Re: The Face of Inflation: Does the U.S. Have a "Peso Problem" revisited

What would be the inflation index from 1980 to 2006 as per Shadowstats, compared to the inflation index using official CPI? -- The figure using official CPI is 2.443 using the CPI calculator This figure may help crystallize my thinking.

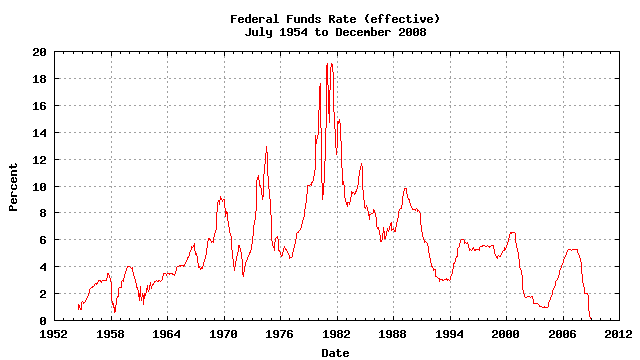

My cursory reading of the CPI inflation graph below gives me a figure of 7.4 but that can be deceiving when eyeballing and estimating an exponential series from percentage changes.

What would be the inflation index from 1980 to 2006 as per Shadowstats, compared to the inflation index using official CPI? -- The figure using official CPI is 2.443 using the CPI calculator This figure may help crystallize my thinking.

My cursory reading of the CPI inflation graph below gives me a figure of 7.4 but that can be deceiving when eyeballing and estimating an exponential series from percentage changes.

). Some of those people reside in the fairyland known as the US Congress. I wouldn't recommend basing your investment decisions on that cohort's pronouncements.

). Some of those people reside in the fairyland known as the US Congress. I wouldn't recommend basing your investment decisions on that cohort's pronouncements.

Comment