Re: Economics is not hard - Part I: Donít let professional economists tell you otherwise

ejanszinflation

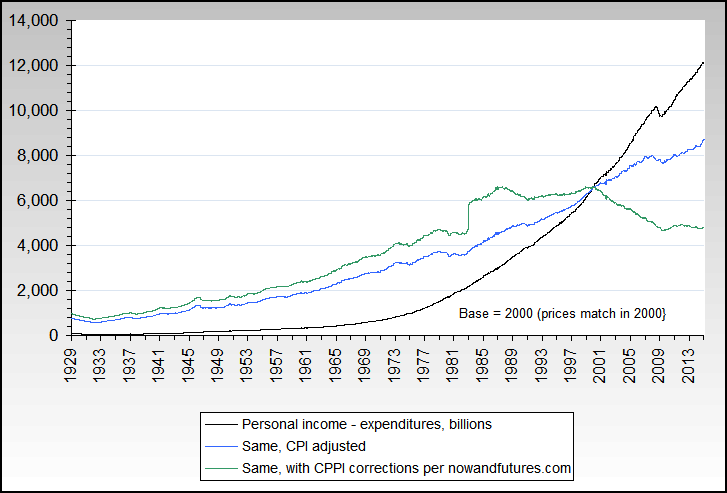

seriously... name for deflation in quality/quantity of goods from a decline in purchasing power of income & savings w/o a nominal increase in finished goods prices?

the forecast was correct... but what to call it? ej is the only analyst to forecast it correctly... er, why not call it janszinflation

Originally posted by MarkL

View Post

seriously... name for deflation in quality/quantity of goods from a decline in purchasing power of income & savings w/o a nominal increase in finished goods prices?

SMALLER PACKAGING FOR SAME PRICE

Posted Thu by DEBORAH B. written to Kellogg Company

----- Original Message -----

From: Deborah

To: kellogg@casupport.com

Cc: Clark

Sent: Thursday, September 25, 2008 7:29 AM

Subject: Fw: Consumer Affairs 013649751A

Consumer Affairs Department

Per your email below: As you know, recent economic pressures have affected all of us as we see higher prices on goods and services we purchase for our families and homes. As a company, we also face significantly higher prices for ingredients, energy, packaging materials, labor, equipment, freight and warehousing.

It is interesting that the response by Kellogg to the economic situation is to reduce

package size, while maintaining cost. As a family, we also face the same higher prices - and paying the higher cost of gas to commute to work and school is significant. Our response is somewhat different however. Since it is not possible for us to reduce the hours that we work and still get paid the same amount of money (which would allow us time to go out and get a second job - wow - I wonder if my boss would go for that), we are forced to reduce our spending. That means finding the best deals we can on all goods that we buy, and purchasing smaller quantities for the same price we paid for larger packages is NOT an option. I will look for product that is on sale, less expensive, and not repackaged in smaller quantities just so that YOU can continue making the same amount of money, paying C Level staff ridiculous amounts for their salary and annual bonuses.

Shame on Kellogg.

Deborah

----- Original Message -----

From: Clark To: kellogg@casupport.com

Sent:Tuesday, September 23, 2008 9:20 PM

Subject: Re: Consumer Affairs 013649751

Mr. G.

I understand that we are in hard times but we are all used to having to pay a little more at the pump, at the grocery store, restaurants, etc. What we as consumers DON"T want to see is getting less product for price as the previous size larger package that contained more product and that is what you are doing by cutting down the size of your packaging. As a result, you can not count on me as a continued customer any longer. Doesn't get it for me or anybody I know for that matter.

May want to rethink this. I am going to CC my large family on this so you may get further comments on cutting down the size of your Famous Amos cookies and other Kellogg products but NOT the prices.

Lastly, why in the world would you think that reducing the size of your package and giving less pr

oduct is beneficial to the consumer? Consumers are much smarter than that and I am amazed that you obviously do not know that.

Wow!

Sincerely yours,

A Former Customer of many years.

---- Original Message ----

From: "kellogg@casupport.com"

Sent: Tuesday, September 23, 2008 7:30:58 PM

Subject: Re: Consumer Affairs 013649751A

Mr.

Thank you for contacting us regarding our recent reduction of our carton sizes on select Kellogg's cereal. We appreciate the opportunity to respond. The Kellogg Company remains committed to providing consumers with healthy and nutritious foods at a fair price. As you know, recent economic pressures have affected all of us as we see higher prices on goods and services we purchase for our families and homes. As a company, we also face significantly higher prices for ingredients, energy, packaging materials, labor, equipment, freight and warehousing. To help offset those increased costs, Kellogg is reducing the size of some of our products to help consumers. We hope we may count you among our valued family of consumers in the years ahead as we continue to offer you delicious and nutritious products at an affordable price.

Sincerely,

Consumer Affairs Department

013649751A

Kellogg NorthAmerica

PO Box CAMB

Battle Creek, MI 49016-1986

Posted Thu by DEBORAH B. written to Kellogg Company

----- Original Message -----

From: Deborah

To: kellogg@casupport.com

Cc: Clark

Sent: Thursday, September 25, 2008 7:29 AM

Subject: Fw: Consumer Affairs 013649751A

Consumer Affairs Department

Per your email below: As you know, recent economic pressures have affected all of us as we see higher prices on goods and services we purchase for our families and homes. As a company, we also face significantly higher prices for ingredients, energy, packaging materials, labor, equipment, freight and warehousing.

It is interesting that the response by Kellogg to the economic situation is to reduce

package size, while maintaining cost. As a family, we also face the same higher prices - and paying the higher cost of gas to commute to work and school is significant. Our response is somewhat different however. Since it is not possible for us to reduce the hours that we work and still get paid the same amount of money (which would allow us time to go out and get a second job - wow - I wonder if my boss would go for that), we are forced to reduce our spending. That means finding the best deals we can on all goods that we buy, and purchasing smaller quantities for the same price we paid for larger packages is NOT an option. I will look for product that is on sale, less expensive, and not repackaged in smaller quantities just so that YOU can continue making the same amount of money, paying C Level staff ridiculous amounts for their salary and annual bonuses.

Shame on Kellogg.

Deborah

----- Original Message -----

From: Clark To: kellogg@casupport.com

Sent:Tuesday, September 23, 2008 9:20 PM

Subject: Re: Consumer Affairs 013649751

Mr. G.

I understand that we are in hard times but we are all used to having to pay a little more at the pump, at the grocery store, restaurants, etc. What we as consumers DON"T want to see is getting less product for price as the previous size larger package that contained more product and that is what you are doing by cutting down the size of your packaging. As a result, you can not count on me as a continued customer any longer. Doesn't get it for me or anybody I know for that matter.

May want to rethink this. I am going to CC my large family on this so you may get further comments on cutting down the size of your Famous Amos cookies and other Kellogg products but NOT the prices.

Lastly, why in the world would you think that reducing the size of your package and giving less pr

oduct is beneficial to the consumer? Consumers are much smarter than that and I am amazed that you obviously do not know that.

Wow!

Sincerely yours,

A Former Customer of many years.

---- Original Message ----

From: "kellogg@casupport.com"

Sent: Tuesday, September 23, 2008 7:30:58 PM

Subject: Re: Consumer Affairs 013649751A

Mr.

Thank you for contacting us regarding our recent reduction of our carton sizes on select Kellogg's cereal. We appreciate the opportunity to respond. The Kellogg Company remains committed to providing consumers with healthy and nutritious foods at a fair price. As you know, recent economic pressures have affected all of us as we see higher prices on goods and services we purchase for our families and homes. As a company, we also face significantly higher prices for ingredients, energy, packaging materials, labor, equipment, freight and warehousing. To help offset those increased costs, Kellogg is reducing the size of some of our products to help consumers. We hope we may count you among our valued family of consumers in the years ahead as we continue to offer you delicious and nutritious products at an affordable price.

Sincerely,

Consumer Affairs Department

013649751A

Kellogg NorthAmerica

PO Box CAMB

Battle Creek, MI 49016-1986

Comment