Re: Debt-deflation Bear Market Update - Part I: First Bounce officially over (really)

was that the question? better... not bulletproof...

stocks were close... better if taxes taken into account... not if survivor bias.

Originally posted by raja

View Post

What Does This Imply For Future Long-Term Returns In The Market?

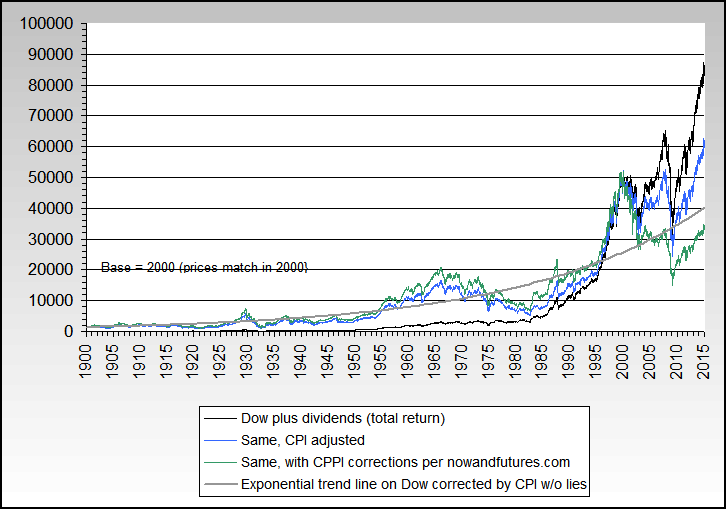

For 30 year periods (and for other longer periods of at least 15 years) starting today we should expect the nominal GDP plus dividends figure to be in the range of about 7.5% (although with huge volatility around that average figure in any given year). This somewhat low level is driven by today's very low interest rate outlook, low inflation outlook and relatively modest real GDP growth outlook. Due to the historical and logical relationship of large-capitalization stock returns being no greater than the sum of nominal (after-inflation) GDP plus the dividend yields, we should not expect large-capitalization stock returns to exceed about 7.5%. And this is before trading and management costs and before any income taxes.

For 30 year periods (and for other longer periods of at least 15 years) starting today we should expect the nominal GDP plus dividends figure to be in the range of about 7.5% (although with huge volatility around that average figure in any given year). This somewhat low level is driven by today's very low interest rate outlook, low inflation outlook and relatively modest real GDP growth outlook. Due to the historical and logical relationship of large-capitalization stock returns being no greater than the sum of nominal (after-inflation) GDP plus the dividend yields, we should not expect large-capitalization stock returns to exceed about 7.5%. And this is before trading and management costs and before any income taxes.

Comment