Re: Election as Forcing Function - Part I: On Track for a Bond Market Panic - Eric Janszen

This explains the Fed's move so close to U.S. elections. It also explains why gold has been rising in all currencies versus only the USD.

We'll get the $1 trillion plus dollar global stimulus by the end of Q3 as I forecast July 11, 2012.

Here comes Global Stimulus 3, right on schedule.

Sept. 7: First China committed $158 billion in fiscal stimulus to boost public spending on make-work programs.

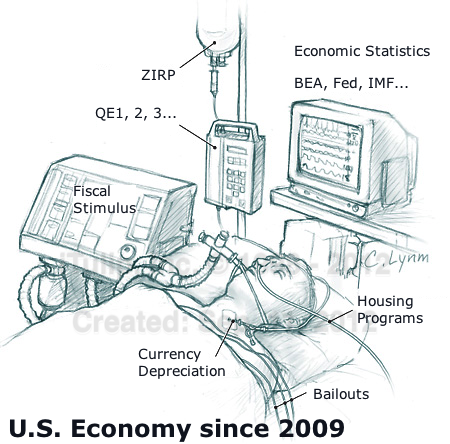

Sept. 13: The Fed committed $240 billion aimed at the housing market with a commitment to go beyond six months "if the labor markets do no improve," which is like saying "I'm going to keep hitting this screw with a hammer until it goes in." The QE is restricted to ASB purchases, not U.S. Treasury bonds.

Sept. 20: Today the Bank of Japan committed $125 billion in asset purchases, including government bonds.

That leaves the ECB and "others" with ten days and $523 billion to go.

My bet? The ECB comes in above $300 billion and "others" altogether at $200 billion, more or less.

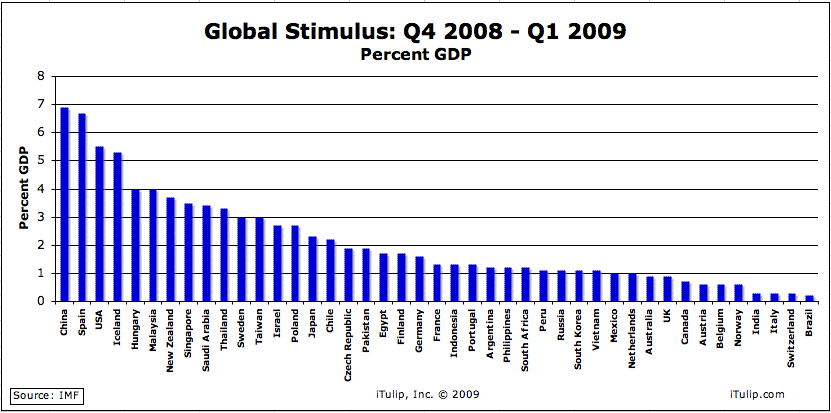

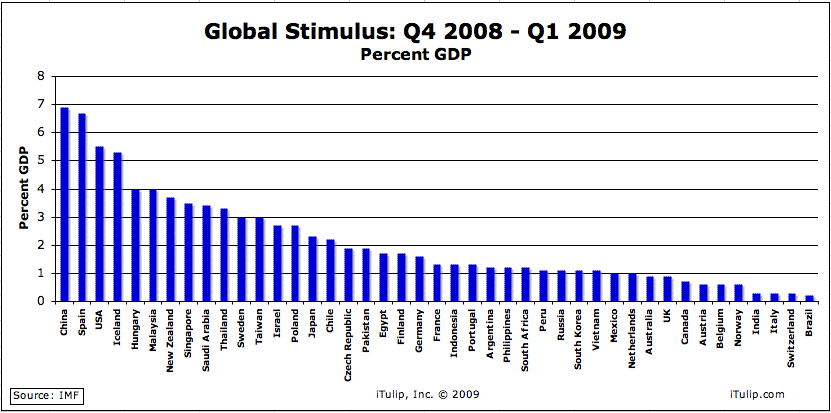

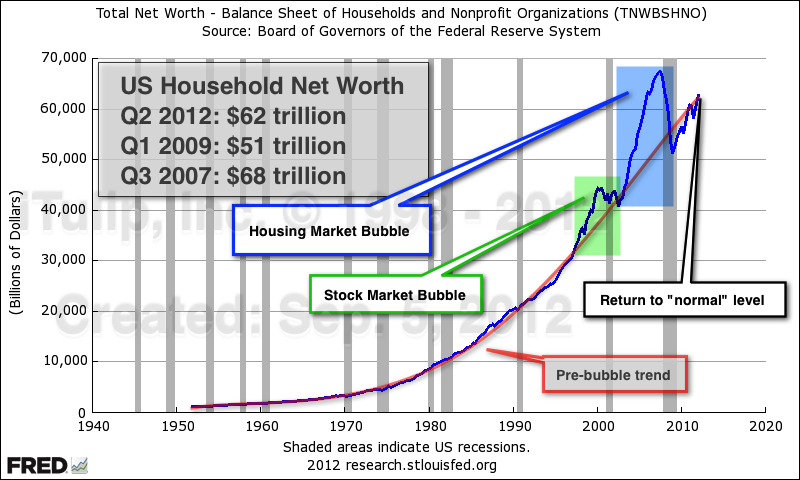

$4 trillion stimulus from Q4 2008 to Q1 2009. Third try's a charm or is this the end of the road for coordinated global stimulus?

This explains the Fed's move so close to U.S. elections. It also explains why gold has been rising in all currencies versus only the USD.

We'll get the $1 trillion plus dollar global stimulus by the end of Q3 as I forecast July 11, 2012.

Here comes Global Stimulus 3, right on schedule.

Sept. 13: The Fed committed $240 billion aimed at the housing market with a commitment to go beyond six months "if the labor markets do no improve," which is like saying "I'm going to keep hitting this screw with a hammer until it goes in." The QE is restricted to ASB purchases, not U.S. Treasury bonds.

Sept. 20: Today the Bank of Japan committed $125 billion in asset purchases, including government bonds.

That leaves the ECB and "others" with ten days and $523 billion to go.

My bet? The ECB comes in above $300 billion and "others" altogether at $200 billion, more or less.

$4 trillion stimulus from Q4 2008 to Q1 2009. Third try's a charm or is this the end of the road for coordinated global stimulus?

Comment