullet in the gun. It will be fired and there will be another asset inflation, like the 1996 - 2000 stock market bubble and the 2001 - 2005 housing bubble. But where?

Join our FREE Email Mailing List

Return to iTulip.com

Copyright © iTulip, Inc. 1998 - 2006 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

I was so sure there was a vast arena full of howling people somewhere below us, above us, or beside us that at one point I went outside to look for it. But the sound came from nowhere and everywhere. These were Koreans, a boisterous and communal group, being their boisterous and communal selves. My host said he didn't mind not watching the game, the business at hand was more important, but I knew he was lying. I asked our waiter to bring in a TV. On the flight to Japan the next day -- we did get a deal done -- the Koreans on the flight stopped me to ask, "Did you see the game?! Did you see that!"

So last night as I look at pictures of Italy, today's World Cup winner, and think of Korea. Reading about South Korea's nutty neighbor to the north, I'm also reminded that a mere four years before my visit, Korea stood on the brink of economic catastrophe and how they responded.

Here's an interview of Mary Jordan, Northeast Asia co-bureau chief for the Washington Post, by Phil Ponce of the Jim Lehrer Newhour, September 8, 1998:

PHIL PONCE: "You were here a year ago and you gave a picture of a very prosperous Korea, where people were buying things and were well dressed. What's Korea like now?"

MARY JORDAN: "Well, it's just been a stunning reversal of fortune for a country. This time last year it was still a powerhouse. You know, there was great pride in every American home. There was a Korean-made air conditioner or computer or some electronics goods. And this year so many people that were working in those factories are out of work that the city had almost no homeless people last year, but every city park now has become almost like a virtual tent city, with homeless people, families, people that were even owners of companies that are now sleeping under the stars, because they have lost everything, lost their jobs, lost all their savings."

Then, almost as quickly, Korea came roaring back. Michel Camdessus, Managing Director of the International Monetary Fund, speaking at the Conference on Economic Crisis and Restructuring, Seoul, Korea, December 2, 1999 put it this way:

"Two years ago, Korea stood on the brink of a potential disaster, a situation that came as a shock, as it became the latest, and perhaps the most unexpected, country to be caught-up in the tide of contagion that was sweeping through global financial markets and economies. One year later, the global economy, shaken by new crises in other corners of the world was in precarious condition."

"With each passing month, we see ever more encouraging indicators of the speed and vitality of Korea's recovery, clear evidence -- Mr. President -- that the policies you adopted in response to the crisis were the right ones and that they are working. Well over a year ago, once the currency had stabilized, short-term interest rates fell below pre-crisis levels and now long-term rates have also done so. At the same time, the country's usable reserves were already climbing to record levels, and exports had begun a strong rebound. During 1999, unemployment has fallen sharply, and recent statistics show that Korea is well on its way to realizing 9 percent growth this year."

"President Kim, I should like today to salute the government, the institutions, and the people of Korea for the remarkable courage and determination with which you met the crisis. For if this was a Korean crisis, you have met it with a Korean response, and now the rewards are Korea's to build upon for the future. Of course, the IMF stepped forward as soon as Korea requested help and we are gratified to see that the program that was initiated immediately, and which is now entering its third and final year, has contributed to such a quick and strong recovery in Korea, which couldn't be explained without the spirit of sacrifice, the sense of community and solidarity, the capacity for renewal which are distinctive values and quality of your people."

Back to the Mary Jordan interview for background on the foundations of that spirit of sacrifice:

PHIL PONCE: "How about middle class families, those families that still have, where somebody is still employed and still earning some income, how have their lives been changed?"

MARY JORDAN: "Well, there's 44 million people in South Korea, and most of them are middle class people. And that's been the strength of this country. And I guess I think it's fair to say that there's no life that hasn't really been changed there. There's - Korea is famous for being kind of an education powerhouse. They tend to staff the Harvard - Stanford in greater numbers than any other country in the world, and many of those Korean students have had to return home because when the value of the currency crashed, Harvard, instead of costing 30 grand, cost 50 grand a year. So the middle class, the kids are hurt, they're coming back from school. Some are joining the army to help out. People have turned in gold necklaces that meant a lot, gold baseballs, souvenirs, trying to melt them down for money, trying to help the country. You know, even middle class people who were just kind of clawing their way up and have kind of finally made it, you know, good working conditions, a nice house, are now, you know, living on the floor of their relatives because they can't pay the rent."

Jordan alludes to what Camdessus meant by "...the spirit of sacrifice, the sense of community and solidarity..." It wasn't only the $58 billion loan from the IMF that pulled Korea out of the abyss. As this San Jose Mercury News article noted in December 1, 1999:

"The recovery may be partly a reflection of South Koreans' determination to overcome the crisis. At the height of the financial turmoil, millions of Koreans sold or donated 222 tons of rings, necklaces and other gold trinkets worth $2.2 billion to aid the bailout."

"I sold two gold rings and one necklace,'' said Lee Suk-ja, a housewife. "It was a small amount, but I take a great pride in taking part in helping the country in time of need.''

Imagine that. You're out of work or may be soon. Many of your friends are. What do you do? Do you sell your valuables to pay your bills? No, you sell them and give the proceeds to the government to help your country, your fellow Koreans. You can argue how much these $2.2B helped versus the $58B IMF loan and other steps, but this display of sacrifice by the individual to the group had to have a major positive psychological impact.

What's remarkable about the Korean crisis experience is both how quickly the nation fell from prosperity into despair and how quickly it got back out again. The US can fall just as quickly into despair. How quickly can it climb out again? That depends on the antecedents.

In the highly leveraged, crisis prone Globologna Economy, everyone gets their turn in the barrel. Maybe it will be the USA's turn next time. If so, will the people of the US display the "...the spirit of sacrifice, the sense of community and solidarity..." shown by a homogenous, egalitarian Korean society dominated by a large middle class?

Three reasons why a Korean Crisis Solution will not likely work for the US:

- The IMF doesn't have enough money to bail out the US and the country is already in debt up to its eyeballs to most countries that have money to lend and a fair number that do not.

- American citizens don't have enough gold to contribute meaningfully to the cause and those that have it got it to protect their wealth from an irresponsible government not donate it to that government. How many Americans will in a crisis feel that giving money to their government is the same as giving it to their fellow American?

- The US is not a homogenous, egalitarian society dominated by a large middle class. The US is a socially stratified society with a shrinking middle class. The US has become the most unfair society on earth.

What can the US government do in case of a serious economic crisis like Korea's in the late 1990s? The tax cut and deficit spending bullets have been fired. The asset inflation game has played out in a housing bubble and bubbles in other assets. All the "wealth" that the US can print has been printed, and paid for with loans from energy and goods exporting nations. All the fiscal stimulous that can be generated by deficit spending has been applied, less debt that the US has to monetize and, in a world of $74 oil, create massive inflation.

Liquidity is the last bullet in the gun. It will be fired and there will be another asset inflation, like the 1996 - 2000 stock market bubble and the 2001 - 2005 housing bubble. But where?

Join our FREE Email Mailing List

Return to iTulip.com

Copyright © iTulip, Inc. 1998 - 2006 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Comment