Re: Stable credit and money supply vs 12%/year

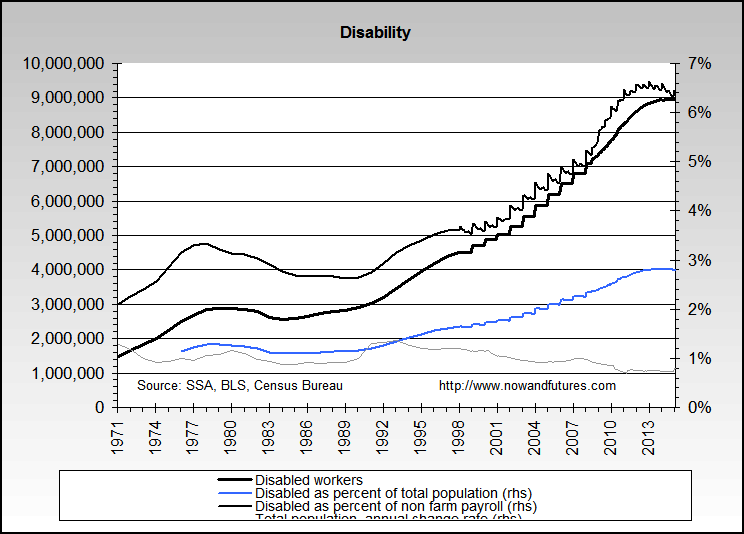

wouldn't the increase from 3 million in 1990 to just under 9 million disabled workers in 2013 imply that the total population has increased threefold to keep the disabled as percentage of the population flat? Since the percentage has even been declining, something must be wrong in this graph. Is it the left-hand scale?

Originally posted by bart

View Post

Comment