2010 Review and 2011 Forecast - Part I: Down the rabbit hole we go

Confusion is a word we have invented for an order that is not understood.

- Henry Miller (1891 - 1980)

We are taught to be ashamed of confusion, anger, fear and sadness, and to me they are of equal value as happiness excitement and inspiration.

- Alanis Morissette (1974 - )

If confusion is the first step to knowledge, I must be a genius.

- Larry Leissner

CI: Where you been?- Henry Miller (1891 - 1980)

We are taught to be ashamed of confusion, anger, fear and sadness, and to me they are of equal value as happiness excitement and inspiration.

- Alanis Morissette (1974 - )

If confusion is the first step to knowledge, I must be a genius.

- Larry Leissner

EJ: Drilling. Dreaming. Pulling my hair out, what’s left of it.

CI: For what?

EJ: New discoveries. Quite a few dry holes, sad to say, but also a few insights, enough to keep me going. That and the warm and generous holiday cards we’ve received from so many of you. Thank you.

CI: Such as…

EJ: Mining the Treasury Department data to build a US Bond and Currency Crisis Dashboard, we find some interesting changes in the behavior of private and official foreign investors in the US securities.

CI: US Bond and Currency Crisis Dashboard?

EJ: The bond and currency crisis we have called KaPoom since 1999 is approaching, but is still perhaps several years away, or maybe not. That’s part of the confusion.

CI: Confusion?

EJ: Anyone who studies the data who does not admit to confusion is either approaching it too simply or is not admitting the fact that the data, in the traditional framework of interpretation, it makes little sense. It didn’t make any sense in 1995 either when I started the research that developed into iTulip.com three years later, but after crunching the data and reading the history of such eras, the outcome became clear by 1999: asset bubbles. Now we’re in a netherworld. Suspended animation. Waiting for the other shoe to drop. Pick your favorite turn of phrase, but “it” is not over yet. “It” has only yet begun. The question is, what is it, exactly?

CI: What’s in the Treasury data?

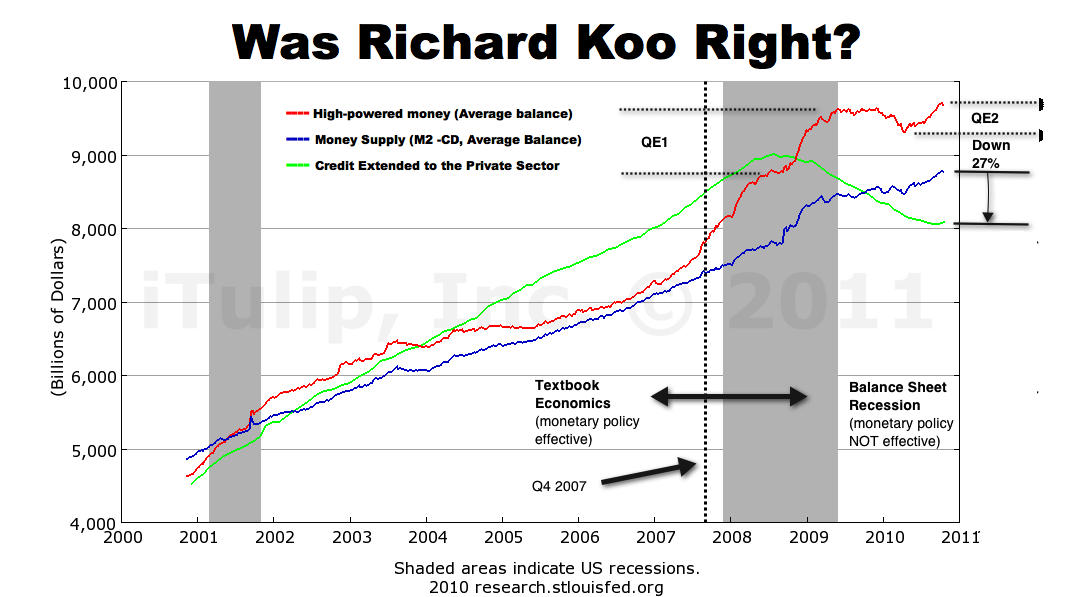

EJ: A shift in preference toward government debt and away from private sector debt occurred after the Housing Bust Recession and persists well into the “recovery.”

CI: You mean The Great Recession?

EJ: No, that’s the Bullhorn name for it. I’ll never call it that. You have to call a thing what it is. I think Alice will back me up on this. The recession resulted from the collapse of the private credit markets. That resulted from credit risk that accumulated during the years of the housing bubble that was financed with over-rated debt securities. The over-rating was due to regulatory capture. It’s all laid out in the article I wrote for Harper’s in 2007 that was published in early 2008. So how can I call it a Great Recession? That makes it sound like an unfortunate accident rather than the predictable disastrous outcome of reckless and unscrupulous behavior that it was. Am I to join the dreamers who can’t remember what happened? No, I cannot help but remember. The next crisis is equally predicable. It too will be portrayed as an accident, even though it will follow as logically and inexorably from its antecedents as the Housing Bust Recession followed from its own. All are episodes in a long, continuous process of cleaning accumulated errors stretching back 40 years, errors rooted in set of politically expedient economic fallacies.

If I’ve learned anything over the 15 years I’ve been at this, the crowd cannot tell if it is awake or dreaming, and so it accepts these events as curious and random as in a dream. I was interviewed by a prestigious magazine today for a story I’m to write for them, due shortly. I explained to the editor why I never use the words “green” or “clean” energy in my book. Was it really so long ago that American truckers sat idle because the cost of diesel fuel ate up their profits, and the public transportation systems of every major city groaned under the strain of millions of commuters who could not longer pay for the gasoline for their cars? That was in the spring of 2008, only two and half years ago. Did that really happen or did we dream it? If it was real and it happens again, but in a more extreme way because both oil supply and currency weakness will feed into the process, there won't be many green minded citizens around. Who will care about the environment when most can’t afford to drive to work? Peak Cheap Oil means we will rip the planet to shreds for the last drop of oil and lump of coal, I explained to the editor. Money is the green that we really care about. I thought she was going to cry. I felt bad, so I lightened it up with some gung-ho “We’re Americans, goddammit!” stuff about how we'll pull together and fix it, and she brightened.

CI: How do we come to believe these fallacies?

EJ: We humans cannot see much beyond our own perceived – usually misperceived – self-interest. We see an idea that we think benefits us as a good idea, and one that we think doesn’t benefit us as a bad idea. Since 2006 I talked about the dangers posed by government subsidies to the housing industry, but because most of us benefited from those subsidies no one wanted to hear it. In fact the use of the term “subsidy” and “housing” in the same sentence elicited not protest but confusion. Garlic before vampires. It wasn’t just that the idea that we, the American homeowners, were beneficiaries of government largess was objectionable but the crowd was blind to the very fact of these subsidies as such, the interest rate deductions and loan guarantees. The same principle applies to government price fixing of exchange rates and interest rates via sales of government securities. As long as it appears to be working, keeping the dollar from caving and interest rates from rising, and paying the federal government’s bills, these practices are not only accepted but are not seen as price fixing per se, but that’s what they are. I mean, what else can you call a monetary and trade system predicated on the uneconomical investment by foreign central banks and other official entities in trillions of dollars of government securities?

CI: Can you verify that?

EJ: In “China’s Holdings of U.S. Securities: Implications for the U.S. Economy,” a 2008 Congressional Research Office report, begins: “Given its relatively low savings rate, the U.S. economy depends heavily on foreign capital inflows from countries with high savings rates (such as China) to help promote growth and to fund the federal budget deficit.”

Where’s the mystery here? That’s “fund the federal budget deficit” not the trade deficit but a negative federal savings rate. If the United States was behaving like the United States used to, then okay, maybe, except that the lending itself encourages all kinds of bad behavior.

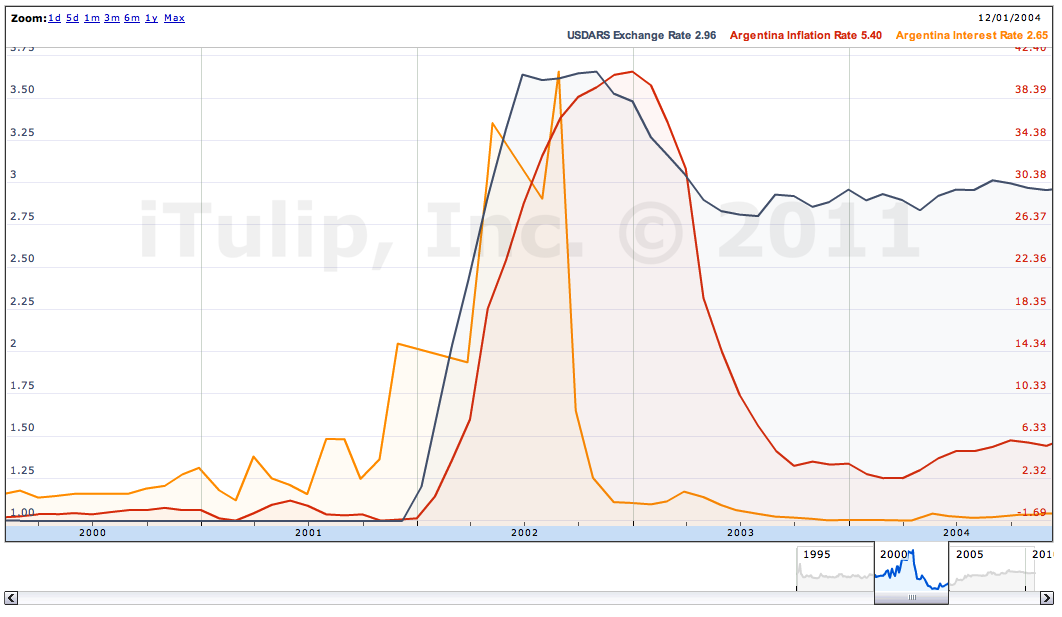

Put yourself in their shoes. How’d you like to fund Argentina’s federal budget deficit with your savings, or Jamaica’s or Zimbabwe’s? It’s politically unsustainable.

Here’s how Paul Volcker put it recently.

Paul Volcker warns the dollar's "exceptional role" is in danger as U.S. influence declines

Bloomberg: December 2, 2010

"This is a troubling time for America, a troubling time for the world," ex-Fed chief says

Former Federal Reserve Chairman Paul Volcker, who is chairman of President Barack Obama's Economic Recovery Advisory Board, said the U.S. dollar is in danger of losing its role as a global benchmark currency.

"The growing question is whether the exceptional role of the dollar can be maintained," Volcker told a gathering of New York civic leaders at the University Club of New York.

The decline of the U.S. economy, political gridlock at home, U.S. involvement in two wars and "festering" geopolitical issues in the Middle East and Asia have undermined the ability of the U.S. to influence global events, Volcker said.

"This is a troubling time for America, a troubling time for the world," Volcker said in remarks to Common Cause, a civic group. He said the U.S. is facing its most difficult economic crisis since World War II. "If ever there were a need for clear-headed, confident leadership, nationally and internationally, that time is now."

Even as the U.S. remains the world's pre-eminent nation by default, Volcker said, its example no longer inspires other countries to trust U.S. leadership. He said the U.S. is hobbled by lobbyists and an unwillingness to pass realistic budgets, as well as a civil service that he said has lost its ability to attract America's best and brightest to public service.

"The time is gone when the U.S. could lay claim as the putative superpower with both unchallenged economic and military might," Volcker said.

"The growing sense around much of the world is that we have lost both relative economic strength and, more importantly, we have lost a coherent successful governing model to be emulated by the rest of the world," Volcker said. "Instead, we're faced with broken financial markets, underperformance of our economy and a fractious political climate."

CI: That about sums it up. Isn’t that what he told you when you met him at the University Club last summer? Did he read your book?Bloomberg: December 2, 2010

"This is a troubling time for America, a troubling time for the world," ex-Fed chief says

Former Federal Reserve Chairman Paul Volcker, who is chairman of President Barack Obama's Economic Recovery Advisory Board, said the U.S. dollar is in danger of losing its role as a global benchmark currency.

"The growing question is whether the exceptional role of the dollar can be maintained," Volcker told a gathering of New York civic leaders at the University Club of New York.

The decline of the U.S. economy, political gridlock at home, U.S. involvement in two wars and "festering" geopolitical issues in the Middle East and Asia have undermined the ability of the U.S. to influence global events, Volcker said.

"This is a troubling time for America, a troubling time for the world," Volcker said in remarks to Common Cause, a civic group. He said the U.S. is facing its most difficult economic crisis since World War II. "If ever there were a need for clear-headed, confident leadership, nationally and internationally, that time is now."

Even as the U.S. remains the world's pre-eminent nation by default, Volcker said, its example no longer inspires other countries to trust U.S. leadership. He said the U.S. is hobbled by lobbyists and an unwillingness to pass realistic budgets, as well as a civil service that he said has lost its ability to attract America's best and brightest to public service.

"The time is gone when the U.S. could lay claim as the putative superpower with both unchallenged economic and military might," Volcker said.

"The growing sense around much of the world is that we have lost both relative economic strength and, more importantly, we have lost a coherent successful governing model to be emulated by the rest of the world," Volcker said. "Instead, we're faced with broken financial markets, underperformance of our economy and a fractious political climate."

EJ: Who knows. Besides trying to work out our investing future for all my friends here, I have a growing list of keynote speeches on the docket for the coming months. I love to do these things and I think the experience brings value to the iTulip community but it does take me away from the analysis and writing.

CI: Such as?

EJ: Two weeks ago I presented to a group of CEOs and managers of cable companies, and by that I mean everything from mining companies that dig the copper out of the ground that go into the cables to the companies that manufacture the shielding to the guys that stick a connector on each end. Some serve the government market, others the computer and telecom industry. What a great group of people. These are the folks who actually create jobs. They deserve all of the respect we can give them but they get very little. The current administration likes the idea of job creation but not actual job creation because if they did they have at least one person on the economic team who’d ever been responsible for making payroll. In a perfect world according to EJ, no one is allowed to run for elected office unless they have made payroll for at least three years, and in a industry not subsidized by the government.

CI: What did they want to hear from you?

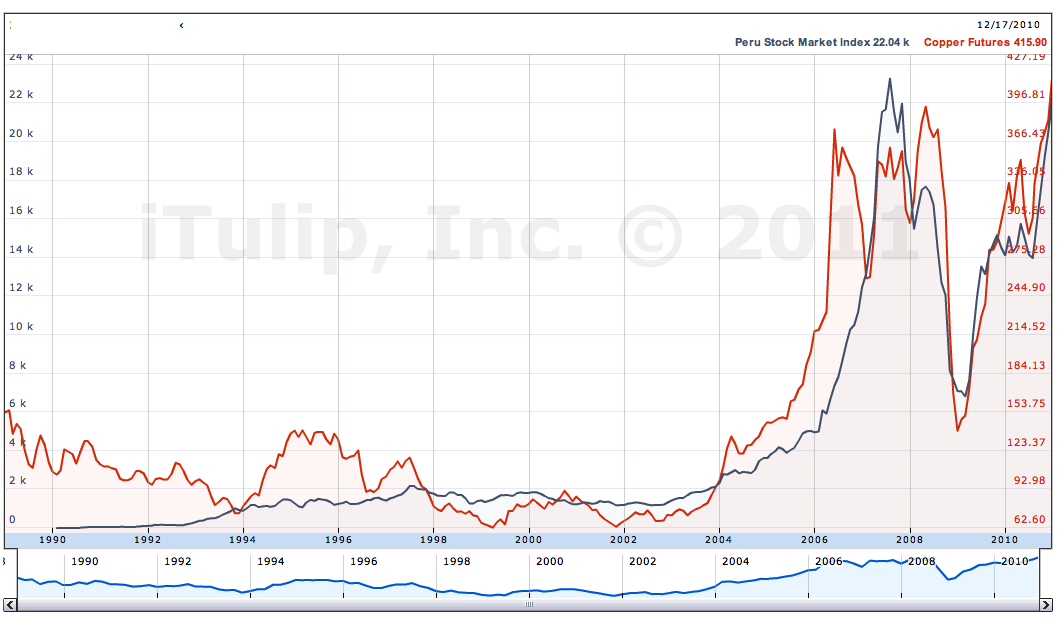

EJ: Again, put yourself in their shoes. You just survived the FIRE Economy boys crashing the economy up and down. Because the Fed failed to stop the corruption that led to the excesses that produced the collapse, it then had to depreciate the dollar to prevent a deflation spiral. The good news is that you aren’t bankrupt. The bad news is that if you have a two-year-old five year fixed priced government contract you went cash flow negative this year because between liquidity, demand, and exchange rates, copper prices went crazy. That’s great if you’re in Peru where they mine the copper but not so good if copper is an input cost on your balance sheet.

CI: What did you advise them?

EJ: Oh, they’ve learned how to deal with it: no fixed price contracts. Those days are over. Keep inventory down to three weeks, under the billing cycle so costs can be passed on.

CI: Sounds like inflation...

EJ: You think?

CI: Where is all of this leading up to?

EJ: The short-term benefits of the government price fixing blind us to the long-term risks. Sovereign credit and currency risk builds and builds, but it takes so long – decades – that we become unaware of it, like villagers living at the base of a long dormant volcano. The private credit market volcano erupted in 2007 after it lay dormant since the 1930s, forgotten. After the bond and currency fixing measures fail eventually, as they always do, there will be much hand wringing about what happened, and reams of articles about black swans and other nonsense, as if events did not follow from antecedents but force majeure. When it happens it looks something like this.

CI: Can we get our leaders and the people to wake up?

EJ: No. The problem is lack of sufficiently broad exposure to the facts here in the US. We don’t have a fourth estate, a national media in the role of providing checks and balances to government and business excesses. Instead we have media that sells product. In the late 1990s it sold tech stocks, in the early 2000s the Iraq War, from 2002 until 2007 it sold houses, and in the future it will sell whatever measures are a “necessary” price for social stability, national security, or whatever phrases are used, because things are going to get dicey once this 40 year old Rube Goldberg monetary and trade contraption comes apart when it’s hit with a Peak Cheap Oil sledgehammer? I'd expect the topic to get covered on the Jon Stewart or Stephen Colbert show, but nowhere else. I mean, how healthy is the American fourth estate when all of the serious journalism here is done by comedians?

CI: The FIRE Economy is part of this?

EJ: It developed from a combination of two factors, of free market fundamentalist ideology applied to the real world and good old-fashioned corruption. In any country’s financial system, the real world, the mice play when the cats are away. In the fantasy world of free market fundamentalism the mice don’t eat the cheese off the plate on the table in middle of your nice, warm living room. They crawl and shiver in the snow covered woods and duke it out with the squirrels for nuts and berries. In the real world the good, moral and timid mice stay where they belong, but take the cats away and pretty soon the house is swarming with audacious mice, not all of who are on the up-and-up. Big surprise. Of course, on the other side of it you have the uber-regulators, the self-styled sheriffs who want to put up a checkpoint at every intersection.

CI: Such as Bill Black?

EJ: I got into a long email debate with Bill Black on how to get the unconstructive players out of the banking and financial system and he got testy with me. I get the sense that he won’t be happy until all the guys who broke the law are in prison. I argued what I think is a more practical approach, an amnesty program. It’s a difference of philosophy about objectives. For me the objective is to get the unconstructive players out of the industry so the good guys – that’s most of them – don’t have to share the industry with them.

CI: I’d like to see that.

EJ: I’ll send a note to Bill and see if he’s okay with me sharing it. I don’t see why he would not, but who knows.

• Foreign investors develop an allergy to US corp. bonds

• Government bond auctions don't fail, bond auctioneers do

• Keep an eye on the Seignorage Laffer curve

• Ripe for a correction: inflation and stock markets are at pre-crisis levels in commodity exporting countries

• EU investors are supporting US stocks and avoiding their own stock markets, at least for now

CI: We’ve wandered far from original topic here, the change in the composition of foreign purchases of US securities.

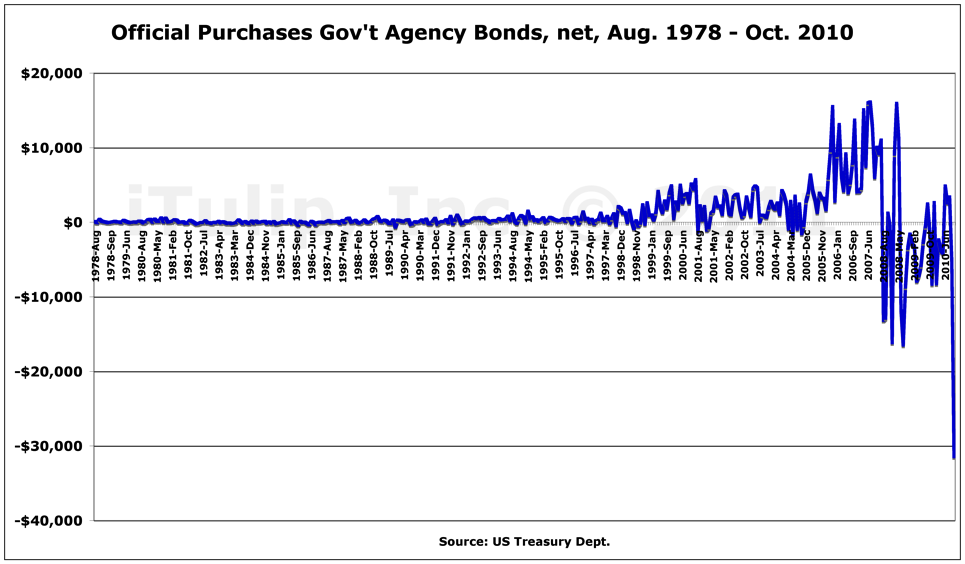

EJ: But it’s more fun this way, isn’t it? We cover more ground. Since securities are what we export to our trade partners in exchange for goods, any major change in what private and official institutions are buying and selling on net is significant. For starters, foreign central banks remain less than enthusiastic about holding the bonds issued by our nationalized mortgage lenders Fannie Mae and Freddie Mac.

Evidence is that they continue to swap them for Treasury bonds. The curious thing is that private investors are net buyers of Agency debt while central banks are selling, but both are avoiding US corporates as if they were a bubble. Who knew? more... ($ubscription)

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

For a concise, readable summary of iTulip concepts read Eric Janszen's September 2010 book The Postcatastrophe Economy: Rebuilding America and Avoiding the Next Bubble

.

.To receive the iTulip Newsletter/Alerts, Join our FREE Email Mailing List

To join iTulip forum community FREE, click here for how to register.

Copyright © iTulip, Inc. 1998 - 2010 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

)

)

Comment