Re: Debt-deflation Bear Market Update - Part I: First Bounce officially over (really)

There is no profit . . . until you sell it.

When you sell, will you be able to spend the dollars before they continue to inflate? What will you buy?

What about the possible 90% gold-profit tax you mentioned previously?

By the way, I got a good laugh out of this:

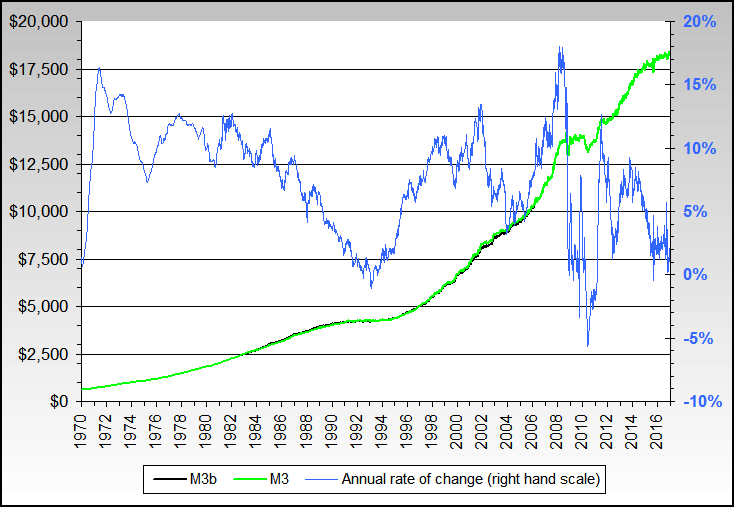

The first time we posted these charts in How to make $301% in six years with low volatility January 2008, we were up 301%. Today: 417%.

When you sell, will you be able to spend the dollars before they continue to inflate? What will you buy?

What about the possible 90% gold-profit tax you mentioned previously?

By the way, I got a good laugh out of this:

Comment