American Kremlin Conference – Part I: Boston Federal Reserve "Long-Term Effects of the Great Recession"

Photo Credit: Fed Chairman Ben Bernanke,

Boston, Massachusetts, October 20, 2011, Eric Janszen

There is not truth, only power, and facts are for little men.

I attended last week’s small, invitation-only conference "Long-Term Effects of the Great Recession" hosted by the Boston Federal Reserve on Atlantic Avenue to hear what a dozen influential economists like Martin Feldstein, Donald Kohn, and Simon Johnson have to say about the state of the economy two years after the so-called Great Recession, and meet members of the media.

The format of the two-day conference, a series of presentations and reviews of academic papers. Each presentation by authors was followed by two peer review presentations and a question and answer session.

Fed Chairman Ben Bernanke gave a 30-minute speech, duly covered by media in attendance. The TheStreet.com called it “The Most Important Ben Bernanke Speech That No One Heard.” His Fedspeak was interpreted by the attentive to mean that the Fed intended to set aside the Taylor Rule that ties interest rate decision rigidly to inflation and adopt a more "flexible" policy that takes unemployment into account. I call it the Burns Rule and investigate the implications in Part II.

On the other side of the street, Occupy Wall Street protesters quietly displayed their dissent. I asked a dozen Fed employees during the conference what they thought of the protests. All of them were sympathetic with the demonstrators who were protesting “Congress for Sale” but less so to the “Eat the Rich” contingent. After the event I walked across the street in suit and tie, still wearing my conference badge, to talk to the protesters. I’ll fill you in on those conversations later, too.

Photo Credit: Occupy Wall Street, Boston, Massachusetts, October 20, 2011, Eric Janszen

Cognitive Dissonance: FIRE Economy economists versus American Kremlinologists

Conferences like this require disciplined mental preparation.

Before I walk into a roomful of FIRE Economy credentialed economists and journalists, I have to compartmentalize the knowledge I have gained over 13 years running iTulip.com; pack it in a box and store it in the attic of my consciousness, out of sight. Then I’m on the same wavelength as the presenters and audience, this one comprised of professional investment bank, pension fund, family practice, academic, and Federal Reserve economists, and the journalists from CNBC, Reuters, New York Times, Wall Street Journal there to cover them.

Those who have been reading along on iTulip.com since 1998 will feel my pain. iTulip.com chronicled two asset bubbles and their aftermath, the existence of which was denied by professional economists at the time.

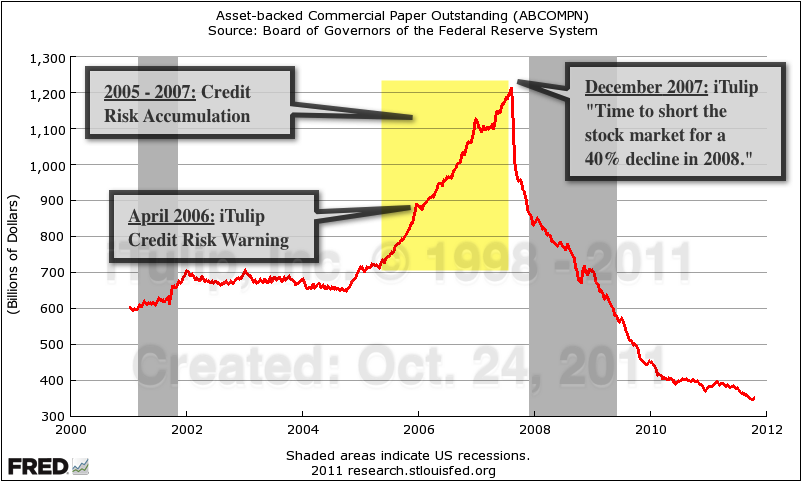

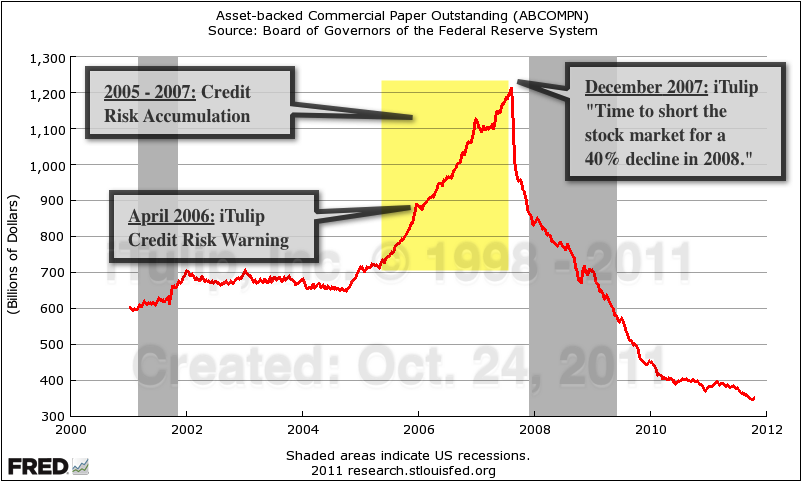

To prep for such a conference, forget that you first became aware of the build-up to the financial crisis and Housing Bust Recession with this first warning about the housing bubble in 2002. That was followed in January 2005 by a forecast of a housing market decline lasting 10 to 15 years, depending on government interference in the market – a long and tortuous decline with it, a deep and short decline without. Forget that in April 2006 you learned about the risks facing the global financial system due to mis-rated asset-backed securities that had been sold to funds all over the planet, polluting the global financial system with credit risk. Forget that in 2007 you became aware of the measures that the Fed planned to take to prevent the approaching de-leveraging panic from devolving into a 1930s type deflation spiral. Forget that you knew the long-term impact of economic policy responses of the central bank and Congress in April 2008: persistent high unemployment and inflation initially exhibited as a decline on product and service quality, later as rising nominal all-goods prices. Finally, forget that in 2008 you knew that once the public realized they’ve been had – again – that they’d take to the streets to express their First Amendment rights to try to get through to unaccountable political representatives whose campaigns were financed by the institutions that created the mess.

Where was the media and the Federal Reserve from 2005 to 2007 when the credit risk was building up?

To enter the Kafkaesque milieu of a professional economics conference where obvious and predictable events are treated as mysterious and unknowable, and keep your sanity, requires not only that you forget what you knew ahead of events but that you also forget what you know about the events after they occurred.

An American economist at an economics conference in the Soviet Union in the 1930s would have experienced a similar split between knowledge of the workings of the economy and what he can say without offending the conference sponsors.

As a government sanctioned economist at a conference in Stalingrad in the early 20th century you couldn’t go wrong penning a paper like Preobrazhensky’s “The Decline of Capitalism.” But if you wandered off the reservation to propose theories that did not align with the ideology and interests of the regime, as Preobrazhensky did when he later published “The Crisis of Soviet Industrialization,” your prospects, both professional and personal, declined precipitously.

According to History of Economic Thought website:

In America today an economist who warns about the long-run economic consequences of FIRE Economy directed economic policies doesn’t face a firing squad, but discretion remains the better part of valor if he wants to get invited to future economics conferences put on by a key promoter of such policies.

To get through the conference, pretend that the financial crisis was not foreseeable and preventable, that the hosts of the event, the Federal Reserve, did not play a leading role in the build-up to the crisis by failing to execute its responsibility to oversee financial system stability, and that the Fed does not continue to oversee the re-growth of systemic risk by failing to dismantle too-big-to-fail financial institutions that continue to be engaged in inherently conflicted speculative and commercial banking, despite the Volcker Rule.

Also pretend that the Fourth Estate did its job by exposing mortgage and securities fraud, endemic and apparent throughout the mortgage lending and finance industry from 2002 to 2008, before the resulting credit risk had a chance to accumulate in the system to the point where a credit crisis could wreck the economy.

In short, you have to pretend that the FIRE Economy doesn’t exist, that economic policy is not geared to preserve and grow it, that these policies did not produce the current conditions of private and public over-indebtedness and are not driving the nation toward insolvency, and so on and so forth. Think: The Fed’s so-called Operation Twist is not a bid to ramp up the price of the collateral on mortgage-backed securities by driving down mortgage rates, instead it’s purpose is to stimulate “the economy.” Think: The Fed’s latest desperate plan to rescue the politically influential real estate industry, to buy mortgage-backed securities, is really about helping homeowners. And on and on.

Once all of these inoculations against the stresses of cognitive dissonance are completed, you are ready to join the group.

Here’s what happens if you understand the workings of the FIRE Economy but don’t manage your knowledge effectively.

If like Dylan Ratigan you mistakenly believe that there is anything to be immediately gained by speaking truth to power, you put your sanity at risk. Dylan's been at it for three years, he says. After 13 years I've learned that it's important to pace yourself.

American Kremlin Conference – Part II: A Play in Four Acts

Photo Credit: Federal Reserve Bank of Boston on the left and OWS protesters on the right side of

Atlantic Avenue, October 19, 2011, Eric Janszen

What, you ask, can one hope to learn from this game of make-believe?

The way to approach such as meeting is as an actor in a play. There is knowledge to be gained in observing and participating in the play itself.

The presenting economists play the role of independent analysts looking for answers to the question of how the economy got into the sorry state that it is in today and what to do about it. The economists in the audience play the role of disciples of the learned economists. The media play the role of unwitting propagandists. I will explain my minor role shortly.

Act I: The Most Important Ben Bernanke Speech That No One Heard

By coincidence Bernanke entered the meeting room as I walked out of to make a call. I extended my hand. The diminutive head of America’s central bank, a good six inches shorter than me, looked up, took my hand, and smiled with an expression that asked, Am I supposed to know you? After once having my hand pressed in Paul Volcker’s giant mitt I was momentarily taken aback by the soft, girlish paw that held mine. I said simply, “Nice to meet you,” and moved on to make my call.

Later that afternoon, as he gave his speech he stood not ten feet from where I sat. I was struck by his lack of presence. Unlike the master politician-for-hire Alan Greenspan or the physically imposing, politically adept albeit morally scrupulous Paul Volcker, Bernanke comes off in person like the bland, politically vacant academic that he is.

His many academic papers going back to the early 1980s about how to fight the abstract deflation dragon he saw looming were his bid for the Fed head job he got so many years later.

He has a deep, emotional connection to the events of the Great Depression. I imagine that growing up he heard so many stories of 1930s hardship over Thanksgiving and Christmas dinner with relatives that he internalized their plight and determined to make it his personal mission to see to it that it never happens again.

The management consultants of the FIRE Economy brain trust, who write the hiring specifications for the next Chairman of the Federal Reserve, read over his papers with delight -- they'd found their boy.

Bernanke has no apparent interest in the conditions of the political economy that gave rise to the debt deflation threat he foresaw and continues his battle to fight off deflation with every means available to him, except the only one that will work: writing off the credit bubble era debt, which solution is politically unacceptable to the commercial banking system to which the Fed is captive.

He hides behind the ideologically neutral jargon of neo-classical economics, using it as a shield to deflect criticism where Greenspan used it like a knife to slice and dice his critics or a smokescreen to send them away in confusion.

The crux of Bernanke’s speech, if it can be said to have one, is that if the Fed learned a lesson from the financial crisis it is that the Fed’s secondary mission to manage risk in the financial system has been elevated in importance to equal its primary mission to maintain the general price level. Simon Johnson later pointed out that the only way to prevent a repeat of the financial crisis is to break up too-big-to-fail financial institutions into small-enough-to-fail institutions that the Fed doesn’t have to bail out at all.

As everyone full well knows, that has not been done and won't be. There stands Bernanke like a man in charge of a city’s building inspectors after a recent 8.0 Richter scale earthquake that leveled half the city. He promises that his best people will see to it that henceforth building standards will be strictly enforced, as if another once-in-100-years earthquake is imminent, as if crap concrete and rebar are not being poured and stuffed into the foundations of every new structure built as he speaks because the concrete and rebar producers are funding the campaigns of the politicians that keep him in office.

Buried in his otherwise somnambulist soliloquy was a momentous phrase, seemingly innocuous: “With respect to monetary policy, the basic principles of flexible inflation targeting -- the commitment to a medium-term inflation objective, the flexibility to address deviations from full employment, and an emphasis on communication and transparency -- seem destined to survive.”

Several interpretations of this statement shortly appeared, but the interpretation in off-the-record conversations I had with a dozen economists at the conference converged on one. I keep all off-the-record conversations in confidence, but I can tell you in summary what they really think about the state of the U.S. economy, the prospects for a resolution of the euro crisis, and the future of China’s finance-based economy. (more... $ubscription)

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2009 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Photo Credit: Fed Chairman Ben Bernanke,

Boston, Massachusetts, October 20, 2011, Eric Janszen

There is not truth, only power, and facts are for little men.

I attended last week’s small, invitation-only conference "Long-Term Effects of the Great Recession" hosted by the Boston Federal Reserve on Atlantic Avenue to hear what a dozen influential economists like Martin Feldstein, Donald Kohn, and Simon Johnson have to say about the state of the economy two years after the so-called Great Recession, and meet members of the media.

The format of the two-day conference, a series of presentations and reviews of academic papers. Each presentation by authors was followed by two peer review presentations and a question and answer session.

Fed Chairman Ben Bernanke gave a 30-minute speech, duly covered by media in attendance. The TheStreet.com called it “The Most Important Ben Bernanke Speech That No One Heard.” His Fedspeak was interpreted by the attentive to mean that the Fed intended to set aside the Taylor Rule that ties interest rate decision rigidly to inflation and adopt a more "flexible" policy that takes unemployment into account. I call it the Burns Rule and investigate the implications in Part II.

On the other side of the street, Occupy Wall Street protesters quietly displayed their dissent. I asked a dozen Fed employees during the conference what they thought of the protests. All of them were sympathetic with the demonstrators who were protesting “Congress for Sale” but less so to the “Eat the Rich” contingent. After the event I walked across the street in suit and tie, still wearing my conference badge, to talk to the protesters. I’ll fill you in on those conversations later, too.

Photo Credit: Occupy Wall Street, Boston, Massachusetts, October 20, 2011, Eric Janszen

Cognitive Dissonance: FIRE Economy economists versus American Kremlinologists

Conferences like this require disciplined mental preparation.

Before I walk into a roomful of FIRE Economy credentialed economists and journalists, I have to compartmentalize the knowledge I have gained over 13 years running iTulip.com; pack it in a box and store it in the attic of my consciousness, out of sight. Then I’m on the same wavelength as the presenters and audience, this one comprised of professional investment bank, pension fund, family practice, academic, and Federal Reserve economists, and the journalists from CNBC, Reuters, New York Times, Wall Street Journal there to cover them.

Those who have been reading along on iTulip.com since 1998 will feel my pain. iTulip.com chronicled two asset bubbles and their aftermath, the existence of which was denied by professional economists at the time.

To prep for such a conference, forget that you first became aware of the build-up to the financial crisis and Housing Bust Recession with this first warning about the housing bubble in 2002. That was followed in January 2005 by a forecast of a housing market decline lasting 10 to 15 years, depending on government interference in the market – a long and tortuous decline with it, a deep and short decline without. Forget that in April 2006 you learned about the risks facing the global financial system due to mis-rated asset-backed securities that had been sold to funds all over the planet, polluting the global financial system with credit risk. Forget that in 2007 you became aware of the measures that the Fed planned to take to prevent the approaching de-leveraging panic from devolving into a 1930s type deflation spiral. Forget that you knew the long-term impact of economic policy responses of the central bank and Congress in April 2008: persistent high unemployment and inflation initially exhibited as a decline on product and service quality, later as rising nominal all-goods prices. Finally, forget that in 2008 you knew that once the public realized they’ve been had – again – that they’d take to the streets to express their First Amendment rights to try to get through to unaccountable political representatives whose campaigns were financed by the institutions that created the mess.

Where was the media and the Federal Reserve from 2005 to 2007 when the credit risk was building up?

To enter the Kafkaesque milieu of a professional economics conference where obvious and predictable events are treated as mysterious and unknowable, and keep your sanity, requires not only that you forget what you knew ahead of events but that you also forget what you know about the events after they occurred.

An American economist at an economics conference in the Soviet Union in the 1930s would have experienced a similar split between knowledge of the workings of the economy and what he can say without offending the conference sponsors.

As a government sanctioned economist at a conference in Stalingrad in the early 20th century you couldn’t go wrong penning a paper like Preobrazhensky’s “The Decline of Capitalism.” But if you wandered off the reservation to propose theories that did not align with the ideology and interests of the regime, as Preobrazhensky did when he later published “The Crisis of Soviet Industrialization,” your prospects, both professional and personal, declined precipitously.

According to History of Economic Thought website:

“Preobrazhensky was largely responsible for rewriting Marxian theory for an agrarian economy, particularly emphasizing the possibility of ‘socialist accumulation’ to replace the capitalist phase (1926) by expanding industry at the expense of peasantry (via prices, not coercion) a proposition that went against the idea of the New Economic Policy. That work landed Preobrazhensky in Siberia for a period. Later he became a favorite of Joseph Stalin, who brought him back into public life. But he then predicted an economic crisis caused by Stalin's industrialization plans. Stalin had him arrested in 1936, and subsequently shot.”

Another Soviet economist, Nikolai Ivanovitch Bukharin, got into trouble when he emphasized small-scale peasant farming and the use of market incentives to rescue the economy from the devastation caused by the pursuit of Stalin’s favored economists’ madcap economic theories. For this he was purged by Stalin in the 1938 trials and shot.In America today an economist who warns about the long-run economic consequences of FIRE Economy directed economic policies doesn’t face a firing squad, but discretion remains the better part of valor if he wants to get invited to future economics conferences put on by a key promoter of such policies.

To get through the conference, pretend that the financial crisis was not foreseeable and preventable, that the hosts of the event, the Federal Reserve, did not play a leading role in the build-up to the crisis by failing to execute its responsibility to oversee financial system stability, and that the Fed does not continue to oversee the re-growth of systemic risk by failing to dismantle too-big-to-fail financial institutions that continue to be engaged in inherently conflicted speculative and commercial banking, despite the Volcker Rule.

Also pretend that the Fourth Estate did its job by exposing mortgage and securities fraud, endemic and apparent throughout the mortgage lending and finance industry from 2002 to 2008, before the resulting credit risk had a chance to accumulate in the system to the point where a credit crisis could wreck the economy.

In short, you have to pretend that the FIRE Economy doesn’t exist, that economic policy is not geared to preserve and grow it, that these policies did not produce the current conditions of private and public over-indebtedness and are not driving the nation toward insolvency, and so on and so forth. Think: The Fed’s so-called Operation Twist is not a bid to ramp up the price of the collateral on mortgage-backed securities by driving down mortgage rates, instead it’s purpose is to stimulate “the economy.” Think: The Fed’s latest desperate plan to rescue the politically influential real estate industry, to buy mortgage-backed securities, is really about helping homeowners. And on and on.

Once all of these inoculations against the stresses of cognitive dissonance are completed, you are ready to join the group.

Here’s what happens if you understand the workings of the FIRE Economy but don’t manage your knowledge effectively.

If like Dylan Ratigan you mistakenly believe that there is anything to be immediately gained by speaking truth to power, you put your sanity at risk. Dylan's been at it for three years, he says. After 13 years I've learned that it's important to pace yourself.

American Kremlin Conference – Part II: A Play in Four Acts

Photo Credit: Federal Reserve Bank of Boston on the left and OWS protesters on the right side of

Atlantic Avenue, October 19, 2011, Eric Janszen

What, you ask, can one hope to learn from this game of make-believe?

The way to approach such as meeting is as an actor in a play. There is knowledge to be gained in observing and participating in the play itself.

The presenting economists play the role of independent analysts looking for answers to the question of how the economy got into the sorry state that it is in today and what to do about it. The economists in the audience play the role of disciples of the learned economists. The media play the role of unwitting propagandists. I will explain my minor role shortly.

Act I: The Most Important Ben Bernanke Speech That No One Heard

By coincidence Bernanke entered the meeting room as I walked out of to make a call. I extended my hand. The diminutive head of America’s central bank, a good six inches shorter than me, looked up, took my hand, and smiled with an expression that asked, Am I supposed to know you? After once having my hand pressed in Paul Volcker’s giant mitt I was momentarily taken aback by the soft, girlish paw that held mine. I said simply, “Nice to meet you,” and moved on to make my call.

Later that afternoon, as he gave his speech he stood not ten feet from where I sat. I was struck by his lack of presence. Unlike the master politician-for-hire Alan Greenspan or the physically imposing, politically adept albeit morally scrupulous Paul Volcker, Bernanke comes off in person like the bland, politically vacant academic that he is.

His many academic papers going back to the early 1980s about how to fight the abstract deflation dragon he saw looming were his bid for the Fed head job he got so many years later.

He has a deep, emotional connection to the events of the Great Depression. I imagine that growing up he heard so many stories of 1930s hardship over Thanksgiving and Christmas dinner with relatives that he internalized their plight and determined to make it his personal mission to see to it that it never happens again.

The management consultants of the FIRE Economy brain trust, who write the hiring specifications for the next Chairman of the Federal Reserve, read over his papers with delight -- they'd found their boy.

Bernanke has no apparent interest in the conditions of the political economy that gave rise to the debt deflation threat he foresaw and continues his battle to fight off deflation with every means available to him, except the only one that will work: writing off the credit bubble era debt, which solution is politically unacceptable to the commercial banking system to which the Fed is captive.

He hides behind the ideologically neutral jargon of neo-classical economics, using it as a shield to deflect criticism where Greenspan used it like a knife to slice and dice his critics or a smokescreen to send them away in confusion.

The crux of Bernanke’s speech, if it can be said to have one, is that if the Fed learned a lesson from the financial crisis it is that the Fed’s secondary mission to manage risk in the financial system has been elevated in importance to equal its primary mission to maintain the general price level. Simon Johnson later pointed out that the only way to prevent a repeat of the financial crisis is to break up too-big-to-fail financial institutions into small-enough-to-fail institutions that the Fed doesn’t have to bail out at all.

As everyone full well knows, that has not been done and won't be. There stands Bernanke like a man in charge of a city’s building inspectors after a recent 8.0 Richter scale earthquake that leveled half the city. He promises that his best people will see to it that henceforth building standards will be strictly enforced, as if another once-in-100-years earthquake is imminent, as if crap concrete and rebar are not being poured and stuffed into the foundations of every new structure built as he speaks because the concrete and rebar producers are funding the campaigns of the politicians that keep him in office.

Buried in his otherwise somnambulist soliloquy was a momentous phrase, seemingly innocuous: “With respect to monetary policy, the basic principles of flexible inflation targeting -- the commitment to a medium-term inflation objective, the flexibility to address deviations from full employment, and an emphasis on communication and transparency -- seem destined to survive.”

Several interpretations of this statement shortly appeared, but the interpretation in off-the-record conversations I had with a dozen economists at the conference converged on one. I keep all off-the-record conversations in confidence, but I can tell you in summary what they really think about the state of the U.S. economy, the prospects for a resolution of the euro crisis, and the future of China’s finance-based economy. (more... $ubscription)

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2009 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Comment