Next Bubble or Last Hurrah? - Part I: Stocks and houses

• All about the stock market

• Inflation is a process, not an event

• The consumer credit surprise

The condition of high unemployment and rising cost-push inflation from high energy and food prices and a weak currency while housing prices sink doesn’t need a new name like “biflation” or some other nonsense. Inflation is a process not an event.

Monetary policy with respect to housing in the FIRE Economy and commodity prices and wages in the Productive Economy are separate but related phenomena. As asset prices in sectors of the FIRE Economy continue to deflate, inflation is developing from the early stages, when manufactures reduced package sizes and inputs quality, as we forecast, to the next stage, good old fashion goods, services, and wage price inflation.

If the Fed doesn’t get on the stick and stop it, commodity and wage price inflation is going to get ugly in the Productive Economy in the coming quarters. On the other hand, if the Fed does not act to stop it, the FIRE Economy will crash anew, with the politically critical real estate sector taking the biggest hit.

This culmination of the inherent contradiction of monetary policy objectives between the FIRE Economy and the Productive Economy is the end of the line for the either the FIRE Economy or the Productive Economy. The Fed will be forced to choose between them.

CE: Where've you been?

EJ: Traveling, traveling, and more traveling.

CI: What, did you join the Navy?

EJ: Speaking gigs, research projects, magazine articles, book proposals, and more, all producing valuable inputs into the ever-expanding iTulip worldview.

CI: What about that company you invested in and joined the board of? What is it? What do they do? How are they doing?

EJ: Article One Partners. The company does crowd sourced intellectual property search for patent validation, meaning if you are a high technology, pharmaceutical, auto manufacturer or other company that deals with patents and you need to know the quality of a patent we put our team of over a million scientists and technologists including subject experts around the world on the case. The company has more than 60 clients including 13 of the top Fortune 100. Out of that huge group a few dozen will typically be expert in a client's subject area. Researchers review all kinds of related literature, from old product brochures to obscure speeches. It’s a much more thorough process than the typical process of hiring a small team of generalists to review the patent literature, particularly for publications in foreign languages. It’s amazing what they can turn up to invalidate a claim. Conversely, worldwide brands use Article One to strengthen their patents with research that indicates that their patents are strong.

CI: How do you make money doing that?

EJ: As a researcher you are in a contest with others to be the first to get your response accepted by the client as the winning piece of evidence to a research request. If you go to the company’s web site today you can see recent $5,000 and $10,000 rewards. Close to $1 million has been awarded to researchers so far. So it’s not chump change. The company is also starting a business line for its community to identify buyers and sellers of patents in commercially valuable business areas. iTulipers who are techies, who like to sleuth for technical minutia and enjoy a good contest of wits, or are informed about the business opportunities to broker patents, will probably enjoy being an AOP researcher.

CI: And supplement their income. Cool. You mentioned in our pre-interview that a publisher asked you to write a book proposal for a new book…

EJ: The proposed book is on a topic I’m expert on but frankly I’m not sure that’s the right book for me to write just now. No book of major significance is going to get much national attention, our media being what it is today. The best economics-related books out there are the books you’ve never heard of, where they get lost in the heap of Glenn Beck type books. These books live outside the extremist framework of discussion that the FIRE Economy media creates so they get no national media attention, so you have to go look for them. The debate process is itself broken.

CI: Give me an example of a broken debate.

EJ: For example the debate about inflation or deflation as potential outcomes of the US credit bubble. They have for years been debated as equally likely and viable outcomes, when in fact one is as likely as summer in the northern hemisphere in August and the other as likely as Paris Hilton inventing a stem cell cure for cancer. The debate should have been about what kind of inflation we’ll have, that we are now having. But for a country that’s ballooned its external Treasury debt from $1.4 trillion to $4.5 trillion in six years, and faces impossible refinancing costs should interest rates rise to reflect the actual rate of default and inflation risk facing the US bond market, a debate about inevitable inflation is put off until the inflation evidence becomes undeniable. By then it’s too late for most people to protect themselves – gold, silver, and commodities prices in general will have already anticipated the event. Same deal for the stock market and housing bubbles. The system provides belief formation cover for a period of time, long enough for a group of interested parties to, for example, make off with money from sales of worthless securitized mortgage securities before the roof caves in, if you’ll excuse the pun. It’s a perverse application of the system of propaganda that Edward Bernays explained in his book titled “Propaganda” in 1928, back before the term carried negative connotations.

CI: Your book idea?

EJ: It explains how the American media operates today. Two objectives. Objective one is to arm readers with a tool for self-defense, to prevent them getting sucked into the latest scam, whether it’s like the New Economy scam of the dot com era, the dream of home ownership scam of the housing bubble, or the weapons of mass destruction scam of the Iraq War. Objective two is that you can’t fix a broken system if you don’t know how it’s broken. It’s not simply an issue of media ownership concentration. The system is more subtle than that. I haven’t seen any book that adequately explains it, and going into the Peak Cheap Oil era it will be critical for Americans to understand how opinion formation is accomplished by special interests, else the public policy response is likely to be highly unconstructive, with the vast majority of Americans passionately pushing for policies that are completely against their own interests.

CI: As they did in the case of the health care debate?

EJ: Yes, as they did in the case of the so-called health care so-called “debate.” That debate was framed by health insurance companies. The key principle is this: whoever frames the debate wins the debate. The objective for a group of interests is to narrow the debate to two positions, the average of which is a positive outcome for the interested parties. The health care “debate” was framed between death panels versus free enterprise. The health care plan we got as a result was a compromise between two absurd extremes. Imagine if the debate was instead about which approach achieves the lowest economic rents and management overhead, helps the most citizens, best promotes sickness prevention, encourages medical technology innovation, and motivates bright young people to enter the medical industry? Instead, in the end the health insurers gave up the immoral privilege of denying coverage to those who most need it, a privilege they should never of had in the first place, in exchange for 40 million new customers at taxpayer expense. Good deal for the health insurers, bad deal for the American people. And it will happen again and again and again as long as the system persists. My friends in Europe and Asia watch slack jawed at the way public policy issues are debated in the US. But most Americans have no idea how broken our media is, yet wonder why nothing gets fixed.

CI: That is an important book for the country, but do you think the national media will promote a book that criticizes the national media?

EJ: I'd write it in such as way as to stimulate debate about public policy debate itself, not vilify the media. I have friends in the media going back to my college days and they don’t like the system, either. Many are approaching retirement age and aren’t in a position to try to provoke reform from within, so it will have to be the next generation of journalists that leads the charge. This all presumes I find the time to write it.

CI: Okay, on to stocks, bonds, gold, inflation, and housing, our favorite topics. Bonds have been taking a beating. Inflation rising?

EJ: More likely the bond market is playing chicken with the Fed. What happens after June when the Fed’s latest buying program winds up? At that point the Fed will hold more Treasury debt than China and Japan combined. Bernanke floated the idea of a QE3, to keep the bond market guessing. Bond traders are testing the Fed’s resolve. I call it “walking the plank.”

CI: Investor options?

EJ: You can, like Bill Gross, bet that bond yields will continue to rise as bonds prices fall. That strategy has failed him several times in the past ten years, but in the context-free, zero-memory-world of the business media, Bill Gross getting out of Treasury bonds for the Nth time in a decade is news all over again. It’s obvious that if not for purchases by governments, the US Treasury bond market would have weakened considerably by now, and may be despite bond purchases. If this is the real deal, the beginning of the end of The Game, I’d expect gold to behave differently than it is today.

CI: Like how?

EJ: That’s outside the scope of this discussion.

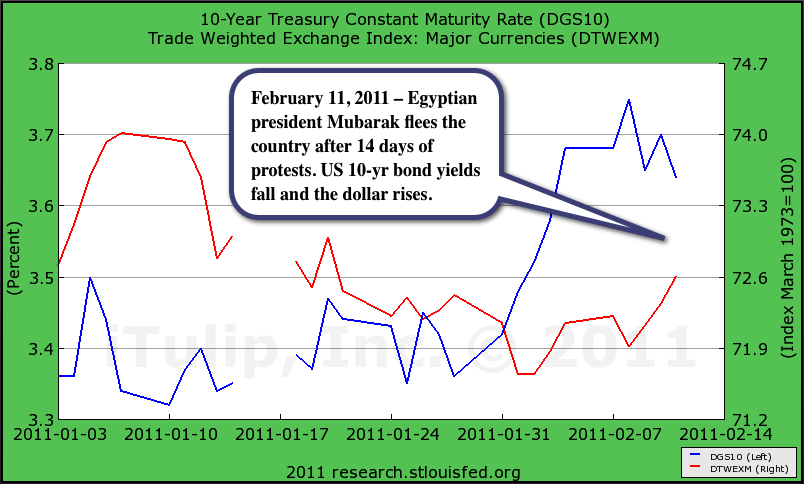

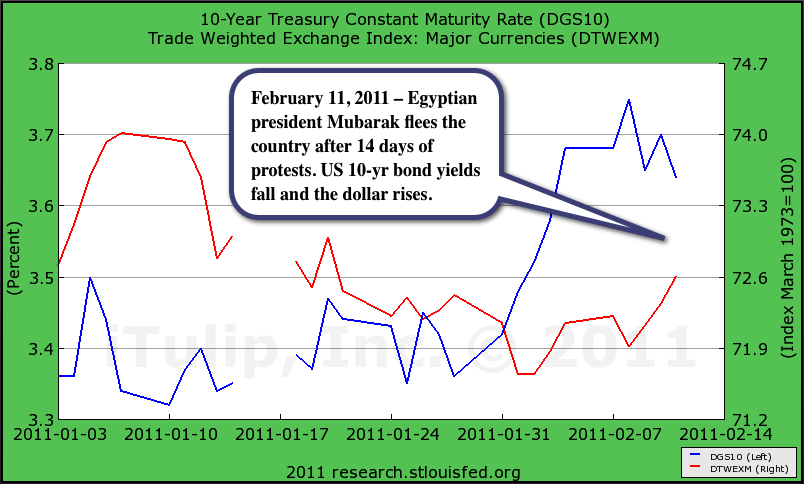

CI: But isn’t Bill Gross’s point in that CNBC interview that the political crisis in Egypt failed to cause the usual flight to safety response, to the dollar and into 10-year Treasury bonds, didn’t happen?

EJ: Yes, but it’s a question of interpretation.

The market indeed did the opposite of a flight to safety response. One interpretation is that the dollar and US bonds are no longer considered safe by foreign investors. That’s Gross’s read. Another interpretation is that market participants were not worried about the outcome of the Egyptian uprising, so there was no capital taking flight. I think it’s partly the latter and partly the fact that other factors effecting dollar value and bond yields are more important, in particular the Fed’s post-bubble bind, the contradiction between the need to continue to reflate, to maintain negative real interest rates to manage debt deflation in the real estate market, and the need to manage inflation expectations in a Peak Cheap Oil world. The entire global monetary system has to be revamped to take ever-rising energy costs into account, but no one knows how to do it.

CI: What do you think of the views of authors who think the US is a nation of half-wits that the world hates?

EJ: Not much. The US is the most under-appreciated nation on earth by North Americans themselves. In speeches I explain the reason: only 10% of Americans even have a passport and less than 5% of them use it more than once ever few years. In my travels outside the US I don’t experience the majority as hating America. They are disappointed in us because of recent screw-ups, but still see the American experiment in individual liberty and economic freedom as the most successful to date. We’re the model, the best incarnation of an ideal so far. But we do have to keep fighting to keep it, and at this time I think addressing the dysfunctional media issue is a first priority. Other countries will continue to aspire to the model if we maintain it. That is our responsibility.

CI: Back to bond markets, where the rubber meets the road. Are US lenders running negative real rates?

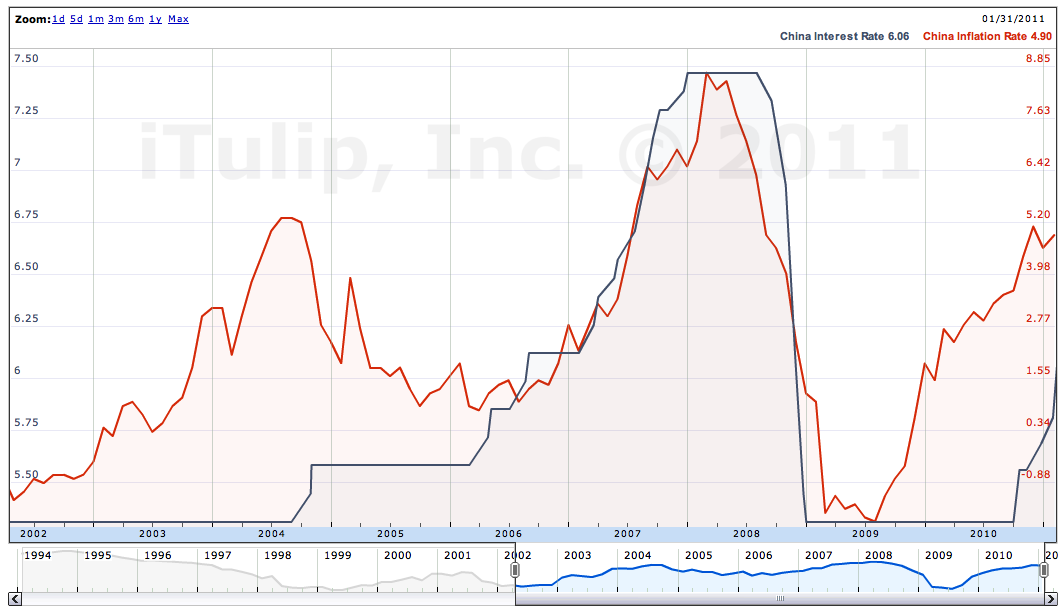

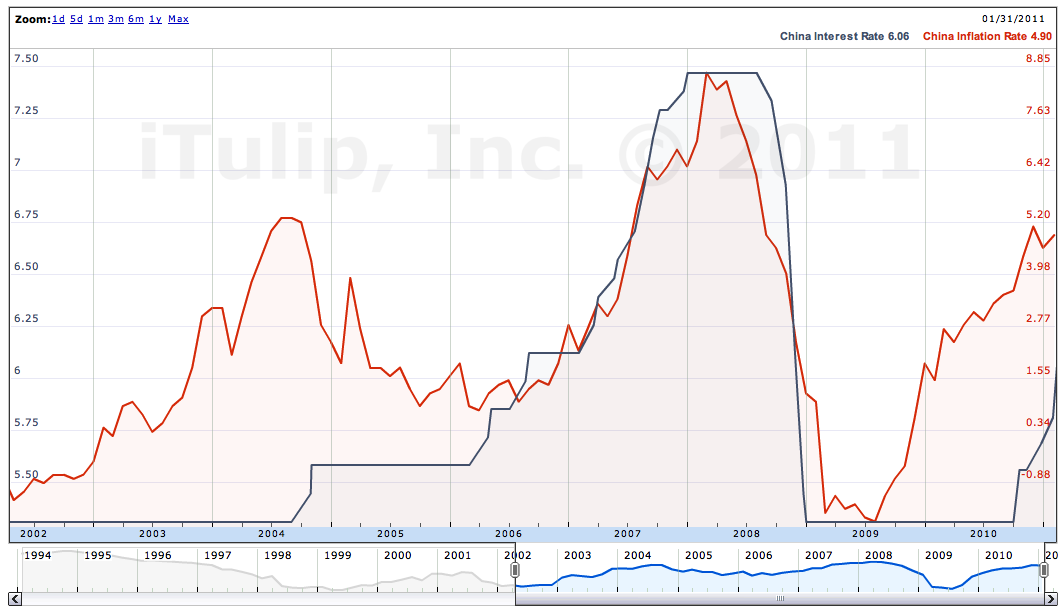

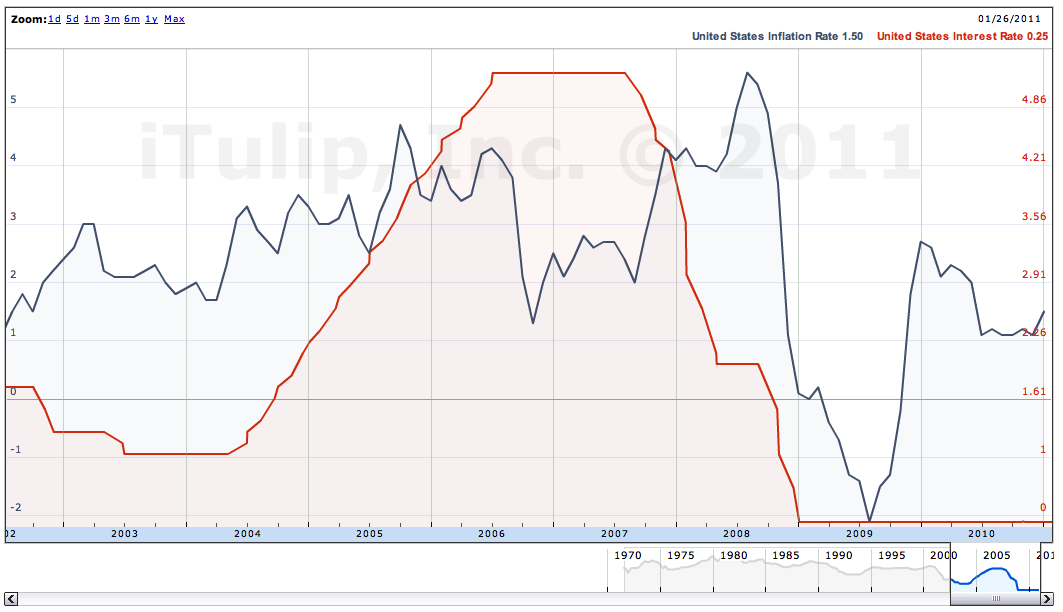

EJ: Consider these two charts. The first shows interest rates and inflation in China from Jan. 2002 to Jan. 2011. Notice that as inflation has begun to rise from near zero in early 2009 to near 5% in early 2011, and interest rates have risen from 5% to nearly 6%. If the People’s Bank of China remains true to form, it will keep cranking rates up as it did in 2008 when inflation peaked at over 8% before the US-centric financial crisis and resulting global economic mess saved China from having to chase inflation up the yield curve.

Rising inflation and interest rates in China

CI: The chase started in 2003, the beginning of the first Peak Cheap Oil cycle.

EJ: Yes. Now let’s look at the US.

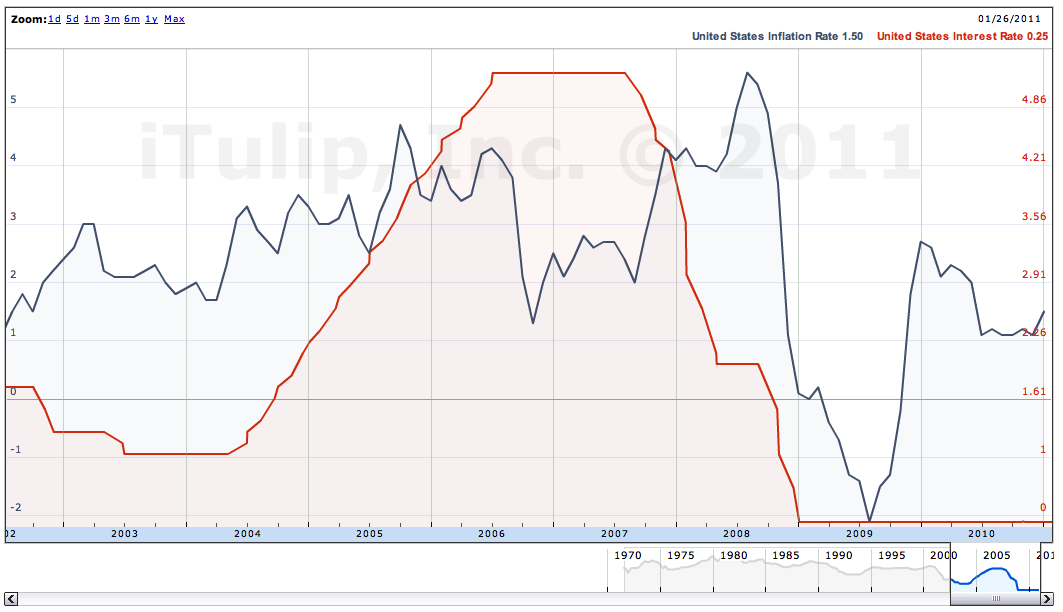

Rising inflation but not interest rates in the US

After a brief decline and leveling off of inflation in 2009 and 2010, inflation is on the rise, but interest rates remain officially a full 2.4% under the official inflation rate.

CI: By “inflation” in the charts you mean PPI finished goods, your preferred measure?

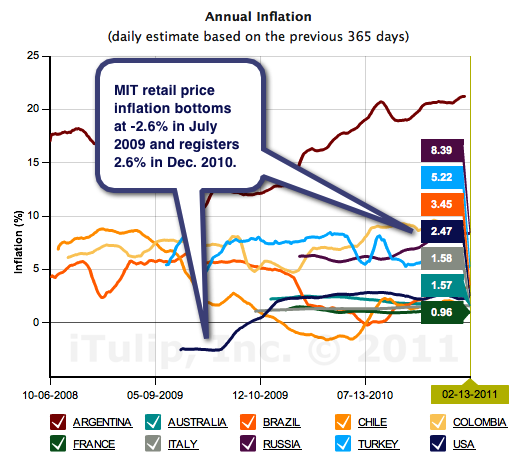

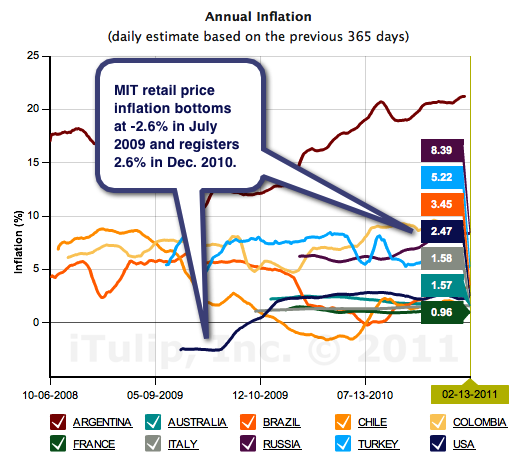

EJ: No, this comparison uses the officially reported CPI numbers for each country. It’s useful insofar as it indicates real rates of interest. MIT recently launched a new service called the Billion Prices Project that monitors “daily price fluctuations of ~5 million items sold by ~300 online retailers in more than 70 countries.”

Given that these are online-only retail prices, you’d expect a strong discounting bias in the data. Nonetheless, the index picks up a full point more inflation than the CPI does.

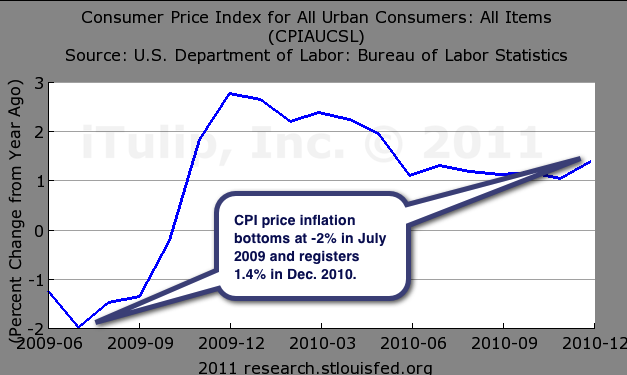

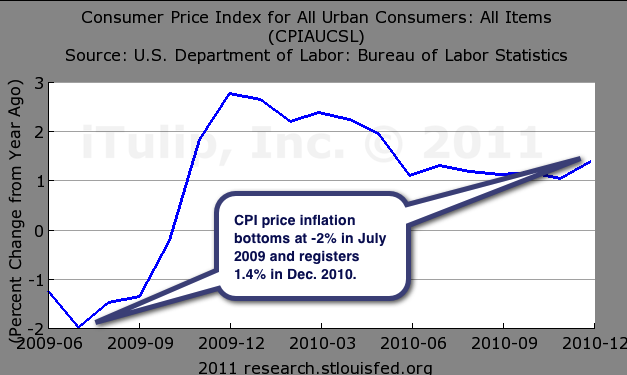

CPI inflation by the BLS

The CPI registered a deflation bottom of -2% in December 2010 – the bottom limit that we forecast, by the way – peaked just below 3% in Dec. 2009, and then fell to 1.4% inflation in December 2010, in time for Bernanke’s 60 Minutes appearance for a discussion of deflation threats. The MIT inflation index registered a -2.6% deflation bottom, as you’d expect when they were measuring the retail FIRE sale we talked about in 2008, as dozens of retailers went belly up, and stood at 2.5% in Dec. 2010, at the time of Bernanke’s deflation protest. Again, the measure likely understates inflation because of the online-only price data sourcing. It’s at least 3% if not higher.

CPI inflation by MIT

CI: “So who are you going to believe, me or your own eyes?”

EJ: It’ll stop being funny by Q3.

Next Bubble or Last Hurrah? - Part I: Stocks versus everything

Orlando, Florida, January 2011 (Photo credit: Eric Janszen)

CI: Is that why are stocks up? Inflation?

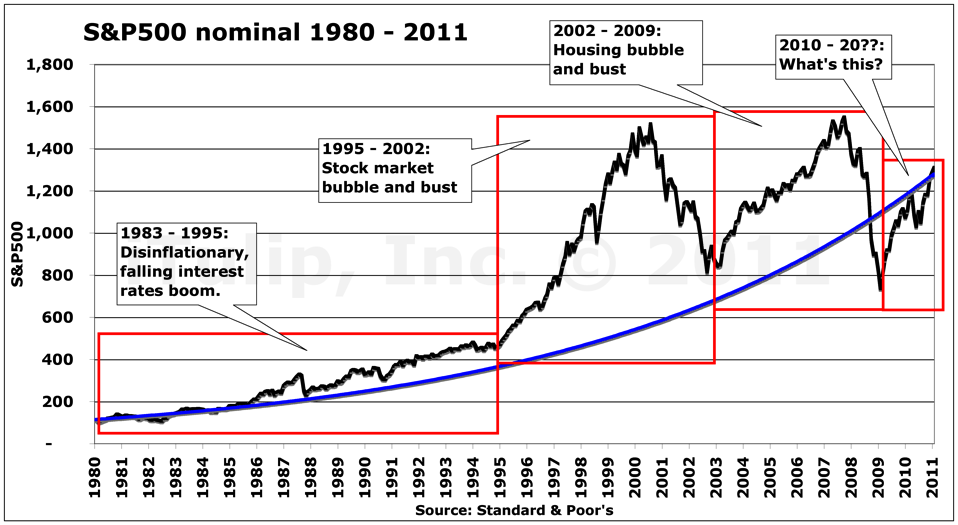

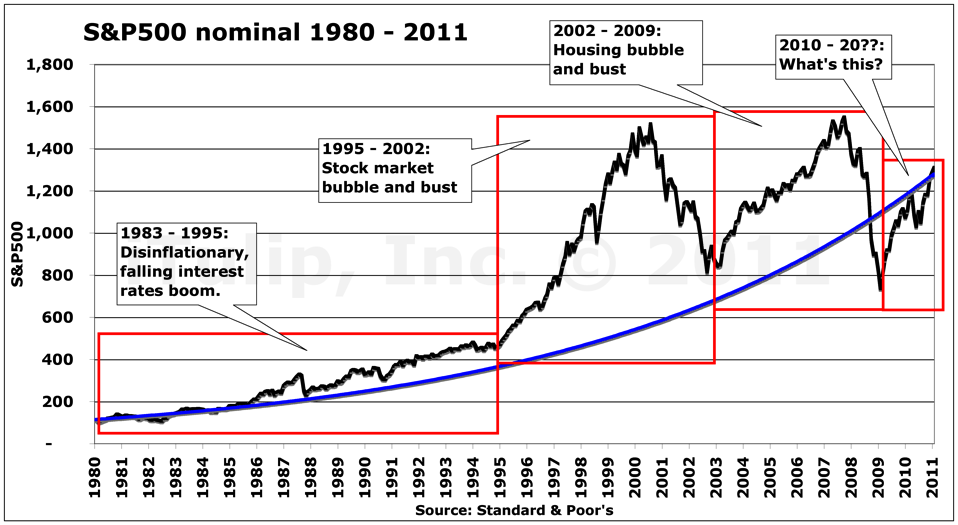

EJ: The usual reasons, plus a few new ones. There’s the pig pile effect of fund managers throwing in the towel and jumping in because they look bad sitting on the sidelines while their braver competition that got back in earlier rakes in the big returns. Every quarter that a fund manager sits out the party, the more painful it is. Then there’s the escape from bonds into stocks to balance inflation risks. But any discussion of the stock market requires historical context.

Since the birth of the FIRE Economy in the early 1980s, the US stock markets have gone through three distinct periods that correlate to developments in the political economy. The first is the 1983 – 1995 disinflationary boom as interest rates fell. The debt structure of the entire economy was re-financed at ever lower interest rates for 12 years. Next came the 1995 – 2002 stock market bubble and bust that developed out of the extraordinary changes in reserves rules and regs (see What Really Happened in 1995?). Next came the 2002 – 2009 housing bubble and bust housing bubble and bust. Finally, we get to the period we are in today. more... $subscription...

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

For a concise, readable summary of iTulip concepts read Eric Janszen's 2010 book The Postcatastrophe Economy: Rebuilding America and Avoiding the Next Bubble .

.

To receive the iTulip Newsletter/Alerts, Join our FREE Email Mailing List

To join iTulip forum community FREE, click here for how to register.

Copyright © iTulip, Inc. 1998 - 2010 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Times Square, New York City, January 2011 (Photo credit: Eric Janszen)

• All about the stock market

• Inflation is a process, not an event

• The consumer credit surprise

The condition of high unemployment and rising cost-push inflation from high energy and food prices and a weak currency while housing prices sink doesn’t need a new name like “biflation” or some other nonsense. Inflation is a process not an event.

Monetary policy with respect to housing in the FIRE Economy and commodity prices and wages in the Productive Economy are separate but related phenomena. As asset prices in sectors of the FIRE Economy continue to deflate, inflation is developing from the early stages, when manufactures reduced package sizes and inputs quality, as we forecast, to the next stage, good old fashion goods, services, and wage price inflation.

If the Fed doesn’t get on the stick and stop it, commodity and wage price inflation is going to get ugly in the Productive Economy in the coming quarters. On the other hand, if the Fed does not act to stop it, the FIRE Economy will crash anew, with the politically critical real estate sector taking the biggest hit.

This culmination of the inherent contradiction of monetary policy objectives between the FIRE Economy and the Productive Economy is the end of the line for the either the FIRE Economy or the Productive Economy. The Fed will be forced to choose between them.

CE: Where've you been?

EJ: Traveling, traveling, and more traveling.

CI: What, did you join the Navy?

EJ: Speaking gigs, research projects, magazine articles, book proposals, and more, all producing valuable inputs into the ever-expanding iTulip worldview.

CI: What about that company you invested in and joined the board of? What is it? What do they do? How are they doing?

EJ: Article One Partners. The company does crowd sourced intellectual property search for patent validation, meaning if you are a high technology, pharmaceutical, auto manufacturer or other company that deals with patents and you need to know the quality of a patent we put our team of over a million scientists and technologists including subject experts around the world on the case. The company has more than 60 clients including 13 of the top Fortune 100. Out of that huge group a few dozen will typically be expert in a client's subject area. Researchers review all kinds of related literature, from old product brochures to obscure speeches. It’s a much more thorough process than the typical process of hiring a small team of generalists to review the patent literature, particularly for publications in foreign languages. It’s amazing what they can turn up to invalidate a claim. Conversely, worldwide brands use Article One to strengthen their patents with research that indicates that their patents are strong.

CI: How do you make money doing that?

EJ: As a researcher you are in a contest with others to be the first to get your response accepted by the client as the winning piece of evidence to a research request. If you go to the company’s web site today you can see recent $5,000 and $10,000 rewards. Close to $1 million has been awarded to researchers so far. So it’s not chump change. The company is also starting a business line for its community to identify buyers and sellers of patents in commercially valuable business areas. iTulipers who are techies, who like to sleuth for technical minutia and enjoy a good contest of wits, or are informed about the business opportunities to broker patents, will probably enjoy being an AOP researcher.

CI: And supplement their income. Cool. You mentioned in our pre-interview that a publisher asked you to write a book proposal for a new book…

EJ: The proposed book is on a topic I’m expert on but frankly I’m not sure that’s the right book for me to write just now. No book of major significance is going to get much national attention, our media being what it is today. The best economics-related books out there are the books you’ve never heard of, where they get lost in the heap of Glenn Beck type books. These books live outside the extremist framework of discussion that the FIRE Economy media creates so they get no national media attention, so you have to go look for them. The debate process is itself broken.

CI: Give me an example of a broken debate.

EJ: For example the debate about inflation or deflation as potential outcomes of the US credit bubble. They have for years been debated as equally likely and viable outcomes, when in fact one is as likely as summer in the northern hemisphere in August and the other as likely as Paris Hilton inventing a stem cell cure for cancer. The debate should have been about what kind of inflation we’ll have, that we are now having. But for a country that’s ballooned its external Treasury debt from $1.4 trillion to $4.5 trillion in six years, and faces impossible refinancing costs should interest rates rise to reflect the actual rate of default and inflation risk facing the US bond market, a debate about inevitable inflation is put off until the inflation evidence becomes undeniable. By then it’s too late for most people to protect themselves – gold, silver, and commodities prices in general will have already anticipated the event. Same deal for the stock market and housing bubbles. The system provides belief formation cover for a period of time, long enough for a group of interested parties to, for example, make off with money from sales of worthless securitized mortgage securities before the roof caves in, if you’ll excuse the pun. It’s a perverse application of the system of propaganda that Edward Bernays explained in his book titled “Propaganda” in 1928, back before the term carried negative connotations.

CI: Your book idea?

EJ: It explains how the American media operates today. Two objectives. Objective one is to arm readers with a tool for self-defense, to prevent them getting sucked into the latest scam, whether it’s like the New Economy scam of the dot com era, the dream of home ownership scam of the housing bubble, or the weapons of mass destruction scam of the Iraq War. Objective two is that you can’t fix a broken system if you don’t know how it’s broken. It’s not simply an issue of media ownership concentration. The system is more subtle than that. I haven’t seen any book that adequately explains it, and going into the Peak Cheap Oil era it will be critical for Americans to understand how opinion formation is accomplished by special interests, else the public policy response is likely to be highly unconstructive, with the vast majority of Americans passionately pushing for policies that are completely against their own interests.

CI: As they did in the case of the health care debate?

EJ: Yes, as they did in the case of the so-called health care so-called “debate.” That debate was framed by health insurance companies. The key principle is this: whoever frames the debate wins the debate. The objective for a group of interests is to narrow the debate to two positions, the average of which is a positive outcome for the interested parties. The health care “debate” was framed between death panels versus free enterprise. The health care plan we got as a result was a compromise between two absurd extremes. Imagine if the debate was instead about which approach achieves the lowest economic rents and management overhead, helps the most citizens, best promotes sickness prevention, encourages medical technology innovation, and motivates bright young people to enter the medical industry? Instead, in the end the health insurers gave up the immoral privilege of denying coverage to those who most need it, a privilege they should never of had in the first place, in exchange for 40 million new customers at taxpayer expense. Good deal for the health insurers, bad deal for the American people. And it will happen again and again and again as long as the system persists. My friends in Europe and Asia watch slack jawed at the way public policy issues are debated in the US. But most Americans have no idea how broken our media is, yet wonder why nothing gets fixed.

CI: That is an important book for the country, but do you think the national media will promote a book that criticizes the national media?

EJ: I'd write it in such as way as to stimulate debate about public policy debate itself, not vilify the media. I have friends in the media going back to my college days and they don’t like the system, either. Many are approaching retirement age and aren’t in a position to try to provoke reform from within, so it will have to be the next generation of journalists that leads the charge. This all presumes I find the time to write it.

CI: Okay, on to stocks, bonds, gold, inflation, and housing, our favorite topics. Bonds have been taking a beating. Inflation rising?

EJ: More likely the bond market is playing chicken with the Fed. What happens after June when the Fed’s latest buying program winds up? At that point the Fed will hold more Treasury debt than China and Japan combined. Bernanke floated the idea of a QE3, to keep the bond market guessing. Bond traders are testing the Fed’s resolve. I call it “walking the plank.”

CI: Investor options?

EJ: You can, like Bill Gross, bet that bond yields will continue to rise as bonds prices fall. That strategy has failed him several times in the past ten years, but in the context-free, zero-memory-world of the business media, Bill Gross getting out of Treasury bonds for the Nth time in a decade is news all over again. It’s obvious that if not for purchases by governments, the US Treasury bond market would have weakened considerably by now, and may be despite bond purchases. If this is the real deal, the beginning of the end of The Game, I’d expect gold to behave differently than it is today.

CI: Like how?

EJ: That’s outside the scope of this discussion.

CI: But isn’t Bill Gross’s point in that CNBC interview that the political crisis in Egypt failed to cause the usual flight to safety response, to the dollar and into 10-year Treasury bonds, didn’t happen?

EJ: Yes, but it’s a question of interpretation.

The market indeed did the opposite of a flight to safety response. One interpretation is that the dollar and US bonds are no longer considered safe by foreign investors. That’s Gross’s read. Another interpretation is that market participants were not worried about the outcome of the Egyptian uprising, so there was no capital taking flight. I think it’s partly the latter and partly the fact that other factors effecting dollar value and bond yields are more important, in particular the Fed’s post-bubble bind, the contradiction between the need to continue to reflate, to maintain negative real interest rates to manage debt deflation in the real estate market, and the need to manage inflation expectations in a Peak Cheap Oil world. The entire global monetary system has to be revamped to take ever-rising energy costs into account, but no one knows how to do it.

CI: What do you think of the views of authors who think the US is a nation of half-wits that the world hates?

EJ: Not much. The US is the most under-appreciated nation on earth by North Americans themselves. In speeches I explain the reason: only 10% of Americans even have a passport and less than 5% of them use it more than once ever few years. In my travels outside the US I don’t experience the majority as hating America. They are disappointed in us because of recent screw-ups, but still see the American experiment in individual liberty and economic freedom as the most successful to date. We’re the model, the best incarnation of an ideal so far. But we do have to keep fighting to keep it, and at this time I think addressing the dysfunctional media issue is a first priority. Other countries will continue to aspire to the model if we maintain it. That is our responsibility.

CI: Back to bond markets, where the rubber meets the road. Are US lenders running negative real rates?

EJ: Consider these two charts. The first shows interest rates and inflation in China from Jan. 2002 to Jan. 2011. Notice that as inflation has begun to rise from near zero in early 2009 to near 5% in early 2011, and interest rates have risen from 5% to nearly 6%. If the People’s Bank of China remains true to form, it will keep cranking rates up as it did in 2008 when inflation peaked at over 8% before the US-centric financial crisis and resulting global economic mess saved China from having to chase inflation up the yield curve.

Rising inflation and interest rates in China

CI: The chase started in 2003, the beginning of the first Peak Cheap Oil cycle.

EJ: Yes. Now let’s look at the US.

Rising inflation but not interest rates in the US

After a brief decline and leveling off of inflation in 2009 and 2010, inflation is on the rise, but interest rates remain officially a full 2.4% under the official inflation rate.

CI: By “inflation” in the charts you mean PPI finished goods, your preferred measure?

EJ: No, this comparison uses the officially reported CPI numbers for each country. It’s useful insofar as it indicates real rates of interest. MIT recently launched a new service called the Billion Prices Project that monitors “daily price fluctuations of ~5 million items sold by ~300 online retailers in more than 70 countries.”

Given that these are online-only retail prices, you’d expect a strong discounting bias in the data. Nonetheless, the index picks up a full point more inflation than the CPI does.

CPI inflation by the BLS

The CPI registered a deflation bottom of -2% in December 2010 – the bottom limit that we forecast, by the way – peaked just below 3% in Dec. 2009, and then fell to 1.4% inflation in December 2010, in time for Bernanke’s 60 Minutes appearance for a discussion of deflation threats. The MIT inflation index registered a -2.6% deflation bottom, as you’d expect when they were measuring the retail FIRE sale we talked about in 2008, as dozens of retailers went belly up, and stood at 2.5% in Dec. 2010, at the time of Bernanke’s deflation protest. Again, the measure likely understates inflation because of the online-only price data sourcing. It’s at least 3% if not higher.

CPI inflation by MIT

CI: “So who are you going to believe, me or your own eyes?”

EJ: It’ll stop being funny by Q3.

Next Bubble or Last Hurrah? - Part I: Stocks versus everything

Orlando, Florida, January 2011 (Photo credit: Eric Janszen)

CI: Is that why are stocks up? Inflation?

EJ: The usual reasons, plus a few new ones. There’s the pig pile effect of fund managers throwing in the towel and jumping in because they look bad sitting on the sidelines while their braver competition that got back in earlier rakes in the big returns. Every quarter that a fund manager sits out the party, the more painful it is. Then there’s the escape from bonds into stocks to balance inflation risks. But any discussion of the stock market requires historical context.

Since the birth of the FIRE Economy in the early 1980s, the US stock markets have gone through three distinct periods that correlate to developments in the political economy. The first is the 1983 – 1995 disinflationary boom as interest rates fell. The debt structure of the entire economy was re-financed at ever lower interest rates for 12 years. Next came the 1995 – 2002 stock market bubble and bust that developed out of the extraordinary changes in reserves rules and regs (see What Really Happened in 1995?). Next came the 2002 – 2009 housing bubble and bust housing bubble and bust. Finally, we get to the period we are in today. more... $subscription...

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

For a concise, readable summary of iTulip concepts read Eric Janszen's 2010 book The Postcatastrophe Economy: Rebuilding America and Avoiding the Next Bubble

.

.To receive the iTulip Newsletter/Alerts, Join our FREE Email Mailing List

To join iTulip forum community FREE, click here for how to register.

Copyright © iTulip, Inc. 1998 - 2010 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

They are liars and mass-murderers.

They are liars and mass-murderers.

Comment