We've received dozens of emails and phone inquiries over the past few days on EJ's Time at Last to Sell Silver ($ubscription) announcement on April 29, 2011 to inform subscribers of EJ's decision to sell all of his silver that day after holding it for ten years. As of May 5, silver prices have collapsed 27% since then.

To save time answering each inquiry on the call individually, here is a summary.

Five ways that EJ's silver sell call was unlike others you may have read:

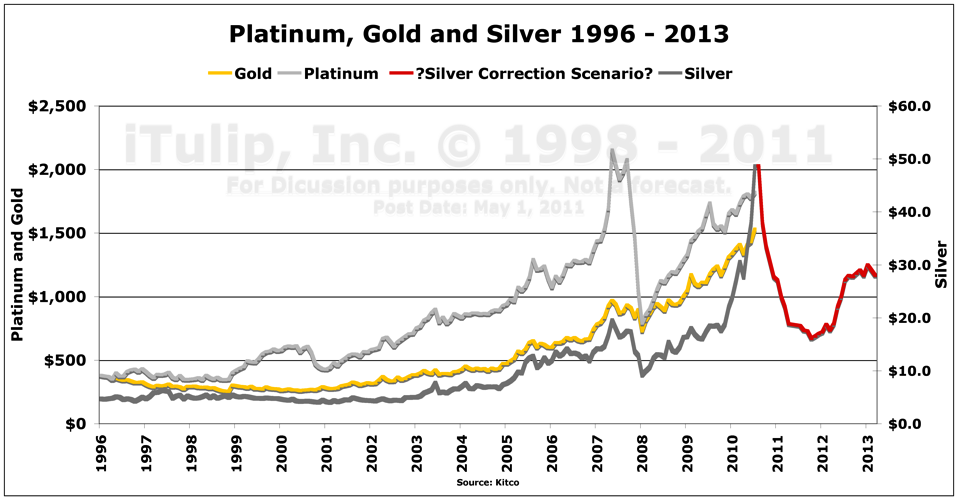

- Did not conflate silver and gold markets

Said gold was likely to fall, too, but not nearly as much as silver, and may even rise. This correction is about the silver market, not precious metals generally, or about gold. In the event, gold declined only 2.5% while silver plunged 12% at the open the next day.

- Waited 10 years to sell

Didn't buy silver a year or two ago. Bought silver in 2001 and didn't sell it until 2011. Bought silver at $4.25 in 2001 when the price averaged $4.36 for the year. At the time an ounce of gold cost 63 ounces of silver. Sold when silver traded for $48.50, at 11.4 times the price paid.

- One sell call in ten years

Unlike the stopped clocks who have been calling for a silver price correction since the price hit $20, EJ has not warned once of an imminent silver price correction before last Friday. He made one (1) sell call in ten (10) years.

- Sold within 2.5% of all time peak nominal price

On the day of that one and only silver sell call, silver reached a London fix spot price peak of $48.70. The spot price EJ locked in for his sale was $48.50.

- To-the-day timing

Starting the very next trading day, silver prices plunged 16%, the largest two day silver price decline in history.

EJ will send an ounce of gold to the first reader who can find another silver sell call that meets all of these five criteria. Five reasons why EJ sold silver on April 29 after waiting 10 years:

Reason #1: The Gold/Silver ratio hit 32, near the all time low of 27 in 1978.

Reason #2: Silver prices have risen far ahead of gold, a currency, and platinum, an industrial metal. The only possible explanation is that we are experiencing a silver bubble, likely driven by a one or more large players cornering the market.

Reason #3: The Silver Stadium is packed to overflowing. Too many rabid and poorly informed silver fans in the stands for my taste. When I got in, the Silver Stadium was virtually empty.

Reason #4: High volatility implies a turning point, as the market divides into two major groups, those who justify the historically high price that's out-of-whack with gold and platinum and those who can't. As a peak approaches, both camps get increasing nervous until the trading breaks to one side or the other. I'm betting it breaks to the downside.

Reason #5: "The pigs get fat and the hogs get slaughtered." An 11x return over 10 years is acceptable.

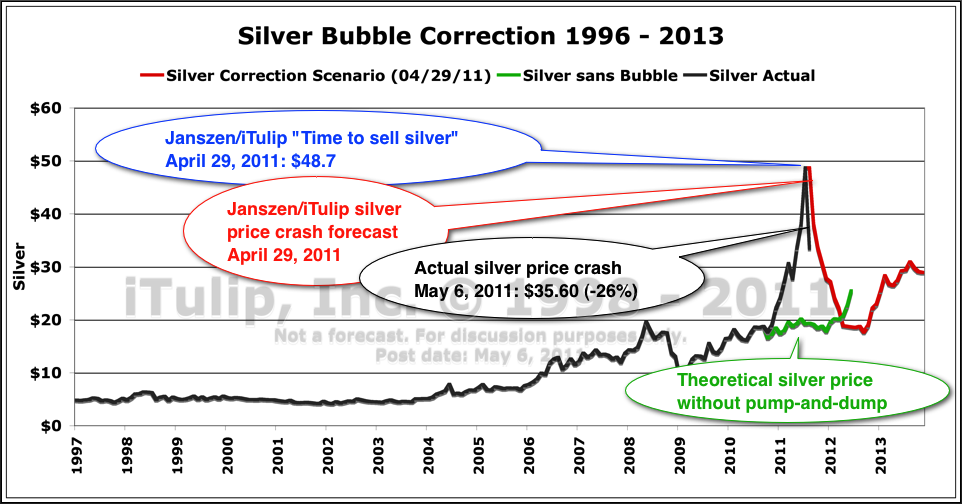

We'll use the chart below to either confirm or invalidate EJ's theory that the silver bubble is in collapse mode. It shows the actual silver price in black, a theoretical non-bubble silver price growth rate in green, and my April 29 price crash scenario in red.

Original chart posted on Sunday May 1 before the market opened in Asia. EJ's silver crash forecast is shown in red.

Last update, close of market Eastern Time May 6. We will update this chart from time to time as the silver price crash continues.

Does EJ hate silver?

EJ writes:

"On a personal note, I'm certain that many of you, like me, like silver. It was not easy for me to sell silver I'd possessed for ten years, and I did keep a small amount as a souvenir. When I buy it back, I probably will not buy 1921 silver dollars again. I enjoyed giving silver dollar coins away as tips to wait staff at restaurants and to friends as gifts. With a cost basis of $4.75, and a sell value of $10, then $20, then $30 as the price went up over the years, the novelty of a 90 year old coin communicated my feelings for the recipients perfectly: to a waiter, that I appreciated superb service, and to a friend a lasting memento of my fond wishes for their good health and success. But it's important to not get attached to one's investments. There is always a time to sell. Your silver doesn't care about you, so you should return the sentiment and view it only as a means to an end. Abstract yourself from your investments, maintain emotional distanced, and focus market dynamics -- the price action, the behavior of market participants, the macro environment, and public sentiment."

What about gold?EJ writes:

"Gold is not a bubble. It may develop into one, but I doubt it because gold unlike silver is a reserve currency, hoarded by central banks as a back-up plan in case the global monetary system breaks down, which it has been in the process of doing for the past decade. If my theory is correct that gold is a currency and will behave like a currency during a bond market and currency crisis, then gold will not become a bubble and will not correct the way a bubble does but as a currency does following the acute phase of a currency crisis. For example, gold may rise to $6000 then decline to $5000 and more or less remain there as the "new" dollar price of gold after the crisis is resolved. Calling that peak price is a non-trivial undertaking that I have been preparing for since I purchased gold in 2001."

Subscribers can click here the original Time at last to sell silver article and thread of discussion before, during, and after the silver market correction that followed.We will add the Time at Last to Sell Silver article to the list that begins in 1998.

- November 1998: Warns on Internet Bubble

- August 1999: No Y2K Disaster

- November 1999: How the Internet Bubble Will End

- March 2000: Internet Bubble Top

- April 2000: A Bear Market is Born

- January 2001: Post-Bubble Recession

- September 2001: Gold Price Bottom at US$270

- August 2002: Warns of Housing Bubble

- January 2004: How Housing Bubble will End

- January 2005: Housing Bubble Correction

- June 2005: Housing Bubble Top, crash to follow that leads to severe recession

- October 2006: Severe recession starts Q4 2007

- December 27, 2007: Start of Debt Deflation Bear Market, 40% decline to follow

- June 16, 2008: Top of commercial real estate market, crash to follow

- September 15, 2008: Fed Funds spread signals crash

- March 27, 2009: Debt Deflation Bear Market: First Bounce

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

For a concise, readable summary of iTulip concepts read Eric Janszen's 2010 book The Postcatastrophe Economy: Rebuilding America and Avoiding the Next Bubble

.

.To receive the iTulip Newsletter/Alerts, Join our FREE Email Mailing List

To join iTulip forum community FREE, click here for how to register.

Copyright © iTulip, Inc. 1998 - 2011 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Comment