Re: Inflation versus deflation debate for Red Pill consumers

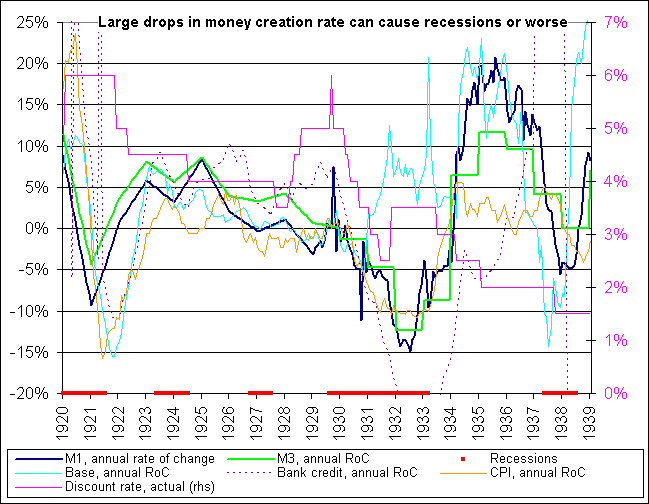

Many forget it was the event of The Great Depression that created the political mandate to prevent a repeat: give us activist central banks and inflationary government policy! So here it is.

It's an election year. There may be recession, if that's useful to get Hillary elected as it was to get Bill elected, but no catastrophe. After that, who knows.

If you are in business, I will give you an analogy. Imagine you are VP Sales. One day your boss, the CEO, comes into your office. He says, "We are very close to closing a round of funding. If we close the funding we may survive to be a great company and make everyone rich. If we do not close the funding we will fail and never know. It's up to you."

Of course the VP Sales has the pipeline to make a huge quarter if he jams on his guys to close all the deals, but he'll blow the rest of the year.

That's what's going on now in the Fed and US government. Take it from an ex-CEO and ex-VP Sales.

p.s. No, I never did this myself, but I have had it done to me.

Originally posted by Rajiv

View Post

It's an election year. There may be recession, if that's useful to get Hillary elected as it was to get Bill elected, but no catastrophe. After that, who knows.

If you are in business, I will give you an analogy. Imagine you are VP Sales. One day your boss, the CEO, comes into your office. He says, "We are very close to closing a round of funding. If we close the funding we may survive to be a great company and make everyone rich. If we do not close the funding we will fail and never know. It's up to you."

Of course the VP Sales has the pipeline to make a huge quarter if he jams on his guys to close all the deals, but he'll blow the rest of the year.

That's what's going on now in the Fed and US government. Take it from an ex-CEO and ex-VP Sales.

p.s. No, I never did this myself, but I have had it done to me.

Comment