|

Just because it's big, doesn't mean it can't go down fast. In a debt deflation, the extreme rate of change even fools central bankers.

by Eric Janszen

(Image: Second Officer David Blair. Before the Titanic sailed, he left with the key to the locker that contained the pair of binoculars for the designated lookout. Historians believe that if the crew had access to the binoculars the iceberg would have been seen in time to avoid the collision that sank the ship. Nice suit, though.)

The business press this morning attributed the 280 point DOW rout yesterday afternoon to investors' worries that the ongoing credit crunch and declining housing market may damage the so-called real economy. But the timing suggests that the market reacted to the release of the Fed's meeting minutes.

The minutes of the early August 2007 closed-door meeting of the Federal Open Market Committee were released late in the afternoon. The markets plunged shortly thereafter. The Fed's stated hope for a "return to more normal market conditions" without intervention is not what investors wanted to hear. They were hoping to read Fed minutes expressing worries that justified the move to cut the discount rate and pour tens of billions into the banking system ten days later. The minutes imply that the Fed was surprised.

The heart if not the soul of the Fed's role in The System, as Greenspan calls it, is as the all-knowing Wizard of Oz. How can the Wizard be surprised and still be the Wizard? Is the Fed really on top of this?

This raises a key question about Bernanke. While we deeply respect Bernanke's intellect, is he well suited for the role of head Wizard? He's an academic, not an astute politician and gun-for-hire like Greenspan. Does he have the instincts and nerve for the job, or will he do what comes naturally to him and wait for the data to stop showing apparently conflicting trends and align, at which point reaction will be too late? Can he convey that he is on top of events, even if he isn't, to maintain the appearance of control?

Watching him in front of a congressional committee at the last hearing, I winced as members of Congress interrupted him when he spoke, chuckled at some of his answers to questions, and generally dissed him. Having run more than 80 board meetings in my career as CEO, my advice to Bernanke is to watch a few tapes of Greenspan and do what he used to do at senate hearings. No matter how badly things are going, never accept disrespect. If you do, you're dead.

Greenspan, not his inquisitors, controlled those hearings, even when the missiles were flying, such as after the 2000 stock market crash. When he asked a ill-informed question–which, given the average Congress person's knowledge of economics and finance, is most of the time–he'd respond with a short meaningless answer. The more ill-informed the question, the shorter and more meaningless the answer. At one hearing I recall Greenspan was asked a question that was outrageously absurd, even by the standards of the US Congress. Greenspan's answer, after a pregnant pause: "I'm speechless."

The Fed's Foggy View

If slashing the discount rate half a percent ten days after hoping aloud that the markets might self-correct appears flip floppy, remember that the Fed considered rate hikes, versus cuts, as recently as May when inflation remained the Fed's predominant concern. Investors have reason to worry that this Fed does not know how to apply, now that the fire is burning, what it learned during the drills.

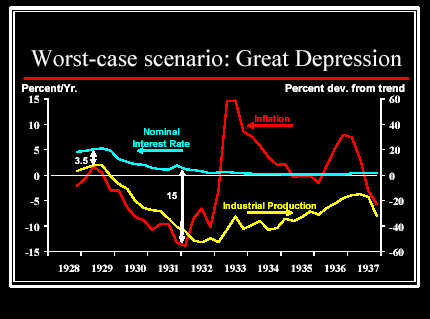

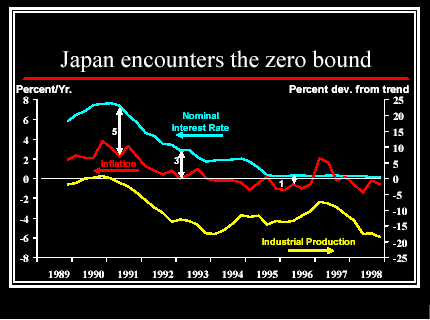

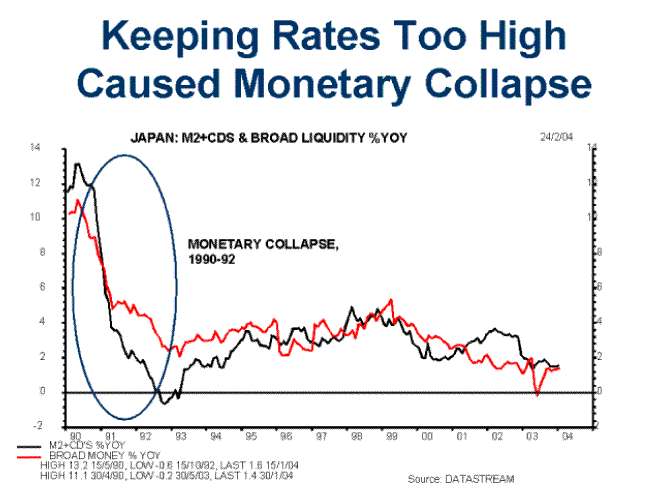

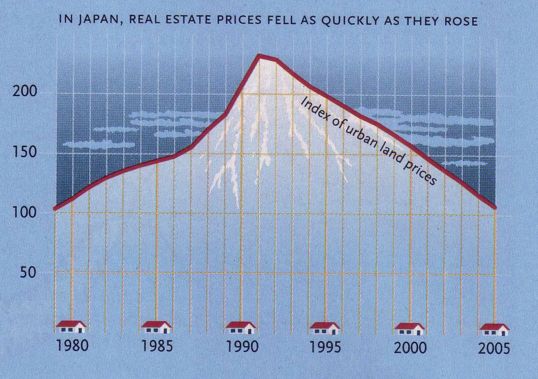

Coming off the housing bubble, the Fed is worried about the US experiencing a flavor of runaway debt deflation such as it suffered in the 1930s, and a less severe but no less worrisome debt deflation episode as Japan suffered after since the end of their stock market and real estate bubble collapsed starting in 1992. Preparedness for that eventuality was the gist of Bernanke's now famous helicopter money speech in November 2002, two and a half years before the housing bubble peaked. The monetary downdraft potential of a US recession under current household debt conditions with financial markets risk polluted at red alert levels is severe.

In my last article, I explained how a financial market crash caused by credit contraction is a long process. As the Japanese learned, when a credit bubble finally pops, the negative economic impact of credit contraction is swift.

A recession is a self-reinforcing process. The Fed is, and should be, afraid of where such a process might take the debt-laden US economy with so much debt riding on housing prices, housing prices riding on employment, and employment riding on consumption. Commentators point out that housing prices are now falling for the first time since The Great Depression. Another respected academic, Professor Robert Shiller, reiterated this point in an interview yesterday. He should also point out that this is the first time national housing prices have declined – ever – in the absence of a recession or depression. Question: what might happen to housing prices when the economy finally goes into recession Q4 2007? The Japanese know: prices collapse and stay there a long time.

The Fed can guess as well as you or I what the next US recession has in store, and isn't interested in confirming their theories by experimentation. We saw that movie in the US in the 1930s and the Japanese are still watching their own version, fifteen years later.

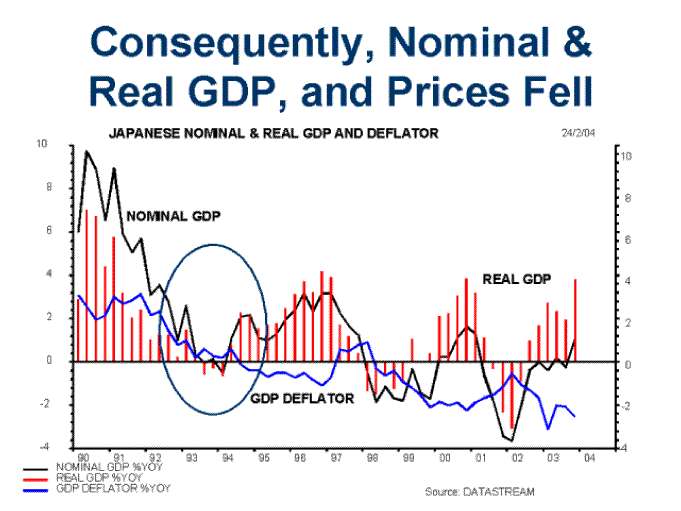

The lesson the Fed learned from the Japanese experience is: once debt deflation forces are in play, don't delay cutting rates. In a credit contraction, disinflation can get away from you quickly, driving up real rates of interest and shutting down the money creation machinery. Keep inflation above zero at all costs.

Don't let this happen

Or this

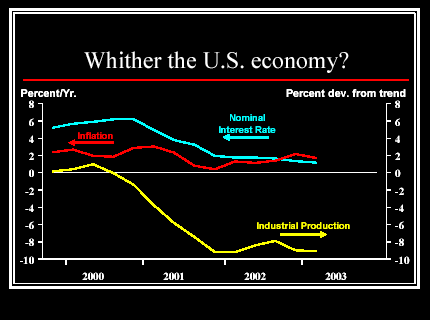

Do use all means to keep inflation above the zero bound, like this

The Greenspan Fed applied this lesson effectively after the stock market bubble crash in 2001. But that was an easier crisis to manage in many ways. A crashing stock market is a negative wealth effect sledgehammer to be sure, and managing its falling on the US economy meant flooding the system with money and creating new asset bubbles. But a stock market crash is not a credit contraction. Credit is the life blood of the economy and markets. Shut it off, and the economy quickly stalls. A technology stock bust wiped out a lot of equity, forced technology companies out of business, and wiped out a few venture capital finds. But housing bubble bust threatens to bring down the credit markets and banking system, and spread crisis to foreign buyers of securitized debt, spill over into the consumer credit markets, cutting demand for exports and wreck economy havoc generally.

The confusing and contradictory nature of the economic data may in itself be strong evidence of major dangers that confront the Fed's decision-making process.

It is of the utmost importance to realize this: given the actual facts which it was then possible for either businessman or economists to observe, those diagnoses -- or even the prognosis that, with the existing structure of debt, those facts plus a drastic fall in price level would cause major trouble but that nothing else would -- were not simply wrong. What nobody saw, though some people may have felt it, was that those fundamental data from which diagnoses and prognoses were made, were themselves in a state of flux and that they would be swamped by the torrents of a process of readjustment corresponding in magnitude to the extent of the industrial revolution of the preceding 30 years. People, for the most part, stood their ground firmly. But that ground itself was about to give way.

- Joseph A. Schumpeter, Business Cycles, 1939

As well prepared as the Fed appears to be theoretically to handle the current crisis, helicopters and all, the conditions for applying the cure this time for this purpose are far more challenging than in 2001 and 2002 when they were conceived. An already heavily depreciated dollar, already lowered taxes, a massive fiscal deficit versus a surplus, oil trading over $70 compared to $22, and a low Fed funds rate base of 5.25% all mean that the Bernanke Fed's and fiscal policy options cannot be executed today in the same hell-for-leather way they were in 2001.- Joseph A. Schumpeter, Business Cycles, 1939

The paradox is that to prevent the recession that can develop into a run-away debt deflation, the Fed needs to cut early and often, but to avoid crashing the bond market and dollar, the Fed has to wait until it sees the whites of bond and currency traders' eyes. Timing, wording, and execution will be critical. And the bond market might get it wrong, too.

As we've discussed several times in past iTulip ShadowFed meetings, in a perfect world for the Fed, a random event occurs outside the U.S. that the Fed can use as a reason to cut. The greatest challenge for the Fed is that this crisis is US-centric. As David Bloom, currency guru at HSBC, said: "The US needs a trillion dollars a year just to stand still." Modern financial crises have always begun on the peripheries of global economy, setting off a chain reaction. Mr Bloom says the seizure this time will be at the heart of the system as the dollar buckles, pressing down on the "aorta of capitalism."

Assuming the Fed pulls off a magical combination of rate cuts with global central banks' cooperation, which appears to still be in place given the ECB's recent noises about suddenly halting its rate hikes program, along with more tax cuts and fiscal stimulus to prevent a hard crash at this time, in the long run the Fed is still a one trick pony. It can print or not. When, not if, the US goes into recession in Q4 this year as unemployment begins to rise, the housing market will take its next and more serious turn down. As inflation falls toward negative rates the Fed will cut drastically. But if they wait that long, the Japanese experience is that the moves will then be too late.

iTulip Indicators of a Sharp Reaction

We are starting to collect iTulip Prosper Lending Group members data. One of our reasons for setting up the group last year was to establish a baseline so we'd have more proprietary data for the iTulip ShadowFed to use to make its decisions. We checked with a few other members informally this week and they are seeing a huge spike in defaults in August after almost no defaults before July 2007. One reported only one default among 100 loans and that was in July 2007, then six so far in August. Things can change very quickly, as I've said, and this may be an indicator. If you are an iTulip Prosper Lending Group member, please send default data to info@itulip.com.

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2007 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

)

)

Comment