Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

So does that mean you are buying more silver? Or that those who have just seen it crash are buying more? Or that central banks are about to start buying silver?

EJs silver call was spot on (dead cat bounce notwithstanding) ,brilliant and deserves utmost respect. Calling for such a major crash when many predicted a correction is what makes it so exceptional.

When it was called originally lots of people said they would be backing up trucks if it broke to 35/30/25. I don't think they will be. Even if 3 billion people already have some silver without new buyers it won't be going up.

EJ explained his thinking in numerous threads. Everything else is hot air. It was a bubble.

"Faced with the choice between changing one's mind and proving that there is no need to do so, almost everyone gets busy on the proof."

Originally posted by Camtender

View Post

EJs silver call was spot on (dead cat bounce notwithstanding) ,brilliant and deserves utmost respect. Calling for such a major crash when many predicted a correction is what makes it so exceptional.

When it was called originally lots of people said they would be backing up trucks if it broke to 35/30/25. I don't think they will be. Even if 3 billion people already have some silver without new buyers it won't be going up.

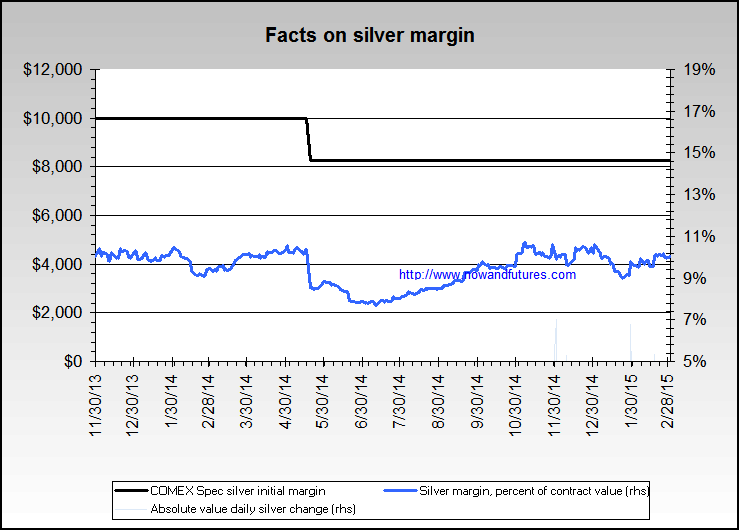

FRED, any chance you can explain which variables are considered when you generate these silver charts? I ask because, at this time, the governments/IMF/CME/Central Banks (etc) intervention in markets is so dramatic, that I'm left wondering how can anybody predict anything accuratly and *be right for the right reasons*.

"Faced with the choice between changing one's mind and proving that there is no need to do so, almost everyone gets busy on the proof."

Comment